There is a very wide variety of marketing practices within the distribution sector. In general, the MDM Market Leaders more broadly embrace marketing as evidenced by resources they apply. Not surprisingly, they obtain better marketing results than other distributors. Distribution Strategy Group in partnership with Modern Distribution Management conducted an electronic survey of more than 175 distributors to better understand these marketing practices.

This article, the first in a two part series, explores distributor approaches to sales channels. The second article looks at how marketing vehicles are used by different distributors.

Introduction

Over the last 20 years, there has been a broad movement by distributors to make operational improvements such as supply chain management, process standardization, LEAN, etc. These practices, though not entirely deployed among distributors have frequently created tangible efficiencies that manifest at the bottom line. While there is still more benefit to be realized from operational improvements, for most companies it is incremental rather than quantum improvement. We believe that the next major frontier for distributors is to develop more significant marketing capabilities. The companies who embrace this challenge will outperform the market and their peers, even, or perhaps especially, in downtimes. As noted by an SVP at a major electronics distributor “True B2B marketing is fairly young in distribution, only 20 to 25 years. The type of sophistication that distribution has in B2B marketing pales in comparison to other industries.” Based on the analysis from the survey, interviews with distributor marketing executives, and our own experience providing marketing consulting to distributors, we agree with the SVP quoted above.

A simple characterization of the distributor marketing imperative is as follows: most distributors whether they are sell MRO products or to OEM’s have solid capabilities with outside sales and inbound telephone sales. However, capabilities for in-store marketing, outbound telephone sales, and e-commerce vary widely. In general, smaller distributors with less than $50M in revenue have very limited capability in channels besides outside sales and inbound telephone sales. By contrast, large national distributors with more than $500M revenue have implemented a full multi-channel capability across all five areas. Global distributors have achieved good levels of integration across the channels along with more sophisticated marketing effectiveness measurements. The imperative for distributors of all sizes is to create and continually refine multi-channel offerings.

In our own consulting experience we have seen some notable exceptions to the trend. At the high end, we have worked with two national distributors each with $500M to $1B in revenue who has no outbound telephone sales and no e-commerce capability. By contrast, we have another client with less than $100M revenue who has a superb e-commerce site and growing outbound telephone sales supported by very good customer data.

The research that we performed consisted of interviews with nearly 20 distributor senior executives and an electronic survey taken by 175 participants across a variety of distribution sectors including heavier participation from industrial, electrical/electronics, building, safety, HVACR, plumbing. Other participating sectors include chemicals and plastics, pulp and paper, janitorial, hardware, oil and gas, grocery, and pharmaceutical. Nearly half of the participants have fewer than 10 stores. 9% are not branch-based, 27% had 10 to 100 stores, and 12% have more than 100 stores. 44% are small distributors, less than $50M revenue, 38% mid-market with $50M to $500M revenue, and 18% large with more than $500M revenue.

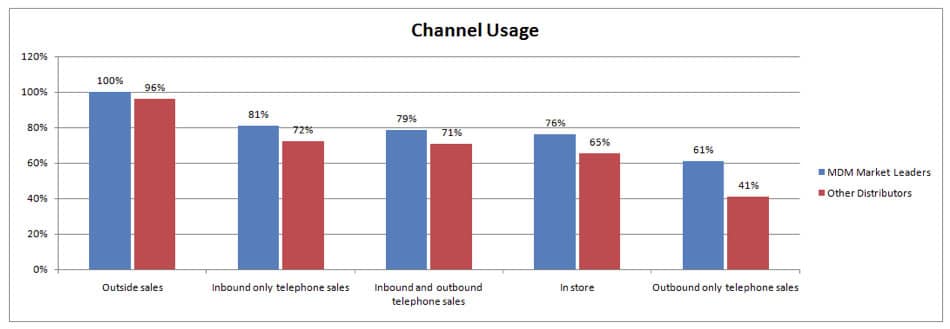

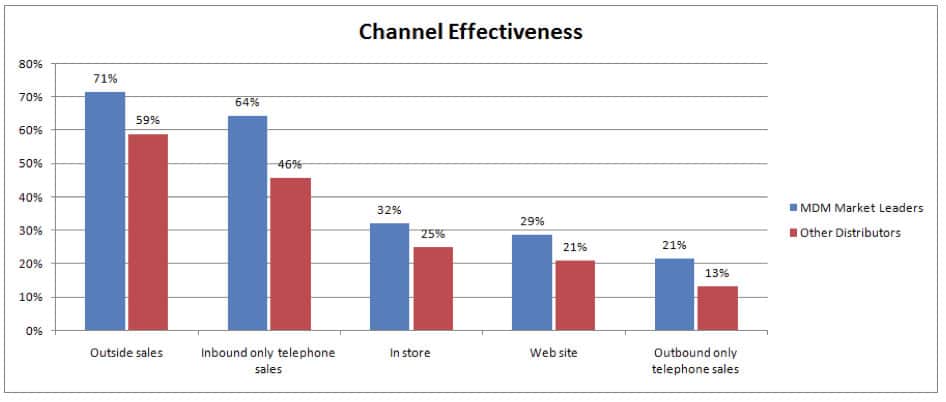

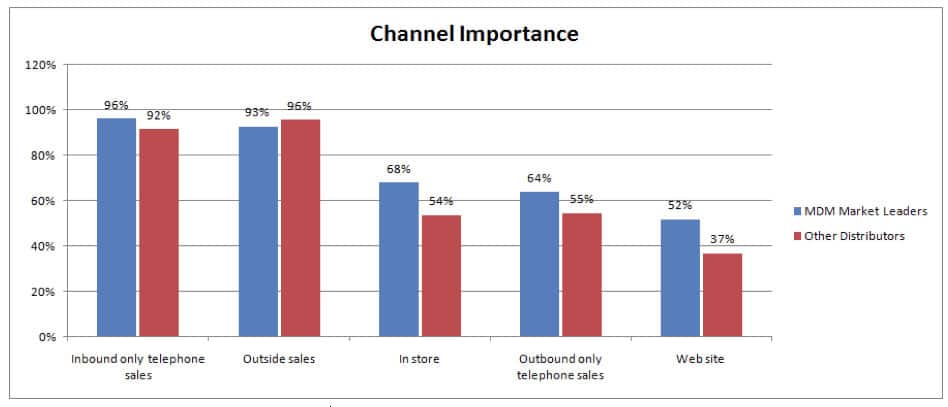

Figure 1 below shows the percentage of distributors in our survey who use various sales channels. With the exception of outside sales, the MDM Market Leaders use more channels than the other distributors. Figure 2 shows a more stark contrast about the effectiveness of the five different channels. Even in the channels used by nearly everyone, outside sales and inbound telephone sales, the MDM Market Leaders have a much higher perception of effectiveness. Figure 3 shows the distributor perception of importance for overall revenue. The MDM Market Leaders have a greater perception of importance for in-store and for outbound telephone sales than other distributors. More than half of the MDM Market Leaders consider the web channel importance whereas only 37% of the other distributors do.

In the remainder of this article, we drill-down into the usage, effectiveness, and importance of channels for MDM Market Leaders against other distributors of different sizes.

Outside sales

As shown in Figure 1, nearly all distributors have an outside sales channel. The level of resource scales with the size of the distributor. Small distributors have up to 20 outside sales personnel, whereas large distributors have hundreds or even thousands. However, the MDM Market Leaders applied more resource to this channel than other large distributors. Furthermore, this channel is considered very important to total revenue, although larger distributors with integrated multi-channel operations considered this channel less important than medium size distributors. For smaller distributors with only two or three channels, outside sales is paramount. The main difference in this sales channel is in levels of effectiveness. As shown in Figure 2, the MDM Market Leaders are significantly more likely to consider this channel effective. From our interviews and from our experience, the market leaders have better data on customers, are further along in CRM utilization, and have better approaches for centralized management of a sales force.

Inbound Telephone Sales

Market leaders participate in this channel at 81% versus 72% for other distributors. The big difference in the use of these channels is the amount of resource applied: 46% of large market leaders have 250 or inbound personnel more as compared to only 25% of other distributors, 65% of medium market leaders have 25-250 whereas only 24% of other distributors. For many of the smaller distributors, the inbound telephone-sales is branch-based whereas for the medium and larger distributors it is call-center based. In general, no companies under $50M consider this channel to be very effective. However, even with larger distributors such as L&W Supply, there is opportunity for refinement and segregation of roles as stated by Jake Gress, Senior Director of Marketing who said “Inside sales are critical for some of our products. However, we need to clearly articulate the roles of the inside sales people because some of them are wearing too many hats.” As with the outside sales, the most compelling contrast between market leaders and other distributors is the level of effectiveness: 71% of leaders think that this channel is very effective whereas none of the other distributors thought it was very effective.

The next three channels are where market leaders really differentiate from the other distributors. Companies who are sophisticated in the use of these channels have transcended the “sell harder” mentality of many smaller, branch-based distributors. They have recruited and groomed professional marketing staffs and they make judicious use of external resources to complement in-house capabilities.

In store

MDM Market Leaders with more than $500M revenue are more likely to have in-store programs and they are much more likely to apply greater resources if they do. For these companies, 90% consider in-store to be very important or important whereas only 50% of the other distributors of similar size consider it to be very important or important. In general, there are comparable perceptions of effectiveness between market leaders and other distributors of comparable size. However, few distributors smaller than $500M in revenue consider their in-store programs to be very effective. As with the inbound telephone sales, the in-store channels are more centralized and coordinated for larger distributors. For smaller distributors, the in-store channel management is more ad hoc.

Outbound Telephone Sales

The data from the electronic survey firmly supported our pre-existing bias that outbound telephone sales is highly underutilized and poorly understood by many distributors. Only 61% of MDM market leaders and 41% of other distributors have an outbound telephone sales channel. Often, the outbound telephone sales function is combined with the inbound telephone sales. The combined channel results are frequently lackluster due to differences in skills and motivation necessary to succeed in outbound versus inbound. Only 21% of MDM market leaders versus 13% of other distributors said this channel was very effective. The channel is considered effective only by distributors with more than $50M revenue.

A number of companies with whom we spoke are in the midst of doing a trial with outbound telephone sales or they are upgrading their outbound telephone sales channel. However, almost no small distributors participate in this channel often because they lack guidance on where to start. A CEO of a small regional distributor said “We are just not very good at finding people to make outbound calls.” In fact, there are a number of ways to start small, test, refine, and reinvest proceeds to grow the operation.

Web

Very few distributors under $50M offer a true e-commerce capability. We found that a little more than half of mid-market distributors offer a basic e-commerce capability consisting of accurate product data, search, a shopping cart, and account login. More advanced capabilities for one-to-one marketing, integration with other channels, and richer personalization are available only from the very largest distributors. One of the biggest challenges for small and medium size distributors is cost justifying the capital expense to deploy a website. Some have turned to multi-tenant or industry websites such as Vanguard National Alliance. Others have limped along with informational websites with an aspiration to provide a transactional website in the future.

36% of MDM Market Leaders believe their website is very effective and 62% consider it to be very important to overall revenue. In direct contrast, none of the other distributors perceived their website is very effective or very important! Clearly, making the website effective and important is a crucial aspect of the distributor marketing imperative.

Conclusion

We believe that the stark difference in usage, effectiveness, and importance of sales channels by MDM Market Leaders relative to other distributors is testament to the centrality of multi-channel distribution strategies for distributors. Simply put, the MDM Market Leaders apply more resource and better management to multi-channel sales and get better results. This dynamic has a parallel in research done at Bain Consulting, covered in “Profit from the Core” by Chris Zook. They studied “sustained value creators”, companies who grew market share and profit over a many year period. They found that the sustained value creators reinvested at 15.3%, nearly twice that of their rivals, at 8.7%. By analogy, we believe that a significant part of the MDM Market Leaders success is derived from their marketing capabilities. For other distributors, the marketing imperative has two implications: In less competitive sectors, responding to the distributor marketing imperative can mean the difference between thriving and leading versus following.

In competitive markets, e.g. electronics where the leaders have well-honed multi-channel offerings, it can mean the difference between surviving versus not.

As part of our research, Distribution Strategy Group is continuing to benchmark distributor marketing practices. In Part II of the Distributor Marketing Imperative we will take a close look at the different marketing vehicles employed by distributors.

Jonathan Bein, Ph.D. is Managing Partner at Distribution Strategy Group. He’s

developed customer-facing analytics approaches for customer segmentation,

customer lifecycle management, positioning and messaging, pricing and channel strategy for distributors that want to align their sales and marketing resources with how their customers want to shop and buy. If you’re ready to drive real ROI, reach out to Jonathan today at

jbein@distributionstrategy.com.