Most distribution companies take a similar approach to touting their position in the supply chain, with 80 to 90 percent of distributors believing their value proposition contains at least one of the following attributes: product selection and availability, speed of delivery and pre-sales or post-sales expertise.

This means many distributors have little to no differentiation in their value proposition, which could be detrimental to their long-term survival. It’s exacerbated by the results of this year’s MDM-Distribution Strategy Group annual State of Distributor Marketing survey, which indicate that distributors believe that their value proposition is differentiated and relevant.

The need for a meaningful value proposition has never been greater than today given the presence of global players and digital disrupters who have extensive multichannel reach and marketing capabilities.

For mid-market and smaller distributors, there is plenty of opportunity to differentiate on customer intimacy in a way that is difficult for the global player to deliver. But most distributors are centered on a value proposition in which a larger foe can compete much more successfully – specifically product selection and availability, and speed of delivery.

What features are important?

It is crucial for distributors of all sizes to develop a relevant and differentiated value proposition to remain competitive. So in this year’s survey, we look at how respondents perceive importance of the features and benefits in their value proposition and how they are performing in relation to them.

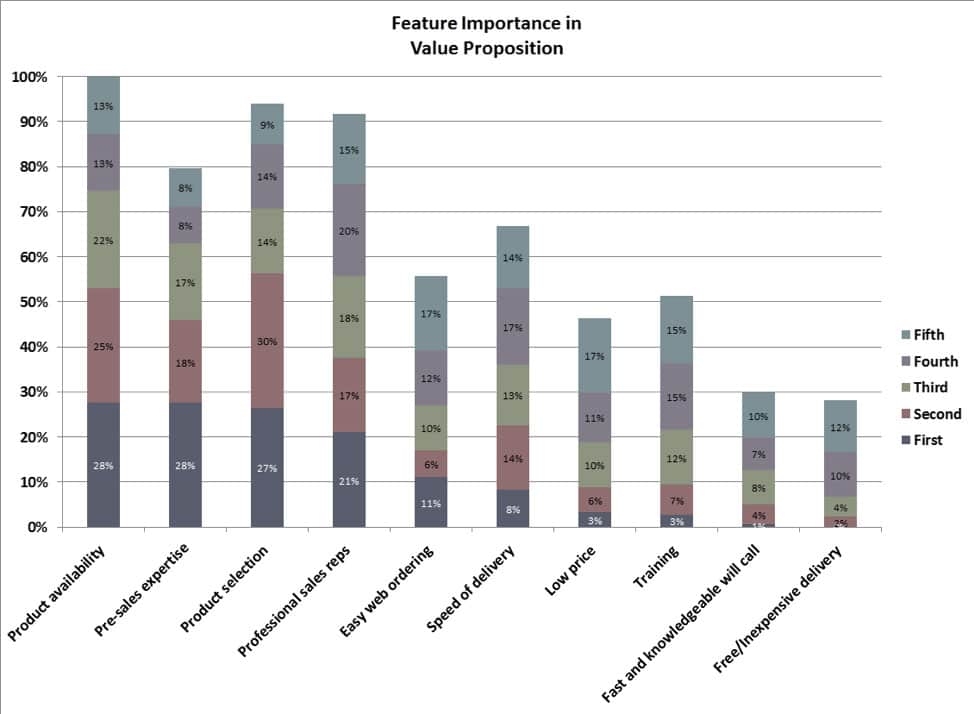

The features included a variety of logistics attributes such as product availability, product selection, speed of delivery, etc. They also included attributes pertaining to the information interface such as pre-sales expertise, professional sales reps and training (see Figure 1).

Figure 1 – Feature Importance

Here are the most important features distributors said they provide customers:

- Product Availability and Product Selection – Product availability and product selection have the highest overall importance among features (number of respondents who listed it as first, second, third, fourth or fifth in importance) in a value proposition, according to respondents in 2017 and also the last time we ran the survey in 2013. In addition, they are essentially tied along with pre-sales expertise for the highest number of respondents who selected it as the most important feature. This makes sense because one of the primary functions of a distributor is to provide assortment of product and immediacy of availability.

- Professional Outside Sales Representatives and Pre-Sales Expertise – The combination of professional sales reps and pre-sales expertise are critical functions of the information interface from distributors to the end customer. In this survey, the overall importance of professional sales reps ranked higher than the importance of pre-sales expertise. However, more respondents considered pre-sales expertise to be more important than professional sales reps. As noted above, it is tied with product availability and product selection as being the most important.

- Easy Web Ordering – When we last performed this survey in 2013, none of the respondents rated easy web ordering as the most important feature. Yet, 11 percent of respondents in this survey consider it most important and more than half consider it to be important. This reflects an increased awareness by distributors regarding customer preferences for easy web ordering. It correlates well with the extensive research that Distribution Strategy Group has conducted regarding end-user preferences, including our recent report published by MDM, What Customers Want.

- Speed of Delivery – While speed of delivery is fifth in overall importance in this survey, as it was in 2013, only 8 percent of respondents in this year’s survey consider it most important. A higher percentage of respondents rated easy web ordering above speed of delivery, a significant shift from 2013.

- Price – Distributor perspective aligns well with our end-user research, namely that price is usually important to end customers, though rarely the most important. When we ask end users to rank the importance of price among 10 or so other features of their distributor, it usually comes in fourth through seventh. We take note if it is higher than that because it means the customer segment is more price-sensitive. Similarly, if it is lower than seventh, it means the customer segment is not very price-sensitive.

Benefits centered on helping customers

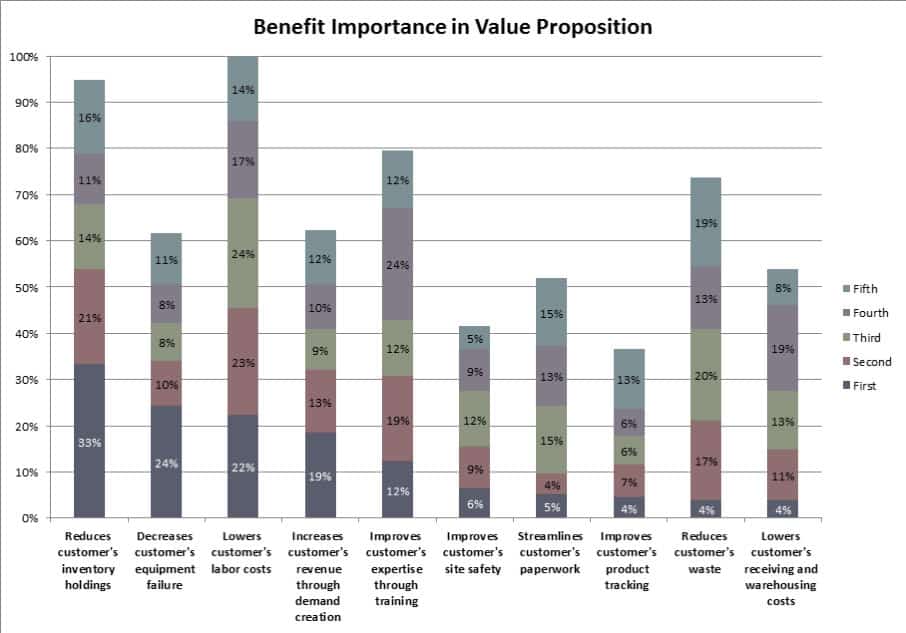

Distributor benefits were primarily focused around helping the end customer reduce cost through lowering labor cost, increasing uptime, reducing logistic costs and reducing held inventory, but it also includes increasing revenue demand and improving site safety as shown in Figure 2.

Figure 2 – Benefit Importance

Here are the benefits rated most important in the distributor value proposition:

- Reduce customer’s inventory holdings – This is a core benefit provided by most distributors. It was also rated most important in the 2013 survey. This year it was second highest overall important next to lowering customer’s labor costs. Many distributors are providing value-added solutions that further reduce customer inventory holdings with VMI, vending machines, integrated supply and optimized availability for resale.

- Decrease customer’s equipment failure – Distributors who provide this benefit do so in a variety of ways, including process improvements, recommending more appropriate products, stocking local backup parts and fast response in case of a failure. Twenty-four percent of the respondents consider this to be the most important benefit they provide.

- Lower customer’s labor costs – Overall, respondents in this year’s survey consider lowering their customers’ labor costs to be the most important benefit. As with decreasing equipment failure, distributors who successfully deliver this benefit are able to help end customer with the right process and the product, while also helping them excel at logistics.

- Increase customer’s revenue through demand creation – This benefit involves revenue generation instead of cost cutting. While many customers appreciate distributors helping with cost reduction, they are ecstatic if a distributor can help them create more demand. However, the ability for a distributor to generate revenue for its customer depends significantly on the nature of the channel. While it is difficult for most industrial distributors to play that role, distributors in the building materials & construction space have been successful in generating customer demand. One example includes an HVAC distributor creating leads and passing them to qualified contractors. Both Amazon and Home Depot have such programs.

- Improve customers’ expertise through training – Improving customer expertise is seen as the third highest overall benefit delivered by distributors. This is often delivered in the form of product, process and certification training. Our end-user research has frequently shown that customers value training more than most distributors realize. Increasingly, customers expect training that can be consumed on their own schedule online as well as in person.

How are companies performing?

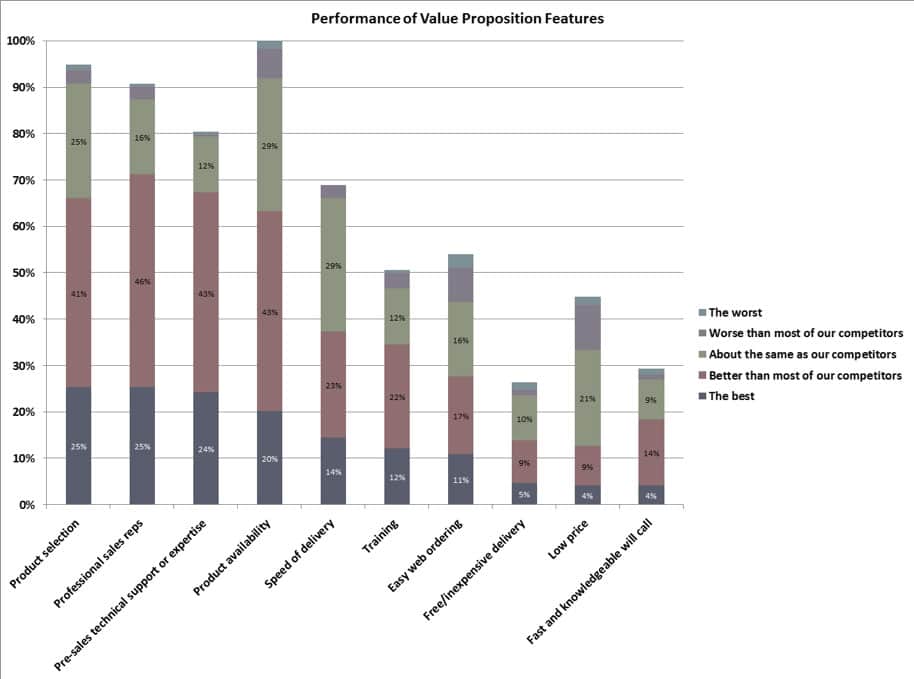

We also asked distributors to perceive how they are performing relative to the features and benefits in their value proposition.

In general, respondents graded themselves well on the features that are most important, including product selection and availability, professional sales reps, pre-sales expertise and speed of delivery. However, even though product availability is the most important feature, respondents gave relatively lower marks for their performance on it than for other important features.

Respondents also graded themselves relatively low for their performance on easy web ordering and price. Based on a Distribution Strategy Group benchmark in which we reviewed more than 2,500 distributor websites, these lower marks seem correct. Many distributor websites are difficult to use, and when it comes to actually ordering, an increasing majority of respondents would rather complete the order via email than a website (see Figure 3.)

Figure 3 – Feature Performance

However, distributor perceptions about how they perform on price can be very unreliable. A “voice of customer” survey we performed for one distributor showed that the company was much more competitive on price than it realized. The customer-facing personnel of this distributor were shocked to see the customer perception as measured in the survey.

For benefits, respondents also gave themselves generally good marks relative to their competitors, most notably in reducing inventory holdings, increasing customer expertise through training and decreasing equipment failure. The respondents’ self-assessment relative to competitors for the other two most important benefits – lowering customer’s labor costs and increasing customer’s revenue through demand creation – was still very positive but not quite as high.

Stepping back from the data slightly, one trend we noticed in the self-assessment of performance for features or benefits is that in every single case the vast majority of respondents believe they are the best or better than most of their competitors. We have observed this phenomenon repeatedly among distributors when they compare themselves against other similar companies. Very few believe they are the worst.

This tendency to overestimate one’s capabilities is called the Lake Wobegon Syndrome. The characterization of this fictional location, where “all the women are strong, all the men are good looking, and all the children are above average,” has been used to describe a real and pervasive human tendency to overestimate one’s achievements and capabilities in relation to others.

The Lake Wobegon syndrome, where all or nearly all of a group claim to be above average, has been observed among many professions. It is essential in developing and implementing a value proposition to get beyond the subjectivity of the Lake Wobegon Syndrome. Specifically, distributors can develop better means for doing market research while also better understanding the voice of the customer, which can be accomplished through qualitative and quantitative measures.

Furthermore, capturing the voice of the customer should not be viewed as an event, but rather a process. For example, it is entirely reasonable to run an electronic survey at least annually to assess how well you are differentiating with your value proposition and where you can improve.

Jonathan Bein is the author of What Customers Want, published by MDM, and is the managing partner of Distribution Strategy Group. Contact him at jbein@distributionstrategy.com.

About This Survey

This research was conducted by Modern Distribution Management and Distribution Strategy Group through an online survey taken by 291 participants across a variety of distribution and manufacturing sectors. There was heavier participation from industrial, safety, electrical, electronics, building materials, oil and gas, HVACR/plumbing and hardware. Other participating sectors included janitorial, pulp and paper, chemicals and plastics, grocery/foodservice and pharmaceutical.

Nearly 50 percent of respondents reported less than $50 million in revenue; more than 40 percent reported $50 million to $500 million in revenue; and the remainder reported more than $500 million revenue.

Jonathan Bein, Ph.D. is Managing Partner at Distribution Strategy Group. He’s

developed customer-facing analytics approaches for customer segmentation,

customer lifecycle management, positioning and messaging, pricing and channel strategy for distributors that want to align their sales and marketing resources with how their customers want to shop and buy. If you’re ready to drive real ROI, reach out to Jonathan today at

jbein@distributionstrategy.com.