Marketing still tactical, rather than strategic, for most distributors

The 2014 distributor marketing survey covered several areas of marketing, including planning, objectives, vehicles, channels and organization. Companies are using more digital marketing than they did in the 2011 survey. They consider it more important, and they are staffing accordingly.

A key challenge articulated by many respondents is proper measurement of marketing return on investment. With the increase of sales and marketing channels, respondents indicated that there is difficulty in attributing a purchase to a particular marketing vehicle or campaign. The main problem is that one or more campaigns may have targeted a particular set of users. Deciding how to attribute the response and the ROI to one of the campaigns can be tricky unless it is set up properly to start.

In addition, many companies have historically viewed marketing as a cost center and have made minimal attempts to measure marketing ROI. As a result, it can be difficult to know what measurements make the most sense.

Along with the challenge in measurement for multiple channels, respondents identified the challenge of getting proper and consistent messaging across all of the channels. Staffing allotment and failure to follow a clearly defined marketing plan both contribute to this challenge.

In addition, messaging to multiple influencers instead of just one was mentioned by several respondents as a marketing hurdle.

Planning and Objectives

Respondents were asked to identify the primary influences on marketing activities. Corporate strategy has the biggest influence on marketing activities, followed by the sales department.

Marketing plans and responses to competitive actions had much less effect on actual marketing activities. While 80 percent of respondents create a marketing plan annually, only 40 percent rely heavily on the plan. Slightly more than 40 percent rely somewhat on the marketing plan. In essence, for most companies, the marketing plan is a document that is written and ignored. As a result, marketing usually ends up as a service organization with a tactical role for most distributors, rather than a strategic role.

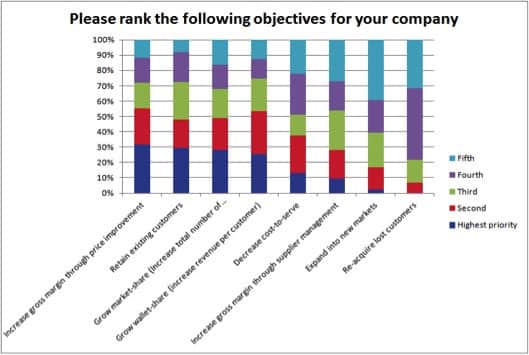

Respondents were also asked to identify what they wanted to achieve with their marketing programs. The top four priorities were to increase gross margin through price improvement, retain existing customers, grow wallet share and grow market share. These four priorities are externally focused and fall in the realm of sales, marketing and product management. By contrast, the next two priorities, decreasing cost-to-serve and increasing gross margin through supplier management, are operationally focused.

Customer retention is a bigger issue for small companies. Survey participants revealed that the omnichannel programs of larger distributors caused some customers to switch suppliers.

Larger companies placed greater emphasis on increasing gross margin through supplier management.

Marketing Vehicles and Channels

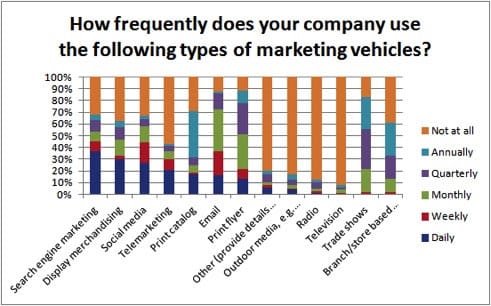

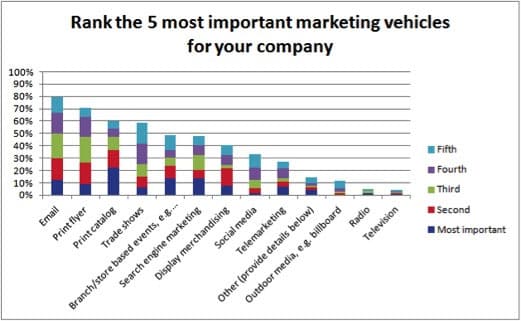

Distributor marketing programs are shifting away from store-based merchandising and events toward digital media, including email marketing, search engine marketing and social media. The emphasis on print media changed little since the previous survey. The most frequently used vehicles, as shown in Figure 2 on the next page, include search engine marketing, in-store display merchandising, social media and telemarketing.

While digital vehicles are increasing in the frequency of use, print vehicles, such as flyers or catalogs, continue to be viewed as important or very important for respondent companies. (See Figure 3 below.)

Key Marketing Trends

The 2014 survey revealed some key changes from the 2011 edition. While distributors shift from store-based marketing efforts to digital platforms, the size of the company has an impact on how developed some of these strategies are. Some of the key trends identified include:

Digital

- Email: More than half of respondents do email marketing one to two times per month; 16 percent do it daily. Overall, email marketing is the most heavily used marketing vehicle and considered the most important marketing vehicle. It was the sixth most important marketing vehicle in the 2011 survey.

- Search engine marketing: Search engine marketing and display marketing have switched places regarding frequency of usage from the last survey to this one. More than 35 percent use SEM daily; 17 percent use SEM weekly or monthly. A third of the respondents do not use SEM at all, most likely because they have a limited Web presence or no e-commerce. The portion of respondents who use SEM at least monthly grew from 45 percent in the prior survey to 53 percent.

- Social media: The percentage of companies that update social media at least monthly grew from about 30 percent to just less than 60 percent. Midsize companies use social media the most frequently.

In-store

- Display merchandising: The portion of respondents who perform display merchandising at least monthly shrank from 60 percent in 2011 to 45 percent. While companies still use display merchandising, it was third most important in the prior survey and seventh most important in the current survey.

- Branch- and stored-based events: Though used infrequently, branch- and store-based events rate moderately high in importance to respondents from this survey.

Print/Telemarketing

- Catalog: The portion of companies that publish a catalog at least annually increased from 58 percent to 70 percent. More respondents chose catalog as the most important vehicle in the current survey than any other marketing vehicle.

- Print flyer: Almost 90 percent of the respondents publish a print flyer, with 30 percent producing it monthly or weekly and 20 percent producing it quarterly. In the prior survey, the print flyer was considered the most important vehicle; it is now second most important.

- Telemarketing: Companies that performed telemarketing at least weekly remained around 30 percent.

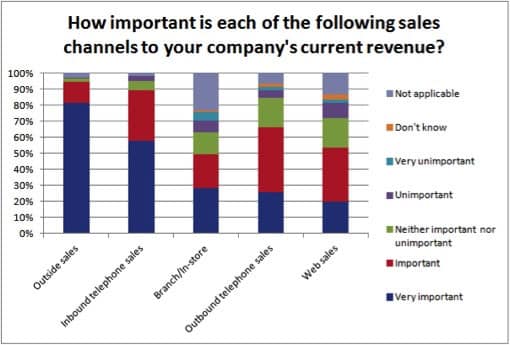

The importance of sales and marketing channels has also shifted in the current survey. The emphasis on outside sales is partly correlated to a large percentage of respondents who are small distributors or manufacturers. (See Figure 4.) Often, outside sales is the only channel for these small companies.

The importance of inbound and outbound telephone sales shifted from the prior survey. Inbound is very important to 55 percent of respondents versus 65 percent in the prior survey. The importance of outbound sales remained the same from the prior survey to this one. However, the previous survey showed a strong correlation between size and importance for outbound telephone sales and Web sales. Overall, Web sales rated important or very important for 50 percent of respondents versus 40 percent in the previous survey.

Marketing Organization

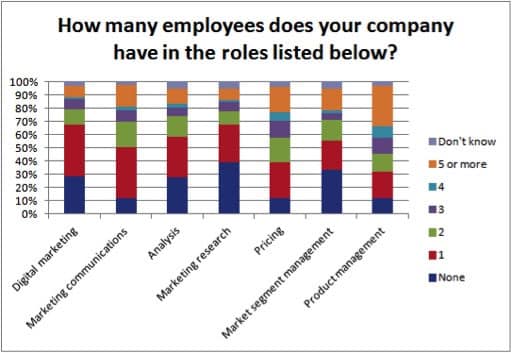

Marketing as a distinct job is still lacking in many distribution companies, particularly when the role is focused on something other than communications, product management or pricing. (See Figure 5.) While the number of people by job function is clearly correlated with company size, there are a few notable points.

Product management is the most heavily staffed job function followed by pricing. These functions may be in marketing or in another department.

For many companies with less than $50 million in annual revenue, the only marketing job function is marketing communications. The marketing department in smaller and even mid-size companies is frequently in the sales department.

Marketing research is the least heavily staffed job function, followed by market segment management. Few companies with less than $250 million in annual revenue have dedicated marketing research personnel or segment managers. In midsize and smaller companies, market segment management is combined with product management. However, when the role is combined, there is usually much more emphasis on product management.

About This Survey

This research was conducted by Modern Distribution Management and Distribution Strategy Group. It included an online survey taken by 305 participants across a variety of distribution and manufacturing sectors. There was heavier participation from industrial, safety, oil and gas products, electrical, electronics, building materials, janitorial, HVACR/plumbing and hardware. Other participating sectors included pulp and paper, chemicals and plastics, grocery/foodservice and pharmaceutical.

Nearly 50 percent of respondents were small distributors with less than $50 million revenue, nearly one-third had $50 million to $500 million in revenue, and 17 percent were large with more than $500 million revenue.

Half of the respondents have 10 or fewer branches, a quarter have 10 to 100 branches, 13 percent have more than 100 branches, and 11 percent have no branch.

Jonathan Bein, Ph.D. is Managing Partner at Distribution Strategy Group. He’s

developed customer-facing analytics approaches for customer segmentation,

customer lifecycle management, positioning and messaging, pricing and channel strategy for distributors that want to align their sales and marketing resources with how their customers want to shop and buy. If you’re ready to drive real ROI, reach out to Jonathan today at

jbein@distributionstrategy.com.