Let’s talk candidly. After 40 years in the sales profession, 30 years devoted to sales performance improvement, and nearly seven years focused directly on distribution, I’ve seen potentially powerful sales teams with passionate people still fall short of their full potential.

Too often, entrenched habits and legacy mindsets set the bar lower than necessary.

This isn’t an exhaustive list of industry sales challenges, but these are the ones I’ve seen that repeatedly hold back smart, capable distributors from achieving more.

Persistent Problems That Stunt Distributor Sales Growth

Inconsistent Sales Approaches

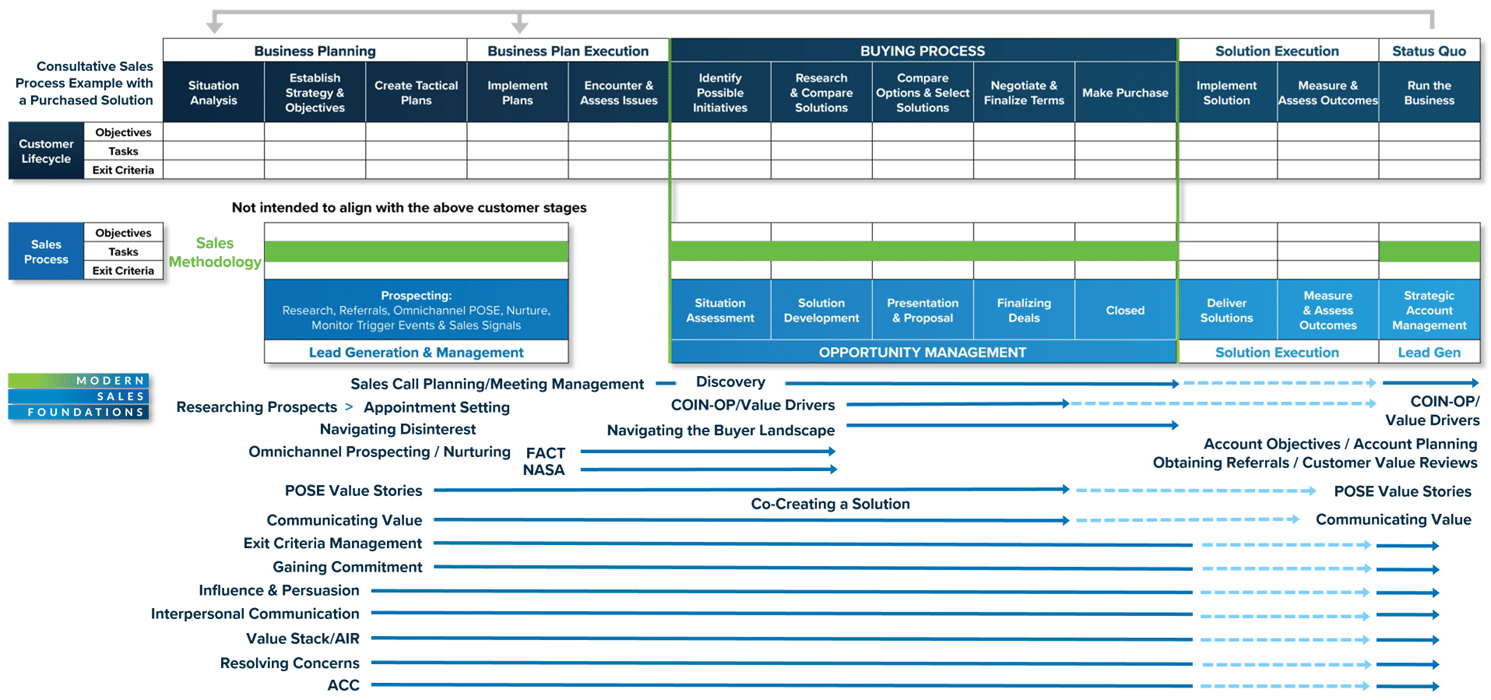

Sales methodology is often a free-for-all. When every sales rep improvises their own methods without an aligned approach to new business development, opportunity management, or even territory and account management (which is where most distributors focus), the organization loses more than just consistency. You end up with:

- Widely varying results: Star performers may excel, but average reps get left behind without replicable strategies or shared best practices.

- Management challenges: Sales leaders struggle to coach effectively—there’s no “right way” to reinforce, so improvements happen by accident, not by design.

- Territory imbalances: Without standard processes, some territories outperform while others underperform, regardless of market potential.

The result? Sales effectiveness is left to chance, initial momentum fades, and scaling growth becomes a herculean effort.

Coaching That Doesn’t Build Capability

This makes it nearly impossible to manage consistently across territories or even to coach to close identified skill gaps. Speaking of coaching, when it occurs, it is mostly opportunistic, deal focused, and more feedback than true sales coaching that will raise performance across a territory. Sales leaders often confuse deal-chasing or feedback with coaching. The pain points here:

- Sporadic, transactional guidance: Coaching is event-based: focused on closing THIS deal, not building long-term ability.

- Missed development: Long-term skills, such as strategic questioning or account planning, don’t get the attention they deserve.

- No ripple effect: When feedback is all about the current opportunity, there’s no mechanism for scaling improvement across the whole territory or whole team.

This leads to limited talent development and more frequent plateauing of individual and team results.

“Great Relationships”— But Cheap Talk Without Visibility

Relationships are a cornerstone in distribution. Sales teams and their leaders cite deep relationships with customers as a reason for their success, yet most can’t produce a relationship map for even their key or strategic accounts. Specific, logical account objectives with documented, regularly updated account plans designed to achieve those objectives are often quite rare.

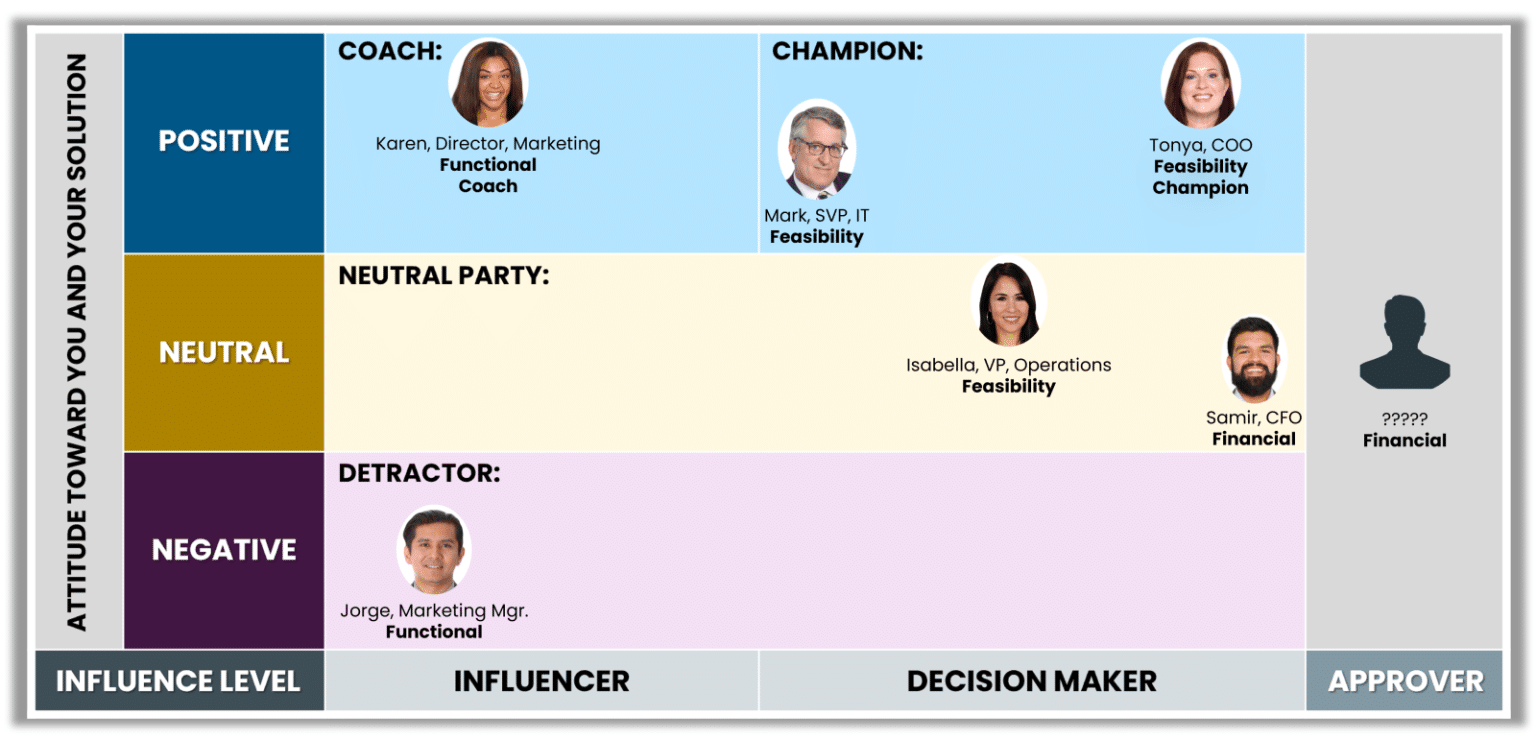

- Few can produce a relationship map for key accounts, showing who the decision-makers, influencers, and users truly are with their attitude toward your company (positive, neutral, negative) and their level of influence on a sliding scale (influencer, decision maker, approver).

- The illusion of depth: Years of “getting along” are mistaken for real influence. If a key contact leaves and your business evaporates, was that a relationship, or just transactional comfort?

- Misaligned priorities: Without understanding the customer’s goals and politics, reps react to surface-level requests rather than shaping real solutions.

The real pain sets in when unexpected churn or missed opportunities reveal just how little you truly know about what drives your customers. This could include the passing of the torch from a retiring ex-buyer to one from a younger generation without a personal relationship or history with you.

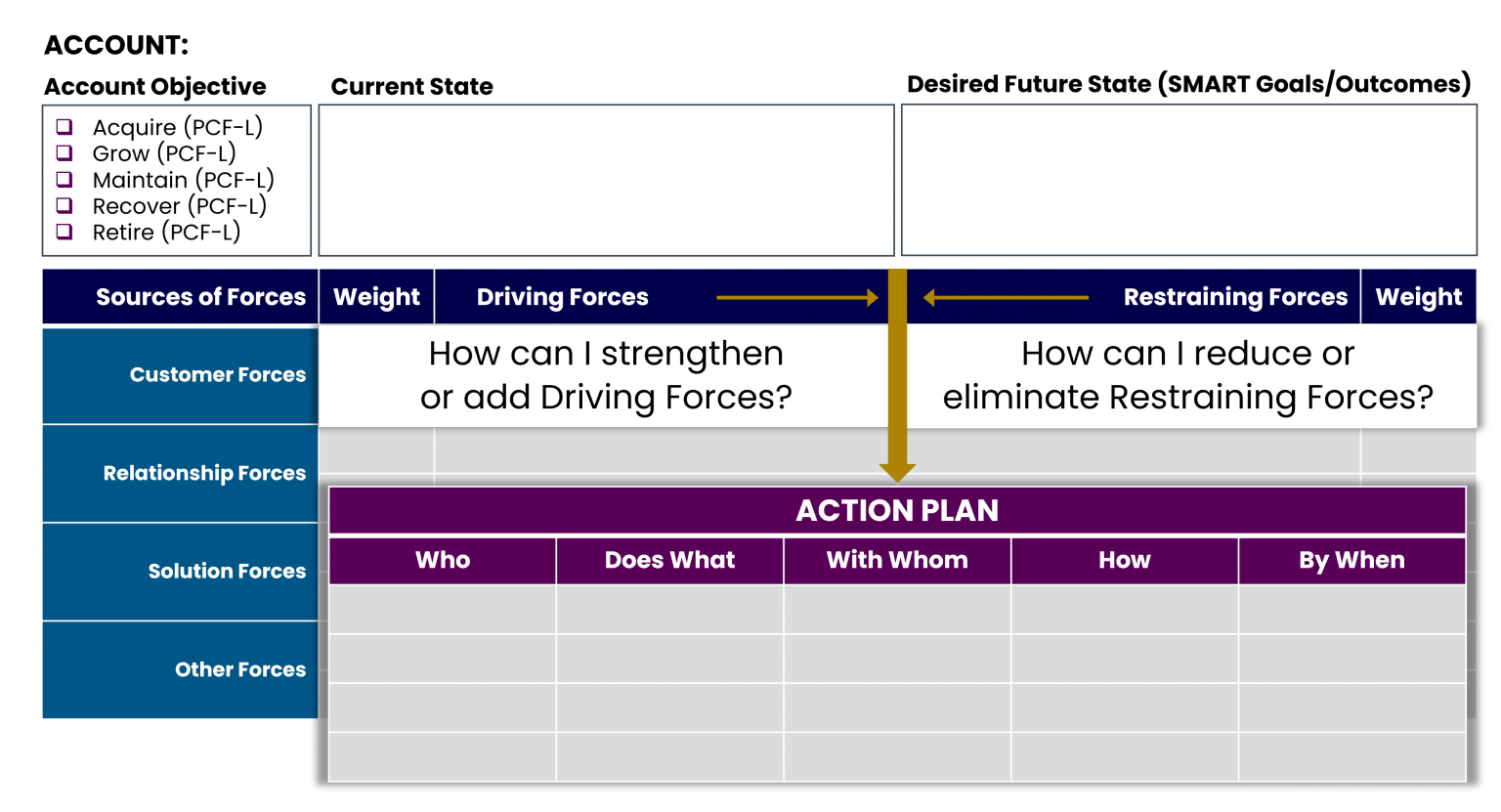

Lack of Working, Living Account Plans

Account planning, when done at all, is too often a one-and-done activity. The side effects:

- Outdated plans: Account plans are created for an annual review and then promptly forgotten, gathering dust instead of guiding action. (Pardon the silly reference, but Elf isn’t the only thing on the shelf gathering dust.)

- Reactivity rules: Sellers are consumed by fire-fighting mode, dealing with whatever comes their way rather than proactively shaping outcomes.

- Missed growth levers: Opportunities for upselling, cross-selling, reversing declining orders, or tweaking service delivery fall through the cracks, especially as account needs may evolve over time.

This means significant potential sits untapped while competitors with structured plans chip away at your market share.

Poor CRM Adoption and At-Risk Institutional Knowledge

CRM usage is non-existent, low, or poorly adopted. Things like “Who Sells What To Whom and How” are not documented, and neither is COIN-OP or the Challenges, Opportunities, Impacts, Needs, Outcomes, and Priorities for each key account. Without consistent CRM usage:

- Critical data lives in heads, not systems: The understanding of “Who Sells What to Whom and How” or the customer’s COIN-OP (Challenges, Opportunities, Impacts, Needs, Outcomes, and Priorities) are tribal knowledge, not organizational assets.

- Onboarding and transitions are painful: When a salesperson leaves, they take irreplaceable account context with them, as well as deep product knowledge gained over years of work.

- No shared intelligence: Teams can’t quickly analyze trends, spot warning signs, or collaborate on key pursuits.

For leaders looking to scale or step up customer experience, this is a massive roadblock.

Overwhelmed by SKUs and Territories, Lacking Guidance

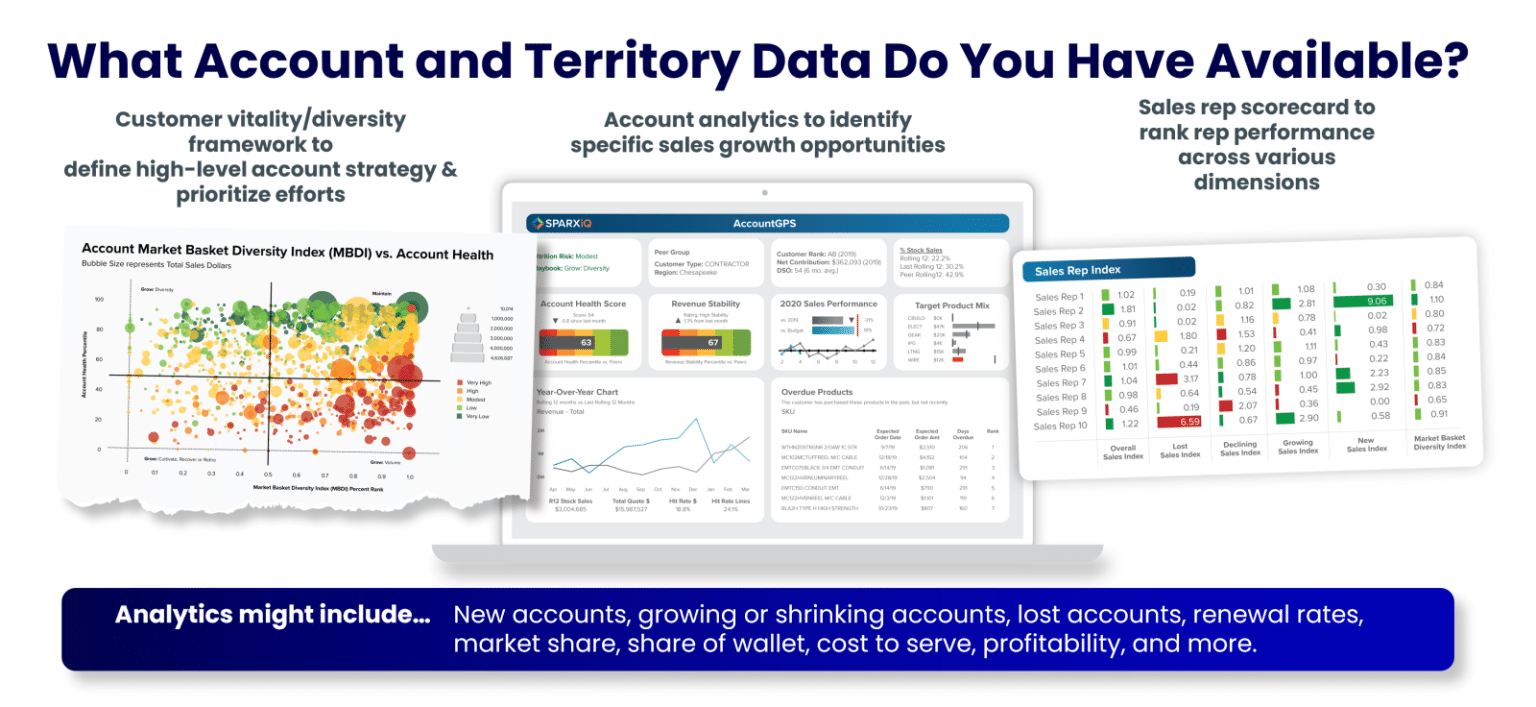

Distributors often offer vast catalogs and cover huge territories. In fact, territories are so large and SKUs so plentiful, that without a guided selling analytics tool (which most don’t use) to guide account managers on where the best upsell, cross-sell, overdue, or declining orders are, sellers rarely optimize their territory potential. This leads to:

- Information overload: With thousands of SKUs and hundreds of accounts, frontline sellers struggle to know where to invest their effort.

- Blind spots: High-potential accounts for upsell, cross-sell, or recovery are missed, purely because there’s no data-driven prioritization.

- Non-strategic approaches: Relying on intuition leads to focusing on noisy accounts, not necessarily the most profitable ones.

This lack of direction results in wide “potential gaps” where untapped opportunities remain invisible and untouched.

Pricing Issues Tied to “Being Liked”

Speaking of SKUs, many distributors’ sales forces price based on “last price paid” without regard to strategic pricing guidelines—and even when strategic pricing is in place, there are many manual overrides.

Reasons vary but include the fact that pricing is often an emotional battleground for sellers. There is often an overconcern about “being liked” (which is how they gauge “relationship”), poor negotiation skills, and—as mentioned above—a lack of predetermined account objectives and no analytical approach to account optimization to provide guidelines and guardrails.

- Legacy pricing habits prevail: “Last price paid” becomes the de facto benchmark, regardless of changes in cost, order size, value, or market conditions. (I was kind not to mention tariffs, right?)

- Manual overrides undermine value: Even when strategic pricing guidelines are set, reps bow to convenience or fear of friction with customers, making manual overrides far too often.

- Margin erosion: Over-concern for being “liked” turns into leaving money on the table, especially when teams lack negotiation skills or the confidence to communicate value.

The consequence? Profitability suffers and the organization sends mixed signals to the market about the true value they deliver.

While these problems are the most common and impactful that I encounter, every organization is unique. There may be other pain points depending on your size, structure, markets, or strategy—but if you’re being honest with yourself, you’ll likely recognize at least several of these challenges.

The Payoff: What High-Performing Distributors Do Differently

For every pain point above, there are proven solutions that unlock far greater outcomes. Here’s what I’ve seen separate leaders from the pack:

Adopt Clear, Practical Sales Methodologies

High-performing distributors:

- Establish unified playbooks for new business development, opportunity management, and account management and growth. These aren’t just “shelfware”—they guide everyday activity.

- Teach and reinforce best practices: Methods are learned in onboarding, coached weekly, and celebrated in team meetings. We know what gets measured gets done but we sometimes forget that what gets talked about and asked about regularly gets attention and focus.

- Embed sales methodology, negotiation, value articulation, and territory planning and execution as central skills, not afterthoughts.

The payoff: Predictable processes make success scalable, not isolated.

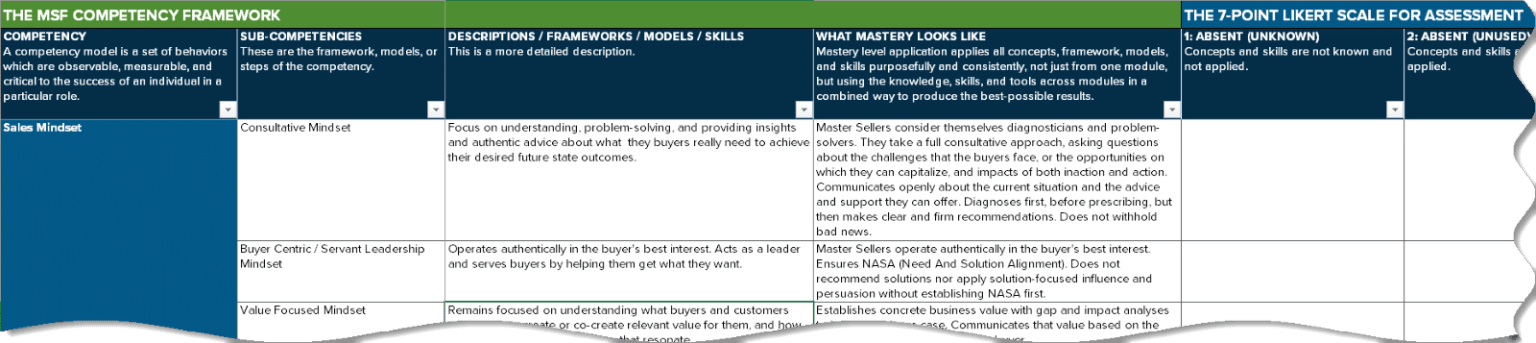

Use Competency Assessments to Drive Coaching

In best-in-class organizations:

- Competency models clarify expectations: Everyone knows what good looks like at each stage of the sales cycle.

- Regular assessments identify individual strengths and opportunity areas (skill gaps or sales competencies to close), so coaching is always personalized and relevant.

- Coaching is structured, not sporadic: It happens in a cadence, tied to development goals, and tracked over time.

This creates a culture of coaching and a cadence of continuous improvement which accelerates the growth of capabilities across your team, steadily improving results.

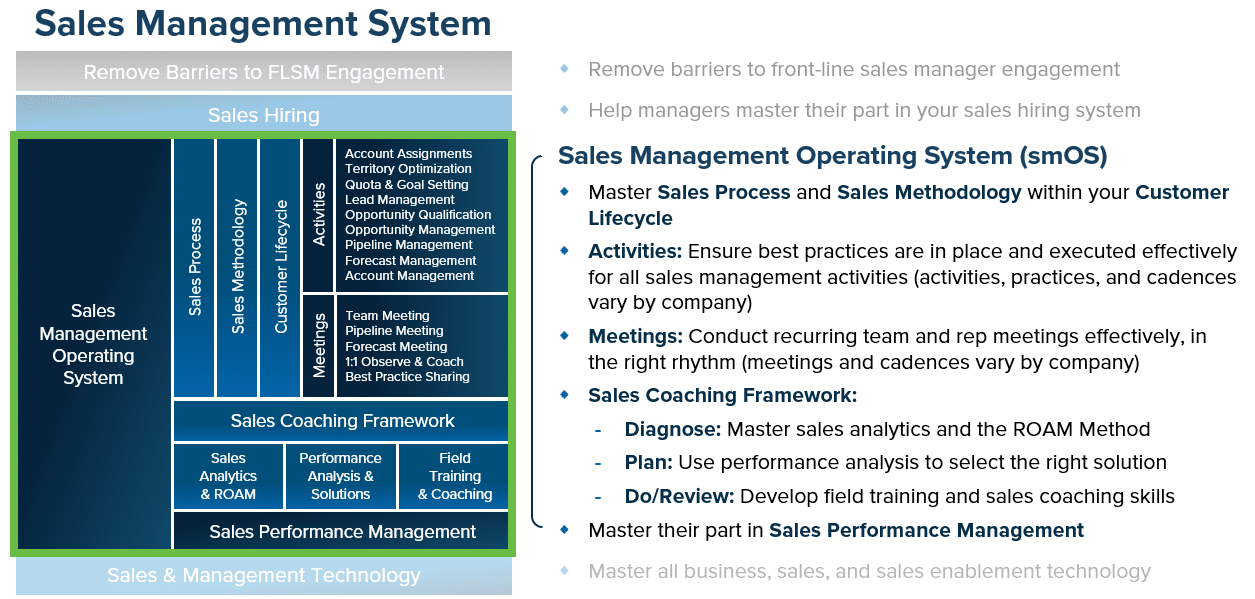

Treat Sales Management as a Discipline

Top distributors make sales management systematic:

- Weekly cadence calls: Consistency in performance discussion keeps everyone aligned and accountable.

- Structured pipeline and account plan reviews: These aren’t box-checking sessions, they’re opportunities to solve challenges and spot risks early.

- Skill-development meetings: Teams practice selling scenarios, resolving concerns, and value communication in a safe environment.

This discipline turns management from a reactive firefight into a proactive leadership function.

Maintain Current, Actionable Account Plans

Exceptional teams:

- Update account plans regularly: Plans should evolve with customer needs and the plan tasks that you complete, not just after annual/biannual reviews or QBRs.

- Use relationship maps strategically: Identify key influencers, detractors, and champions so outreach is targeted, and relationship management is purposeful.

- Tie every customer touch to a goal: Sales calls, service check-ins, and executive meetings should all support specific objectives on both sides of the table—the customer’s and yours.

The result is a coordinated, intentional approach that maximizes account potential.

Build Relationships Purposefully and Intentionally

High-impact sellers are deliberate about relationships. They:

- Invest time to understand customer priorities: They research market trends, competitor moves, and internal customer goals.

- Act as partners, not just vendors: By proactively suggesting improvements and aligning with what matters, sellers are invited into deeper strategic conversations.

- Anticipate shifts before they happen: Early signals from accounts are caught because trust runs deep, not just wide.

This intentionality dramatically raises the seller’s value in the customer’s eyes and creates defensible differentiation.

Leverage Data-Driven Tools for Territory Optimization

Data and analytics transform potential into results:

- Guided selling technology surfaces which accounts are ripe for upsell, cross-sell, or recovery, down to the SKU and timing.

- Dashboards track opportunities so no hot lead goes unaddressed, and trends are visible to both reps and leaders.

- Proactive focus: Salespeople spend time where impact is greatest, not just where they’re most comfortable.

This adds clarity, focus, and ROI to every sales hour and marketing dollar invested.

Enforce Pricing Discipline with Enablement

Winning organizations reinforce pricing disciplines:

- Arm reps with tools: Price calculators, margin impact analyzers, and talking points support value-based conversations.

- Ongoing training: Teams practice negotiation techniques and learn to navigate price pressure confidently.

- Outcome-focused mindset: Salespeople shift from “being liked” to “delivering value”—and margins improve as a result.

- A focus on change management: Very little change happens in companies because managers “say so.” This is a far-larger topic but consider that you will need to lead and manage change to get new behaviors to stick and become “the way we do things around here.”

Strategic pricing discipline can be transformative for both the top and bottom lines.

Closing Thoughts

Most distributors know their teams could do better. The critical question is:

How much better could you be if you addressed these root causes?

The CEOs and senior sales leaders of top-performing organizations don’t leave growth to chance or let tribal knowledge and past practices set the bar. They put foundational sales systems and coaching routines in place that make excellence the standard, not the exception. Your competitors aren’t waiting.

Are you ready to reclaim untapped potential and define what “great” looks like in your market? If so, I hope this article is helpful and I would enjoy hearing about your successes or challenges, along the way.

Additional Related Resources

- Article: 9 Steps Distributors Can Take to Radically Improve Sales

- Book: The Building Blocks of Sales Enablement

- Courses:

Mike Kunkle is an internationally recognized expert on sales enablement, sales effectiveness, sales training, sales coaching, sales management, and sales transformations.

He’s spent over 30 years helping companies drive dramatic revenue growth through best-in-class enablement strategies and proven effective sales systems.

Mike is the founder of Transforming Sales Results, LLC where he designs sales training, delivers workshops, and helps clients improve sales results through a variety of sales effectiveness practices and advisory services.

He collaborated to develop SPARXiQ’s Modern Sales Foundations™ curriculum and authored their Sales Coaching Excellence™ and Sales Management Foundations™ courses.

Mike's book, The Building Blocks of Sales Enablement, is available on Amazon, with others coming soon in 2026, starting with The CoNavigator Method for B2B Selling.