Historically, distributors were limited to in-store marketing vehicles such as print flyers, catalogs, some telemarketing and tradeshows. Marketing vehicles that have become prevalent in the past five years include email, search engine marketing, increased telemarketing and social media.

Of course, the marketing vehicles are linked significantly to the marketing channels chosen by a company. As noted in Part 1 of this report, published in the May 10, 2011, issue of MDM, many companies have outside sales and inbound telephone sales channels. Fewer companies have a transactional website. Companies without e-commerce will make only token efforts in search engine marketing. In fact, some may avoid it altogether because they feel that the aesthetics or content on their websites are inadequate and so it may be counterproductive to draw attention to them.

In this article, we look at how MDM Market Leaders (defined as the largest distributors in their sectors) and other distributors use direct response and in-store marketing vehicles as well as mass media and social media marketing vehicles. The main differences between the leaders and other distributors lie in the use of print catalogs, search engine marketing and in-store events. The market leaders are more likely to use these marketing vehicles and to consider them important in their overall marketing efforts.

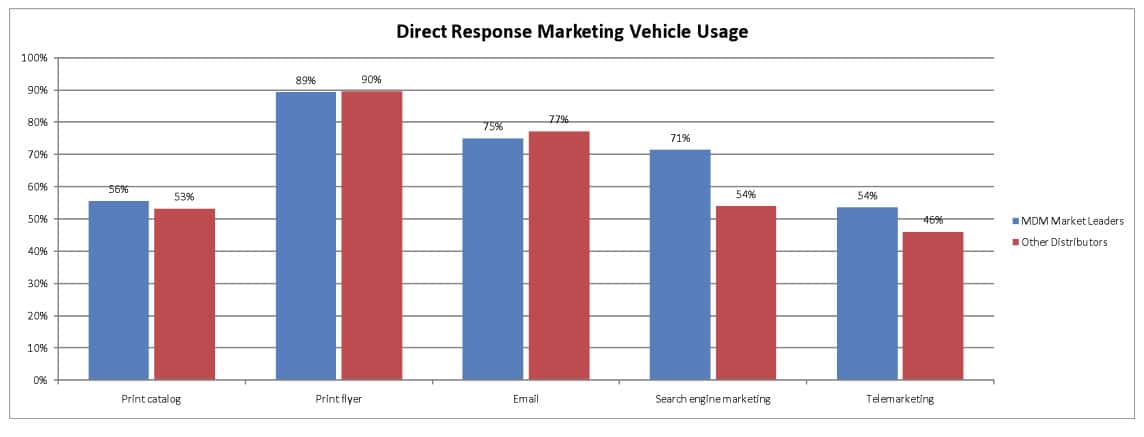

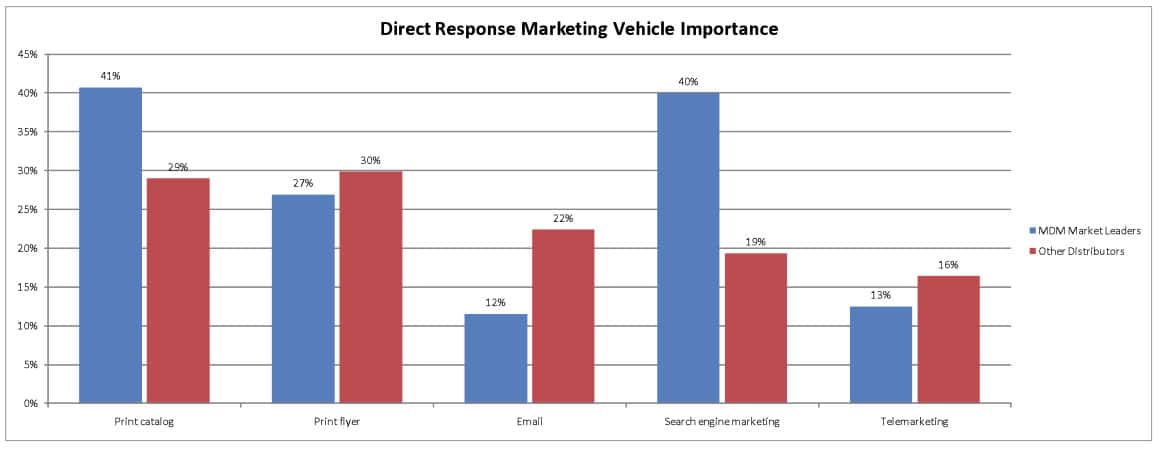

Direct Response Marketing Vehicles

As shown in Figures 1 and 2, the MDM-Distribution Strategy Group survey covered five direct response marketing vehicles including print catalog, print flyer, email, search engine marketing and telemarketing. With the exception of search engine marketing, MDM Market Leaders and other distributors have similar likelihoods of using a specific direct response marketing vehicle.

Catalog Marketing. Slightly over half of all respondents have catalog marketing programs. The main differences among respondents are size of catalog, frequency of distribution, and circulation. The MDM Market Leaders create larger annual catalogs but they also are effective with monthly mini-catalogs often customized to specific market segments. Distributors who are less focused on MRO sales are less apt to perform catalog marketing. Some vendors who either never had a catalog or ceased printing a catalog years ago are now moving directly to electronic catalogs. Yet, many distributors realize that their customers will first look in a print catalog and only then purchase online or over the phone. These distributors have not bought into the idea that “print is dead.” Instead, they are growing circulation of their print catalogs and show no sign of slowing down.

Email and Print Flyers. Almost 90 percent of survey respondents use print flyers and just over 75 percent use email marketing to reach customers. Larger distributors have daily or weekly operations focused on creating and delivering print-flyers or email whereas smaller distributors may do monthly or quarterly versions. One of the virtues of print-flyers and even more so with email is that it is easy to measure results because there is usually a specific offer associated with each of these vehicles. In contrast to other direct marketing vehicles, print flyers and email are primary vehicles for smaller companies who typically have less mature capabilities in search marketing, catalog marketing or telemarketing.

Email marketing is easy to do, but hard to do well. Burt Schraga, CEO of Bell Electrical Supply, Santa Clara, CA, said: “We do not believe in email marketing because it is highly commoditized. Everybody has got Constant Contact. I think the way to reach out is to send print material.” Large companies employ email marketing specialists who can create more targeted offerings, which addresses these concerns. These specialists can also leverage software tools such as Eloqua, Net Results Marketing or Silverpop that automate email responses based on what a customer viewed or how many times they visited a website, for example.

Search Engine Marketing. The use of search engine marketing is a clear point of differentiation between the practices of MDM Market Leaders and other distributors. Search engine marketing is a strategy focused on using free and paid tools online to optimize company visibility on Web search engines. More than 70 percent of the leaders use search engine marketing versus 54 percent of the other distributors. The increased usage by leaders is also reflective of their increased emphasis on the Web as a channel. Smaller distributors are less likely to have any e-commerce capability. As a result, 40 percent of the market leaders view this channel as important where only 19 percent of the other distributors do. Slightly more than half of the MDM Market Leaders do search engine marketing on a daily basis, often through dedicated in-house SEO/SEM experts. By contrast, smaller companies typically rely on third-party expertise.

Telemarketing. The presence of telemarketing was slightly higher for leaders at 54 percent versus 46 percent for other distributors. The main difference is the frequency with which the MDM Market Leaders do telemarketing: Half have daily, ongoing operations versus 31 percent for the other distributors. As noted in the first part of series, the outbound telephone sales channel is well utilized by about 20 percent of all distributors. Similarly, best practices for telemarketing such as list hygiene and selection of agents with proper skills are not well disseminated or applied by most distributors.

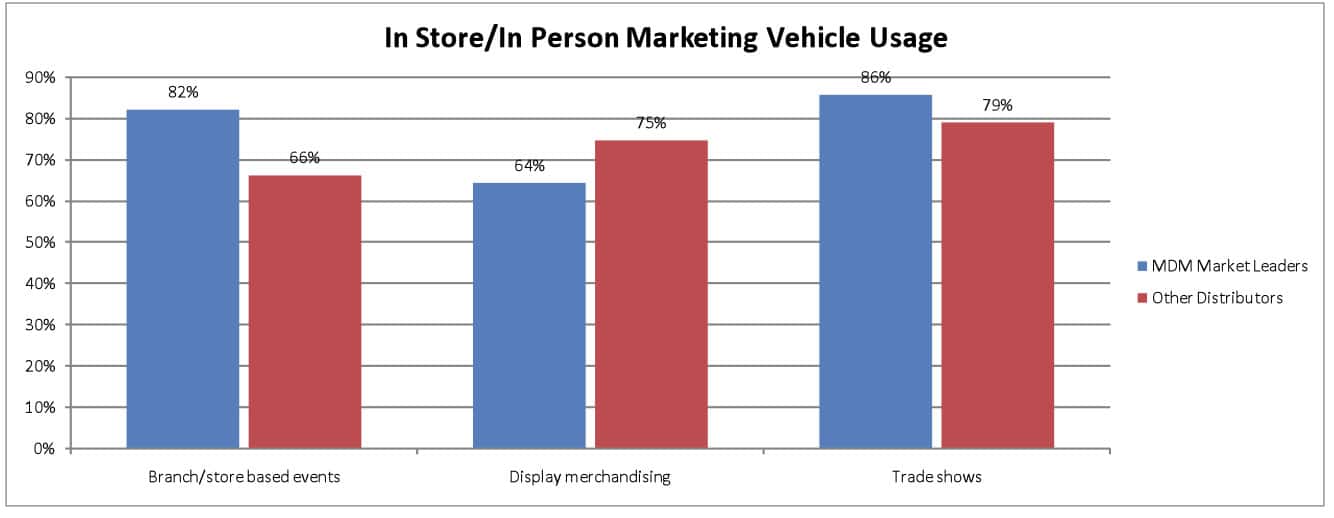

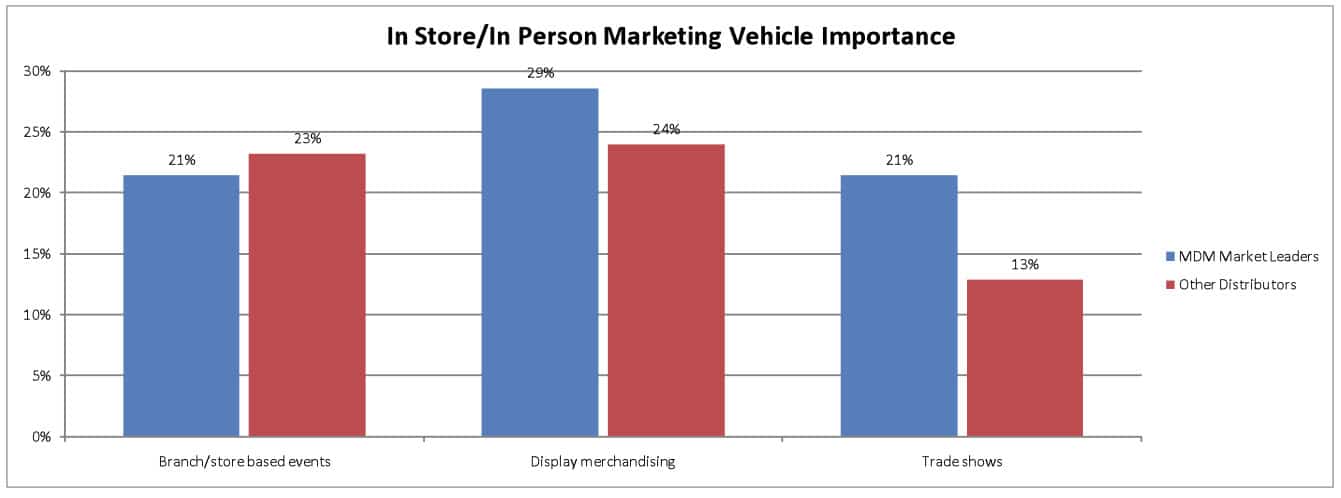

In-Store/In-Person Marketing Vehicles

As shown in Figures 3 and 4, the survey covered three in-store/in-person marketing vehicles including branch/store events, display merchandising and trade shows. Although each of these vehicles is commonly used by distributors, the MDM Market Leaders attach less importance to these vehicles than to catalog marketing and search engine marketing. They also attach more importance to these than to email marketing and telemarketing.

Trade shows. For many, a trade show is considered a necessary evil. On one hand, it is critical to have presence at certain trade shows. On the other hand, there are often minimal measurable results from the trade show. Larger distributors with professional marketing departments participate quarterly or even monthly whereas smaller companies only do annual trade shows.

Branch events. Over 80 percent of the market leaders use branch events versus 66 percent for the other distributors. The branch events can include training, sharing of best practices, and introduction of new suppliers. For distributors with more than $100 million revenue, branch events are usually held monthly and coordinated with the corporate marketing department. For very small distributors the events are held quarterly or even annually.

Display merchandising. This marketing vehicle is used less by the MDM Market Leaders than it is by the other distributors. This could be driven by distributors who do not operate branches and rely on catalogs and websites or distributors who focus on selling to OEMs. Many small distributors utilize display merchandizing with daily or weekly adjustments to increase sales. The market leaders who do utilize display merchandising rate it as more important than do smaller distributors.

Mass Media Vehicles

In general, mass media is a less common and less effective means for reaching the “prosumer†audience of B2B distributors. Among the survey respondents 7 percent use TV ads, 11 percent use radio commercials, and 8 percent use outdoor advertising, such as a billboard. Within the seven respondents who use TV as a marketing vehicle, one distributor sells consumer products and three of those seven only employ TV ads quarterly or annually. Use of radio by distributors is similar to TV: Only 4 of the 12 respondents who use radio do it weekly or daily. Grainger is a visible notable exception in its use of mass media, particularly television. The message of the MRO distributor’s ads is that Grainger has a wide selection of products. We wonder whether this is really the best message for them to convey through this expensive campaign given the incredibly high levels of existing awareness the company already enjoys about its brand and its huge assortment of products. This campaign is in conjunction with the distributor’s strategy to grow the number of product categories, suppliers and products beginning in 2006. Still, as large as Grainger is, their TV media must be applied carefully to reach a a responsive target audience.

Social Media Vehicles

Most distributors’ efforts with social media are experimental and involve straightforward uses of LinkedIn, Facebook and Twitter. Of the 36 percent who currently have a social media initiative, nearly a quarter of them are involved on a daily or weekly basis. Less than half of those with a social media initiative consider it important. However, a number of distributors understand that its importance as a marketing vehicle will grow as younger people are hired into the workforce. Nevertheless, the workforce is aging at only 2 percent to 2.5 percent per year, so it will be several years before those who have grown up with social media form a significant portion of the workforce. We believe that mobile applications that support ordering in the field will evolve much more rapidly than social media which is primarily awareness-oriented.

Conclusion

The choice of marketing vehicles depends heavily on distributors’ choice of marketing channels. In the previous article, we said that most distributors, whether they sell MRO products or to OEMs, have solid capabilities with outside sales and inbound telephone sales. However, capabilities for in-store marketing, outbound telephone sales and e-commerce vary widely. From the standpoint of marketing vehicles, the imperative for many distributors is to improve three marketing vehicles:

- Catalog marketing — For some companies, this may mean initiating a new effort or resuscitating prior work to begin catalog marketing. The efforts with the catalog will spill over to the e-commerce site because once the product content is created, it can be used in print or electronically. For those companies who publish a catalog annually or every other year, there is a great opportunity to do smaller form editions that are monthly or quarterly.

- Search engine marketing — Marketing returns on good search engine marketing can vastly exceed older methods of marketing or personal selling. A good e-commerce site is important but not a pre-requisite for SEO/SEM. Sites with good content and clear calls to action are also worthy of search engine marketing.

- In-store events — We spoke to a number of companies who believe that there is limited return on in-store marketing because “decision-makers rarely visit our store anyhow.†To break this self-fulfilling prophecy, distributors should improve all aspects of planning, targeting, execution, and follow-up for in-store events.

Jonathan Bein, Ph.D. is Managing Partner at Distribution Strategy Group. He’s

developed customer-facing analytics approaches for customer segmentation,

customer lifecycle management, positioning and messaging, pricing and channel strategy for distributors that want to align their sales and marketing resources with how their customers want to shop and buy. If you’re ready to drive real ROI, reach out to Jonathan today at

jbein@distributionstrategy.com.