We saw a dramatic shift in 2017 and 2018 in the amount of revenue coming through e-business channels for distributors in part due to a lower barrier to entry for smaller companies; platform costs are less expensive, better product data is available, and distributors in general have more know-how around how to use these technologies.

By 2020, more than 60 percent of companies in our annual survey of distributors will see 10 percent or more of their revenue coming through website ordering. About a third will have 20 percent or more. We’re moving rapidly toward a winner-takes-most or even a winner-takes-all scenario, which happens when e-business makes up more than 25 percent revenue. That means a distributor has developed a systematic approach to generating demand that takes market share from competitors.

E-business goes beyond just shopping-cart revenue. E-business involves a broader strategy that incorporates website ordering, EDI, punchout and email/fax order automation, along with an aligned team that is incentivized to drive revenue to these channels. This is critical to achieving e-business at scale and creating real value for shareholders. Going digital makes the transaction more efficient and a distributor’s team more productive – both of which drive the bottom line.

To create real value and build a barrier between themselves and the competition, distributors should aim for at least 50 percent of revenue coming through e-business. When distributors reach this threshold, they create enormous value due to the efficiencies created. They are then able to invest those profits into their business to either continue growing their e-business reach, or to expand the business in other ways, including people, locations or products and services.

Every customer base is different. To reach scale with e-business, it’s key to know what customers want through a survey. The cost to a distributor of not knowing the voice of the customer includes overbuilding or underbuilding e-commerce; having too many or too few salespeople; too much or too little branch infrastructure; lost efficiencies in e-procurement, EDI and email order automation; passing up high-margin opportunities with small and medium customers; and the wrong media for the targeted generation. These would offset any gains from an investment in e-business.

Areas of Opportunity to Create Value with E-Business

E-Commerce Lift: With the right e-commerce infrastructure (defined as website ordering) supported by an aligned team of field sales reps, inside sales reps and customer service reps, distributors will see an increase in revenue from new customers online. Distributors will also experience a channel shift from existing customers, who move their orders online. With the right cross-sell and upsell functionality built into the website (think: recommended or “customers who bought this product also bought”), existing customers may also grow their average order size. The greatest benefit to the distributor with e-commerce is the improvement in gross-margin dollars thanks to the lower cost-to-serve required on this channel.

E-Procurement Lift: Distributors that leverage EDI and punchout – typically with their largest enterprise customers – will experience a lift in gross-margin dollars. EDI stands for Electronic Data Interchange and represents the electronic communication of data between two businesses; in other words, a customer sends its order from its ERP system to the distributor’s ERP system. Punchout involves direct access by a purchasing agent to a supplier’s e-procurement system online. Both reduce the need for a customer or distributor to manually enter item information.

Order Entry Productivity Benefit: Customer service reps are freed up to focus on other more value-added activities when they no longer have to manually input the orders that are coming in via e-commerce and e-procurement channels. Email order automation takes orders placed by email and converts them into a sales order in your ERP system.

Order Accuracy Improvement: Distributors experience fewer ordering errors as a result of e-business because their reps are no longer re-keying orders; this reduces the costs that can be associated with those errors.

Field Sales Cost Reduction: Distributors that leverage e-business can reduce their sales headcount and the associated expense because of the increase in self-service. We estimate distributors can reduce sales headcount by one field sales rep for every $2 million in e-commerce revenue, assuming $100,000 in compensation per rep. Some of those reps can be replaced or supported by a proactive inside sales force at a lower cost. The field salespeople that remain can focus less on mundane tasks and more time on consultative value-added activities such as generating more business from existing customers and targeting new customers that match a distributor’s value proposition.

Sample Company Return on Investment

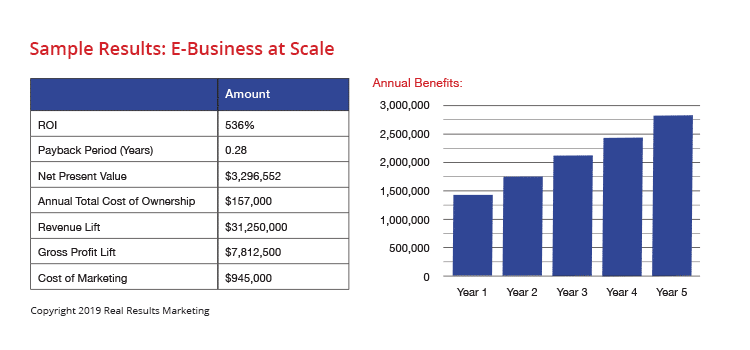

The following has been created to detail financial results expected from e-business at scale (defined as more than 25 percent of revenue through e-business) by a distribution company. The results in this report are based on projected costs associated with a project over a five-year period.

| Company Profile |

| Customers: 4,000 |

| Revenue: $100M |

| Gross Margin: 25% |

| Gross Profit: $25M |

| Average Order Size: $250 |

By Area of Opportunity:

E-Commerce Lift: From 5% to 25% over 5 years

E-Procurement Lift: 1%

Order Entry Productivity Benefit: From 45,000 to 135,000 orders over 5 years

Order Accuracy Improvement: Errors down from 1% to 0.25% of orders

Field Sales Cost Reduction: 6 fewer sales reps by year 5

The results are as follows:

The Bottom Line

To create lasting value, distributors should aim to achieve at least 50% e-business revenue, a big goal for most but one that will give them an edge that is hard to beat.

To do this, they must deliver a relevant omnichannel approach for all customers. Note that online ordering, or buying, is different from the functionality and data required for shopping; shopping happens before the transaction and includes finding, researching and selecting a product. A good shopping experience is critical to driving demand across all channels. A destination website is key to leveraging e-business for value creation. But it’s just part of a larger strategy that includes tools and channels like EDI and order automation that can quickly drive bottom-line growth.

After understanding the right setup for customers, distributors can act fast. For example, order automation can be implemented almost immediately. E-commerce can be implemented in a year with the right partner and access to product data, usually one of the biggest hurdles.

Distribution Strategy Group works with distributors to implement an omnichannel strategy in line with their customers’ needs. Contact Distribution Strategy Group today to learn more.

>>Download this report in PDF.

Jonathan Bein, Ph.D. is Managing Partner at Distribution Strategy Group. He’s

developed customer-facing analytics approaches for customer segmentation,

customer lifecycle management, positioning and messaging, pricing and channel strategy for distributors that want to align their sales and marketing resources with how their customers want to shop and buy. If you’re ready to drive real ROI, reach out to Jonathan today at

jbein@distributionstrategy.com.