In our surveys of more than 10,000 end customers, we found that age matters a lot when it comes to how distributors’ customers shop and buy. Millennials prefer electronic methods to all others, with 41 percent using search frequently or very frequently, a higher percentage than other generations. The up-and-coming generation, Gen Z (born between 1998 and 2016), has an even stronger affinity for electronic channels, even if they also are more likely to buy in person.

After all, Gen Z grew up in a digital and mobile era, with much of that generation born after Amazon went public. As the influence of these younger generations increases, the importance of digital marketing, including search, e-mail and social media, continues to grow as well for distributors, according to results from the MDM/Real Results Marketing 2018 State of Distributor Marketing survey.

But while distributors are growing their use of digital vehicles, it may not be quickly enough. Many still rely on trade shows, print flyers and branch-based events despite customers’ decreasing preference for these channels.

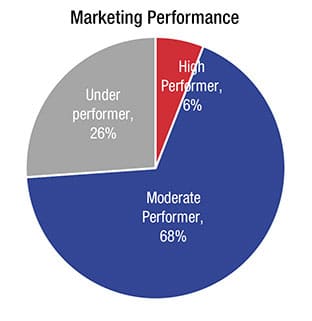

Marketing Performance

The percentage of distributors in the survey who are extremely satisfied with their marketing results landed in the single digits once again this year, with just 6 percent falling in the “high performer” range – slightly up from our 2017 survey and low compared with a broader cross-industry survey by salesforce.com that found 12 percent were high performers. Respondents who answered “very satisfied” or “moderately satisfied” were classified as moderate performers; respondents who answered “slightly satisfied” or “not at all satisfied” were classified as underperformers.

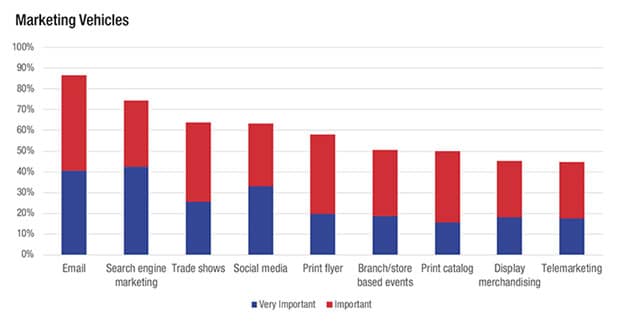

Marketing Vehicle Importance

Three of the top four most important marketing vehicles for distributors in the latest survey were digital, including e-mail, search and social media. In fact, more respondents rated the digital vehicles as very important than any other vehicles. The percentage who rated search as important or very important grew from 65 percent to 74 percent. Over this time period, many leading distributors have doubled or tripled the number of keywords that search engines recognize. Social media experienced an even more dramatic shift from 48 percent in 2015 to 63 percent in 2018. The percentage who rated e-mail important or very important grew from 83 percent in 2015 to 87 percent in 2018.

Three years ago, distributors told us that two of their top marketing vehicles were print flyer and print catalog. In this year’s survey, those two dropped to fifth and seventh, respectively. Those who rated print flyer important or very important went from 77 percent in 2015 to 58 percent in 2018, a sharp decline. Print catalog went from 64 percent to 50 percent over the same period. So, while print is still relevant for many distributors, it is clearly on the decline as the preference for digital marketing grows.

Except for display merchandising, which dropped to eighth-most-important in 2018 from seventh in 2015, other in-person and in-store vehicles remained the same, with trade shows third, branch events sixth and telemarketing ninth. The percentage of distributors that rated in-person and in-store marketing vehicles as important or very important were comparable to 2015.

For mass media (not shown in the graph) including television, radio and outdoor signage, the rankings in 2018 were identical to 2015. However, the percentages of respondents who rated these as important or very important diminished significantly. For example, outdoor media went from 9 percent to 3 percent; television from 6 percent to 2 percent.

Clearly, mass marketing is used sparingly, and primarily by larger distributors and manufacturers with larger marketing budgets.

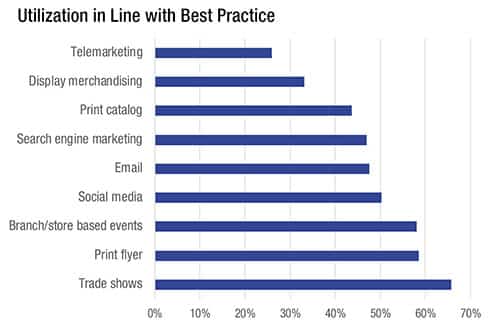

Marketing Vehicle Frequency

The three marketing vehicles that have the highest percentage of use by distributors in the survey are also three of the most traditional, namely trade shows, print flyers and branch events. However, many distributors are more sporadic in their use of digital vehicles, which are newer. For example, over 50 percent of respondents are doing e-mail or search marketing monthly, quarterly, annually or never.

From 2015 to 2018, those who e-mail daily or weekly shifted from 40 percent to 48 percent. For these vehicles to be effective, they must be used on a daily or weekly basis. Telemarketing is significantly underutilized by distributors, who are more comfortable with field sales reps selling to existing customers.

We recommend that display merchandising and telemarketing be used daily and that e-mail, search-engine marketing and social media be used daily to weekly, depending on your customer base.

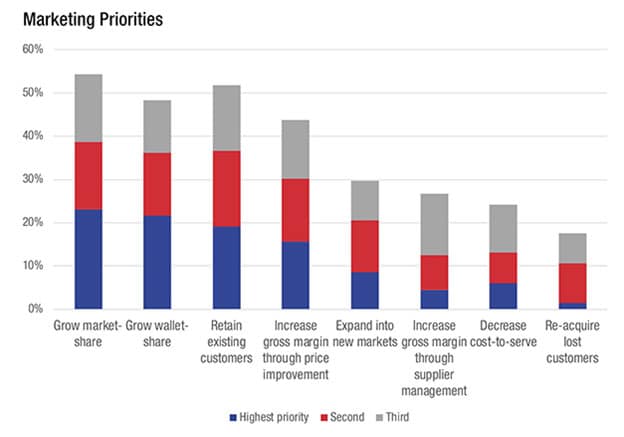

Marketing Objectives

From 2015-2018, distributors’ top marketing objectives have been growing market share, growing wallet share, retaining existing customers and improving margin through pricing. These four objectives have rated significantly higher than the other four objectives in all years that we have surveyed.

Within the top four objectives, margin improvement through pricing has slipped from second to fourth. Within the bottom marketing objectives, customer re-acquisition has remained as the lowest marketing priority from 2015 to 2018. Expanding into new markets has remained as the fifth priority from 2015 until 2018; however, 24 percent indicated it was the top priority in 2015 versus 30 percent now.

Multichannel Strategy Required

The results of this year’s survey show that distributors need to continue to move toward going beyond field sales when developing a marketing strategy, as the role of the outside salesperson will continue to change as end-user preferences shift. Gaining proficiency in digital marketing methods is critical. Evaluate how your customers want to be communicated with in your efforts to market to them or stimulate demand. Develop personas as well, by industry and role, recognizing that even within a customer’s business, preferences may vary.

A manager on a plant floor, for example, may prefer a phone call or visit by a sales rep, while a purchasing agent might prefer to receive marketing collateral by e-mail, complemented by a print catalog once a year for easy reference. A multichannel marketing strategy will work best to stimulate demand, including a mix of traditional channels such as catalogs and flyers, and digital marketing through e-mail. The key is regular touch points with the customer.

About This Survey

This research was conducted by Modern Distribution Management and Distribution Strategy Group through an online survey taken by 266 participants across a variety of distribution and manufacturing sectors. There was higher participation from industrial, safety, electrical, electronics, building materials, oil and gas, HVACR/plumbing and hardware. Other participating sectors included janitorial, pulp and paper, chemicals and plastics, grocery/foodservice and pharmaceutical. Nearly 50 percent of respondents were small companies with less than $50 million in revenue, more than 40 percent of respondents have $50 million to $500 million in revenue, and the remainder have more than $500 million in revenue.

Originally published on MDM.com.

Jonathan Bein, Ph.D. is Managing Partner at Distribution Strategy Group. He’s

developed customer-facing analytics approaches for customer segmentation,

customer lifecycle management, positioning and messaging, pricing and channel strategy for distributors that want to align their sales and marketing resources with how their customers want to shop and buy. If you’re ready to drive real ROI, reach out to Jonathan today at

jbein@distributionstrategy.com.