Management literature on sales effectiveness in the wholesale sector is voluminous. Yet, for all the literature, CRM software and selling techniques (Challenger Sales, Ninja Selling, Storytelling, etc.) the end results are fleeting. Distributors have spent loads of money on sales effectiveness with limited gains.

Our work with distributor sales forces, over two decades, has consistently found three immutable facts:

- North American distributors find outside sales forces essential while their counterparts in other countries do not have them or use them sparingly.

- Sales forces tend to concentrate their efforts on mature technologies to existing accounts. Rather quickly, their return on time invested (ROTI=GM$ per Call/$Cost per Call) falls as product technologies approach commodity status.

- Customers are ambivalent about buying either sales-assisted or online as long as they know what they want to buy.

The result is that most sales forces are expensive and too often a financial drain in a low-operating-margin business.

Sales efforts need a different focus and a better mission to justify their ongoing investment. Our work since the Great Recession has been to improve ROTI through focusing on new products and new technologies, an area that distributors are not particularly adept at.

Headwinds in New Product Sales

An enduring and legitimate challenge in launching new products and new technologies is the risk that vendors that front the product or service will add distribution or bypass distribution as sales increase. Both possibilities are supported in the turbulent history of manufacturer-distributor relationships.

Also, new products require investments in product specialists and development of effective marketing efforts. Historically, technical specialists and qualified marketers are expensive, and turnover is high as their skill sets are in demand. Distributors must dedicate themselves to sufficient evaluation and funding of these professionals.

Our experience of four decades in B2B channels finds distributors who invest and successfully drive new product and new technology sales have higher earnings and higher growth than their competitors; most are in the top quartile of financial performance in their industry.

New Product and New Technology Launch Process

Our research has consistently found that distributors that have a documented, process-based approach to new technologies have 60% greater first-year sales in new products and technologies than those who do not. The research also finds that only a third of distributors have an ongoing new product launch process.

For edification, we refer to new products and new technologies as distinct but similar events. New products refer to net new products to the organization while new technologies represent new applications that usually cover many products.

New products and technologies are, most often, platforms from existing technologies with better lifecycle returns, their long run performance costs less than existing options.

The New Product Launch process, done well, is learned through practice; setbacks and rework are not uncommon in early trials. Over time, however, a well-honed new product/new technology introduction integrated with the sales effort pre-launch can prove to be one of the most valuable organic growth elements of the distributor. And, from a financial return perspective, organic growth is more durable, consistent, and offers richer returns than acquisitive growth.

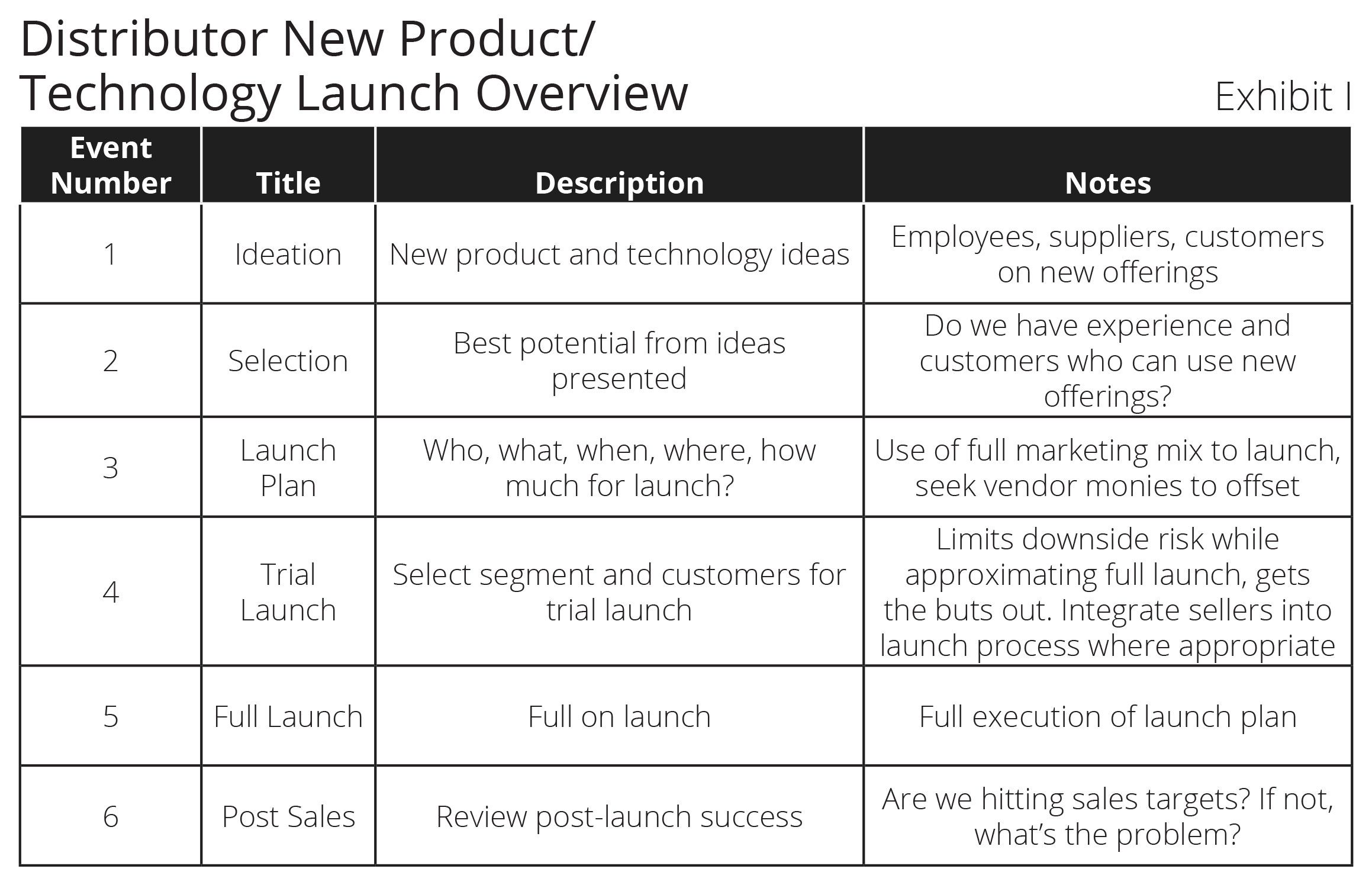

In Exhibit I, we give a tabular overview of the new product/new technology development process. There are six distinct steps with name, description and notes related to the process as follows:

Ideation: Idea generation is the beginning of any new product/technology endeavor. To get good ideas, we advocate generating many ideas from industry insiders including employees, customers and suppliers. At this stage of the process, evaluating ideas is less important than generating as many as possible for review. A simple email campaign asking for input is often the best means to get ideas to review and most requests are honored with a reply.

Selection or Idea Evaluation: In this stage, it is critical to select a knowledgeable team regarding the firm’s markets, customers, and who understands the market mix capabilities of the organization.

Broadly speaking, key sellers, market managers, product managers and inside sales should be a part of this team. On average, 10% or less of ideas generated are selected at the end of this stage. And these should be prioritized by the top two or three to cover in the near term.

Launch Plan: This stage is too often glossed over but specific, exacting plans regarding the key questions of the launch are critical. Each product/technology should have a mini-marketing and sales plan specifying target customers and segments, supporting sales promotions, cost and funding of promotions, product training, and any other pertinent event to a product launch. Assignments and prioritization of the events with due dates also is recommended.

Trial Launch: We encourage a trial launch, which is a truncated launch of the new product in a defined and small but representative sample of the full target market. The trial launch should follow as many elements as possible of the full launch plan with the objective of the trial being twofold

- Any bugs in the launch are known and fixed before the full launch.

- Customer reactions, if negative or underwhelming can be researched before committing to the full launch.

Full Launch: This is the culmination of all previous launch processes and involves sales, marketing, product management and others. The full launch should be driven from a mini-marketing plan and financial justification specific to the product or technology under consideration. The full launch typically lasts four to eight months before a post-launch review is appropriate.

Post Sales: This is the formal review of sales progress from the Full Launch. If sales are ahead of plan, the review is generally quick, and the team is encouraged to press on with the original plan. If sales are substantially behind forecast, the review of the launch process, including forecast and marketing intelligence should be investigated.

If a sales forecast is 5% to 10% behind, we often advocate staying with the plan with minor modifications. If the forecast is 25% or more behind forecast, we generally advocate a thorough review with the consideration that the launch is suspended if a significant flaw or terminal event is found in the original launch plan.

Involving the Sales Team

Outside sales are a fixture in distributor organic growth. Too often, however, sellers are encouraged to sell existing technologies to existing customers; this offers the least incremental returns. When sellers are supported by a corporate-wide new product/new technology launch that marshals the full capabilities of the firm, their contribution to organic growth and returns on time invested improve, often dramatically.

Increasingly, outside sales is not an entrepreneurial exercise, but is supported by the marketing process and as needed, operations. Their future success reflects a planned go-to-market strategy of new products and new technologies.

Scott Benfield is a consultant for B2B Manufacturers and Distributors. He is the author of six books and numerous research projects on B2B channels. He can be reached at benfield.scott@aol.com or (630) 640-5605.