Expectations High for Distribution E-Commerce in 2016

The fifth annual MDM distribution e-commerce survey conducted with Distribution Strategy Group revealed several key trends:

- The number of companies with at least 10 percent of their total revenue from e-commerce grew nearly 8 percentage points from 2014.

- Most distributors require a customer to log in to see pricing and purchase products.

- The primary objectives among distributors for e-commerce remain acquiring new customers, enhancing their company brands and improving the user experience.

- A quarter of distributors receive 50 percent or more of their orders by email.

This article examines the results of the 2016 State of E-Commerce in Distribution Survey and how the industry’s e-commerce offerings are maturing.

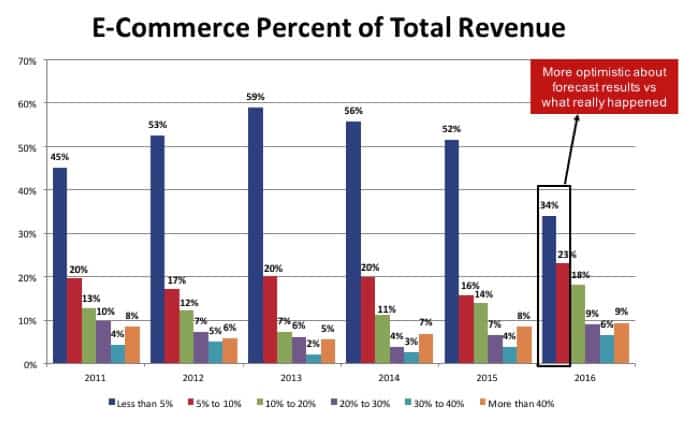

More distributors are crossing the threshold to e-commerce maturity. In the 2016 State of E-Commerce in Distribution survey, the percentage of respondents with a mature e-commerce offering (at least 10 percent of total revenue through the e-commerce channel) increased 8 percentage points from 2014. At the same time, the percentage of respondents with 5 to 10 percent of total revenue from e-commerce declined from 20 percent in 2014 to 16 percent in 2015.

Companies with nascent e-commerce (revenue less than 5 percent) fell 4 percent, further supporting the move toward more mature e-commerce offerings.

As in prior surveys, expected revenue percentage for the current year shows aggressive growth compared to actual revenue percentage in the prior year. The estimated percentage of revenue in the nascent stage is forecast to reduce by 18 percentage points in 2016 versus 2015 with the move toward maturity. This phenomenon, irrational exuberance, is similar to what was experienced in the dot-com era. There tends to be a “build it, and they will come,” mentality. But only in cases with a very small company or exceptional planning will companies be able to move beyond the nascent stage the first year of e-commerce.

As with the introduction of any new sales channel, there are new challenges to be overcome when implementing an e-commerce channel. In most instances, a distributor must modify online product acquisition and fulfillment processes.

Additionally, generating demand for the e-commerce channel takes a focused strategy and plan, just like a branch strategy. For example, for a distributor with many branches but no regional or centralized distribution center, the fulfillment of the e-commerce channel may take a backseat to fulfillment of orders in the local market. If a distributor can generate demand for the e-commerce channel but cannot fulfill the order based on customer expectation, it creates a negative customer experience.

For customers accustomed to the Amazon-like order and fulfillment process, the expectation and requirements are different. Distributors that address the unique challenges – and opportunities – of the e-commerce channel are more often rewarded with a compressed time period in the nascent stage as they move into the growth and maturity phases.

The typical breakdown of distributors’ experience in the nascent stage include:

- Development of the capability – six months to one year.

- Working out operational kinks after launch – one year.

- Getting to 5 percent of total revenue – two to three years.

Previous research conducted by Distribution Strategy Group confirms that in many cases, not only will a distributor lose orders by not having an e-commerce solution that meets their customer requirements, but those customers may move all their purchases to a competitor.

E-Commerce Priorities

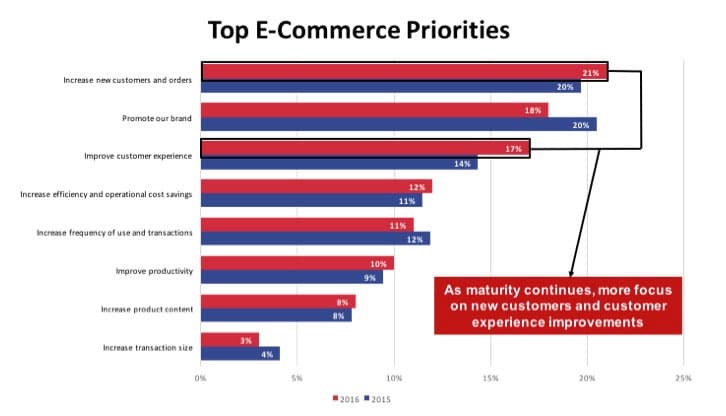

The top priorities for e-commerce, as shown in Figure 2, are:

- Increase new customers and orders

- To promote our company brand

- Improve the customer experience

As the distributor e-commerce channel continues to mature, priorities get more focused on gaining new customers and orders. But distributors are putting more emphasis on improving the user experience, which is a natural and continual evolution as the e-commerce channel grows.

The priorities “increase efficiency and operational cost savings” and “improve productivity” both increased slightly from last year. Distributors moving from the nascent to maturity phase start to shift priorities to take advantage of the savings afforded by moving a higher percentage of business to the e-commerce channel.

E-Commerce Platform

E-commerce platforms employed by distributors fall into five categories:

- Enterprise – generally supports complex, high-end integrations with organizations with >$500 million in revenue.

- Mid-market – greater functionality and flexibility than ERP-provided platforms that are not bound to one ERP and are generally found in organizations with revenue up to $750 million.

- Homegrown – developed from scratch and often incorporate third-party components, such as a shopping cart and/or content management system.

- ERP-provided – integrated directly with the ERP system and generally characterized with limited functionality and customization flexibility.

- Hybrid – generally a mix between homegrown plus open source, such as Magento.

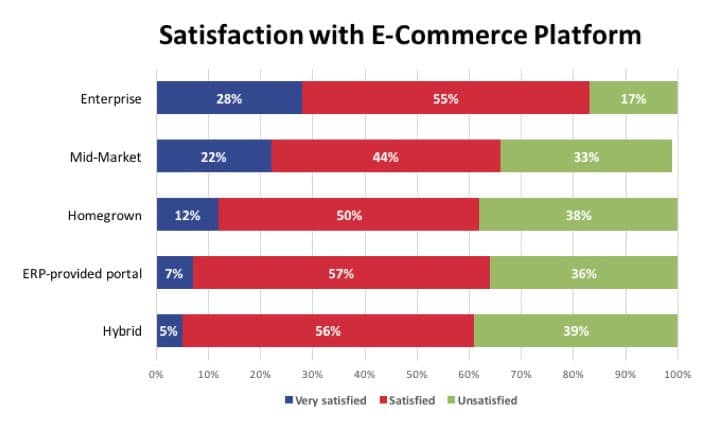

Distributors with enterprise level e-commerce platforms are more satisfied than others; 22 percent of distributors with mid-market platforms said they were very satisfied, more than three times more than distributors with ERP-provided platforms. (See Figure 3.)

ERP-provided platforms tend to be a popular starting point, especially for smaller distributors. However, as customers begin using the ERP-provided platforms, often demand for additional functionality and flexibility encourages distributors to graduate to a mid-market or even an enterprise-level platform.

Understanding the features and functionality required by customers is crucial to developing an effective strategic digital road map and compressing the time spent in the nascent stage. The road map also points to what platform is required to meet customer requirements. Some distributors have customers purchasing through traditional methods. For those, an ERP-provided platform may be completely adequate. For other distributors and sectors, the customer base may demand more robust functionality, requiring a more sophisticated and flexible platform.

E-Commerce Pricing Practices

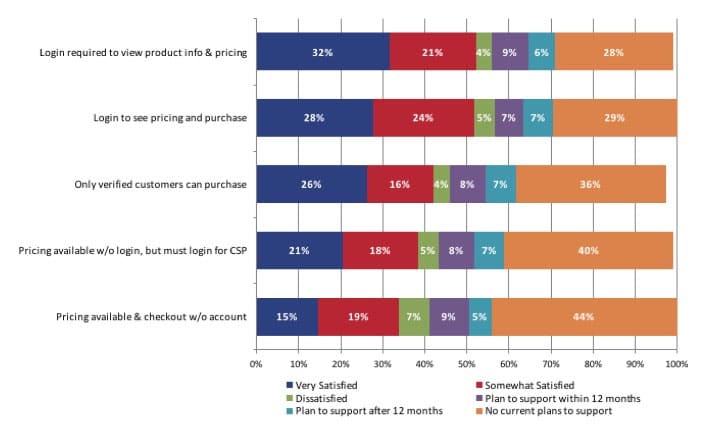

The topic of how pricing is handled on distributor websites is a hot and often spirited topic. As shown in Figure 4, the majority of distributors currently require a login to view pricing. These distributors will only sell to verified customers. Shoppers who are not verified can’t browse and buy products using a credit card. Some of that is driven by contracts or regulations that require a customer to be certified in some manner to purchase a product; in those instances, the distributor takes every precaution to sell only to authorized purchasers.

In other instances, however, distributors show pricing (generally list price or the highest price) and allow checkout without an account and payment by credit card. Customers with accounts having customer specific pricing do need to log in to see their contract prices.

There are many reasons to not show price. Some of the more common reasons include:

- Pricing varies by branch and, therefore, it is unclear what price to show on the website.

- Technical infrastructure is not sufficient to support different prices for different customers.

- Concern with holding prices constant with print catalog/flyer.

- Trade conflicts and/or can sell only to authorized or certified purchasers.

- Difficulty in training customer service/sales personnel to stop overriding existing pricing in the ERP.

Best practices generally include showing a price without a login, assuming there are no contractual or regulatory restrictions. Pricing shown is generally the highest price structure to avoid channel conflict. Most customers understand they need to log in to see their specific pricing and to purchase on account versus with a credit card.

In most cases, the barriers to showing pricing on a distributor website can be overcome with a combination of technology, training and process modifications.

Email Ordering Trend

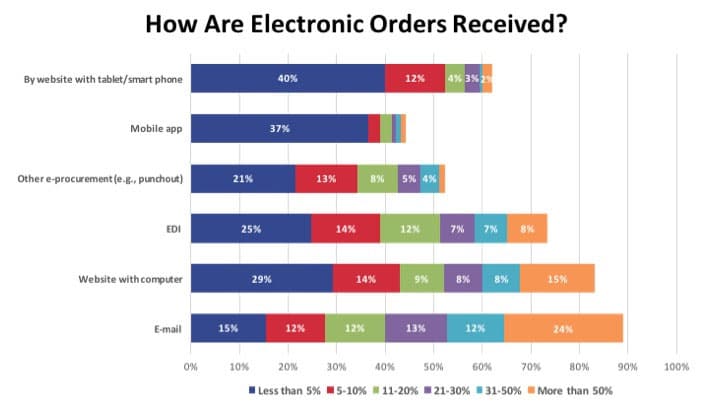

The most common method for a distributor to receive an electronic order is via email (see Figure 5). Nearly a quarter of respondents indicated they receive more than 50 percent of electronic orders via email.

The trend shifts the order-entry burden in the purchasing relationship. If a customer places an order on a distributor website, the customer is doing order entry. When a customer can just send the email order from his or her system, the order-entry burden falls on the distributor.

Moving Forward

The “go-live” of an e-commerce site is a key milestone, but it is just the beginning of a long-term journey. Product data is the foundation of most B2B distribution sites, and it should be thought of as needing daily exercise through continual updates. If multiple websites show the exact same product data, search engines will attempt to select which site is the “authoritative” version of that data. This makes search engine optimization (SEO) a critical element of an e-commerce strategy.

Modifying product data to include key benefits for distributor customers is where the real SEO benefit comes in. A distributor that has hundreds of thousands of SKUs will find that impossible to do for every SKU. Focus first on the most important SKUs that drive revenue and profit for your company.

Significant differences exist between what distributors’ customers want and need. Some distributors need a robust website for customers to shop, but most of the buying remains offline. Other distributors need robust shopping and buying sites. We have seen instances where distributors are planning to spend nearly 10 times more than is needed. Conversely, other distributors are not spending enough to get the right platform to meet customer needs.

Part 2 of this research will dive into best practices of driving demand and keeping visitors engaged.

About This Research

This research was conducted by Distribution Strategy Group with Modern Distribution Management. The research included an online survey taken by 468 participants across a variety of distribution sectors.

There was heavier participation from industrial, safety, electrical, building materials, janitorial, oil and gas products, JanSan, HVACR/plumbing and hardware, power transmission/bearings. Other participating sectors include chemical and plastics, pulp and paper, chemicals and plastics, grocery/foodservice and pharmaceutical.

One third are small distributors with less than $50 million revenue, nearly 40 percent are mid-market with $50 million to $500 million, and 18 percent are large with more than $500 million revenue. The remaining 10 percent did not disclose the revenue range.

About 33 percent are primarily focused on MRO, 13 percent are focused on OEM customers, 19 percent serve trades/contractors, 21 percent are an even blend of MRO and OEM, and 14 percent are in other categories.

Jonathan Bein, Ph.D. is Managing Partner at Distribution Strategy Group. He’s

developed customer-facing analytics approaches for customer segmentation,

customer lifecycle management, positioning and messaging, pricing and channel strategy for distributors that want to align their sales and marketing resources with how their customers want to shop and buy. If you’re ready to drive real ROI, reach out to Jonathan today at

jbein@distributionstrategy.com.