Executive Summary

A remarkable tipping point took place in 2017 – distributor e-commerce as a percentage of revenues shifted significantly, based on the seventh annual MDM distribution e-commerce survey conducted with Distribution Strategy Group.

Key trends:

- The number of distributors in the top two phases (mature/leader or more than 10 percent of revenue through e-commerce channels) of their e-commerce journey increased from 34 percent in the prior year to 41 percent, continuing a three-year trend.

- At the same time, the number of distribution companies in the lowest e-commerce usage phase (less than 5 percent of total revenue) dropped 9 percentage points from the prior year.

- Top priorities for e-commerce include improving customer experience and increasing the frequency of website use and transactions, indicating a major shift from just three years ago as distributors mature from information-oriented sites to transactional sites.

This article examines the initial results of the 2018 State of E-Commerce in Distribution Survey and how the industry’s e-commerce offerings are maturing. Subsequent reporting will examine the changes and additional topics in more detail.

E-commerce adoption by wholesale distribution companies hit a milestone mark in 2017 – it’s growing up. Following seven years of research indicating a sluggish overall level of e-commerce adoption at first, the 2018 State of E-Commerce in Distribution survey indicates a much broader cross-section of wholesale distributors are well on their journey of transitioning to a higher percentage of sales through e-commerce channels.

We classify the stages of the e-commerce journey in the following manner:

- Nascent = Less than 5% of e-commerce revenue

- Growth = 5% – 10% of e-commerce revenue

- Mature = 10% – 20% of e-commerce revenue

- Leader = More than 20% of e-commerce revenue

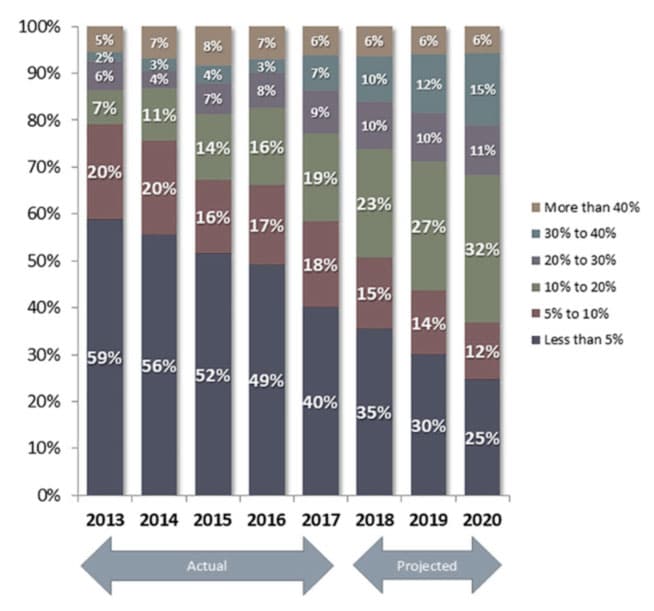

The 2018 survey shows the percentage of respondents with a mature e-commerce offering (at least 10 percent of total revenue through the e-commerce channel) has grown significantly in each of the past three years (Figure 1). In 2015, the number of companies in the mature phase was 33 percent. In 2016, that rose to 34 percent; followed by a 7-point jump in 2017 to 41 percent, showing very significant movement to the mature stages of e-commerce. From another perspective, that means over the past three years, a large number of distributors in the survey moved into upper tiers of e-commerce usage. That’s a meaningful move of the needle when gauging the level of investment and management attention to e-commerce as a competitive lever.

Perhaps the most notable finding this year is the change in the number of companies in the nascent stage, which is less than 5 percent e-commerce as a percent of total revenue. Based on prior years, we would have predicted the 2017 percentage to be in the 45 percent to 47 percent range. The remarkable drop to 40 percent indicates the tipping point for B2B e-commerce maturity has arrived.

Figure 1: E-Commerce as a Percentage of Total Revenue

B2B E-Commerce Forecast

Carrying the trend forward, the second part of Figure 1 is a prediction of where the stages will be in 2020. With a fairly aggressive 5 percent drop in each of the next three years, the number of respondents in the nascent phase of e-commerce will be just 25 percent. Conversely, the number of respondents in mature stages are forecasted to be in the range of 64 percent, or about two – thirds of B2B companies responding to the survey. More than 30 percent of the respondents will have more than 20 percent e-commerce revenue.

Two factors are helping drive these changes. First, B2B e-commerce platform providers continue to up their game in terms of offering more capabilities at increasingly affordable prices. Second, product data is more available as buying groups and associations are providing or assisting col- lection of the data and making it available to signi cantly more distributors with reasonable costs. Manufacturers are increasingly getting better at providing product data to distributors. However, there is room for improvement, especially with smaller manufacturers.

E-commerce Priorities

Also eye-opening is that objectives for e-commerce are shifting too, as many of those nascent stage sites have moved from information-oriented sites to full transactional sites.

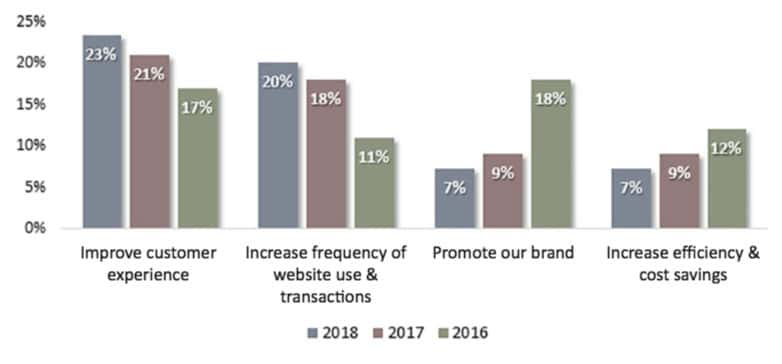

The top two priorities for e-commerce, as shown in Figure 2, are:

- Improve the customer experience

- Increase frequency of website use and transactions

As B2B e-commerce adoption matures, the top priorities shift as well. It is no surprise that with increasingly greater adoption, the importance of both “customer experience” and “increasing frequency of website use and transactions” grew precipitously.

Correspondingly, a top priority just three years ago of “promoting our brand” has dropped significantly as distributors move from more information-oriented web pages to sites that handle significant transaction and revenue volume. Additionally, the category “increase effciency and cost savings” has also decreased. As e-commerce maturity continues on the upward path, ef ciencies and cost savings are being realized; therefore, distributors are shifting priorities to other areas, such as improving the customer experience.

Figure 2: E-Commerce Priorities

Moving Forward

The continued rapid e-commerce maturity is a very significant shift and will have dramatic impli- cations for distributors on how to differentiate their offerings. Additionally, distributors must identify new objectives for each of the subsequent maturity stages with the goal of driving to higher levels of functionality in a shortened time frame.

The distributor imperative to get into, or increase, their e-commerce game is urgent. End-users are researching, finding and buying products and solutions online. If they are not using your website, they are using another distributor or manufacturer to get information and make purchases. Keeping end-users on your site for their needs is essential for a distributor’s short-term and long-term growth.

Subsequent parts of this report will explore the Amazon effect, distributor marketing implications, and prescriptions on what to do now based on your phase of e-commerce maturity.

Dean Mueller is Independent Consultant at Distribution Strategy Group. He has more than 30 years of experience in sales and marketing and helps distributors build holistic digital strategies that drive a significant shift to online sales, improve profitability and grow customer satisfaction. Take your digital strategy to the next level. Contact Dean at dmueller@distributionstrategy.com.