As we approach 2023, businesses across sectors are watching the latest inflation indicators, balancing that against rate hikes and GDP changes and are considering how to respond with their next pricing moves. Which prices should adjust? How often? What’s the best way to communicate the change? Distributors are no exception, and pricing, across all channels, is finally getting the attention it deserves. The following are some “no regret” moves to help navigate your next pricing decision.

1. One size does NOT fit all

Blanket price increases generally fall short of expectations because they fail to acknowledge that different market segments often have varying use cases for any given SKU. Inevitably, some prices are set too high – so long, volume – while others are not changed enough, leaving money on the table.

Instead, be strategic by identifying SKUs or product families that are delivering higher value to target segments, and charge fairly for them. This might include areas where you’ve invested in higher quality products, better service, faster delivery or fewer stockouts. Or perhaps you haven’t invested but your competitors are struggling to deliver, and the dynamics are shifting in your favor.

Value-based pricing also goes both ways. Low-value, low-cost alternatives may be right for price-sensitive customers or those experiencing hardships. For lower-value products, price buyers, or relationship buyers in distress, working to meet the market by limiting or even rolling back price increases on low-value products can be the right thing to do from both a customer lifetime value and fairness perspective.

2. Offer choices when necessary

Some customers can absolutely absorb price increases, and you’ll observe that in their consistent purchasing behavior. However, for those who have budget constraints or basic requirements, it’s important to have a solution that fits their needs.

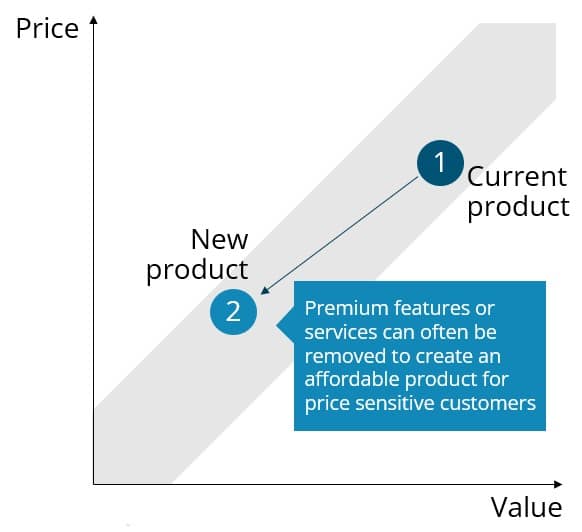

As mentioned, one way to navigate this is simply offering a lower-price, lower-value option. In some cases, these products might have margin profiles that are just as advantageous for your business while protecting your price integrity on other premium items.

But what if you don’t have a lower priced option? Well, make one! It’s often the case that premium features, services, or terms can be reduced to create a low-value, low-cost flanking product that still serves a need for customers until they’re able to return business as usual and may even boost your relevance in new market segments. Additionally, flanking products serve as great tools to defend value and price on premium items because they can be offered to customers who demand discounts. Now your sales team is armed with something to call bluffs during tough B2B negotiations.

Figure 1: Offer lower-price alternatives, but keep price and value aligned!

3. Reduce the sting

We touched on aligning price with value, but we should also consider price perception. Psychologically, customers won’t feel all price changes equally, and you can deploy strategies to minimize pain while achieving your goals.

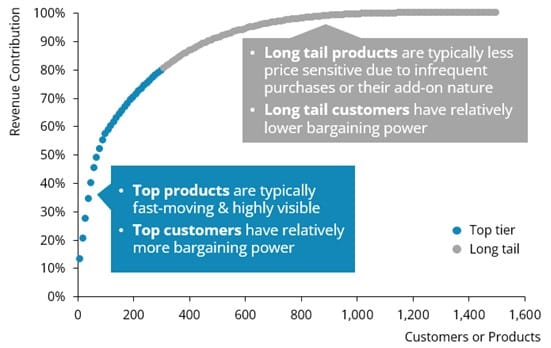

Limiting price increases on your best sellers will often generate good will, and it also means that when customers pay the most, it’s on items they don’t buy every day versus products that are highly tracked or that competitors offer.

From a customer perspective, treating your key products with care rewards those accounts for loyalty and acknowledges their relatively stronger negotiating positions.

Figure 2: Segment your products and customers by importance

4. Normalize price adjustments

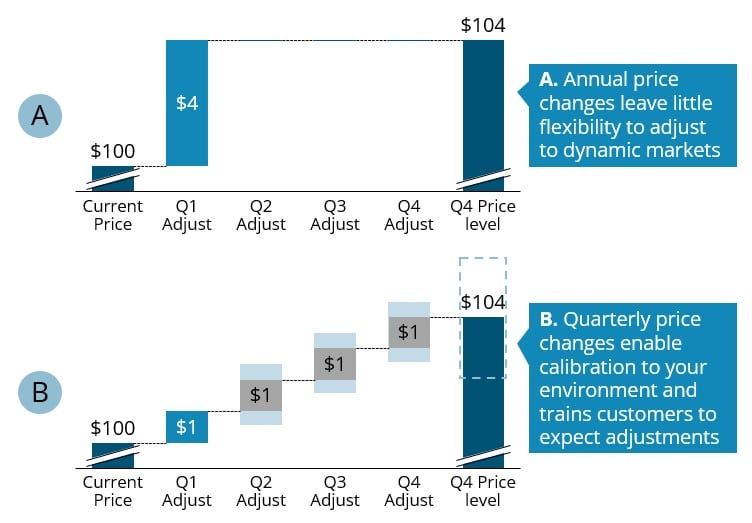

Some distributors have capable pricing and quoting tools that allow them to adjust prices in real time, but often customer-level agreements lock in pricing over several years, while other distributors may adjust prices annually or even less frequently.

Consider changing that cadence. Implementing an enterprise policy to review or adjust price quarterly – which may include price decreases on some items – has several potential benefits. First, it allows quick adjustments to changing market conditions, and reduces the downside of insufficient one-time increases. Second, it trains your customers to anticipate pricing adjustments, and gives your sales team an easier way to approach pricing conversations because of their frequency and friendlier incremental changes.

Figure 3: The benefits of regular price adjustments

5. Communication: Don’t forget to add a spoonful of sugar

The concept of fairness goes a long way towards making price changes stick. If your business relies on transportation and logistics to ship products, a fuel surcharge makes sense. But if you’re distributing software with a remote workforce, the same rationale won’t work.

Additionally, it’s never too early to remind your customers of all the great things you do for them. Ideally this should be a normal recurrence (i.e., quarterly business reviews), and even when price changes are announced, don’t forget to package it with a value message.

Price increases to existing customers are often communicated via written notice, and the following straightforward approach that may help you structure these letters.

- Provide advance notice. Don’t skip the letter; your customer service team will thank you.

- Start with value you bring to the customer. For instance, “ABC Distribution has invested to increase the quality, selection, and availability of products over the duration of our relationship.”

- Describe the situation with transparency. By saying, “Costs across our supply chain have increased up to XX% over the past Y months. We’ve improved our operational efficiency to minimize the impact to our customers, but we will be making a pricing change next quarter” you give the customer a clear understanding of what you are seeing and the impact.

- Be clear. “Starting January 1st, we will be adjusting prices by x% on SKUs/product families/services by X% or $Y,” leaves little room for miscommunication.

- Be gracious. Your customers want to know that you have their best interests in mind. Always conclude with a statement such as “We appreciate your loyalty and will continue to invest in our relationship to deliver the service you depend on.”

Price changes, and price change conversations, are never easy. However, remember that running a healthy business means that you can reliably and effectively connect suppliers with end customers over the long term. Keep these principles in mind to maintain your critical relationships, find new customers and profitably grow your business.

Pete Morelli is a pricing expert who believes that distributors and B2B companies should be paid what they’re worth. He helps organizations gain clarity around the value they provide to set profitable pricing strategies that are easily communicated and defended.

Pete designs and directs pricing engagements as a Senior Director at Holden Advisors on a team of seasoned practitioners who have walked in your shoes and have solved the most challenging profit problems for distribution, manufacturing, and industrial clients.

The Professional Pricing Society considers Pete among their top speakers, and he holds an MBA with a competitive strategy and pricing focus from the University of Rochester’s Simon Business School.