To stay relevant with clients, distributors need to ensure they are adding value to the sale

According to data from the eighth-annual MDM distribution e-commerce survey conducted with Real Results Marketing, more than half of manufacturers who responded to the 2019 MDM-Real Results Marketing State of E-Commerce survey said they are using e-commerce to sell to end-users.

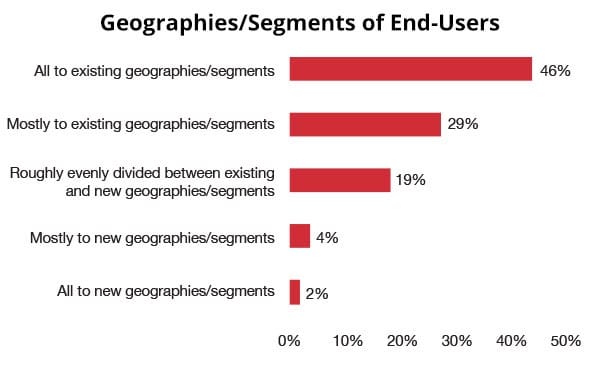

Historically, suppliers have sold directly to a few of their largest customers. About 46% in the latest survey reported they are selling direct online only to existing markets and segments — not new ones.

But now, many suppliers say that they’re using e-commerce to sell direct in markets or segments where their existing distribution channels don’t reach or don’t serve well. For many, it’s about testing the waters with a new set of customers.

Distributors should take note. Manufacturers seem to be more willing to endure a little more channel conflict to reach more customers, especially if they don’t feel a distributor is adding value to the sale.

Mitigating Channel Conflict

Some manufacturers that sell direct did have strategies to mitigate the impact on their distribution channels.

One manufacturer respondent said they are selling a secondary brand online that has little-to-no distributor support. “We charge significantly higher prices so as not to compete with distribution,” the manufacturer wrote. “When we engage the end-user, we always suggest they save money by buying from our distributors.”

Another said they are using e-commerce to “test the readiness of some new markets and segments where we actually do not have a dedicated sales team.” One manufacturer said they are leveraging e-commerce to target new segments and generate demand for their product offering through landing pages.

Selling to Distributors

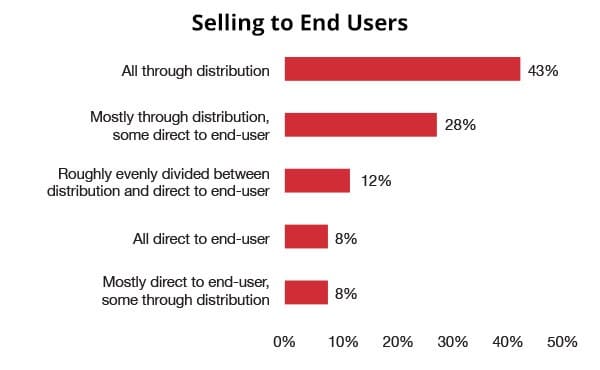

A little over 40% only sell to distributors through e-commerce, with about 28% saying most of their e-commerce sales came through distribution.

In these cases, the distributor is making purchases or reorders on the manufacturer’s website. It’s a much more transactional relationship compared with how an end-user might use a website. This is typically hundreds of customers (distributors) versus the thousands or tens of thousands that would be purchasing if they sold directly to end-users.

It’s not just about conducting transactions online. It’s also about using electronic channels to conduct business for greater efficiencies. That includes EDI and punch-out, as well as email order automation, both of which can improve the efficiency by which channel partners transact business.

Driving Demand for E-Commerce

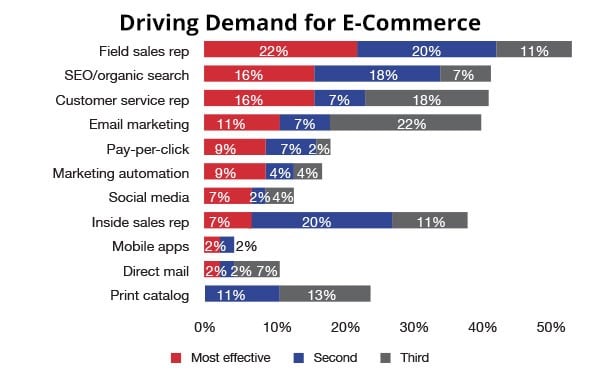

Manufacturers reported field sales reps were their most effective vehicle for driving demand, with 22% saying it was most effective and another 20% saying it was the second-most effective vehicle.

Organic search followed, and then customer service reps and inside sales reps. Email marketing was considered effective as well, but not noted as a top priority; a related but more sophisticated vehicle, marketing automation had just 9% of manufacturers saying it was the most-effective vehicle. Marketing automation remains an under-used but highly effective tool to target and message the right prospects and customers at the right time.

We would expect that how manufacturers drive demand for e-commerce varies based on whether they are targeting end-users or distributors. While distributors care more about the buying experience (the actual transaction), an end-user cares about both the shopping (finding, researching and selecting a product) and the buying experience.

In fact, after shopping on a manufacturer’s website, an end-user would be much more likely to submit an order in other ways, including email or phone call. Or they might reach out to their distributor sales rep.

In separate research, we have surveyed more than 10,000 end-users; customers typically prefer to start their shopping experience on a distributor or manufacturer’s website before picking up the phone, sending an email or ordering in another way. End-users know that a manufacturer is much more likely to have robust product and application resources on their site than a distributor is.

Rule-based product configurators are a plus, helping end-users build their own kits for their application. Manufacturers also frequently have tools to compare products. This represents a deeper level of content that helps customers go beyond scanning product pages and pricing. Manufacturers should partner with their distributors to integrate these kinds of resources into their websites or to build tools that are unique to a distributor’s customer base.

Marketing Vehicle Spend vs. Effectiveness

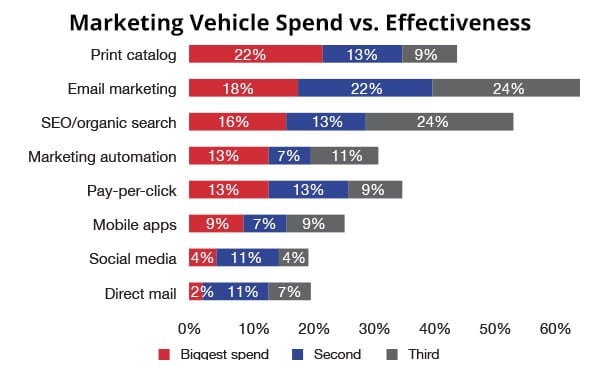

Interestingly, manufacturers say they spend the most on print catalogs, but it is ranked as the lowest in importance in terms of effectiveness in driving demand to their e-commerce channel. A few ways manufacturers can leverage print to drive e-commerce shopping and buying include icons for videos and PDF resources and shortened URLs pointing to product pages.

Spend and effectiveness also didn’t line up for organic search through search engine optimization (SEO), which manufacturers placed as No. 2 in importance to driving demand, but spending was third. SEO should be a top priority and seen as a long-term investment whether you’re targeting distributors or generating demand among end-users. SEO has even greater importance for manufacturers as they should be viewed by search engines as the authoritative source for information on their products, which can have benefits for the distributor, as well.

Companies should focus on organic search (free results through search engines such as Google) first before dedicating significant resources to pay-per-click campaigns through a channel like Google AdWords.

Whether on the manufacturer or distributor website, most businesses said they wanted to continue to improve the customer experience, which can be made better through personalization and relevance. And efficiency is everything. An outstanding omnichannel shopping experience, no matter where the purchase is ultimately made, is critical and even expected in today’s market.

But channel partners need to understand what the customer wants if they want to build the right resources and tools to drive sales. The risk of not knowing include overbuilding or underbuilding e-commerce, and lost efficiencies in e-procurement, EDI and email order automation, among other costs.

Adding Value for the Supplier

Distributors should be concerned about leaking revenue to manufacturers’ selling online. This leakage, combined with the impact of Amazon, raises the stakes for distributors that don’t communicate a strong value proposition. It’s not just about developing, communicating and acting on a value proposition to end-users.

Distributors need to offer value upstream, as well. This is especially true if they sell commodity products, which are at higher risk for disintermediation online by manufacturers and Amazon.

About This Research

Distribution Strategy Group conducted this research with Modern Distribution Management. The research included an online survey taken by 251 participants across a variety of sectors. Of those identifying as either manufacturer or distributor, 69% were distributors and 31% manufacturers.

There was greater participation from industrial, safety, electrical, building materials, janitorial, oil and gas products, HVACR, plumbing and hardware and power transmission/bearings. Other participating sectors include chemical and plastics, pulp and paper, JanSan, grocery/foodservice, and pharmaceutical.

About 36% of respondents represent small companies with less than $50 million revenue. About 41% are mid-market with $50 million to $500 million, 9% are large with more than $500 million revenue. The remaining 13% did not disclose the revenue range.

About 25% of respondents are primarily focused on MRO, 11% are focused on OEM customers, 24% serve trades/contractors, 25% are an even blend of MRO and OEM, and 15% are in other categories.

Jonathan Bein, Ph.D. is Managing Partner at Distribution Strategy Group. He’s

developed customer-facing analytics approaches for customer segmentation,

customer lifecycle management, positioning and messaging, pricing and channel strategy for distributors that want to align their sales and marketing resources with how their customers want to shop and buy. If you’re ready to drive real ROI, reach out to Jonathan today at

jbein@distributionstrategy.com.