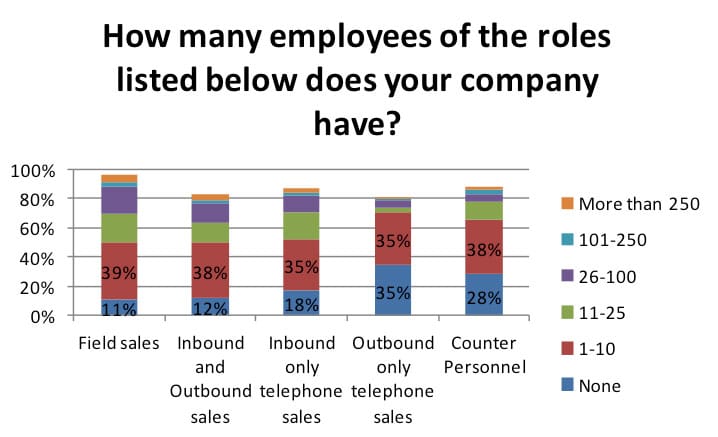

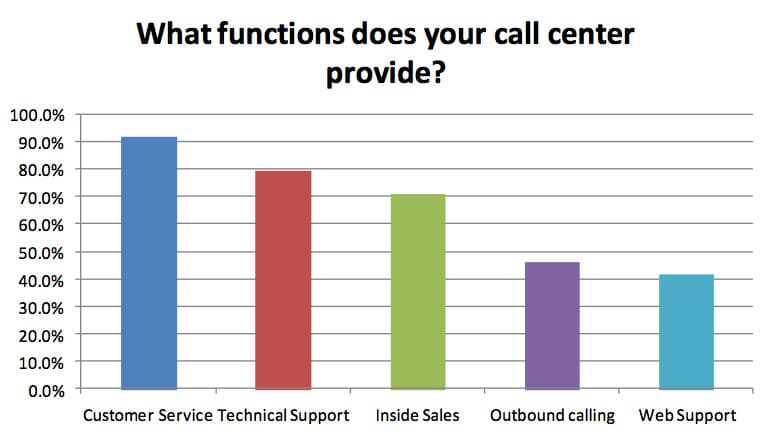

While social media and e-commerce are gathering increasing attention among distributors, some of the most successful have utilized call centers to support effective inside sales as part of an integrated multi-channel offering. However, in a recent MDM survey, the vast majority of distributors have limited inside sales functions or outbound-only telephone sales (see Figure 1) in large part because they may not understand the power of inside sales by itself or in conjunction with field sales, e-commerce and direct response marketing.

For many, inside sales involves ordering, technical support, returns handling and credit management. Rarely does it involve proactive, outbound sales. Simply put, those with the title “Inside Sales” spend little or no time actually doing inside “sales” because they lack the time, training or aptitude or skills to be successful.

Here are some common signs that suggest inside sales should be improved:

- Steady, repeat customers buy the same set of products in the same quantity over and over.

- Cross-selling opportunities are routinely missed.

- Average order value is low because salespeople are not upselling and cross-selling into other product lines.

Most of the distributor’s revenue comes from a small number of large accounts that are managed entirely by field sales. Meanwhile, small- to medium-sized customers are underserved or unserved by field sales.

There are too many “one-and-done” customers who buy once and never return because there was no outreach after the first sale.

Margins suffer because discounts are given frequently and often unnecessarily by customer service representatives who are trying to please the customer.

In partnership with Modern Distribution Management, we conducted a survey of distributors in an effort to understand their proactive selling practices. We found that there is a lot of room for improvement in building the inside sales function into a sales growth center.

Limited Proactive Selling

Proactive selling is defined as making outbound calls into accounts to generate additional business as well as leveraging inbound calls by upselling, cross-selling and better understanding customer needs. Making proactive outbound sales calls is markedly different from selling on the inbound call and requires a different skill set.

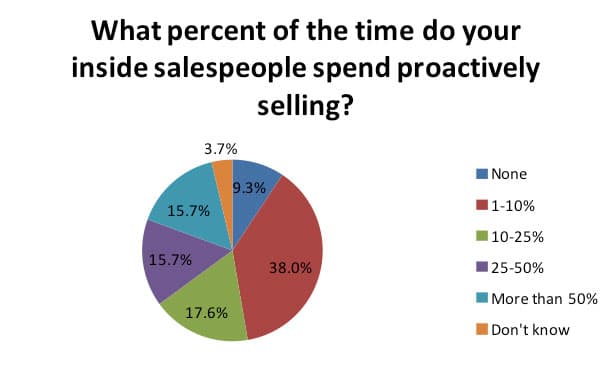

As the data in Figure 2 indicates, nearly half of the respondents stated that their inside sales reps are proactively selling less than 10 percent of the time. One sales executive at a mid-market distributor said: “We are overloaded with large customers who need customer service. We don’t have time to be more proactive.” Others have said that their inside sales reps are not sufficiently trained, nor do they have the skill sets required to be proactive.

Paradoxically, the strong service culture in distributors of all sizes is an impediment to having a good inside sales channel. The service culture often breeds a mentality of “do whatever it takes to satisfy the customer.” In turn, many people end up being generalists with skills in several areas. By contrast, the best inside salespeople are sharp-shooters. They are singularly focused on getting additional revenue and less focused on day-to-day customer service.

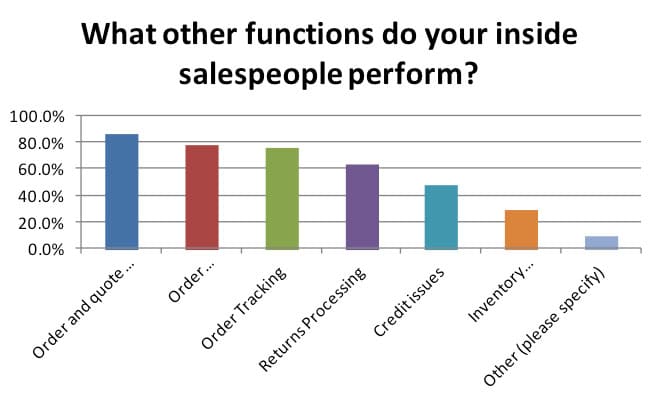

Figure 3 outlines the other activities inside salespeople are performing. The amount of time spent performing these activities supports the premise that inside salespeople are spending most of their time on functions that are not directly sales-related. Much time is spent on ordering and quoting, which are prime opportunities for upselling and cross-selling.

However, when we asked if survey respondents felt their inside salespeople had the time to be more proactive during their day, 63 percent said that they did. But the perception among many managers is that inside salespeople have more time than they actually do to do outbound calling. The reality is other non-sales tasks quickly fill their time.

This underscores that many distributors significantly underestimate what is involved in successful inside sales.

Another thing to consider is the change in the way customers are communicating with distributors. Our research has shown that as much as 50 to 75 percent of customers prefer to communicate using email or fax when placing an order or requesting a quote. Many more prefer to use websites for order placement. This does not mean that proactive selling stops because we are not communicating with our customers via telephone.

There are still ways to “sell” using these tools; an example is including a new product link on the email that is being returned to the customer with the pricing information.

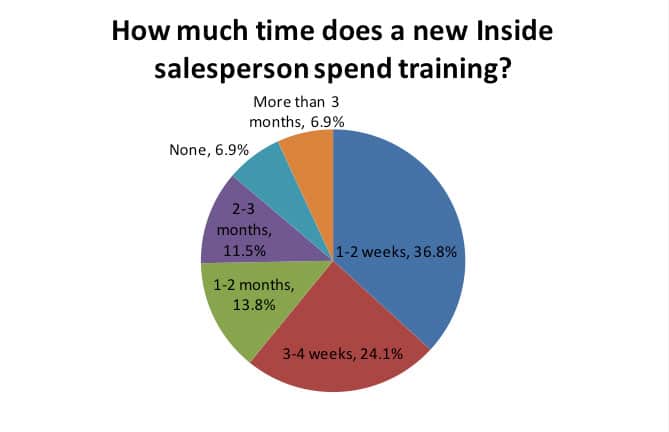

Training was a recurring theme throughout the survey. More than two-thirds of the respondents said that their training programs for inside sales representatives were four weeks or less. The majority of this time is spent in technical training, i.e. product, order/quote entry and customer service. Minimal time is spent on actual sales training.

Obviously, the other part is that unless the salesperson has the right personality and aptitude to do outbound calling, they will do every other task before getting to outbound.

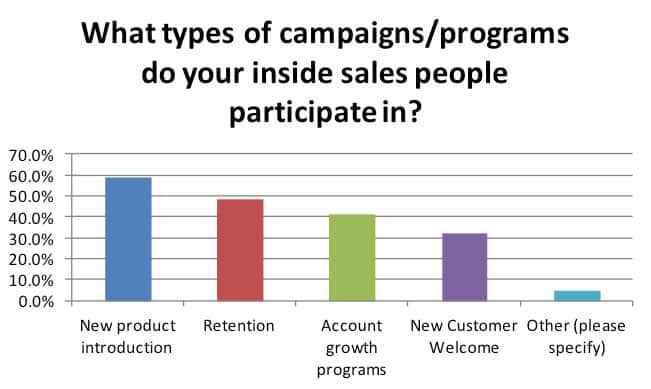

The most common campaign programs in place were for new product introduction, with less emphasis on customer lifecycle programs. This is indicative of a lack of quality proactive selling. Customer lifecycle management is key to growing and retaining customers and effective proactive selling is centered on understanding this process. Integrating selling and marketing programs into a cohesive lifecycle program is the basis for double-digit sales growth.

A good rule of thumb is to ensure that on at least 50 percent of the inbound phone calls some type of upsell or cross-sell is being offered. Obviously this will depend on the specifics of the business and how often customers are calling in, but each customer contact presents an opportunity to uncover customer needs. Even a well-resolved customer service call can be an opportunity to strengthen customer relationships and to probe for customer needs.

The Benefits of a Centralized Call Center

How the inside sales function is structured within the organization plays a key role in the success of the program. Many distributors are branch/geographically focused and have inside sales spread throughout the branch network. Fifty percent of respondents said that they had a functioning call center within their organizations. Not surprisingly, the activities most performed within the call centers were customer service-related.

Centralization of the inside sales function is the optimum structure for effectiveness. A centralized call center allows for consistent hiring, training and activity overview. It is also an excellent way to create a team atmosphere that can be used for idea exchange and support. Effective salespeople thrive in an environment of healthy competition.

The measurements of call center performance in the survey were also indicative of the customer service-related tasks performed in the call center, with average speed of answer; number of calls answered and call service quality being the most measured activities. Measurements of effective salespeople are markedly different than those for customer service activities. We’ll discuss these measurements in our next article.

Double-Digit Benefits

When done properly, proactive inside sales can provide significant revenue growth with small and mid-market customers. We often have seen 15 to 20 percent annual growth over a multi-year period after inside sales programs have been properly initiated.

Inside sales can also play a key role in both margin and sales growth with larger customers. One significant way is to identify additional key contacts within these large and oftentimes geographically disparate organizations. Field sales simply cannot uncover as many contacts as an inside salesperson can with a well-targeted calling plan. An effective upselling and cross-selling plan is also necessary to increase margins in these large accounts, since they may have pricing contracts in place.

In the next article, we will cover best practices for inside sales and for the integration of inside sales with other channels.

Debbie Paul is Partner at Distribution Strategy Group. Debbie helps distributors identify and communicate their value so they can better serve and sell to their customers. At Newark Electronics, she oversaw the growth of small- to medium-sized high-potential accounts with results of over 10% growth in the first year, continuing in subsequent years at a rate of 15-20%. Ready to tap the full potential of your customer base? Contact Debbie at dpaul@distributionstrategy.com.