Although e-commerce initiatives are front and center for many distributors today, in-store revenue remains essential. Yet most distributors with walk-in trade place limited emphasis on in-store marketing and merchandising. Analysis from a recent MDM survey showed that many of the merchandising decisions are decentralized, or left up to the location manager, including which products to feature, how often to rotate featured products and planograms, or shelf layouts.

Furthermore, while distributors value the expertise and involvement from their suppliers in merchandising, almost half receive no co-op funding from them, according to the survey. And even though most distributors perceive their display marketing and merchandising efforts as effective, one-third did not know how much revenue is generated from those efforts.

All of this suggests that, unlike retailers, most distributors do not view display marketing and merchandising as a core competency. It is treated as an afterthought with limited connection to the broader promotional strategy. The in-store marketing results are best summarized by Scott Bebenek, president of Canadian industrial distributor network Independent Distributors Inc., who said: “The percentage of sales sold from showrooms seldom comes close to the ratio of the square footage of the showroom to the square footage of the total facility.”

Display Space and Products

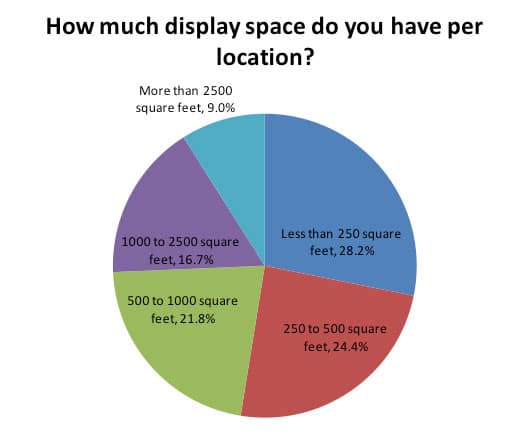

More than half of the respondents to the MDM survey have less than 500 square feet of display space. Less than 10 percent of the respondents have more than 2,500 square feet of display space. There was no correlation between number of locations and the amount of display space per location. Indeed, in our own experience we have seen small distributors with large showrooms and large distributors with smaller display space and vice-versa.

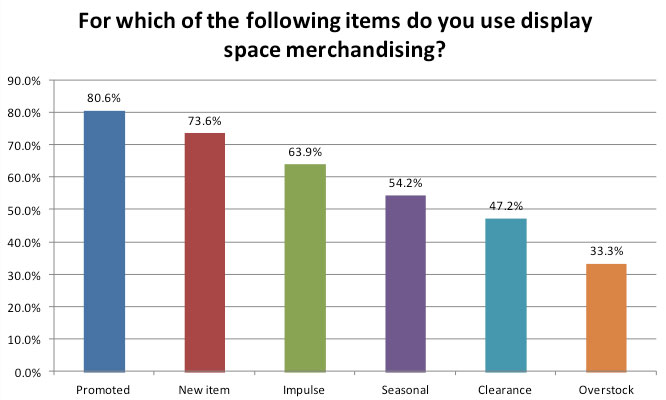

Over half of the respondents feature 30 or more items on display, under a quarter have fewer than 10. The most common items in display space are new items and promoted items as shown in Figure 2.

Merchandising Approach

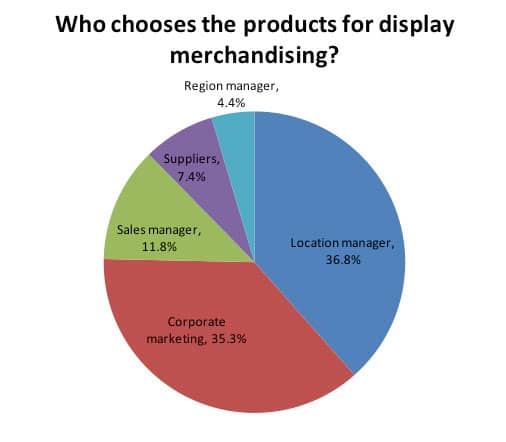

Successful retail merchandising is most often driven by a centralized corporate function that defines general approaches. Certain customization in merchandising is left to the discretion of the local store or franchise. Yet in this survey, corporate marketing chooses products to feature in merchandising only about one-third of the time. The location manager also chooses products for display for about one-third of the respondents. However, as expected, corporate marketing has more influence on products for display in larger distributors, 41 percent, than small ones, 27 percent. When planograms, or shelf layouts, are created, corporate marketing is responsible about half the time whereas the location manager is responsible one-quarter of the time.

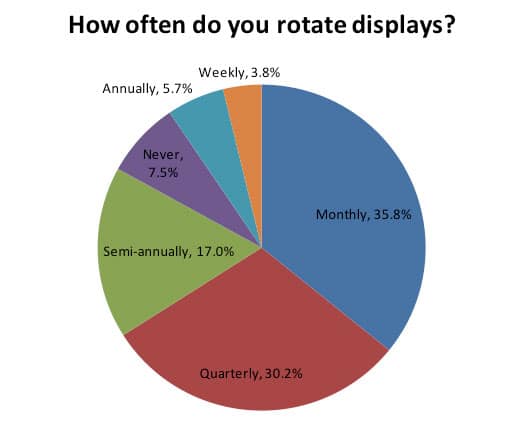

In retail, some displays are rotated weekly, but most are rotated every three to six weeks. The rotation is essential to show a broader set of products. Yet, only 40 percent of distributors in this survey rotate display products frequently, i.e. weekly or monthly. Thirty percent of the respondents rotate semi-annually, annually or never. Such infrequent rotation limits the effectiveness of in-store sales.

For pricing, more than half of respondents said that displays are not priced. When asked why the displays are not priced, many of the answers were some variation of the following: “We have different pricing for different customers so it would confuse them if prices were displayed.” Our experience in catalog, e-commerce and store settings strongly supports the importance of pricing on almost all products. When a customer looks at a power saw, for example, he wants to know whether it is a $50 product or $250 product. Once the base price is clear, he can estimate the actual price he will based on the contract pricing in place.

Supplier Involvement

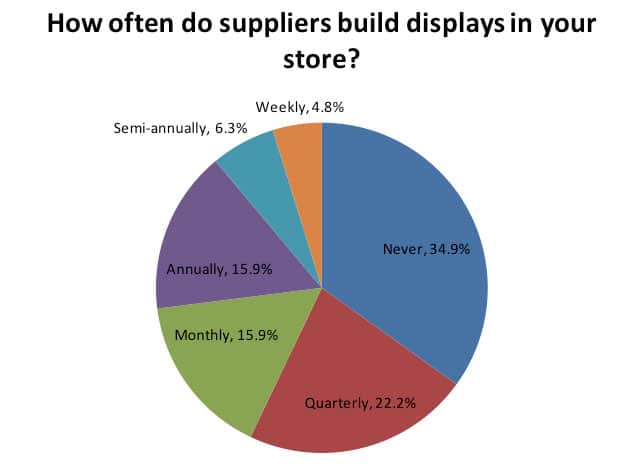

Supplier involvement for in-store activities including product introduction, training, co-op funding, and merchandising can boost in-store sales. Figure 5 shows how often suppliers participate in actually building in-store displays. More than one-third of distributors do not involve suppliers at all. 56 percent of large distributors receive help from the supplier at least every quarter versus only 21 percent of small distributors. In our experience, product suppliers, when given the opportunity, jump at the chance to support in-store marketing activities. It provides greater exposure to their brands and time in front of end-users as well as distributor personnel where they can share product features and benefits. Supplier reps often have time for these activities even with smaller distributors but are not often asked to participate.

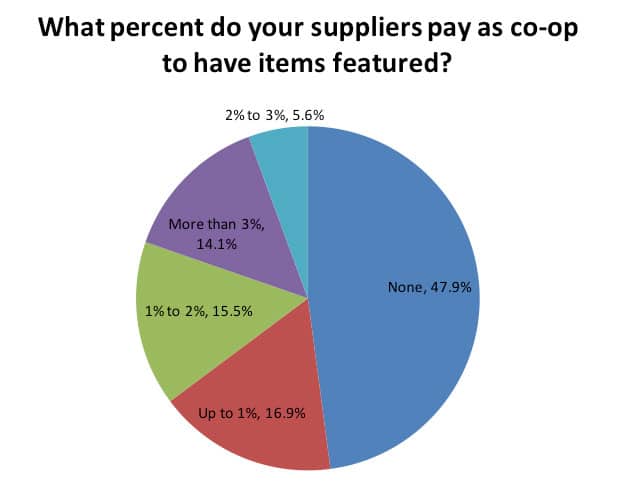

When it comes to co-op funding, nearly half of the distributors receive no co-op funding for display marketing. One-third of the distributors receive up to 2 percent funding for display marketing. Large distributors are three times as likely to get more than 2 percent co-op funding for display marketing. Since supplier funding is based on a percentage of sales, the size of the distributor does not determine funding, rather it is the sale of their products that is the source of the contribution. Suppliers are always working to get their products in front of end-users and in-store marketing provides that opportunity.

Merchandising Effectiveness

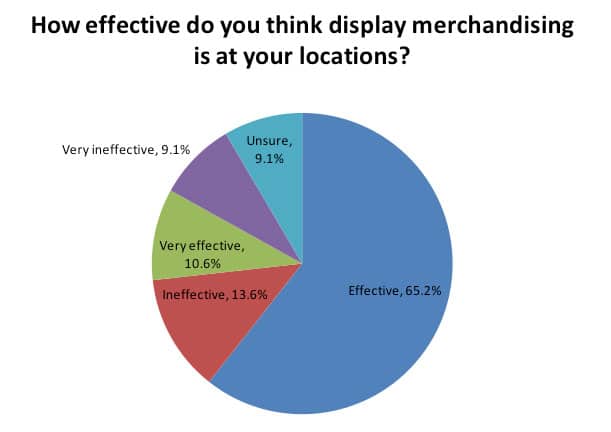

More than three-quarters of distributors believe that their display merchandising is either effective or very effective. Large distributors are more confident than small distributors in the effectiveness of display merchandising with 90 percent who believe it is either effective or very effective. We are skeptical about the effectiveness of these programs for several reasons:

- Effectiveness measurement – 60 percent measure effectiveness by quantity of items sold. Only 15 percent used more sophisticated metrics such as margin or revenue per square foot

- Revenue from display marketing – One-third of respondents do not know how much revenue comes from display marketing, but more than 75 percent believe the programs are effective or very effective. Unless they know how much revenue is generated, how can the assessment of effectiveness be credible?

- Monthly promotional strategy – Only one-sixth of respondents believe that their display marketing is highly linked to the monthly promotional strategy. Given the lack of coordination with other promotional programs, we consider it less likely that display marketing is working well in isolation from other marketing programs and monthly promotional strategy.

What to Do Next

Among distributors with walk-in trade, those with the highest overall revenue have realized the greatest benefit from showroom merchandising efforts. They have more expertise, a higher level of supplier participation and better measurements to ensure success. Smaller and mid-size distributors have significant opportunity to improve in-store revenue through more effective use of displays. Supplier participation and funding is not limited to larger distributors. Supplier reps will always take the time to work on in-store marketing activities and funding can always be attained as a percent of sales.

Distributors need to start with a strategic plan that includes target revenue expectations, identification of the right products for display, a timetable for rotating products, visible signage including pricing and a set of measurements to monitor and modify the plan as needed. Add-on sales to walk-in customers should be a part of the strategy. It is common for customers to pick up extra batteries or other commonly used consumable items when those products are well-merchandised and near the sales counter. While in-store sales are not the greatest driver of sales, every dollar counts. If you have the space available why not use it to increase your revenue and profits?

About This Survey

This research was conducted by Distribution Strategy Group with Modern Distribution Management. The research included an online survey taken by 85 participants across distribution sectors. There was heavier participation from industrial, electrical and safety. Other participating sectors include chemicals and plastics, building materials, pulp and paper, janitorial, hardware, oil and gas, grocery and pharmaceutical. 47 percent are small distributors with less than $50M revenue, 17 percent are mid-market with $50M to $500M revenue, and 36 percent large with more than $500M revenue.

Jonathan Bein, Ph.D. is Managing Partner at Distribution Strategy Group. He’s

developed customer-facing analytics approaches for customer segmentation,

customer lifecycle management, positioning and messaging, pricing and channel strategy for distributors that want to align their sales and marketing resources with how their customers want to shop and buy. If you’re ready to drive real ROI, reach out to Jonathan today at

jbein@distributionstrategy.com.