Distributors Increase Search Marketing Efforts

More companies now view search marketing as “very important”

A joint MDM-Distribution Strategy Group survey reveals that distributors are increasingly relying on search marketing instead of email marketing. This article examines how distributors across sectors approach marketing, what they consider the most effective channels to be and the frequency with which they conduct their different marketing vehicles.

Over the last three years of the joint MDM-Distribution Strategy Group annual survey, search marketing has overtaken email marketing as the most important marketing vehicle for distributors.

While this trend is driven by the increased deployment of e-commerce sites, our observation is that most respondents are placing more emphasis on corporate marketing with search rather than product marketing.

This year saw the percentage of respondents describing search marketing as very important at 47 percent, while email marketing remained at 36 percent.

Last year was a bit more balanced, with 38 percent of respondents describing search marketing as very important and 36 percent considering email marketing as very important.

Two years ago, 42 percent of respondents considered search marketing very important while 36 percent considered email marketing very important.

Satisfaction with marketing programs

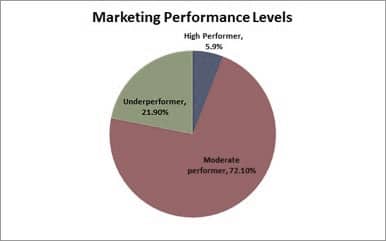

In this year’s survey, we again asked respondents to rate their satisfaction with results of their company’s marketing initiatives. Respondents who answered “extremely satisfied” were classified as high performers; respondents who answered “very satisfied” or “moderately satisfied” were classified as moderate performers; and respondents who answered “slightly satisfied” or “not at all satisfied” were classified as underperformers.

This year’s data reveals something intriguing. Just under 6 percent of respondents were extremely satisfied with their marketing (see Figure 1). This article will explore what those top performers are doing so well.

Figure 1 – Marketing Performance Levels

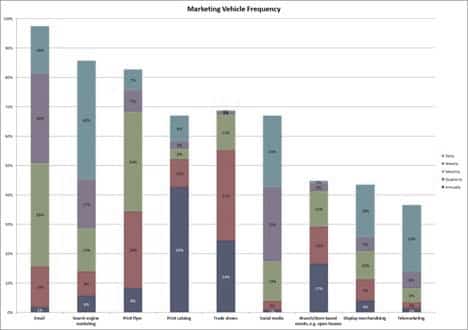

Marketing vehicle frequency

Survey respondents were asked to rate the frequency of their marketing vehicles as daily, weekly, monthly, quarterly, annually or not at all. Figure 2 shows the total percentage of respondents who used each marketing vehicle in 2017

This table, indicating the prevalence of each marketing vehicle, revealed two interesting conclusions. First, it showed a modernizing trend, which is the widespread use of email and search marketing. Second, it showed that social media and print catalogs were fairly similar in frequency, despite their truly disparate uses.

If your company is interested in corporate marketing, social media is helpful. If interested in product marketing, print catalogs may still be preferred.

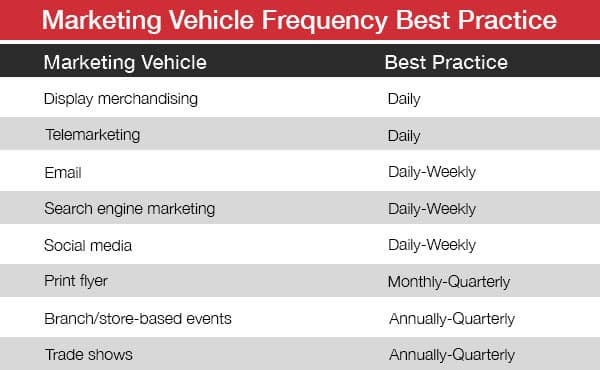

The best practices for frequency of contact through each marketing vehicle varies. For example, print flyers have the greatest effect when done monthly to quarterly. Anything more or less frequently yields weaker results, and possibly lower ROI. Table 1 displays our assumptions about the optimal frequency of marketing vehicles gauged in this survey, except mass media.

Best practices frequency

With this in mind, we can begin an analysis of the three groups of performers – high, moderate and low – and reveal how often each of them are engaging in marketing best practices.

Figure 2 – Marketing Vehicle Frequency

People and in-store

Trade shows – (annually/quarterly) – Only 55 percent of the high performers attend trade shows quarterly to annually, while 77 percent of moderate performers and 74 percent of low performers followed this best practice. This is an inverse correlation, as one would expect that the high performers would be doing it better. Trade shows are less important in this era, and more importantly, the frequency with which they should be implemented is going down. Quarterly is fine, and annually is enough.

Display merchandising – (daily) Just 40 percent of high performers, 51 percent of moderate performers and 33 percent of low performers conduct display merchandising – and most aren’t doing this properly. Physical stores need constant tweaking, and it seems like a big portion of companies aren’t doing this.

Electronic and digital

Email – (daily/weekly) – With 60 percent of high performers, 40 percent of moderate performers, and 42 percent of low performers sending email, it looks like the high performers are getting it right, but everyone still needs to catch up.

Search – (daily/weekly) – Here is where the differences get stark – 75 percent of high performers do search optimization daily or weekly, with moderates at 60 percent and low performers at 40 percent.

Social – (daily/weekly) – Prioritization of social was 50 percent for high performers, 76 percent for moderate performers and 45 percent for low performers. Social media boosts corporate marketing but isn’t very helpful for product marketing. This data reflects that as larger companies are likely more pleased with their marketing, they are placing less emphasis on corporate marketing and instead on product marketing.

Mass media – Only 8 percent do radio or TV, 10 percent do outdoor media such as billboards

Table 1 – Frequency Best Practice

Catalog – (annually/quarterly) With 60 percent of high performers, 72 percent of moderate performers and 71 percent of lower performers using catalogs, distributors seem to understand this vehicle.

Flyer – (monthly/quarterly) – Just like catalogs, most companies understand how to use flyers, with 62 percent of high performers, 70 percent of moderate performers and 76 percent of low performers sending them.

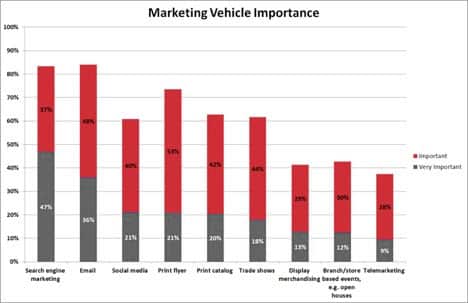

Marketing vehicle importance

In addition to frequency of usage, the survey measured how respondents view the importance of each marketing vehicle (see Figure 3). High performers placed much greater importance on social media, and they placed somewhat greater importance on the use of print flyers. The overall population placed more emphasis on in-store vehicles, including events and display merchandising.

This section examined what portions of each survey demographic felt that each practice was very important.

High performers put high priority on email; 64 percent of them felt that it was very important, while slightly more than 30 percent of moderate and underperformers rated it this highly.

Figure 3 – Marketing Vehicle Importance

Print catalog is very clearly on the decline, as only 41 percent of high performers, 20 percent of moderate performers and 13 percent of low performers rated this as very important. The previous section showed that people are executing on this fairly well, but it seems nonetheless unimportant to them.

High performers emphasize search optimization and marketing, and 76 percent of them rated it as very important. The moderate and low performers put this in only the 40s however.

All three groups place very little priority on social media, with around 20 percent of each category rating it as very important.

For print flyers, 41 percent of high performers felt it was very important. Only one fifth of the moderate performers felt this way, but only eleven percent of the under performers felt it was very important.

About This Survey

This research was conducted by Modern Distribution Management and Distribution Strategy Group through an online survey taken by 291 participants across a variety of distribution and manufacturing sectors. There was higher participation from industrial, safety, electrical, electronics, building materials, oil and gas, HVACR/plumbing and hardware. Other participating sectors included janitorial, pulp and paper, chemicals and plastics, grocery/foodservice and pharmaceutical.

Nearly 50 percent of respondents were small companies with less than $50 million revenue, more than 40 percent of respondents have $50 million to $500 million in revenue, and the remainder have more than $500 million revenue.

Jonathan Bein, Ph.D. is Managing Partner at Distribution Strategy Group. He’s

developed customer-facing analytics approaches for customer segmentation,

customer lifecycle management, positioning and messaging, pricing and channel strategy for distributors that want to align their sales and marketing resources with how their customers want to shop and buy. If you’re ready to drive real ROI, reach out to Jonathan today at

jbein@distributionstrategy.com.