The race to embrace digital marketing vehicles continued in the MDM/Real Results Marketing 2019 State of Distributor Marketing survey, potentially at the expense of opportunities that more traditional channels still offer.

An analysis of five years of survey data reveals that distributors are focusing more on digital marketing vehicles – email, search and social media – and less on the more traditional, such as print catalogs and collateral, trade shows and branch-based events. In general, distributors’ ongoing shift to digital is a good thing; depending on the segment, customers do prefer to be communicated with digitally. But traditional vehicles have not yet worn out their welcome; abandoning print and in-person entirely for digital is not the answer.

We’re living in an omnichannel world, with both Baby Boomers and Zoomers (the newest name for Gen Z, who is the latest generation to enter the work force) driving purchasing decisions. Distributors do seem to recognize this, with most saying more traditional marketing vehicles like print are still important to their efforts despite increasing the frequency with which they use digital vehicles vs. print and in-person. For example, nearly half of those distributors responding to the survey said print catalogs were very important. In our surveys of more than 10,000 end-users, about 47 percent still shop frequently or very frequently with print.

These customers, while comprising a small group, may be avid about having access to a catalog or product literature, pointing to a need to retain the vehicles – but with smaller or more targeted runs that retain their quality. Certain sectors and demographics tend to use print more frequently, as well. And distributors’ customer-facing personnel will remain critical to driving demand. About 62 percent of distributors’ customers very frequently or frequently shop with a customer service rep, and about the same say they very frequently or frequently shop with a distributor sales reps. The challenge will be balancing distributors’ more traditional vehicles with the right investments in digital.

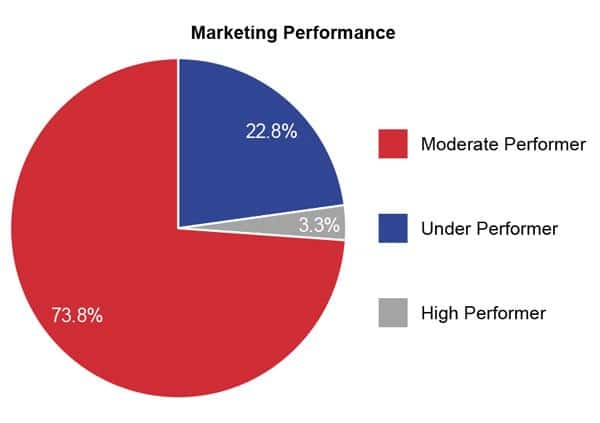

Satisfaction with Marketing Performance

According to the 2019 survey, distributors are generally satisfied with their marketing results. Still, the percentage of distributors in the survey who are extremely satisfied with their marketing results landed in the single digits once again this year, with just 3.3 percent falling in the “high performer” range – down from our 2018 survey. About 74 percent of respondents felt they were moderate performers, and another 23 percent put themselves in the low-performer bucket. Respondents who answered “very satisfied” or “moderately satisfied” were classified as moderate performers; respondents who answered “slightly satisfied” or “not at all satisfied” were classified as underperformers.

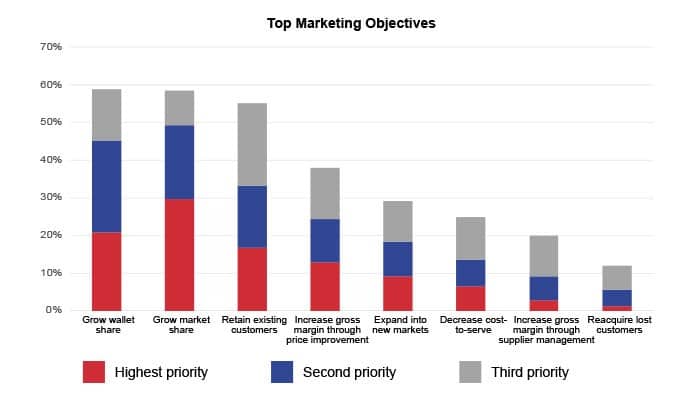

Distributors’ Marketing Objectives

The top four objectives in 2019 for distributors in their marketing initiatives were growing market share and growing wallet share, followed by retaining existing customers and increasing gross margin through pricing management.

Over the past five years, distributors’ goals with marketing have shifted, however, with fewer survey respondents focusing on growing margin through pricing initiatives and supplier management, and more respondents focusing on growing market share and selling more to existing customers. This could be due to the relatively frothy economy we’ve seen over the past few years, riding the wave with less incentive to focus on profitability. There are also more accessible solutions out there today that allow distributors to invest in cloud-based tools that drive profitability through better pricing.

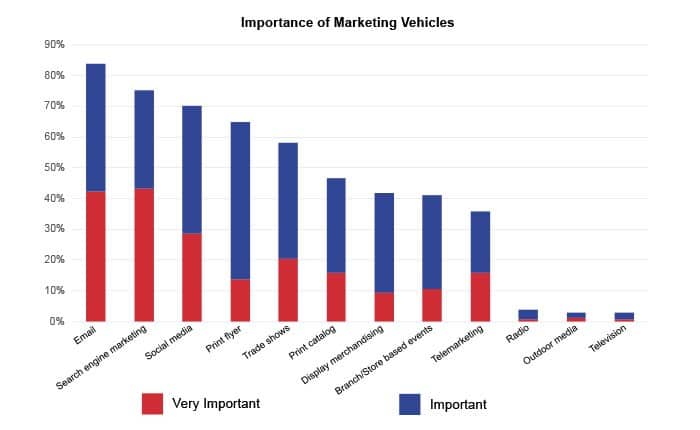

Importance of Marketing Vehicles to Strategy

Three of the top four most important marketing vehicles for distributors in the latest survey were digital, including e-mail, search and social media. Email has remained steady, with 84 percent of respondents saying it was important or very important in this year’s survey. Search engine marketing, which about three-fourths of the respondents have said is important or very important over the past two years, continues to be a top priority for most distributors. In fact, many leading distributors have doubled or even tripled the number of keywords they rank for in the past two years.

Social media has seen the biggest shift over the past five years; in 2015, less than half of distributors responding to the survey said that social media was important or very important. That number grew again this year to 70 percent in 2019.

All of the more traditional distributor marketing vehicles have fallen year over year. Print has decreased in importance to distributors significantly over a five-year period. Interestingly, 29 percent still named trade shows as “very important,” despite the vehicle falling out of favor with many of the respondents. This segment continues to hold tight to trade shows as an effective vehicle for marketing.

Distributors’ use of mass media (television, radio and outdoor signage) hasn’t changed much over five years, but the single-digit percentage who consider it important or very important has gone down considerably. Mass media has never been a well-used vehicle by distributors to reach potential customers; it’s primarily used by larger distributors and manufacturers with larger marketing budgets.

Marketing Vehicle Frequency

While distributors say more traditional marketing methods are less important, distributors are still doing telemarketing and branch-store events more often – in line with best practices. Telemarketing as part of a proactive inside sales strategy remains significantly underutilized by distributors, who are more comfortable with field sales reps selling to existing customers.

More distributors are also timing email and search engine marketing with increasing frequency. But for many, that frequency is still not in line with best practices. Email is a prime example. Most of the distributors in our survey know it’s important; but just 42 percent are emailing as often as they should. Customer research we’ve done shows that most want to be emailed more. E-mail should be used daily to weekly, depending on your customer base. From 2015 to 2019, those who e-mail daily or weekly shifted from 40 percent to 48 percent. Fear of bothering the customer is probably driving some of this.

The three marketing vehicles that have the highest percentage of use by distributors at the right frequency are trade shows, print flyers and social media. Trade shows and print flyers are traditional – vehicles distributors have been using for decades. The digital vehicle – social media – has one of the lowest barriers to entry and is relatively easy to adopt. Younger employees – Millennials and Gen Z – tend to run that part of the business, as well.

However, many distributors are more sporadic in their use of digital vehicles, which are newer. For example, over 50 percent of respondents are doing e-mail or search marketing monthly, quarterly, annually or never.

Make a Bigger Marketing Pie

The biggest takeaway from this year’s survey is that though distributors have embraced the importance of digital marketing tactics, there is still a lot of room for growth. Balancing the new with the old will likely continue to challenge distributors who don’t want to get left behind in this rapidly changing environment.

Many seem to have a mindset that marketing is a fixed resource: If you spend money on email, you can’t continue to invest in print flyers or events. But while more emphasis should be placed on digital, distributors still need to integrate more traditional methods into their overall marketing strategies. It’s not about moving money to something new. It’s about growing the pie. How that pie grows depends on how your customers want to be communicated with, as well as whom within the organization you are communicating to. To be sure, for many segments and customers, traditional vehicles will be less relevant over time and distributors should account for that. Digital will continue to grow in importance.

Over the next decade, marketing will play a bigger role in distributor operations than it ever has. Distributors that don’t find the right mix of traditional and digital strategies will shed market share and lose customer spend to competitors that do. A successful omnichannel marketing strategy should expand to accommodate the new marketing requirements that will help a distributor compete successfully in 2020 and beyond.

About This Survey

This research was conducted by Modern Distribution Management and Distribution Strategy Group through an online survey taken by 329 participants across a variety of distribution and manufacturing sectors. There was higher participation from industrial, safety, electrical, electronics, building materials, oil and gas, HVACR/plumbing and hardware. Other participating sectors included janitorial, pulp and paper, chemicals and plastics, grocery/foodservice and pharmaceutical. Nearly 50 percent of respondents were small companies with less than $50 million in revenue, more than 40 percent of respondents have $50 million to $500 million in revenue, and the remainder have more than $500 million in revenue.

Jonathan Bein, Ph.D. is Managing Partner at Distribution Strategy Group. He’s

developed customer-facing analytics approaches for customer segmentation,

customer lifecycle management, positioning and messaging, pricing and channel strategy for distributors that want to align their sales and marketing resources with how their customers want to shop and buy. If you’re ready to drive real ROI, reach out to Jonathan today at

jbein@distributionstrategy.com.