Most distributors don’t view their inside sales team as a proactive sales force. It’s relatively rare for inside sales reps to make outbound calls to generate more business or to employ active selling techniques. In fact, in a survey, nearly two-thirds of distributor respondents told Distribution Strategy Group their inside sales force spends less than 25 percent of their time proactively selling.

That means they are spending most of their time processing orders and returns, providing technical support, managing inventory or tracking orders. In fact, most distributor inside salespeople are actually playing the roles of customer service reps and don’t have the skillset for a more proactive role. As a result, these distributors are losing out on significant bottom-line benefits and shareholder value. Time and again, we’ve found that training the right people with the right skills to execute a proactive inside sales approach not only boosts sales per customer, but saves distributors money. This report shows how proactive inside sales, combined with an omnichannel strategy, can create real value for shareholders in a distribution company.

Identifying accounts: When we talk about small or mid-sized accounts, we’re referring to their spend with an individual distributor, not their total revenue size. When targeting accounts, consider both current spend, as well as potential for growth. If they are large in size, but only purchase one category from you, they may be a target for a proactive inside sales program.

Areas of Opportunity to Create Value with Proactive Inside Sales

Prospecting: To cultivate new customers, distributors start with leads. Many distributors will then hand those not-always-qualified leads over to their outside sales force to follow up on. The result? Too many distributors are devoting one of their most expensive resources – outside salespeople – to an activity that may produce the least return. A proactive inside sales rep can increase the return on that investment, with a cost of sales 25%-30% lower than that of a field sales rep. The most compelling reasons boil down to simple logistics: Between visiting existing accounts, a field salesperson can reasonably make three or four new-business calls a day. Conversely, an inside salesperson sitting at a desk can easily make 20 contacts on that same day. On a cost-per-contact basis, prospecting through inside sales means significantly less expense. Based on the sample scenario on the next page, using inside sales to make outbound calls costs 33% less to reach more than 6 times the contacts a year.

Nurturing: As part of the proactive inside sales team’s role, nurturing customer relationships can be effective at every phase of the lifecycle, from welcoming new customers to making mid-sized existing customers feel valued. Here are two examples:

Customer Retention: Followup by an inside sales rep is not just a courtesy. It can be a profitable move that can both protect and grow wallet share with customers. For some distributors, an annual increase of 1% in customer retention over each of 10 years results in a 20% increase in annual earnings.

Growing mid-sized accounts: It’s easier and more cost-effective to grow an existing customer than it is to get a new one. One of the highest-return activities an inside sales team can do is to grow mid-sized accounts with potential. If an outside salesperson has an account base of 50-75 accounts, chances are they are not paying attention to the accounts on the bottom of their list, spending close to three-quarters of their time on their 10 biggest accounts. Without those touches, these customers will either continue ordering what they always have, or they will be picked off by the competition. A proactive inside sales force can focus on growing these accounts, connecting with customers to better understand their needs so they can cross-sell or upsell other products and services that could benefit them. These acorns could either grow into large field sales accounts, or solid and profitable inside sales accounts that still benefit the organization. Distribution Strategy Group has seen mid-sized customers represent opportunities for double-digit growth within timeframes of six months or less when they become a focus.

Sample Company Return on Investment: Proactive Inside Sales

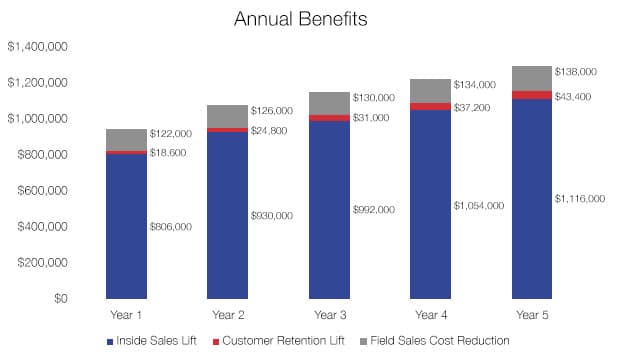

The following has been created to detail financial results expected from a move to a proactive inside sales strategy by a distribution company. The results in this report are based on projected costs for the following sample company associated with a project over a five-year period.

| Company Profile | Inside Sales Profile |

| Customers: 4,000 | Customers: 450 |

| Revenue: $100M | Revenue: $10M |

| Gross Margin: 25% | Gross Margin: 25% |

| Gross Profit: $25M | Gross Profit: $2.5M |

| Average Order Size: $250 | Avg. Customer Size: $22,222 |

Results

Conservative annual growth rates for a proactive inside sales program are: Year 1: 8%; Year 2: 12%; Year 3: 13%; Year 4: 14%; and Year 5: 15%. This results in overall growth of the following:

Not All Accounts Are Created Equal

The returns presented in this report are the result of a strategic approach to selecting and targeting the right accounts for growth through a proactive inside sales force. Not all mid-sized accounts should be targeted. In fact, distributors won’t see the return they are seeking if they select accounts that are too small or don’t have the potential to grow. Many distributors have “house” accounts that either don’t have this potential or are already at their maximum revenue. These accounts are not the best targets for a proactive inside sales program. Consider these figures for the same company in our primary scenario, but with a lower average customer size:

| Sample Small-Account Inside Sales Scenario |

|---|

| Customers: 900 |

| Revenue: $10M |

| Gross Margin: 31% |

| Gross Profit: $3.1M |

| Average Customer Size: $11,111 |

| Amount | |

| Annual Revenue Lift | $1,630,000 |

| Annual Gross Profit Lift | $505,300 |

| Annual Cost of Ownership | $263,133 |

| Net present value | $665,587 |

The Bottom Line

Most distributors don’t realize the pot of gold they have within their mid-sized customer base. Many of these customers have the potential to grow. But because sales resources are usually directed at larger customers in the short term, this potential is not realized. This makes the creation of a proactive inside sales force an opportunity to create significant shareholder value for a distribution company. Using customer segmentation and an integrated sales and marketing approach, distributors can focus on those customers most likely to generate more revenue. This does not mean they are abandoning field sales. On the contrary: They’re shifting their focus so field sales can have a greater impact.

Distribution Strategy Group works with distributors to grow sales of mid-sized customers with high potential, including training a proactive inside sales team to better identify account potential and prospects through the use of probing questions and relationship-building techniques. We show how inside sales can uncover hidden needs and use products, services and capabilities to address them. Contact Distribution Strategy Group today to learn more.

>> Download the full report in PDF.

Jonathan Bein, Ph.D. is Managing Partner at Distribution Strategy Group. He’s

developed customer-facing analytics approaches for customer segmentation,

customer lifecycle management, positioning and messaging, pricing and channel strategy for distributors that want to align their sales and marketing resources with how their customers want to shop and buy. If you’re ready to drive real ROI, reach out to Jonathan today at

jbein@distributionstrategy.com.