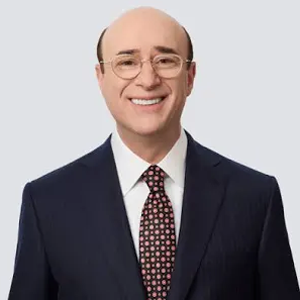

QXO chairman and CEO Brad Jacobs laid out an ambitious transformation plan for the building-products distributor in a recent series of investor Q&A sessions in New York and Laguna Beach, according to new documents the company filed with the U.S Securities and Exchange Commission. Since acquiring Beacon earlier this year, Jacobs has moved quickly to restructure the business, overhaul its technology systems, and set the foundation for scaling QXO to a long-term goal of $50 billion in revenue.

Jacobs said the company launched a comprehensive transformation program immediately after the Beacon deal closed, touching every part of the business — sales, pricing, procurement, logistics, and organizational structure. Among the first steps were rebranding Beacon’s operations under the QXO name across branches, fleet, marketing, ecommerce, and its mobile app, and flattening the corporate hierarchy from nine layers to four to speed decision-making and improve accountability.

QXO also opened a national “Win Room” call center to reactivate dormant accounts and pursue new customers. The company is rolling out a centralized digital pricing platform with tighter override controls and contribution-margin dashboards to limit margin erosion, while new compensation plans now tie pay not just to sales volume but also to profitability.

Jacobs emphasized that technology will be central to the company’s transformation. “We’re building best-in-class platforms across the stack, from CRM and pricing engines to e-commerce and BI tools,” he said. QXO is embedding artificial intelligence into quoting and routing, piloting machine-learning demand forecasting, centralizing procurement to secure better supplier terms, and digitizing its warehouses and transportation systems. The company is also upgrading its ERP, warehouse and transportation management systems, business intelligence tools, and HR platforms to give employees and customers real-time visibility.

Much of the effort is aimed at improving inventory availability and service reliability, Jacobs said. “4%of SKUs drive about 80 percent of sales, and those must always be in stock,” he noted, adding that the company has introduced new scanning, slotting, and placement discipline in its warehouses to ensure fast-moving products are consistently available. “Availability and accuracy, not discounting, will be the key to market share gains.”

Jacobs also addressed QXO’s approach to acquisitions, saying the company will remain disciplined on price while seeking targets it can improve operationally. He acknowledged the presence of much larger competitors in the space, such as Home Depot and Lowe’s, but said QXO’s strategy is focused on operational execution rather than outbidding rivals. “It’s a big ocean and there are a lot of fish in it,” he said. “If we aren’t losing bids on deals, we’re bidding too high. We’ll remain disciplined on purchase price because that’s part of how to create massive shareholder value.”

About 80% of QXO’s current revenue comes from the repair and remodel segment, which Jacobs described as more resilient than new construction. He said the company’s focus will remain primarily on the U.S. market, with Canada as a secondary priority and Europe pursued only selectively.

“We’ve built companies in industries where we weren’t the biggest player but compounded shareholder value by staying disciplined,” Jacobs said. “That’s exactly what we’ll do here.”

Don’t miss any content from Distribution Strategy Group. Join our list.