The majority of respondents were distributors – 75%, with most having 1-10 branches:

| # of branches | % of distributors |

|---|---|

| None | 10% |

| 1-10 | 57% |

| 11-25 | 16% |

| 26-50 | 6% |

| 51-100 | 4% |

| More than 100 | 7% |

Number of inside sales people:

| # of inside sales people | % of distributors |

|---|---|

| None | 10% |

| 1-10 | 47% |

| 11-25 | 23% |

| 26-50 | 11% |

| 51-100 | 7% |

| More than 100 | 12% |

80% described their inside sales teams as mostly reactive. 42% had their inside sales teams centralized at headquarters, while 40% were de-centralized and 16% centralized at a branch.

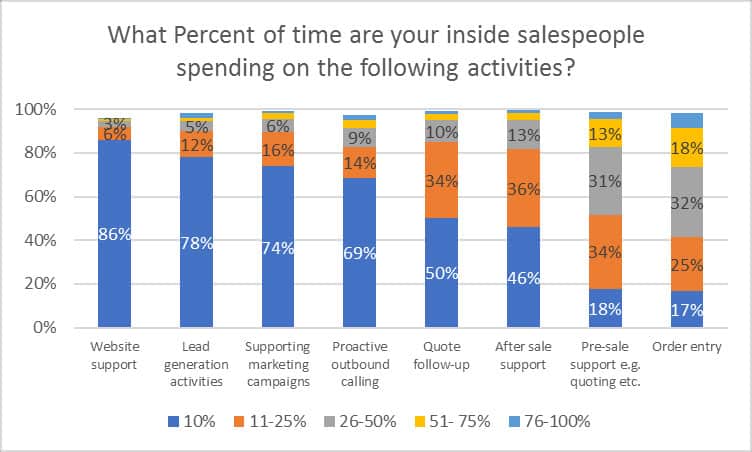

69% of inside sales people are spending less than 10% of their time making proactive outbound calls. They are spending the majority of their time doing after sale support, order entry and pre-sale support.

These activities were ranked as the top five most important in this order:

- Provide an excellent level of service

- Grow sales and profit

- Increase customer loyalty

- Lead generation

- Increase order entry efficiency

The biggest challenges facing the group today were:

- Lack of pro-activity, having enough time to make pro-active calls and training/product knowledge issues.

- 71% of respondents said that their teams were cross-selling and identifying new business opportunities less than 25% of the time.

- 30% of respondents were extremely satisfied or very satisfied with their inside sales teams, while 50% were moderately satisfied and 20% were dis-satisfied.

73% of respondents wanted their teams to have more selling skills training, 91% wanted their teams to have more customer service training and 55% felt they needed more technical training.

The top three most effective ways to train were:

- Informal coaching sessions

- Team members train each other on the job

- Formal training sessions with manager

The most cited methods of measurement of the effectiveness of the inside sales teams were gross profit dollars (50%), followed by overall sales growth (35%) and order entry quantity and quality (31%). 68% of respondents were executive or general managers, with 19% in sales and/or marketing. The majority of respondents’ company revenues fell into the less than $100M range (61%), 25% in the $101M – $500M range and 14% over $500M.

When asked what changes respondents would like to see to their overall sales channel:

- 80% wanted inside sales to be more pro-active.

- 48% wanted to shift field sales accounts that weren’t being effectively managed to inside sales.

- 47% wanted field sales to be more pro-active.

When asked about the selling styles of field sales reps, the respondents fell largely into the following industries:

- Industrial

- Electrical

- Building materials/construction

- Power transmission/bearings

- Hardware

- HVACR

- JanSan

Conclusions

The results of this survey are similar to the survey completed in 2014:

- Companies are still challenged with finding time to be more pro-active rather than 100% reactive.

- Time management is still a challenge – the reactive activities such as quoting and order entry still take the largest amount of time and it is difficult to find spare time for selling.

- Many respondents still think that individuals who can provide a high level of reactive customer service should be selling. Customer service and selling skillsets are opposite; the mindset of a CSR is the polar opposite of that of a pro-active seller.

- Most respondents understood the value of pro-active selling, but were challenged with how to actually do it.

Debbie Paul is Partner at Distribution Strategy Group. Debbie helps distributors identify and communicate their value so they can better serve and sell to their customers. At Newark Electronics, she oversaw the growth of small- to medium-sized high-potential accounts with results of over 10% growth in the first year, continuing in subsequent years at a rate of 15-20%. Ready to tap the full potential of your customer base? Contact Debbie at dpaul@distributionstrategy.com.