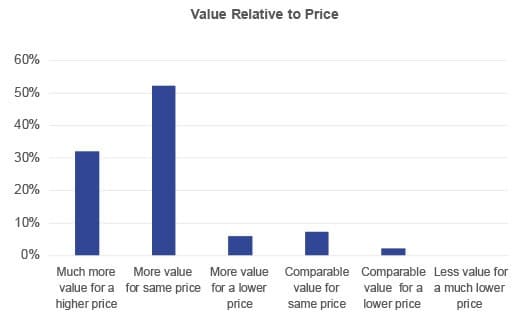

Every time we’ve asked distributors in the past five years whether they provide more value than the competition, we have seen the same results. About 90% of respondents in our annual State of Distributor Marketing survey with Modern Distribution Management think they are delivering more value than their competitors: either much more value for a higher price, more value for the same price or more value for a lower price.

The problem is that 90% of distributors can’t be delivering more value than their competitors. It’s the Lake Wobegon Syndrome, where all or nearly all of a group claim to be above average. The characterization of this fictional location, where “all the women are strong, all the men are good looking, and all the children are above average,” has been used to describe a pervasive tendency to overestimate one’s achievements and capabilities in relation to others. This is not unique to distribution; it’s been observed in many industries and across many professions.

What Differentiates Distributors

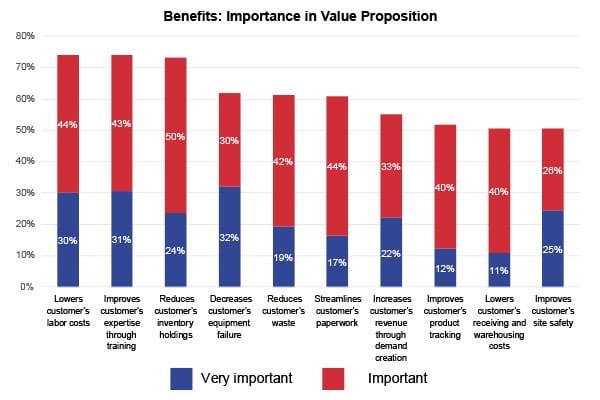

In our 2019 survey with MDM, respondents shared how they view the importance of features and benefits in their value proposition.

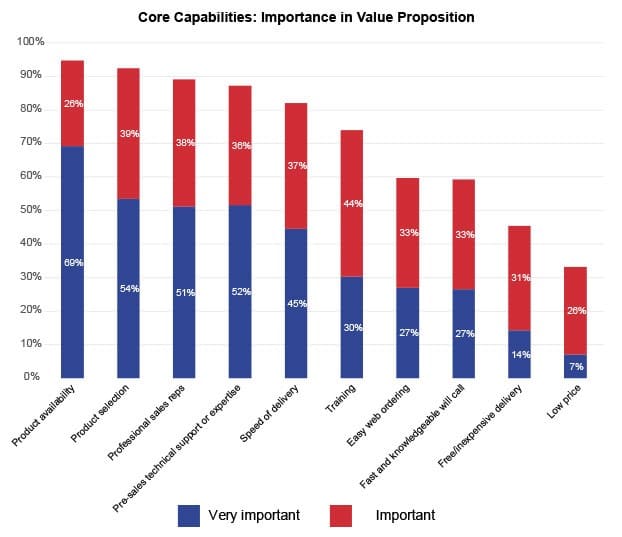

We have found year after year that nearly all the distributors in the survey continue to rate traditional logistical capabilities, such as product selection, availability and speed of delivery, as more important to their value propositions despite a decidedly nontraditional shift in the market. This held true in 2019. In general, respondents graded themselves well on the features that are most important, including product selection and availability, professional sales reps, pre-sales expertise and speed of delivery. Ninety-five percent said product availability was important or very important to their value proposition, and slightly less than that named product selection. Professional sales reps (89%) and pre-sales technical expertise was close behind. Respondents said speed of delivery was important (37%) or very important (45%) to their value propositions.

These logistics capabilities lay at the core of what distributors do; still, most distributors cannot position as leading on these attributes because their largest competitors – a Grainger or an Amazon – won those battles long ago. In fact, doing these things well (if not market-leading) has become table stakes. Even easy web ordering (named by 60% of respondents as either important or very important this year) has become a must-have.

The Lake Wobegon effect reared its head again when asked what the distributors do better vs. what the competition does better. About 40% of distributor respondents said that their competitors competed better on price than they did; of all attributes, price was the top reason cited. About a quarter of respondents named sales, marketing or e-commerce, and 23% named logistical reasons. But most distributors said they performed their core capabilities, as well as value-added activities, better than the competition. In other words, they are focused on the customer, and they believe the competition only cares about price.

Distributors tend to fall back to price as the reason competitors win in a head to head because they don’t have data on what the customer values. Distributors’ perceptions on how well they perform on price can be unreliable; in our voice of customer survey work for individual distributors, involving more than 12,000 end-users, we have found that distributors are usually more price-competitive than they think.

Hidden Value

This tunnel vision around the importance of logistical capabilities and low price to customers may be keeping distributors from articulating the real benefits many say are important to their value propositions, including helping the end customer reduce cost through lowering labor cost, increasing the customer’s expertise through training, reducing the customers inventory holdings, and decreasing customer equipment failure. Improving a customer’s safety onsite has continued to grow in importance as a service to end-users, with more than half saying it was very important or important to the value that they provide.

Despite this, most distributors’ marketing claims remain focused product availability, product selection or delivery. They are merely echoing everyone else and keeping what they do best a secret. Mid-market distributors that continue to focus on product selection, availability and delivery speed will be spinning their wheels over the next decade. These features will not differentiate their businesses in an era of global players and digital disrupters with extensive multichannel reach and marketing capabilities.

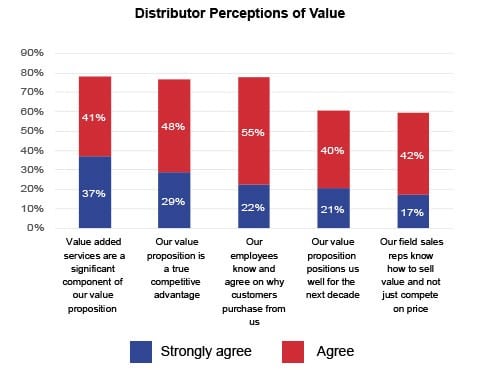

There must be enough value beyond logistics in what a distributor is doing that the customer doesn’t go to a competitor or even direct to the manufacturer. The good news: Distributors in the survey do recognize that their survival depends on value-added services. Thirty-seven percent of respondents strongly agreed that value-added services were a “significant component” of their value proposition.

We also found, based on what distributors labeled important, that they were not trying to be everything to everyone. For example, those that said logistical value-added services, such as reducing a customer’s inventory or lowering receiving and warehousing costs, were most important to their value propositions did not also say that training customers was “very important” to their value proposition. Those that focused on non-logistical value-add, such as training and pre-sales technical support, did not also think low price, speed or delivery or free/inexpensive delivery were “very important.” They focused on one area at the expense of the other, recognizing they could not compete both on low price and provide a high level of specialized services. This is good.

But there is a disconnect between the value they are claiming to provide and the articulation of that value to the market. They also seem to have a lack of clarity around what is adding the most value to customers. It’s much like the story of the merchant, John Wanamaker, who was asked whether its advertising budget was delivering value; he responds, “Half the money I spend on advertising is wasted; the trouble is I don’t know which half.” In other words, distributors need data. They may have opportunities to improve or expand the value-added services that are delivering real value and pare down or stop offering services that customers don’t really want. But without the data, they may provide the right service to the wrong person, or spend valuable resources providing a free service to customers who may only care about price or access to a brand. That’s only going to put pressure on margins and leave opportunities on the table.

The Benefits of a Clear Value Proposition

An effective value proposition clearly differentiates a distributor, and drives every aspect of how they operate, from internal communications to the product offering and the customers you target. If your value proposition is not clear:

Price is your sales team’s go-to selling strategy.

Customers can’t describe your company consistently. If some customers say price and product variety, and others say service, your message isn’t strong enough.

You treat everyone in your customer’s organization the same. Different stakeholders – from the CEO to purchasing – value different things. Messaging should reflect that.

To get beyond the subjectivity of the Lake Wobegon Syndrome, and uncover and communicate real value, distributors need to conduct market research to better understand the voice of the customer. A value proposition tells customers who the company is and why they should do business with them. It is built on what a company does that differentiates it from its competitors. It’s not just about what they do well, but on what’s important to the customers and the market, and what competitors claim about their offering. It helps distributors target the right customers, sell the right products and services, assign the right resources and systematically sharpen their offering.

Many distributors understand they have room to improve. Just 21% of respondents said they strongly agreed their “value proposition positions them well for the next decade.” Only 22% strongly agreed that their employees know and agree on what’s important to customers. And 17% strongly agreed that their people know how to sell value, pointing to commoditization.

The need to message on and align resources around the benefits that truly differentiate is going to grow in importance as we move through this decade because bigger players like Amazon – with its tremendous logistic capability – are already better positioned. Most distributors will never catch up if they continue to try to compete on logistics capabilities.

But if mid-market distributors embrace the value many are already providing – value that goes beyond distributors’ core capabilities – they can compete. In fact, a clear and compelling value proposition could spell the difference between merely surviving and coming out ahead this decade.

About This Survey

Modern Distribution Management and Distribution Strategy Group conducted this research through an online survey taken by 329 participants across a variety of distribution and manufacturing sectors. There was higher participation from industrial, safety, electrical, electronics, building materials, oil and gas, HVACR/plumbing and hardware sectors. Other participating sectors include janitorial, pulp and paper, chemicals and plastics, grocery/foodservice and pharmaceutical. Nearly 50% of respondents were companies with less than $50 million in revenue, more than 40% of respondents have $50 million to $500 million in revenue, and the remainder have more than $500 million in revenue.

Jonathan Bein, Ph.D. is Managing Partner at Distribution Strategy Group. He’s

developed customer-facing analytics approaches for customer segmentation,

customer lifecycle management, positioning and messaging, pricing and channel strategy for distributors that want to align their sales and marketing resources with how their customers want to shop and buy. If you’re ready to drive real ROI, reach out to Jonathan today at

jbein@distributionstrategy.com.