Survey: E-Commerce Also Grows in Importance as Sales Channel

Opportunities remain for distributors to improve marketing plans and measurement as a means to increase marketing effectiveness. The 2015 distributor marketing survey covered several areas of marketing, including biggest marketing challenge, vehicles, channels, measurement and pricing. While there was an increase in email marketing and annual social media marketing compared to 2014, many respondents noted that planning and strategy was not a significant marketing challenge. But without effective planning, the marketing function becomes tactical.

Marketing Challenge

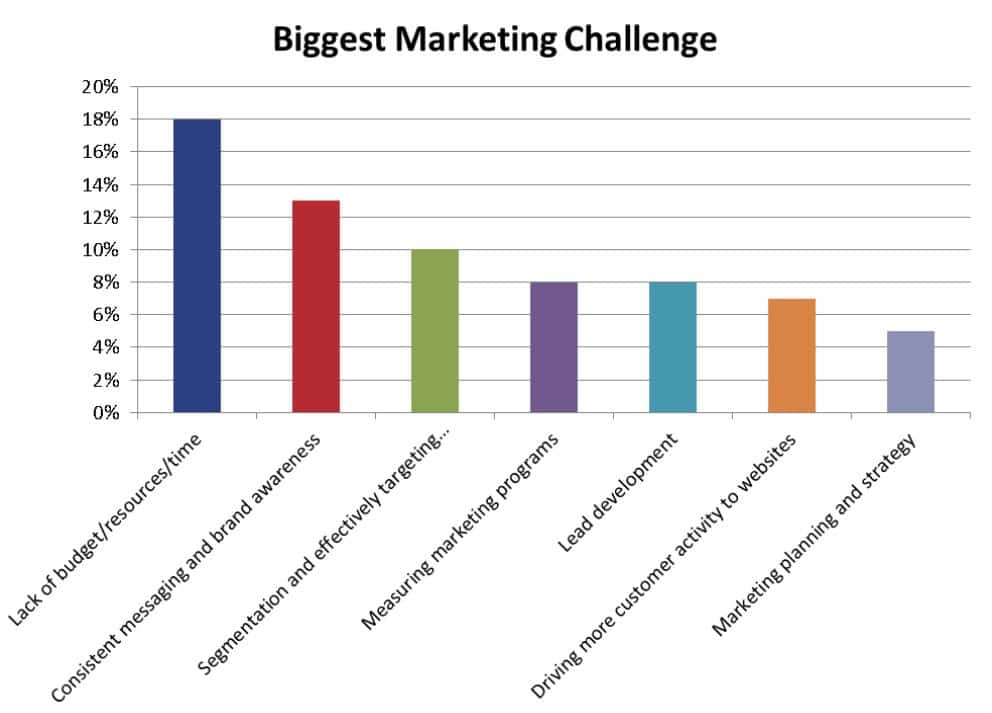

When asked what they considered to be their biggest marketing challenge, distributors diverged on their responses (Figure 1). The largest number of responses, 18 percent, revolved around a “lack of budget, lack of resources and not enough time” theme. Thirteen percent of respondents identified consistent messaging and branding as the biggest marketing challenge. Segmentation and targeting was third with 10 percent of respondents. Measuring marketing programs and lead development tied at 8 percent. Seven percent of distributors said driving more customer activity to their website was the biggest challenge, while 5 percent of respondents cited marketing planning and strategy.

Although marketing planning and strategy received the fewest responses to distributors’ biggest marketing challenge, it is perhaps the most critical. If distributors invested the time and effort in developing an effective marketing plan and associated strategies, the other marketing challenges would dissipate.

Companies would create budgets and allocate time and resources to develop brand awareness and messaging. They would identify, prioritize and effectively target customer segments. They would uncover new leads from programs built into the marketing plan as well as from programs designed to drive more customers online.

Effective planning and strategy development would, in effect, resolve all other issues identified by respondents as their biggest marketing challenges. Considering the competitiveness of the market, distributors must create a marketing plan and execute strategies that will help them maximize market share, customer wallet share and customer retention.

Measurement

Distributors’ attempts to measure their marketing programs is encouraging. When asked how they measure success of their marketing pro-grams, 25 percent of respondents listed growth in sales as the key benchmark, with some distributors looking at overall sales growth and others measuring month-over-month or year-over-year. Fourteen percent said they didn’t measure marketing programs or didn’t know how to measure them. The next two highest responses centered on measurements of a specific program – 9 percent of distributors measured number of leads and 8 percent measured number of website visits. Five percent of respondents measure new customer sales and 5 percent measure the products featured in the campaign.

While measurement is important, distributors should develop a measurement plan before initiating a marketing program. This starts with determining an objective for every program before beginning any work on program development. Measurement strategies can be quantitative or qualitative, including before and after analysis, test and control, longitudinal analysis, modeling and interviewing. Measurements can be on results, activities and attitudes, to name a few.

Although measuring results provides the best measure for ROI analysis, distributors often measure activities that may affect results such as number of leads and website visitors. However, when measuring activities, it is important to understand how those activities correlate to results. For example, a distributor may know that every 10 leads converts to one customer. If they know the lifetime value of a customer, they can estimate their return.

Marketing Vehicles and Channels

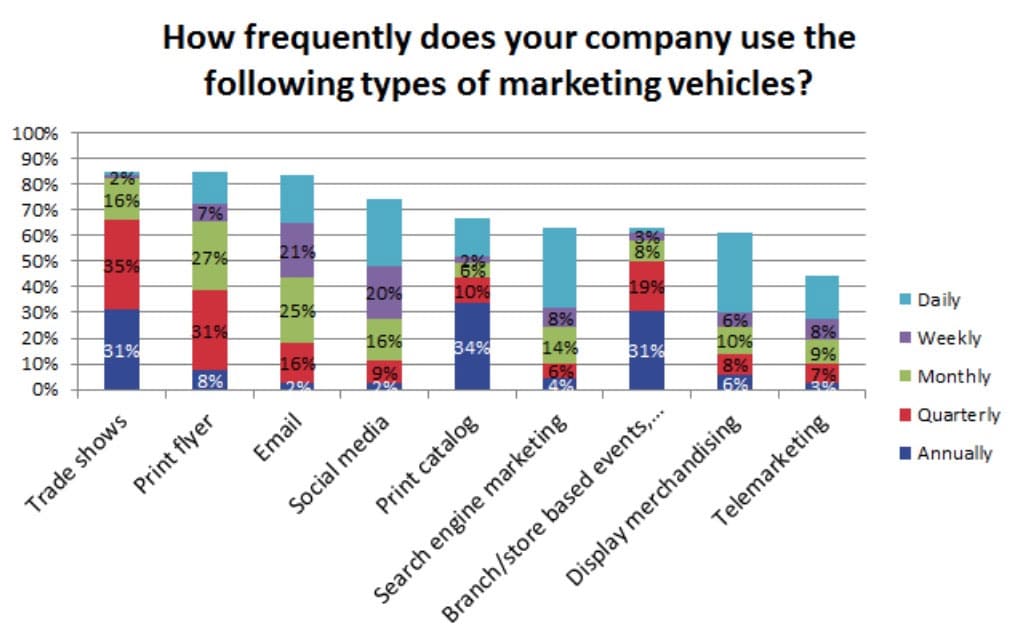

The responses about marketing vehicles and the frequency they are used (Figure 2) were mostly consistent with last year’s results. Trade shows, print flyers and email remain the most commonly used marketing vehicles. However, for the first time, social media displaced catalog for the fourth most used media overall, with most of that increase among those using social media on an annual basis.

The number of companies using email weekly increased 60 percent from 2014, indicating that companies are recognizing that their customers want communication on relevant topics and on a more frequent basis. The use of mass media (radio, TV, billboards) remained very low, as in 2014.

When asked about the level of importance these marketing vehicles represented to companies, the vehicles that were most important included email (42 percent), search engine (36 percent) and print catalog (30 percent). Search engine marketing increased slightly in importance over 2014, but distributors still don’t use SEM as much as they should. This could be due to lack of staffing and focus in this area or simply a lack of expertise.

Outside sales remained the most important overall sales channel, but ecommerce increased from 54 percent who listed it as most important in 2014 to 62 percent in 2015. This indicates that e-commerce continues to surge as a viable sales channel for many companies.

Many companies are not making the connection between e-commerce and SEM as a way to increase traffic to their sites; SEO importance did not increase in importance at the same rate as e-commerce.

Pricing

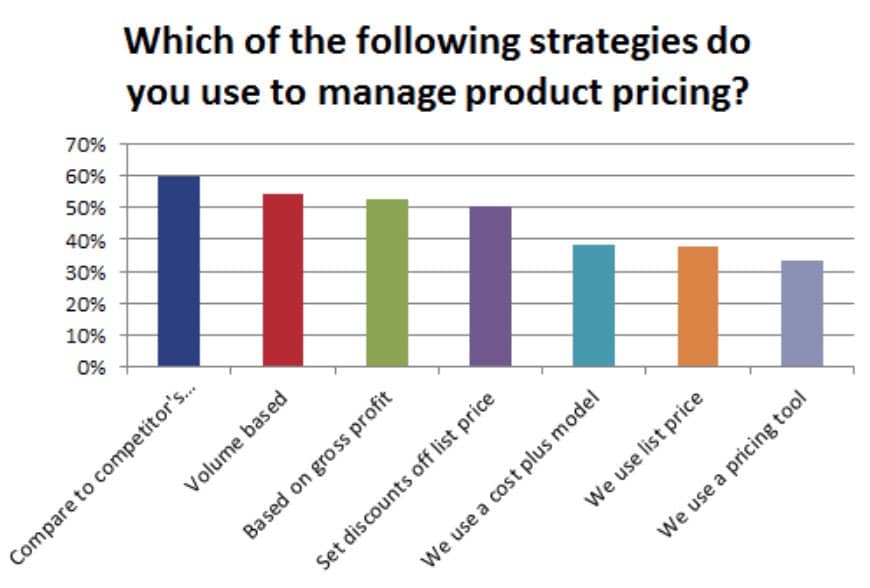

Pricing is a critical element in a distributor’s marketing mix, but how are distributors managing their pricing? When asked what strategies they use to manage product pricing (Figure 3), nearly 60 percent of distributors said that they take a “compare to competitor’s price” approach.

Respondents to this question selected, on average, three different strategies in managing product pricing, which indicates they take a blended strategic approach rather than relying solely on one approach.

While one-third of distributor respondents said they use a pricing tool to manage product pricing, more than 52 percent indicated the pricing tool was their ERP system and another 35 percent use no tools at all. Less than 15 percent use a tool designed specifically to assist in strategically managing product pricing, including some homegrown tools.

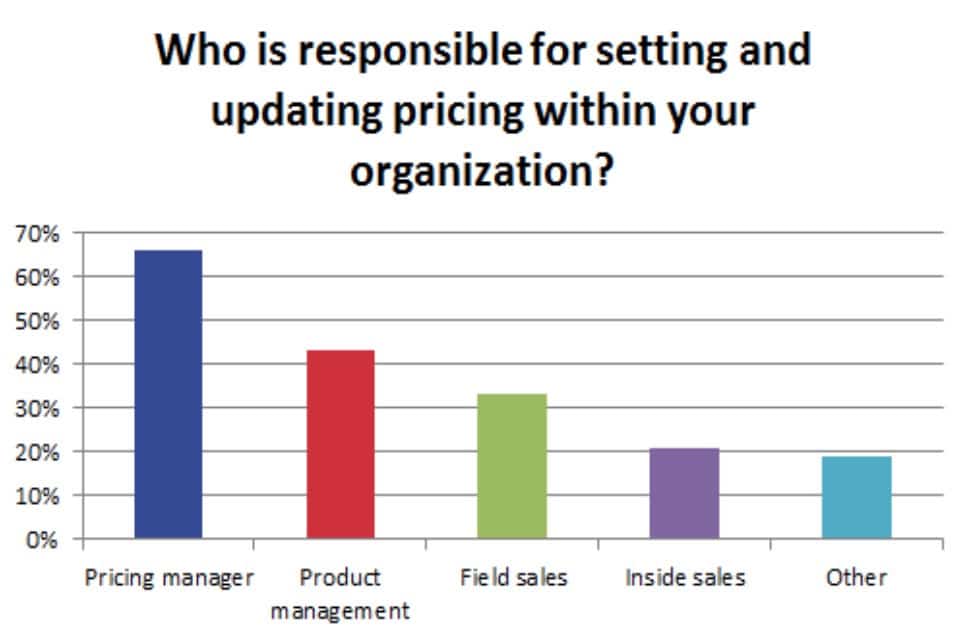

When asked who is responsible for setting and maintaining pricing (Figure 4), 66 percent of distributors identified their pricing manager. About half of the respondents checked two options, indicating that the responsibility was shared, while the other half of respondents had only one person with that responsibility. Just over 4 percent of respondents commented that they have senior management involved in the process.

The prices a distributor charges must reflect the value they provide customers relative to competition. While two-thirds of survey respondents are looking at competitive pricing, it is unclear whether they are actually comparing the value provided to customers from competition to the value they are providing. This requires rigorous and objective research and analysis along with strategic tools to augment price setting. It is imperative that senior management has visibility and input into strategic pricing direction but not in setting actual prices.

About This Survey

This research was conducted by Modern Distribution Management and Real Results Marketing. It included an online survey taken by 382 participants across a variety of distribution and manufacturing sectors. There was heavier participation from industrial, safety, oil and gas products, electrical, electronics, building materials, janitorial, HVACR/plumbing and hardware. Other participating sectors included pulp and paper, chemicals and plastics, grocery/foodservice and pharmaceutical.

Nearly 50 percent of respondents were small distributors with less than $50 million revenue, almost 40 percent of respondents had $50 million to $500 million in revenue, and the remainder were large with more than $500 million revenue.

More than half of the respondents have 10 or fewer branches, nearly a quarter have 10 to 100 branches, 10 percent have more than 100 branches, and 13 percent have no branch.

Debbie Paul is Partner at Distribution Strategy Group. Debbie helps distributors identify and communicate their value so they can better serve and sell to their customers. At Newark Electronics, she oversaw the growth of small- to medium-sized high-potential accounts with results of over 10% growth in the first year, continuing in subsequent years at a rate of 15-20%. Ready to tap the full potential of your customer base? Contact Debbie at dpaul@distributionstrategy.com.