Summary

- Objectives and marketing challenge

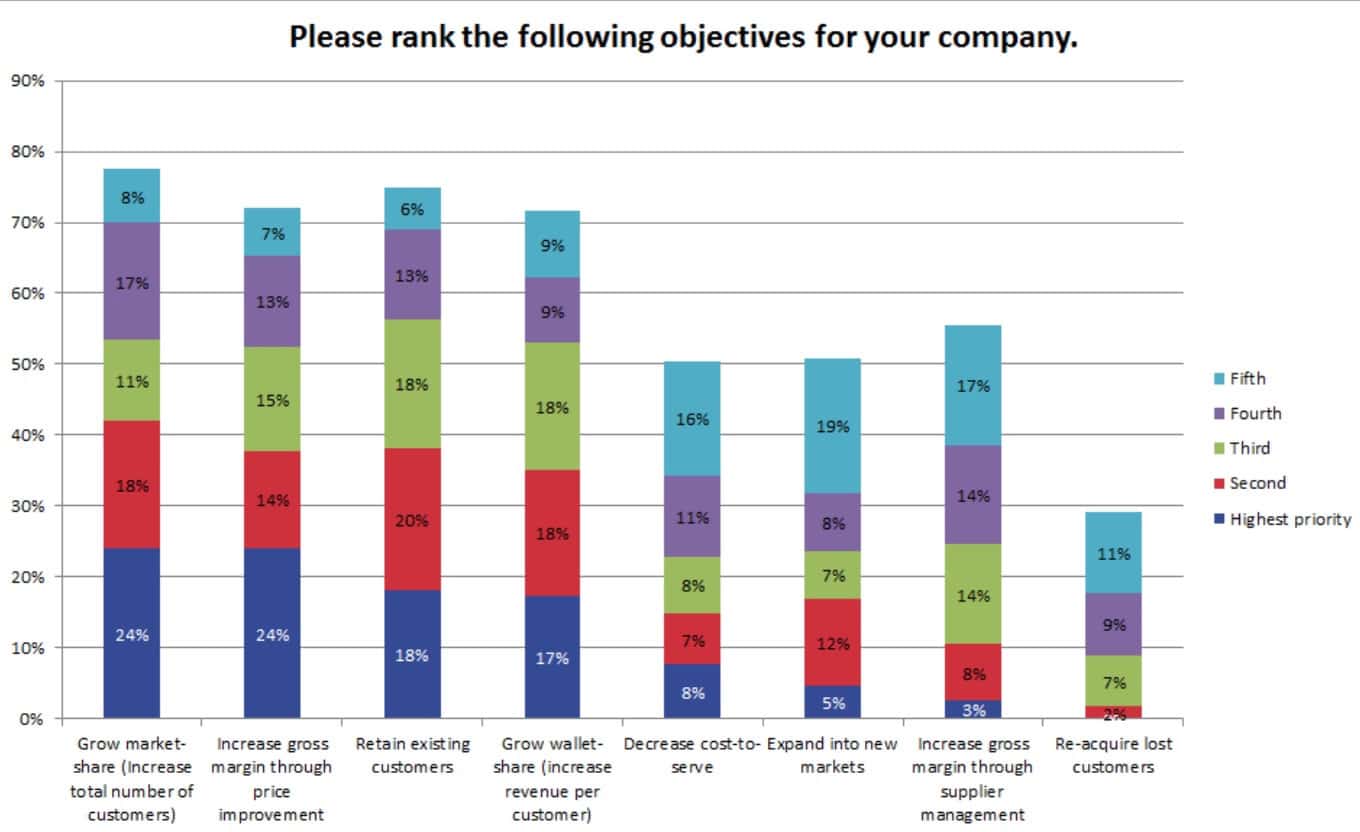

- Grow market share and increase gross margin followed by retain existing customers and grow wallet share are the most common objectives

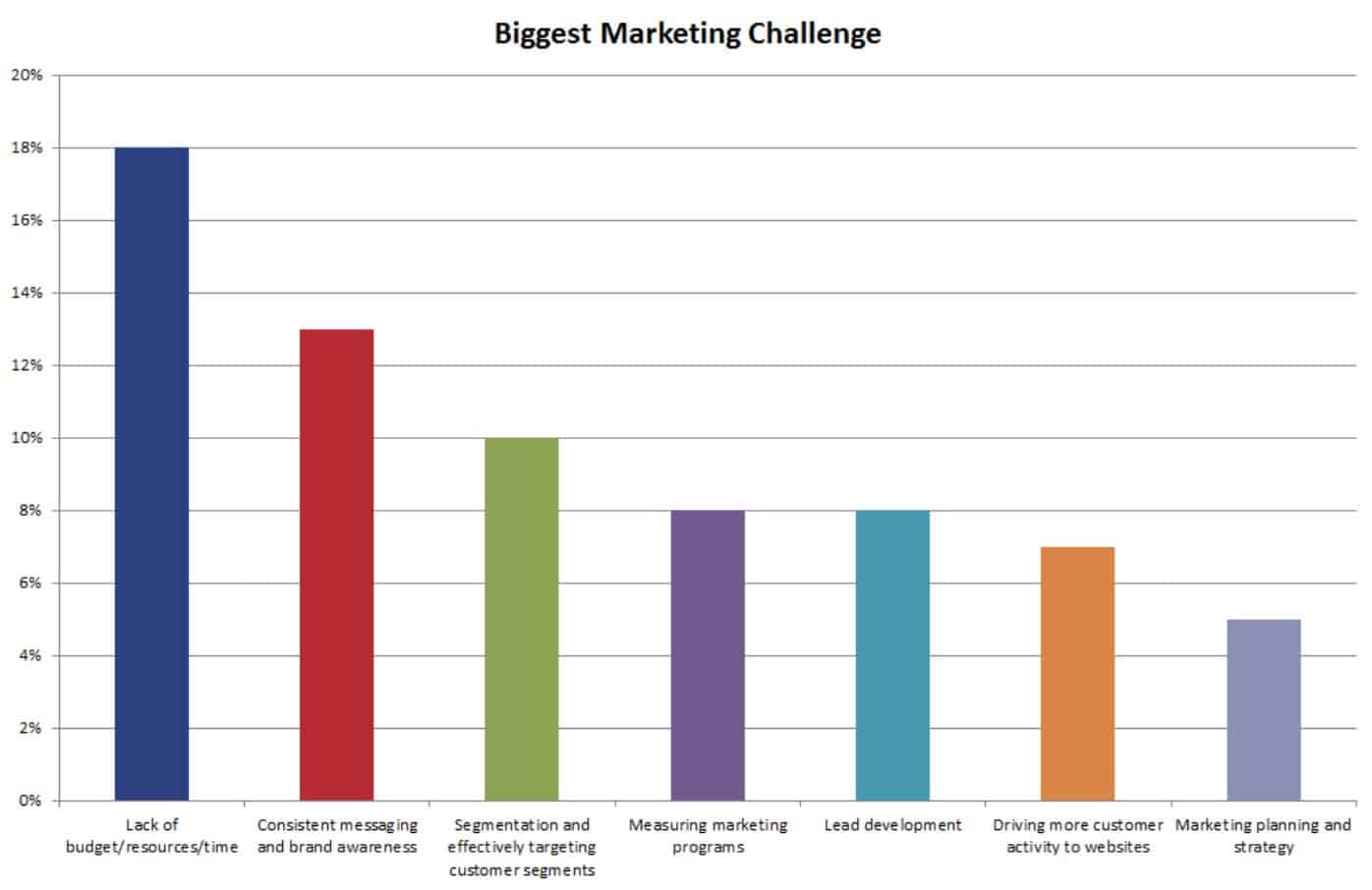

- Budget/resources and branding were named as the top marketing challenges though responses were quite divergent.

- Vehicles and channels

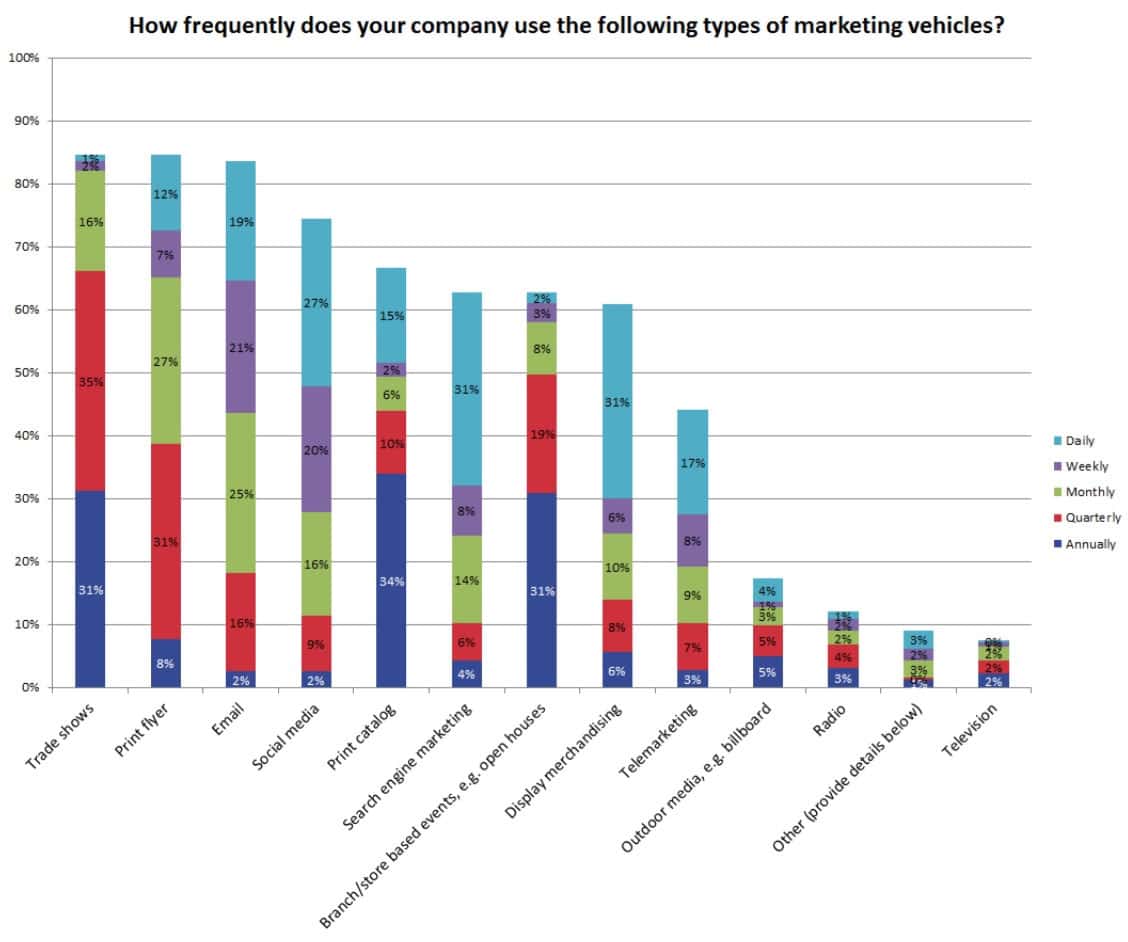

- Print flyers, trade shows, and email remain the most commonly used marketing vehicles

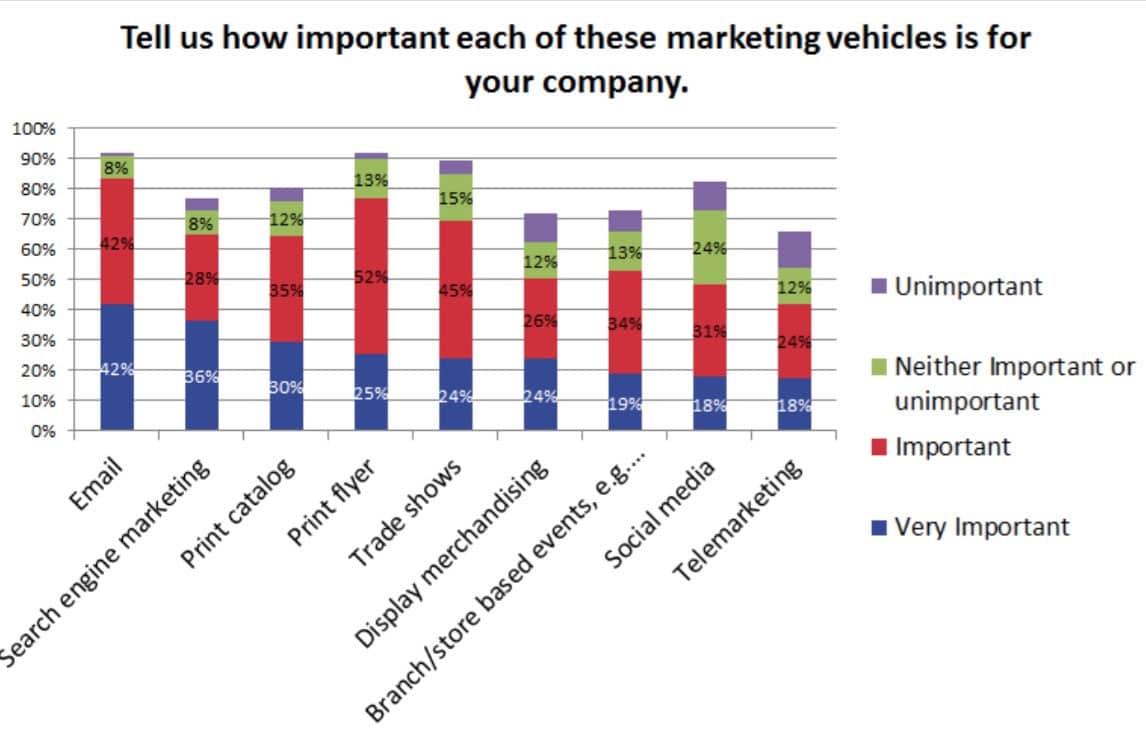

- Most important vehicles are email, search engine, and print catalog

- E-commerce importance as a sales channel is biggest change from 2014

- Organization and infrastructure

- Outbound sales only with 1 to 10 employees increased from 27% in 2014 to 38% in 2015

- Mild increase in personnel for marketing communications, digital marketing, analysis, and research

- Pricing

- Most prevalent pricing approaches are competitive pricing and volume pricing

- Only 12% of respondents use a pricing tool or service

Objectives and marketing challenge

Objectives

The highest priorities are:

- Grow market share and increase gross margin followed by retain existing customers and grow wallet share

- Last year nearly 90% of respondents ranked customer retention as a priority and more respondents chose it as the number one priority.

- This year the top four priorities are all 70%+ whereas last year the top four priorities ranged from 90% to 65% overall

Biggest marketing challenge

Responses appear to be quite divergent.

Two most prevalent responses are:

- lack of budget, lack of resources and not enough time

- consistent messaging and branding

Vehicles and channels

Marketing vehicle frequency

- Print flyers, trade shows, and email remain the most commonly used marketing vehicles

- Companies who email weekly increased 60%

- Social media replaced print catalog as the fourth most popular marketing vehicle, however the increase was among respondents who use social media annually

- Mass media usage (radio, TV, billboard) remained the same.

Marketing vehicle importance

- Most important: Email, search engine, print catalog

- Total importance: Email, print flyer, trade shows

- Material increase in SEM importance relative to last year. Yet, overall few distributors are doing much with SEO or SEM. Mass media remains unimportant

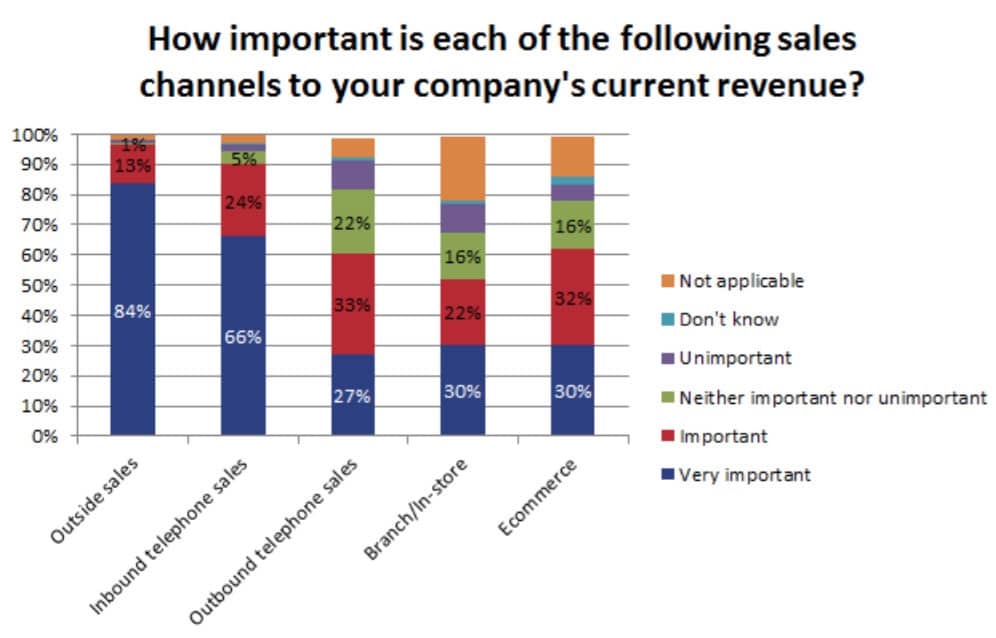

Sales channels

While outside sales remains critical, the big change from the prior survey is e- commerce increased from 54% to 62% important or very important.

Organization and infrastructure

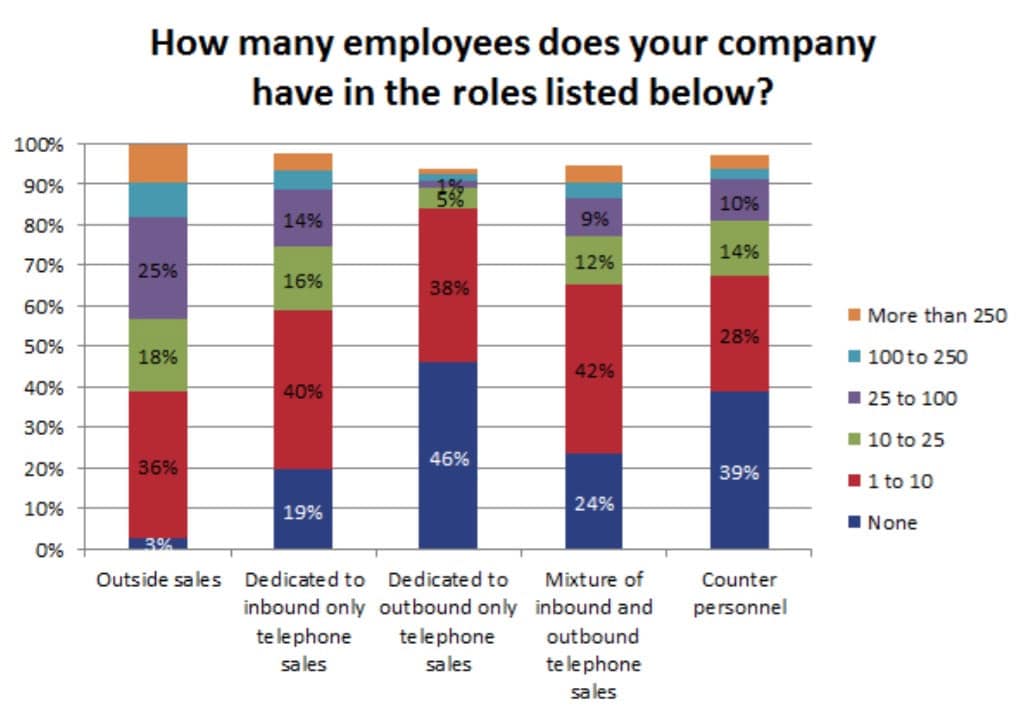

Sales personnel

- Outbound only with 1 to 10 employees increased from 27% in 2014 to 38% in 2014

- Increase in percentage of companies without mixture of inbound and outbound from 19% in 2014 to 24% in 2015

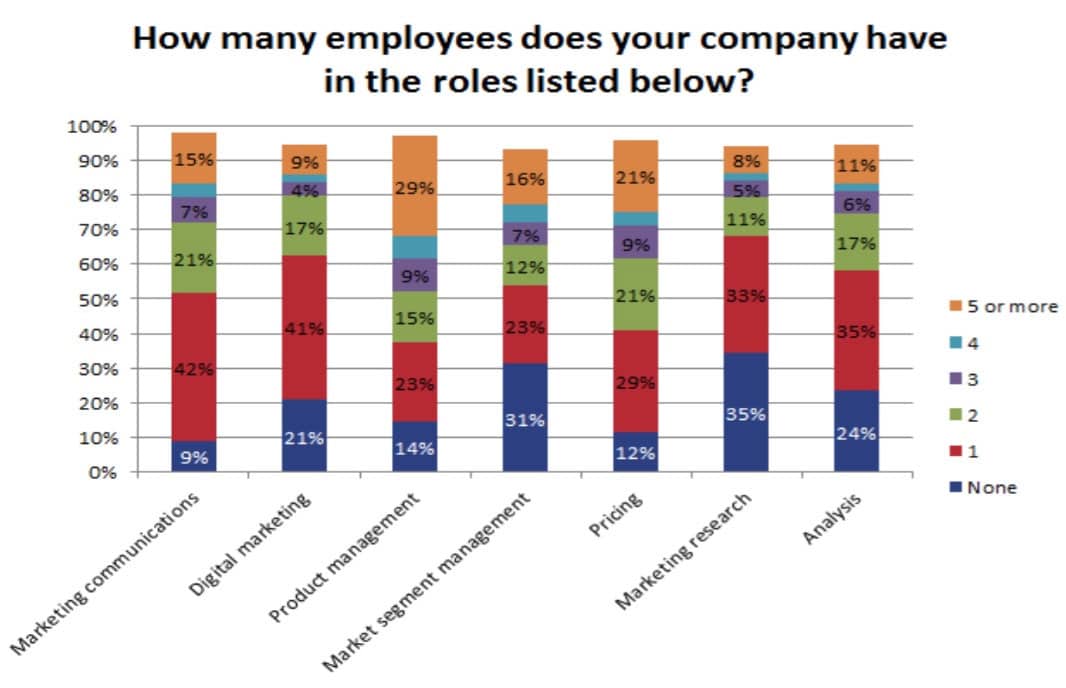

Marketing personnel

Marketing communications — mild increase in companies that have marcom.

Digital marketing:

- mild increase in companies that have digital marketing

- 33% increase in companies that have 2 or more employees

- Marketing research and analysis — mild increase in companies that have at least one employee in these functions

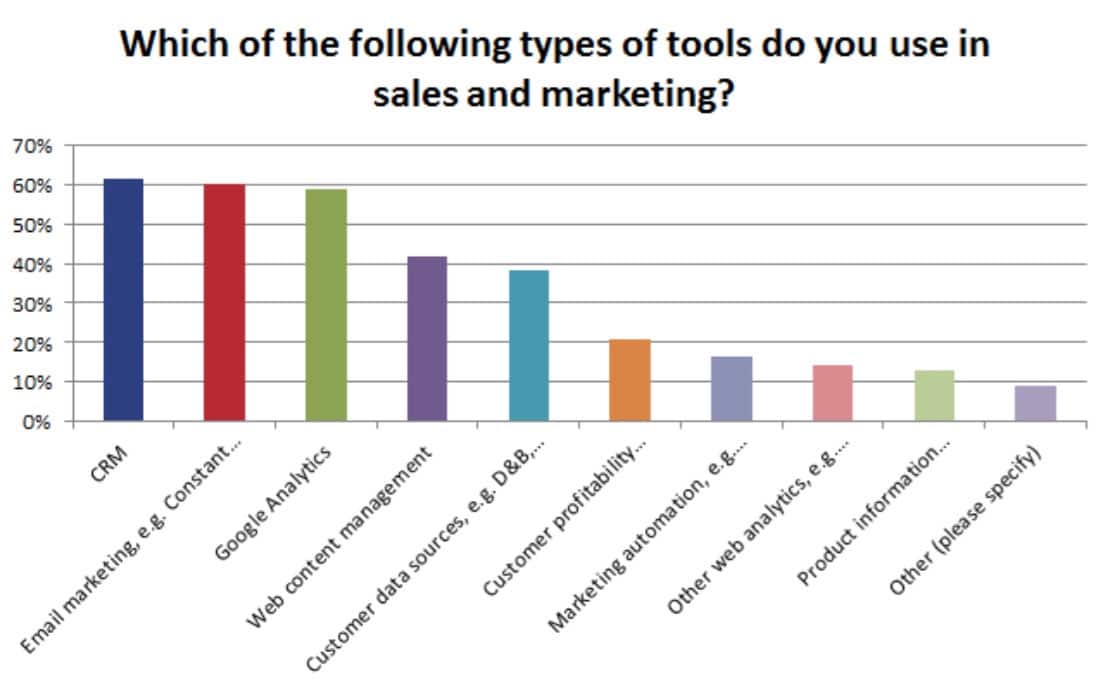

Sales tools

- 60% use CRM and email marketing tools

- 60% use Google analytics, increase from 50% in 2014

- 16% use marketing automation, increase from 12% in 2014

Pricing

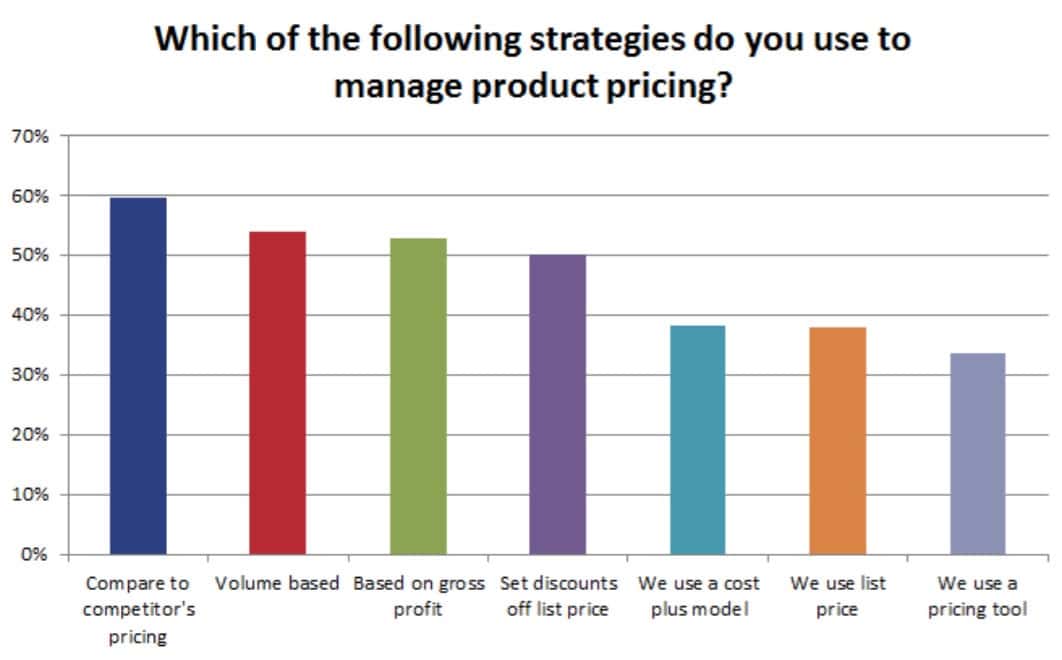

Pricing strategies

- Respondents use multiple pricing approaches

- Most prevalent are competitive pricing and volume pricing

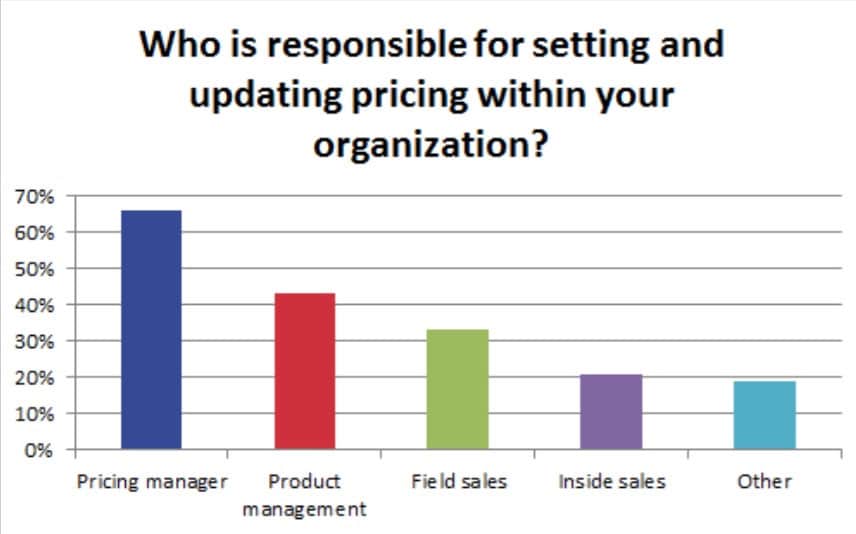

Price setting

- Pricing manager 66%

- Product management 42%

Just over 4 percent of respondents commented that they have senior management involved in the process.

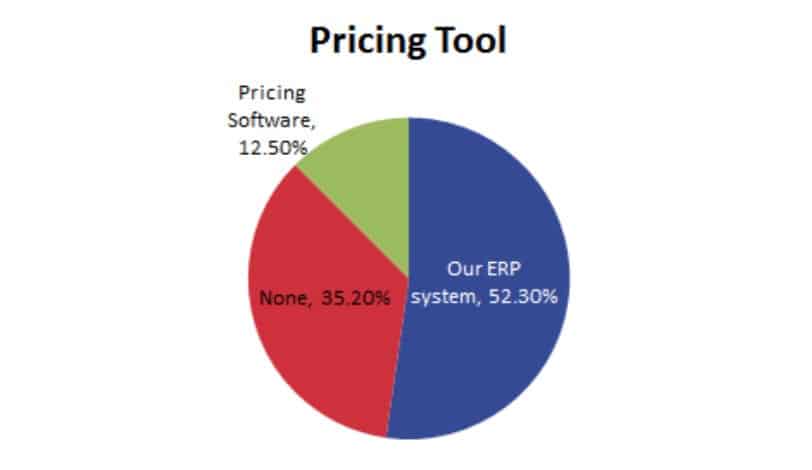

Pricing tool

- Over half use pricing from the ERP system

- 35% have no pricing guidance at all

- Only 12 percent use a pricing tool or service

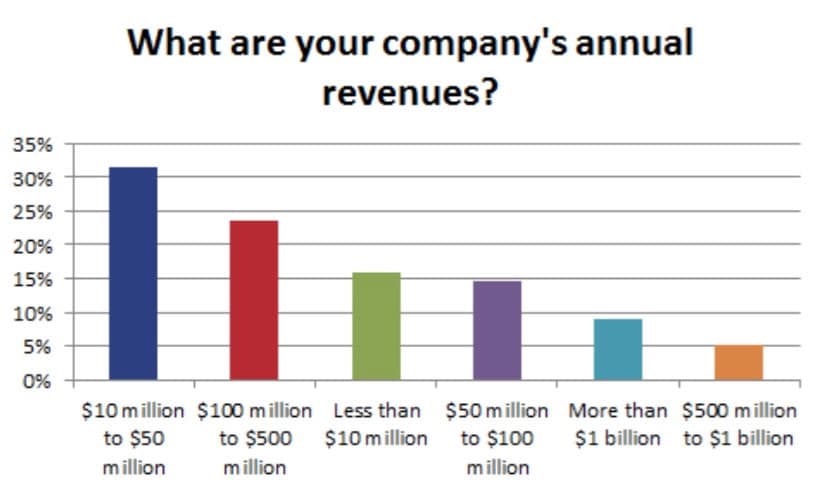

Survey respondents

Respondent annual revenue

- Nearly 50 percent of respondents were small distributors with less than $50 million revenue

- Almost 40 percent of respondents had $50 million to $500 million in revenue

- The remainder were large with more than $500 million revenue.

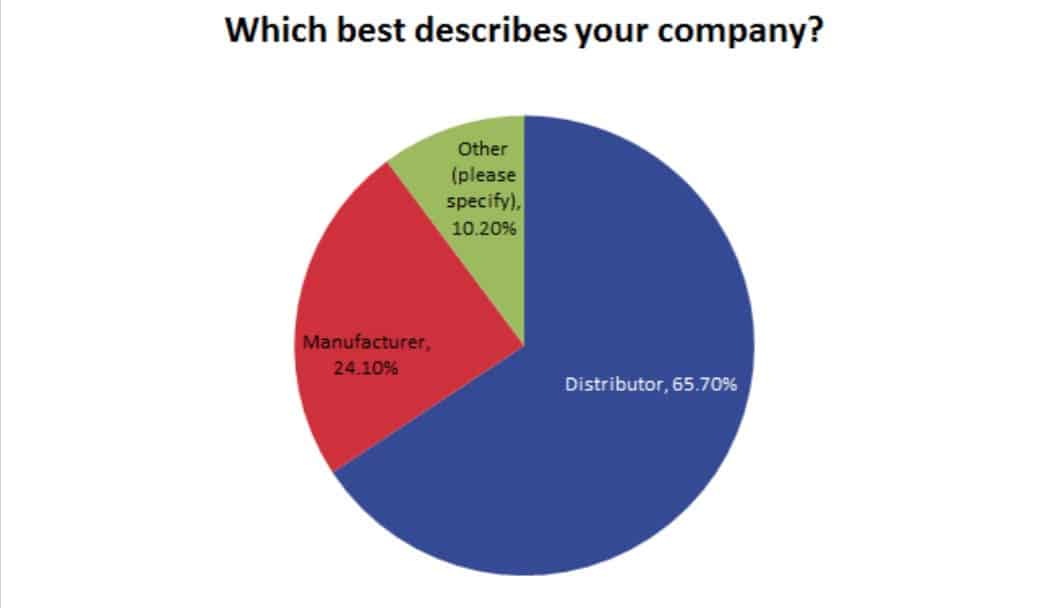

Company description

- 66% distributor

- 24% manufacturer

- Other included

- Buying group

- Association

- Manufacturer’s rep

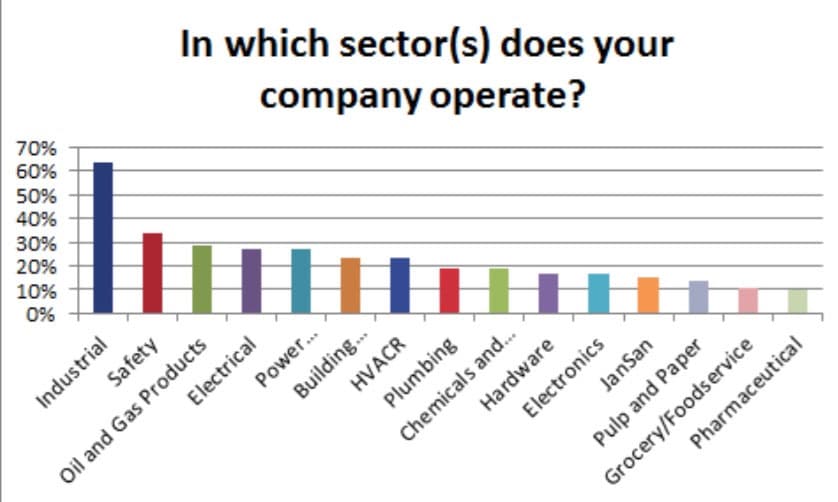

Respondent business sectors

- More than 60% industrial

- One third are safety

- About 30% are oil and gas, electrical, power transmission

- About 20% are building materials, HVACR/plumbing, hardware, jan/san, chemicals and plastics

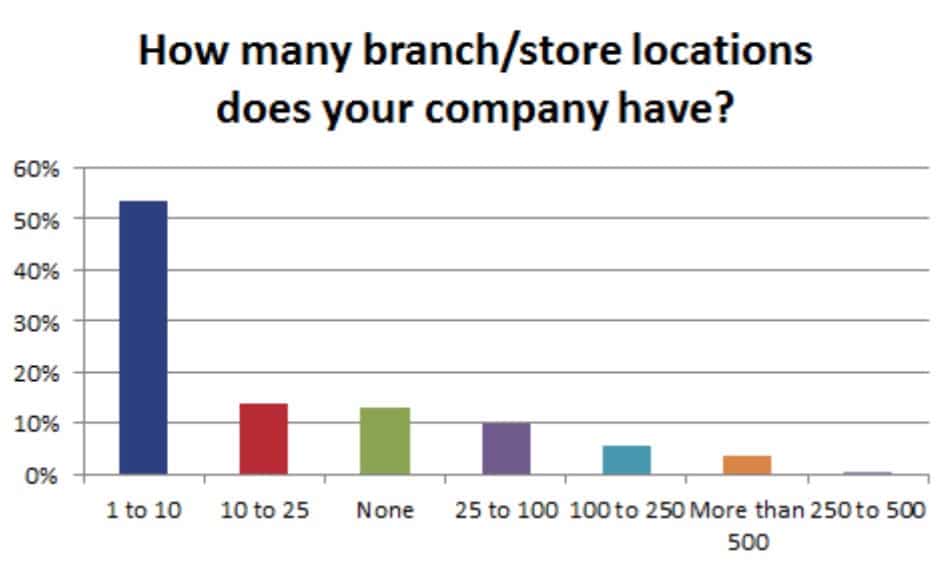

Branches/stores

- 12% have no store

- Half have 10 or fewer stores

- 12% have 10 to 25 stores

- 10% have 25 to 100 stores

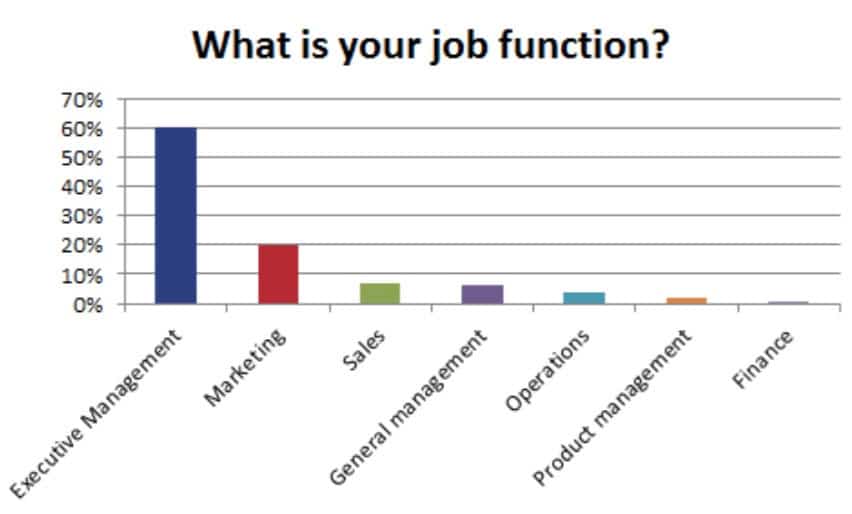

Respondents by job function

- 60% executive management

- 20% marketing

- 5% sales

- 5% general management

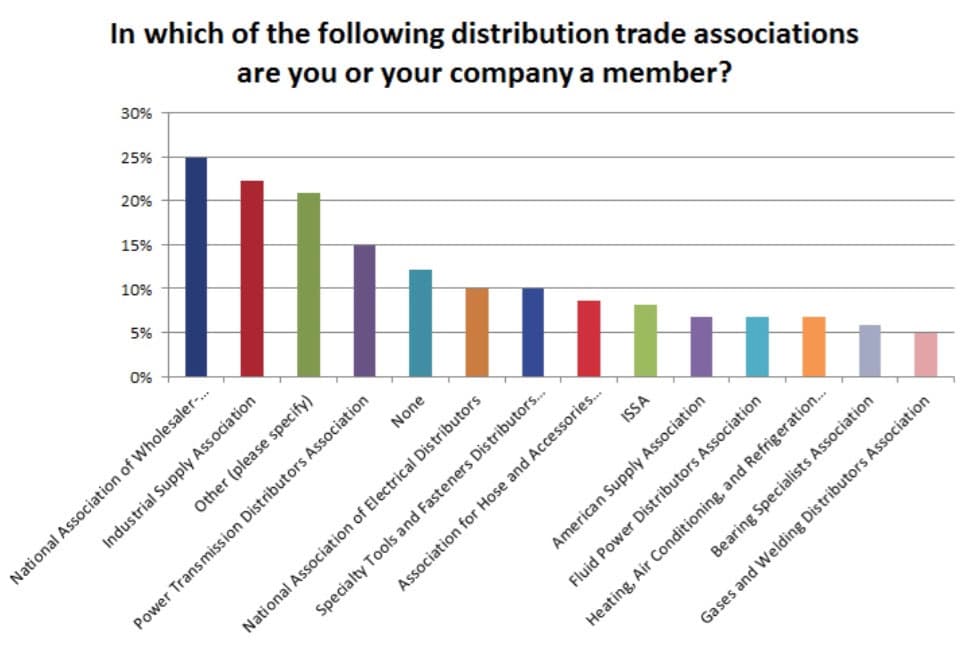

Trade association memberships

- 25% from NAW

- More than 20% from ISA

- 15% from PTDA

Jonathan Bein, Ph.D. is Managing Partner at Distribution Strategy Group. He’s

developed customer-facing analytics approaches for customer segmentation,

customer lifecycle management, positioning and messaging, pricing and channel strategy for distributors that want to align their sales and marketing resources with how their customers want to shop and buy. If you’re ready to drive real ROI, reach out to Jonathan today at

jbein@distributionstrategy.com.