Our forecast is that distributors, in the next five years, will face a new economy where growth becomes more strategic involving cross-functional teams of executives and managers. Growth events will involve more capital, and more is at stake than at any recent time in distribution’s history.

The current economy has ushered in several long-term changes which will affect distributors and their growth plans. First, monetary policy that juiced growth with ultra-low interest rates is over. LIBOR rates were less than 2% a few years ago; today they are at 4.5%.

The result is that on-site inventory, borrowing for acquisitions, and adding capacity in warehouses, customer service, IT and sellers just got more expensive. Currently, the Federal Reserve guidance is in line to increase rates throughout the coming year or until the Consumer Price Index (CPI) falls substantially and unemployment rises.

Secondly, growth is more complex, with more risk, than at any time during the last several decades of distribution. Sales-driven growth, the stock-in-trade of privately held, regional distribution, is becoming less of a go-to event.

As distributors consolidate, growth becomes more complex than a singular sales call. It is now more the domain of marketing and executive decisions as growth investments become larger.

Online business models inclusive of proprietary marketplaces, online channel alliances, new product introductions, new services and national accounts dominate growth decisions. You’ll seldom find these growth options bubbling up from the outside sales force, they require significant investigation, planning, and internal financing costs are high.

Also, the organizational skills and plans to execute these growth options are not sales skills. They take an executive management approach that sequesters skills from across the organization.

This series reviews organic and non-organic growth from a strategic perspective. It will not delve into the domains of sales effectiveness or sales efficiency, areas of growth that are increasingly tactical.

While we believe the sales effort is still important to the overall performance of the distribution organization, we believe that it will cede its importance to more marketing and financial (accretive)-led growth.

Today, many distributors have not wholly mastered strategic growth, especially of the organic variety. This series will concentrate on these efforts while acknowledging more traditional growth strategies.

The Growth Matrix

We offer Exhibit I as a growth matrix for the distribution firm. It follows our distributor advisory work on growth strategies over two decades. In the exhibit, there are 10 primary areas of growth:

These represent more traditional acquisitive and product growth to modern-day opportunities in new channels and new online business models including marketplaces.

Due to space limitations in this three-part series, we won’t cover the entirety of growth opportunities in detail; some growth areas will get more attention than others. In the exhibit, growth has been briefly defined and categorized specific to relative profitability, difficulty and strategic advantage.

For instance, Growth Option 7, New Omnichannel Partners, concerns selling through other e-based businesses that have sprung up over the past decade. These partners include entities such as Amazon Business or specialty online businesses serving specific segments.

The profitability of these efforts in overall return on sales and difficulty to implement is medium or average. The long-term competitive advantage is high as online partnerships are a newer channel with upside growth as commerce moves online.

More traditional growth including acquisitions and product strategies are dealt with in the first part of the matrix and we cover these in the remainder of this installment.

Acquisitive Growth

Growth by acquisition has been a staple of the distribution sector for several decades. Adam Fein’s NAW research on growth by acquisition, done in the late 1990s, was a bellwether for several decades of accretive growth.

Growth by acquisition has favored, by far, the larger distribution firms. They have the size, management expertise and income to successfully acquire better targets. Larger firms look to acquire fixer-uppers and quickly move to improve their earnings. Our observance is that regional distributors, using a metaphor of fish in a small pond, feast on the small fry and are the big fish in a geographic region. National and super-regional firms purchase the regional distributors and national and international firms court the super-regionals.

In years’ past, financial buyers (read private equity) have competed for distributors along with strategic buyers. As borrowing rates have increased and erstwhile acquisitions have declined in number (making multiples rise), the quick returns for a three- to five-year “strip and flip” are not as financially attractive as they were just a few years back. In short, acquisition of a distributor is more of a long-term play and favors strategic buyers who make incremental improvements in the acquired firm.

Acquisitive growth has never been our favorite as its contribution to shareholder wealth is suspect. Academic studies have found that the creation of long-term shareholder value from accretive events has at best, a 40% chance of success. Regardless, there will be distributor acquisitions well into the future.

Our experience in the distribution sector finds successful acquisitions have the following characteristics:

- They are within like product/market sectors

- They take advantage of efficiencies and better management processes of the acquiring firm and are less dependent on top-line growth

- Acquiring firms have a clear advantage in management expertise

- The ERP system and key bolt-on software is common between acquired and acquirer

- New geographic markets are emphasized over net new product-market segments

Acquisitive growth shows no signs of abating with recent acquisitions in leading sectors such as electrical forecast to exceed the prior year by a factor of 2x.1 Returns from acquisitions, however, will not yield the returns of yesteryear as borrowing costs and multiples rise, and less attractive firms, often with poor processes, outnumber better managed targets.

Product growth strategies, often a domain of the sales-intensive model, can become viable avenues for incremental revenue. We touch on them in the final section of this installment.

Product Growth Strategies

Growth in a product group or family has been a double-edged sword for distributors. Too often, distributors spend time and money in growing a product only to have the vendor add competitive distribution.

Yet, our work in B2B distribution discovers firms that lead in launching new products and new product applications have better earnings and better top-line growth. This is the result of giving customers better product performance that reduces total cost of ownership. The key to strong product growth is a strong marketing effort, especially product management including joint planning with key vendors.

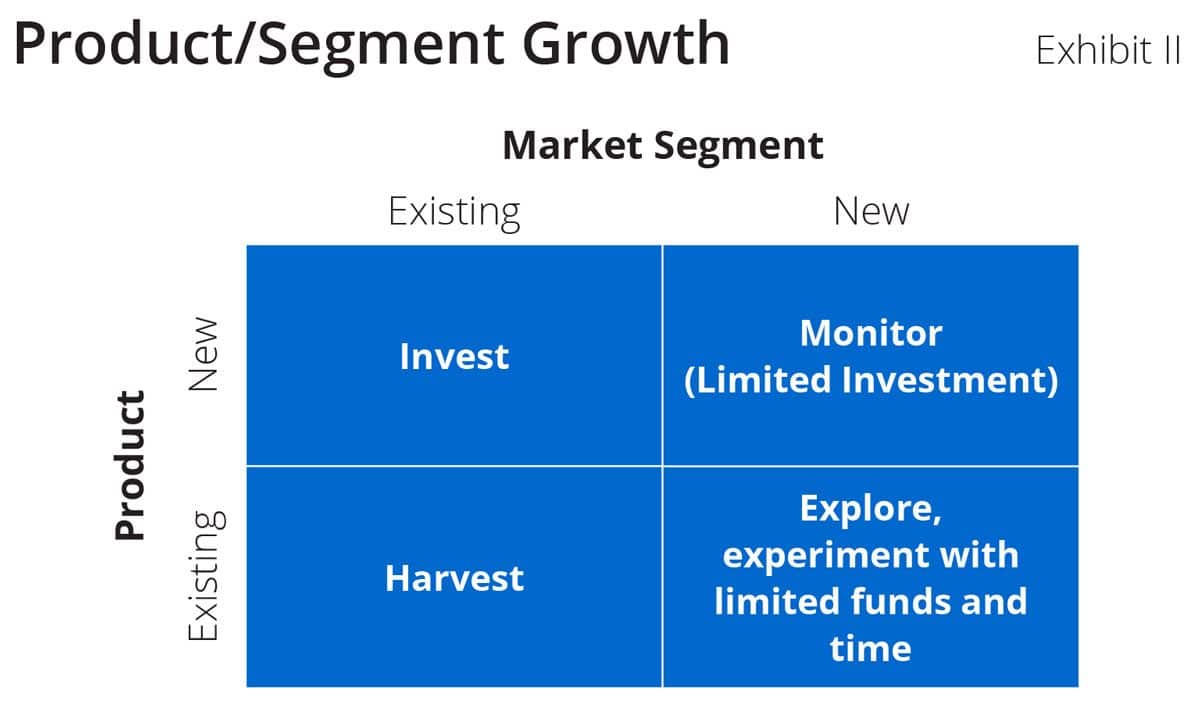

In Exhibit II, a decision quadrant charts product strategies vs. market segments. In the quadrant are existing/new products compared to existing/new market segments.

The strategy suggestions are listed and discussed as follows:

Existing products to existing market segments: This quadrant is typically flush with sales but offers limited upside growth. It is generally better to maximize margin and limit expenditures for better growth opportunities. The overall strategy is to harvest earnings from these efforts and siphon profits off to fund newer growth.

Existing products to new market segments: Historically, distributors are not good at opening new segments unless an acquisition offers the opportunity. There are, sometimes, opportunities that follow a new vendor introduction and a tangential segment. The suggestion is to experiment while setting budget and time limits for efforts.

New products to new market segments: This quadrant is, by far, the riskiest new product venture. We seldom see distributors launch new products to new market segments. If these opportunities are present, it often follows the exit of another wholesale firm who served the segment or as part of an acquisition with a specialty division outside of the at-large sector of the acquiring firm. Investment in this quadrant should be limited with close monitoring.

New products to existing segments: This is typically the best quadrant for growing new product sales, especially private brands. Successful new product introduction is preceded by strong product management plans using the full marketing mix including online tactics.

New product growth is one of the best organic growth options for the distributor. Customers depend on distributors for new products that save time, reduce downtime, and have better lifecycle economics. The growth strategy should be at the top of the distributor’s list for ongoing marketing investment.

Too often, we find where new product growth is spotty. The reasons are generally that new products are left to the sales effort and have little or no market support. We find that many regional and super-regional distribution firms are sales driven and have limited marketing investment, small marketing departments, and few professional marketers.

This is not a criticism but an outgrowth of firms that, heretofore, were sales driven. However, distribution is moving into a new economy with new growth dynamics.

The firms that dominate in the future will be super-regional, national and international in scope. Today, many national and international firms have well-funded, professional marketing efforts. Their comparative Return on Sales are often 2X or more of their regional competitors.

If regional firms are to stand a chance and create lasting organic growth opportunities that grow customer and vendor loyalty, they should consider funding professional marketers who can use the breadth of the marketing mix.

1 See Gordon, D. at https://electricaltrends.com/2022/10/30/acquisitions-accelerate-19-since-july/

Scott Benfield is a consultant for B2B Manufacturers and Distributors. He is the author of six books and numerous research projects on B2B channels. He can be reached at benfield.scott@aol.com or (630) 640-5605.