These days, distributors have so many options for investing in technology and are under so much pressure to improve their capabilities, it’s hard to know where to start.

Based on our extensive experience working with distributors, we want to help you distill your list of choices to the investments that we believe can have the greatest impact on your business.

Not included on this list are ERP, ecommerce and CRM systems. Make no mistake – great systems in these areas are table stakes, but they don’t necessarily have a measurable ROI. Investing in them is an inherent cost of doing business for a distributor.

To make the cut for our 10X tech stack, the technology must have a return that is:

- Predictable: Success is the overwhelming norm

- Fast: Distributors can measure the return in weeks or months, not quarters or years

- Material: The return must be 10X or greater versus the cost of the technology

Which technologies made the cut?

Three technologies made it into our 10X Tech Stack, delivering 10X or more return for distributors.

AI-based cross-sell and reorder recommendation engine

Distributors can significantly increase top-line revenue when they use AI-based technology for cross-selling and reorder recommendations.

Customer service reps may not be confident cross-selling with the information they have. But AI increases the odds they’ll be successful. With this type of technology, you solve common issues like:

- Regular customers who buy a small portion of your products because they’re unaware of your full offering

- Existing analytics designed for back-end use and don’t provide an easy-to-use interface for customer-facing employees

- Online product suggestions that aren’t grounded in statistics and don’t drive sales

With AI-based technology like proton.ai, you increase your wallet share with more effective cross-selling to customers through every channel. One $400 million distributor experienced a $10 million revenue lift over 12 months of using proton.ai’s ecommerce recommendations tool.

Pricing and profit improvement

Most distributors struggle with a consistently large number of price overrides. Pricing is often chaotic and is driven by field sales and customer service, resulting in lower margins and lower profitability.

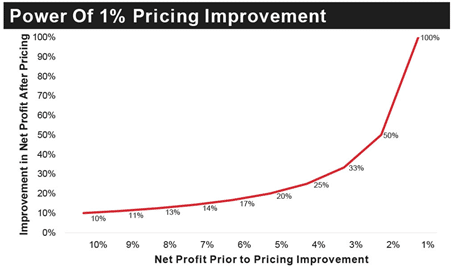

Most pricing improvement technologies can help you capture additional margin without losing much in the way of customer sales. They help you raise prices skillfully and with the right customers and items. Even a 1% increase in gross profit from C and D customers or items can have a dramatic effect on your bottom line.

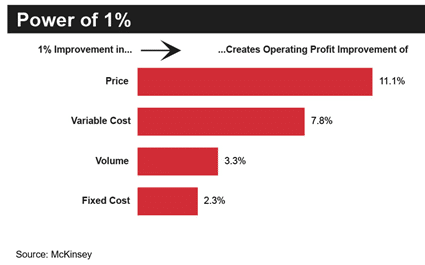

According to McKinsey, a 1% improvement in price creates an operating profit improvement of 11.1% on average. The lower your gross margin, the greater the lift.

You can make significant and sustainable improvements in a short period of time. A $100 million industrial distributor using Epicor Prophet 21 with Strategic Pricing with SparxIQ increased total margin percentage by more than 200 basis points and reduced price overrides by 60%.

Sales order automation

In our research, we have found that customers overwhelmingly prefer to send orders by email. This means customer service reps are spending time re-keying those orders into the ERP, which takes them away from higher-value work, introduces opportunities for error and increases the order cycle time.

Without automation, operating costs for sales orders add up:

- 10 to 30 minutes for manual entry per order from email or fax

- Customer experience negatively impacted by order cycle time

- Average cost per order entered manually: $8.30

- Average cost of human error per order: $30-$60

- Customer Service Reps spend 2-3 hours a day re-entering orders with errors

According to sales order automation provider Conexiom, you increase accuracy, give CSRs 15-30% of their day back for higher-value work, decrease the order cycle time by 90% and reduce order processing costs by 80%. The time to value on this technology is 30 to 45 days.

These three technologies serve five purposes: growing top-line revenue, increasing gross margin, improving the customer experience, increasing accuracy and reducing costs. They give you a lightning-fast return that is predictable, they come at a relatively low cost, and they’re low-risk. Individually, they’re reliable drivers of EBITDA. If you were to combine them, you could leverage them for even greater returns.

We can help you select and move forward with the right solutions for your business. Reach out today at jbein@distributionstrategy.com or call 303-898-8636.

Jonathan Bein, Ph.D. is Managing Partner at Distribution Strategy Group. He’s

developed customer-facing analytics approaches for customer segmentation,

customer lifecycle management, positioning and messaging, pricing and channel strategy for distributors that want to align their sales and marketing resources with how their customers want to shop and buy. If you’re ready to drive real ROI, reach out to Jonathan today at

jbein@distributionstrategy.com.