Key Drivers for E-commerce Demand

Distributor priorities for e-commerce investment continued to evolve in 2017. In our latest research, improving customer experience and increasing the frequency of website transactions and usage were noted as the top e-commerce priorities in our survey of 300 distributors and manufacturers. Another area gaining importance is distributor communication with customers; as we outline below, we feel this represents a greater awareness of the need to provide consistent and relevant updates to customers as a critical component of e-commerce success.

Stronger Marketing Effectiveness

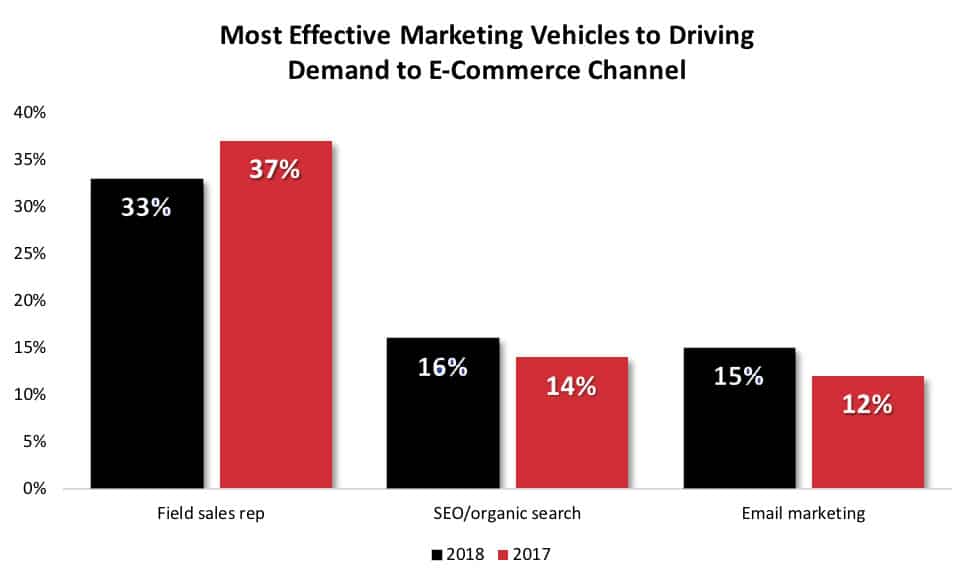

Field sales isn’t what it used to be, but it’s still critical. Manufacturers and distributors are maturing in the way they leverage their sales and marketing functions to promote e-commerce. Our research captured effectiveness in driving demand to the e-commerce channel across 14 methods. The most effective method, by far, continues to be the field sales rep. Distributors with a mature e-commerce channel generally have field and inside sales teams that understand how these capabilities can be both good for their customers and a useful tool for them to strengthen relationships. While field sales reps continue to be seen as the best vehicle for promoting e-commerce, a notable change is emerging, as only 33 percent of respondents preferred this channel in 2018 vs. 37 percent in 2017.

SEO (search engine optimization)/organic search was identified again this year as the second most effective method to drive e-commerce demand. The third most effect method was email marketing. Both SEO and email marketing increased in effectiveness in 2018 compared to 2017. Field sales, inside sales, and customer service reps are still three of the top five most effective methods, so even with a decline in field sales effectiveness, people remain very important.

SEO and email marketing support the top priorities identified in the survey – improving customer experience and increasing website transactions and usage – by making it easier for web users to find the information they seek along with using email to communicate to customers.

Our key takeaway: Marketing automation is likely an underutilized tool with just 3 percent noting it is most effective in driving e-commerce demand. Our perspective is that the capabilities of marketing automation to improve customers’ experience begins where email’s effectiveness tapers off. Used properly, marketing automation can help provide highly relevant and behaviorally-based communication to specific personas such as buyers, engineers, etc.

Spending Rank by Marketing Vehicle

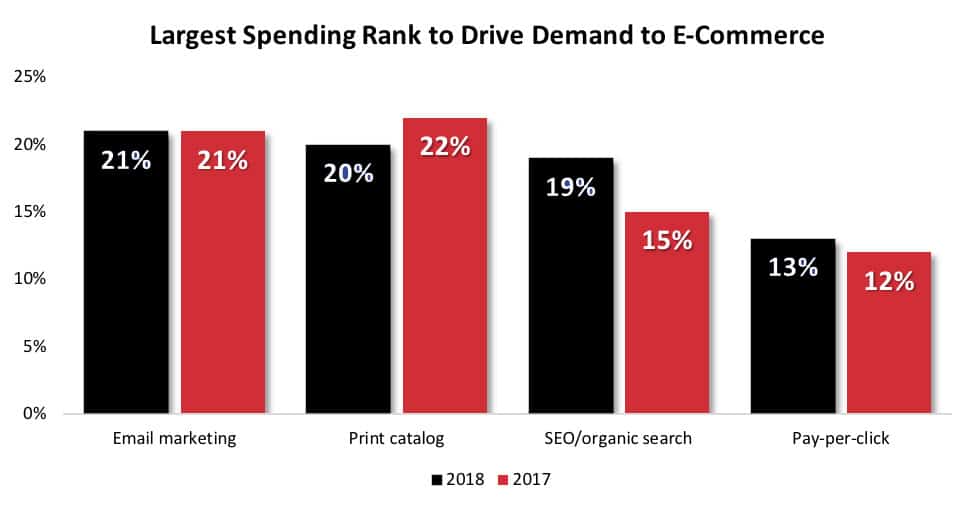

Now that the effectiveness of marketing vehicles has been outlined, the next question is: where are distributors spending their marketing dollars to drive e-commerce? Respondents ranked eight different variables. While email took over the top spending rank, it remained the same percentage as last year. Print catalogs continue to decline each year; however, print remains a strong driver of e-commerce demand if done well.

Notable is the strength of SEO and PPC (pay-per-click). Editor’s note: Here’s a cheat sheet to SEO and PPC from a resource we respect.

Adding these two methods together as a “search” category for 2018, the spend is a significant 32 percent. We forecast both SEO and PPC will increase in both effectiveness and spend in the coming years to continue to make it easier for customers and prospects to find the information and products they need. Distributors that have branches will be well served to place attention on Local SEO activities. Search results on Google are different based on many factors, including the type of device the search was initiated on and the searcher’s physical location. Local SEO is just one important way a distributor can differentiate itself from other brick-and-mortar and pure online sellers.

Many distributors have not yet embraced the power of SEO and/or search marketing. SEO in particular should be considered an essential element for e-commerce. Just as a branch location has construction, maintenance, and utility expenses, SEO should be considered essential and resourced appropriately. Our view: SEO is not optional for successful distributors.

Satisfaction with E-Commerce Investments

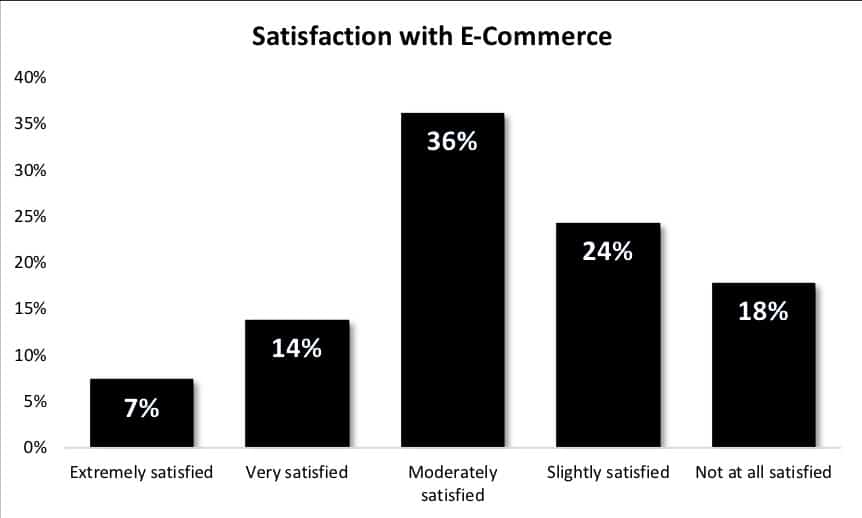

Survey respondents were also asked this year to rate their satisfaction with their returns on their e-commerce investments. The chart below shows that 21 percent indicated they were either extremely or very satisfied with their e-commerce initiatives. Slightly more than a third said they were moderately satisfied.

A quarter of respondents were only slightly satisfied with their e-commerce and 18 percent were not at all satisfied. From this poll, 42 percent of respondents are in what we would classify as needing improvement. Here’s why. From a broader research study we’ve conducted, customer experience requirements continue to increase, making it critical for distributors to a) clearly understand customers’ e-commerce needs and b) use that insight to build a system that can grow with customers’ changing needs.

Distribution Strategy Group has separately conducted extensive research about what customers expect when they shop/research/find/select products versus buy/transact. We find a great deal of variation in various distributors’ customer bases: Discrete customer segments have very different needs that many distributors aren’t factoring into their e-commerce development. Clearly understanding the voice of yourcustomers regarding e-commerce is not just a good thing, it is critical to any distributor’s e-commerce success.

Our research further shows distributors with subpar e-commerce sites are not only losing transactions, they are losing customers that migrate to more robust and easier-to-use competitors’ sites. By our estimates, failing to gather insight specific to your customer base and use it to make changes could easily trigger a 1-percent to 4-percent attrition rate per year for the next several years.

Moving Forward

Small changes can produce big results. As noted in part one of this research report, the rapid shift to e-commerce maturity has significant implications for distributors. Gaining solid support internally, especially with the field sales team, is imperative to effectively drive demand to the e-commerce channel. Both SEO and PPC continue to gain in importance. Distributors placing dedicated resources to their search initiatives – both SEO and PPC – are well positioned to leverage their e-commerce initiatives and compress the time from the nascent stage to maturity. Marketing automation is a very underutilized tool to help distributors improve their overall customer experience.

Just 21 percent of distributors are relatively satisfied with their e-commerce initiatives. Another 42 percent are in the category of potentially needing an e-commerce overhaul. Understanding your customers’ expectations is a critical requirement to building and implementing an e-commerce site that addresses their needs. Effectively communicating a distributor’s unique value proposition based on customer requirements can go a long way toward accelerating your progress from nascent stage to maturity.

Subsequent parts of this report will explore the Amazon effect and prescriptions of what to do now based on your phase of e-commerce maturity.

Jonathan Bein is the author of What Customers Want, published by MDM, and is the managing partner of Distribution Strategy Group. Dean Mueller is a co-author of What Customers Want and a partner with Distribution Strategy Group.

Dean Mueller is Independent Consultant at Distribution Strategy Group. He has more than 30 years of experience in sales and marketing and helps distributors build holistic digital strategies that drive a significant shift to online sales, improve profitability and grow customer satisfaction. Take your digital strategy to the next level. Contact Dean at dmueller@distributionstrategy.com.