Integrate, or Stagnate

Through our market research on e-commerce in distribution and our own consulting practice, we have noticed two seemingly opposite trends in the industry:

Because of reduced barrier to entry, distributors of all sizes have now launched or are launching an e-commerce capability. However, a significant percentage of these distributors are seeing very little revenue traction through their e-commerce site, even after several years.

Many distributors are still trying to determine, not how or when, but if they are going to develop and launch an e-commerce capability. The reluctance is often based on an incorrect perception of how quickly the world is changing or outdated assumptions about the cost of entry.

While these trends appear to be opposite, there is an underlying commonality between those who have launched with little growth and those who are unsure if they should develop an e-commerce capability at all: both groups have a very limiting tactical view of what e-commerce does and how it relates to their business, even in the second decade of the new millennium. In this tactical view, e-commerce is viewed as an ordering mechanism that is part of a cost center driven by IT. For the first group, this tactical view results in a passive approach to promoting the site or driving demand. For the second group, this tactical view reinforces a belief that one may lose some transactions to e-commerce, but they can retain the customer for other business in the branch or with a customer service representative.

The strategic view of e-commerce is that it is a shopping and ordering mechanism that is part of a profit center driven by either a dedicated e-commerce division or by marketing. The strategic view recognizes that the way people shop and buy is changing rapidly, not just among millennials but buyers of all ages. It further recognizes that a distributor’s digital presence is increasingly becoming the first or even the most significant impression a potential customer has. The distributors who have a strategic view of e-commerce place a big emphasis on ROI from demand generation through marketing programs and through the sales organization. The next section details some of those trends as seen in the survey.

Marketing Vehicle Effectiveness and Spend

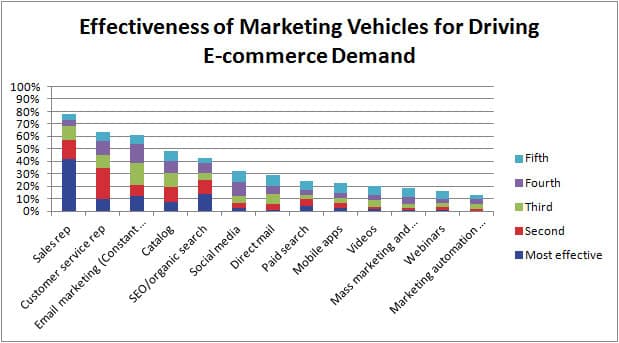

This year, the question on marketing vehicle effectiveness for driving e-commerce demand was changed to include field sales and customer service as choices for vehicles. The survey demonstrated that offline vehicles have a significant impact on driving e-commerce demand. To wit: four of the top seven most effective vehicles are offline including sales rep, CSR, catalog, and direct mail. As shown below in Figure 1, the sales rep is overwhelmingly considered the most effective vehicle for driving e-commerce demand. Customer service reps are considered second most effective and are comparable in effectiveness to email marketing. Email, catalog, and SEO were the top choices in last year’s survey and their order remains the same as last year.

While SEO/organic search is considered effective, paid search was not considered effective by the respondents. We have done reviews of more than 100 distributor websites and fewer than 20 of them do much with paid search. It is a competency that most distributors develop as they reach the end of the nascent stage of e-commerce maturity. And, as with last year, marketing automation still plays no role for almost 90 percent of distributors.

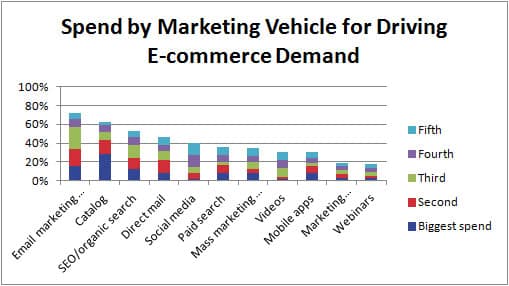

Email marketing and catalog are where distributors spend the most to drive e-commerce demand. However, in last year’s survey, direct mail was third overall among the choices for spend and this year it is fourth, replaced by SEO/organic search. Mass marketing moved down seventh this year from fifth last year.

The Integrated Marketing Approach

Though the survey showed the importance of offline marketing for driving e-commerce demand, many distributors make the mistake of assuming that since buying is digital, shopping must also be digital. Tragically, this restricts the marketing vehicles to SEO, paid search, and email marketing or marketing automation when other offline vehicles are relevant.

Distribution Strategy Group is performing a syndicated shopping and buying survey with several thousand end users participating from multiple distributors to answer four key questions relevant to an effective integrated marketing approach for e-commerce:

- How do my customers shop (not order)? The aggregate data in the survey says that the most common shopping methods are:

- going to a manufacturer website

- using search

- going to a distributor website.

- How do my customers order? Among a choice of ten ordering methods, the ones used most prevalently, in order are:

- by email

- over the phone with a CSR

- by website

- How do my customers want to receive communication? Over the years, we have found that customers want to receive communication in more ways than distributors typically imagine. Most distributors project their own individual preferences as a consumer onto their customer and conclude that their customers don’t want email, phone calls, or print mail. In fact, our research shows overwhelmingly that a significant portion of customers is willing to receive such communications. In addition, more than 80 percent are willing to receive a print catalog annually or more frequently. The aggregate trend is moving away from field sales towards more efficient mechanism for communication, shopping, and buying. About 35 percent of end users either never want a field sales visit or only once per year. Once again, individual mileage does vary significantly: more than 90 percent of one distributor’s end users want a field sales visit at least monthly.

- What ordering methods do my customers require to continue business with me? Many distributors assume that they are losing some transactions as a result of having a subpar e-commerce site. Our research strongly indicates that many of these distributors are actually losing customers, not just transactions. It is imperative to find out what your customers require to do business with you. If they require good mobile ordering, you need to deliver that or you could easily lose 1 percent to 4 percent of your customers per year for the next several years.

Getting clear answers to these questions will deeply inform your e-commerce and integrated marketing strategy. However, as noted in the questions, individual mileage does vary meaning that you cannot rely only on aggregate data – you must understand what your customers and prospects require. The integrated marketing strategy will allow you to grow revenue systematically and to retain customers who might otherwise find another supplier.

This survey was conducted and produced by MDM and Distribution Strategy Group and sponsored by hybris, an SAP Company.

About This Research

This research was conducted by Distribution Strategy Group with Modern Distribution Management. The research included an online survey taken by 415 participants across a variety of distribution sectors.

There was heavier participation from industrial, safety, electrical, electronics, building materials, janitorial, HVACR/plumbing and hardware. Other participating sectors include oil and gas products, pulp and paper, chemicals and plastics, grocery/foodservice and pharmaceutical.

Nearly 40 percent are small distributors with less than $50 million revenue, more than 30 percent are mid-market with $50 million to $500 million revenue, and 19 percent are large with more than $500 million revenue. Others did not disclose the revenue range.

About 30 percent are primarily focused on MRO, 12 percent are focused on OEM customers, 28 percent serve trades/contractors, 20 percent are an even blend of MRO and OEM, and 10 percent are in other categories.

Jonathan Bein, Ph.D. is Managing Partner at Distribution Strategy Group. He’s

developed customer-facing analytics approaches for customer segmentation,

customer lifecycle management, positioning and messaging, pricing and channel strategy for distributors that want to align their sales and marketing resources with how their customers want to shop and buy. If you’re ready to drive real ROI, reach out to Jonathan today at

jbein@distributionstrategy.com.