Digitally Native Vertical Brands (DNVBs) are direct-to-consumer businesses emboldened by such names as online eyeglass retailer Warby Parker and online shave-set seller Dollar Shave.

From clothing and apparel, health and beauty, and food, to furniture, sporting goods and oral care, more than 100 brands have seen success with their digital-first, direct-to-consumer, vertically integrated businesses. You’ve probably heard many of their commercials on talk radio and been served up their ads on your Facebook feed.

It’s the DNVB’s hyper focus on the customer experience that has helped them leapfrog the competition.

“Digitally native vertical brands are maniacally focused on the customer experience, and they interact, transact and story-tell to consumers primarily on the web.” – Andy Dunn, CEO, Bonobos, which started as a DNVB before being acquired by Walmart to be sold on Jet.com.

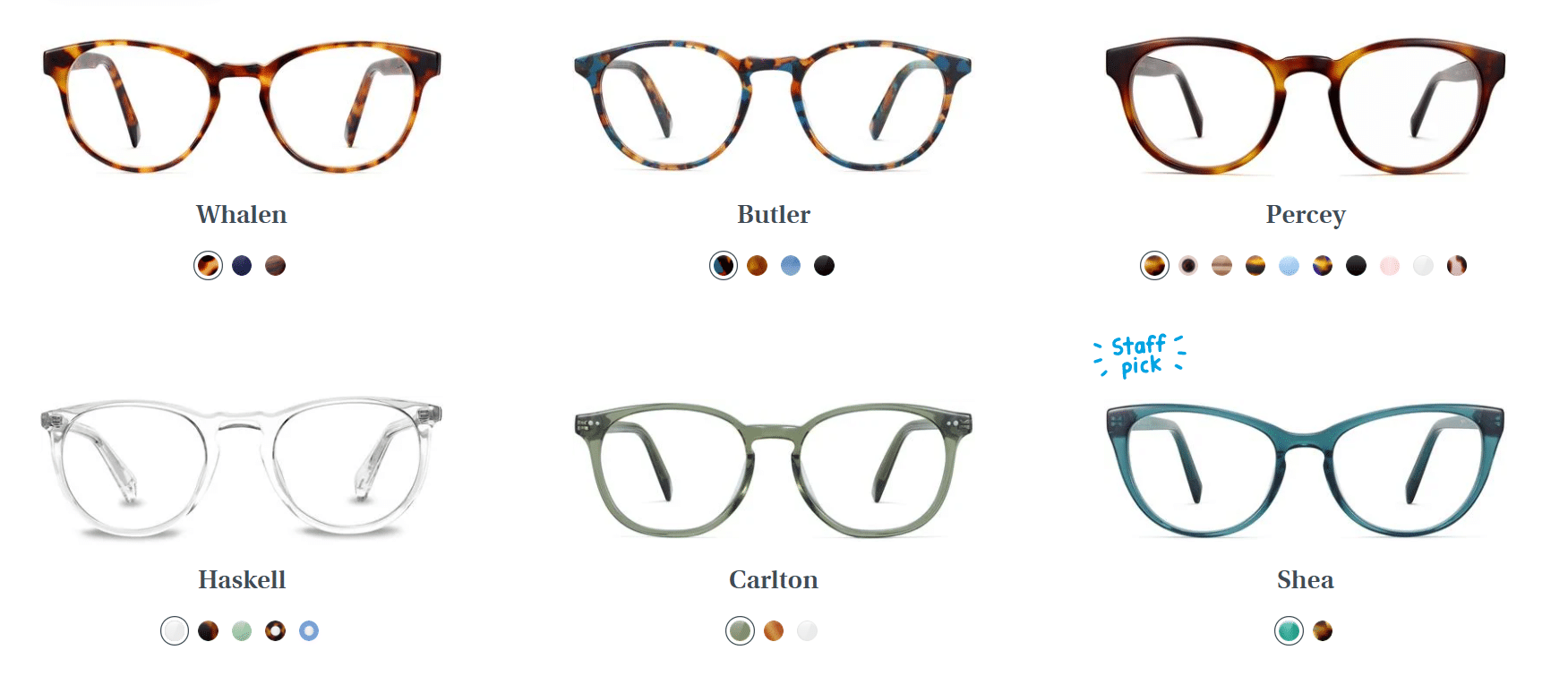

Take the story of Warby Parker.

Self-described as being founded “with a rebellious spirit and a lofty objective,” the founders wanted to offer designer eyewear at a “revolutionary price” after realizing how difficult it was to find glasses that didn’t “leave their wallets bare.”

The founders (still working toward their MBAs) started Warby Parker in 2010 to circumvent the traditional dominant go-to-market channels in the eyewear industry. They decided to go direct to the consumer with an online retailer, which was viewed with not a small amount of skepticism at the time (remember, this was 10 years ago).

But the digital-first model with customer experience at its core proved to be wildly successful. In 2019, they brought in more than $250 million in sales. Warby Parker was recently valued at $3 billion in a recent round of funding.

What does DNVB mean?

Let’s break down the component parts of the DNVB model, and where we might find examples of each in B2B markets:

Digitally Native

A DNVB by definition started online, selling and shipping from orders placed on a website, with no storefront. That’s the “Digitally Native” component of a DNVB model. We’ve seen the rise of pure digital distributors over the past decade, starting online instead of investing in a storefront model, with products that require less guidance for the customer to select and buy.

But just because a brand is founded or sells primarily online, doesn’t mean it can’t provide the customer experience that a brick-and-mortar business offers.

And that’s the whole point of a DNVB. Consider online shoe retailer Zappos.com, which, before being acquired by Amazon, called itself a “service company that just happens to sell shoes.” It is known for its liberal return policy, namely that customers can buy shoes, try them on, and return them for free. Zappos isn’t a DNVB, but it is an example of a digital-first business that prioritized the customer experience.

The B2B world has started to emulate the success of these early B2C companies. Digikey has built out a destination website for electronic components, available for “immediate shipment.” It’s widely understood that a significant majority of its revenue goes through their website.

FinditParts.com is an online source of heavy-duty truck and trailer parts, with a team of support staff available by phone for the buyer and available sales reps for big purchases.

WebstaurantStore.com is an online foodservice supplies distributor to restaurants, selling everything from equipment to disposables to furniture for restaurants.

Amazon Business, of course, is most well-known for its blazingly fast inroads into traditional distribution channels.

These companies’ businesses are thriving because of their focus on the digital channel, embracing some of what has made DNVBs successful.

Vertical

A DNVB is vertically integrated, combining manufacturing, distribution and even retail functions into one business. They sell their own products on their own websites; they aren’t offering others’ brands. The entire supply chain is theirs from top to bottom.

We’re seeing elements of this emerge in traditional distribution channels, especially as manufacturers leverage online channels to reach end-users directly.

Distributors are also embracing more functions. To name just a few, companies like Hilti, Kaycan and Resideo – all from different sectors – are providing both manufacturing and distribution functions for the end-user, carving out a broader value proposition. There are also numerous manufacturers who have a distribution arm that sells only their products.

Brand

In general, consumer brands are much stronger than industrial brands. For a DNVB, it’s all about brand loyalty. A DNVB thrives because of the passion its customers have for what they stand for.

Nevertheless, customers are loyal to some industrial brands, such as cutting tools manufacturer Sandvik, motion and control technologies supplier Parker Hannifin, electrical automation manufacturer Rockwell Automation, and tool-maker Milwaukee.

Could DNVBs Win in B2B?

As of yet, the Digitally Native Vertical Brand is not yet a common thing in B2B markets. But distributors and others in B2B channels can learn from the success of DNVBs.

That said, don’t discount the possibility of a DNVB emerging in these markets. It wasn’t that long ago that most distributors discounted the possibility that Amazon could compete with them, even after AmazonSupply formally launched in 2012 to big fanfare. Now the online juggernaut is poised to pass (by some estimates) more than $50 billion in sales in B2B alone.

Consider the success of DNVB Dollar Shave Club in B2C markets: No one would have expected that a razor company could emerge and compete with the likes of brand giants Gillette and Schick. But not only has the razor and grooming box-by-subscription model worked, the incumbents in the (by some estimates) more than $20 billion market have actually copied them.

What are the lessons for distributors?

- Just like distributors in some verticals are more susceptible to disruption than in others, some markets are primed for a DNVB-like competitor. Considerations include the size or form factor of the product being sold, whether it can be shipped by common carrier and the complexity of the sale. Segments that may welcome a DVNB include Safety/PPE, certain tools, jan/san and office products.

- Marketing has changed. It’s no longer a pamphlet left behind after a sales call. The boundaries between B2B and B2C are blurring, and your customers get their information differently. Most product searches start online in B2B just as they do in B2C. Just as consumer DNVBs are employing fresh methods to draw eyes and new customers, B2B DNVBs likely need to take a few lessons from buzz marketing. Buzz marketing maximizes word-of-mouth benefit based on customer fanaticism. When it works well, it significantly reduces the cost of marketing.

- There’s no question you need to embrace digital channels now. Think about the cost savings DNVBs have reaped online. Digital channels reduce the cost of sales, or eliminate it altogether for some businesses. DNVBs may have higher marketing costs as a result of their intense focus on customer experience, but their margins are not shared with the rest of the channel. That allows them to produce higher-quality products at relatively lower prices and minimal if any field sales. Instead they leverage customer service and inside salespeople, both lower-cost resources that provide the service the customer needs.

Want to dig in more? View a detailed list of DNVBs from Skubana.com.

Jonathan Bein, Ph.D. is Managing Partner at Distribution Strategy Group. He’s

developed customer-facing analytics approaches for customer segmentation,

customer lifecycle management, positioning and messaging, pricing and channel strategy for distributors that want to align their sales and marketing resources with how their customers want to shop and buy. If you’re ready to drive real ROI, reach out to Jonathan today at

jbein@distributionstrategy.com.