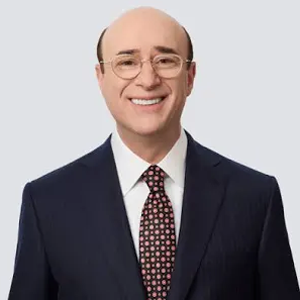

Just hours after QXO Inc. closed its $11 billion acquisition of Beacon Roofing Supply on April 29, CEO Brad Jacobs joined analysts on a call to deliver what he says is “a bold strategic roadmap.” The call focused on how QXO plans to transform building materials distribution into a modern, tech-powered industry.

“We’re not here to build a $10 billion company,” Jacobs said. “We’re building a $50 billion company over time, and this is the foundation.”

Jacobs says technology would be at the core of QXO’s differentiation. He described Beacon as a platform that will be enhanced, not disrupted, by QXO’s digital playbook.

“This is day one of building the first great tech-enabled building products distribution company,” Jacobs said. “We’re going to introduce software that empowers our team and our customers. That’s how we win margin and loyalty.”

Jacobs cited QXO’s plans to roll out AI-driven pricing engines, dynamic ordering portals, and predictive inventory tool features designed to improve both gross margin and customer stickiness.

Jacobs outlined a long-term goal of reaching $50 billion in annual revenue within a decade.

“We’re going to grow through acquisitions, yes, but also by being the best operator in the industry,” Jacobs said. “We’ll do it smarter, faster, and with better tools.”

Analysts on the call noted that while ambitious, the target aligns with Jacobs’ history of scaling platform businesses through both acquisition and organic optimization.

To finance the acquisition, QXO completed a $2.25 billion offering of 6.75% Senior Secured Notes due 2032. Jacobs acknowledged the sizable debt but was quick to note that deleveraging is a priority. “We’re targeting a 4x net leverage ratio by 2026. That’s very achievable given Beacon’s cash flow profile and our operating improvements,” he said.

He stressed that QXO is not pursuing a short-term private equity-style flip. “This is a durable, long-term platform,” Jacobs added.

Rather than focusing solely on systems or cost cuts, Jacobs emphasized the importance of culture and employee integration. Beacon’s 8,000-plus team members, he said, are critical of QXO’s future.

“We’re not just buying revenue—we’re bringing in people, expertise, and relationships,” he said. “We’re going to listen, learn, and lead together.”

He also signaled that QXO would preserve much of Beacon’s leadership and identity. “We’re not coming in with a wrecking ball. We’re coming in with a blueprint,” Jacobs said.

While Jacobs’ presentation was well-received, analyst sentiment was cautiously optimistic.

“This is a logical platform acquisition,” one analyst noted on the call. “The key will be execution—bringing tech in without disrupting service levels.”

Don’t miss any content from Distribution Strategy Group. Join our list.