The fourth annual MDM distribution e-commerce survey conducted with Distribution Strategy Group revealed several key trends:

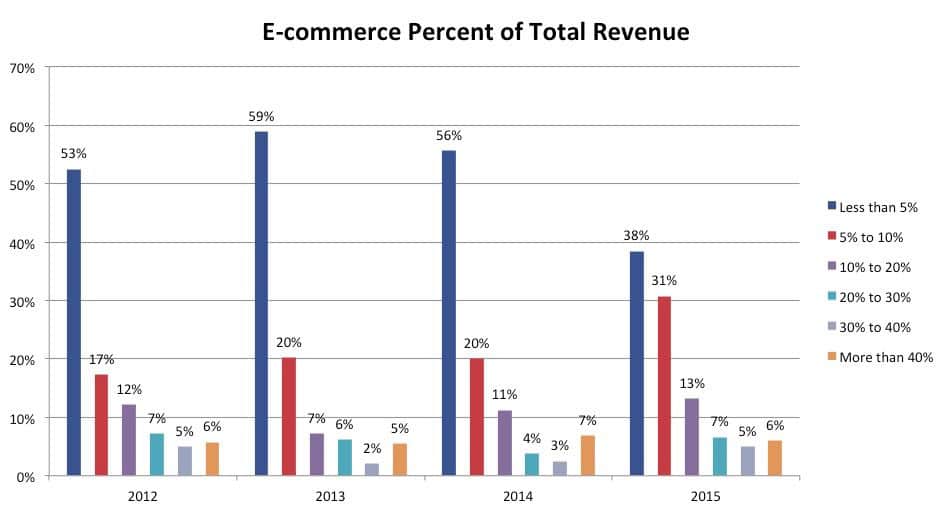

- The percentage of companies with at least 10 percent of their total revenue from e-commerce grew 14 percent in 2014 from 2013.

- Barriers to entry for deploying an e-commerce site have dropped significantly, allowing many more mid-market and small distributors to sell online.

- The primary objectives among distributors for e-commerce remain acquiring new customers, enhancing their company brands and improving the user experience.

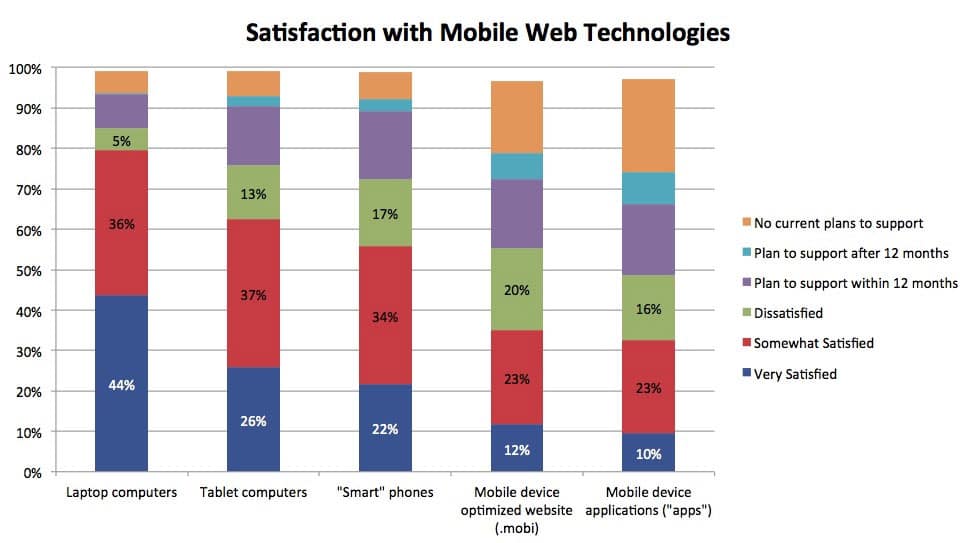

- Distributor satisfaction with mobile enablement on their e-commerce site and mobile applications increased in 2014 from 2013, while satisfaction with mobile optimized websites remained the same.

This article examines the results of the 2015 State of E-Commerce in Distribution Survey and how the industry’s e-commerce offerings are maturing. Part 2 will look at best practices for distributor-integrated marketing approaches to support electronic shopping and buying.

E-commerce in distribution continues to expand. Results of the 2015 State of E-Commerce in Distribution survey indicated a 14 percent increase in number of respondents who have a mature e-commerce offering, i.e., where at least 10 percent of total revenue comes through the e-commerce channel. The percentage of respondents with 5 to 10 percent of total revenue from e-commerce remained at 20 percent. Companies with nascent e-commerce initiatives (revenue less than 5 percent) declined slightly.

Within the survey respondents and beyond, there are two trends shaping e-commerce. First, it is much easier and less expensive to launch an e-commerce initiative today in B2B than it was five or 10 years ago. In that sense, B2B e-commerce has followed the trend of B2C e-commerce in which early initiatives were often $500,000 to $1 million projects. After a few years, the entry price for retail e-commerce dropped significantly to a point where it was possible to enter for $50,000 to $200,000.

The same has happened in the B2B space. This has permitted mid-market and even small distributors to offer e-commerce to their end users. However, the enterprise class e-commerce platforms for larger distributors retain differentiating capabilities, particularly for merchandising, content management, search and personalization.

While it is easier to get into e-commerce, the second trend is that many distributors experience more time in the nascent stage of e-commerce maturity. Many distributors remain in the nascent stage for three to five years. Here is a typical breakdown of distributors’ experience in the nascent stage:

- Development of the capability – six months to one year.

- Working out operational kinks after launch – one year.

- Getting to 5 percent of total revenue – two to three years.

Distributors often underestimate how long it will take to work out the operational processes for e-commerce, including inventory management, fulfillment, product content management and even Web technical support. Companies that stall after working out the operational issues usually do so because their e-marketing capabilities mature slowly.

All this is compounded by competition from the increased number of distributors that now have e-commerce.

This year’s survey participants predict a significant shift from the nascent phase into the development and mature offerings in e-commerce, as shown in Figure 1. But predictions about future performance are known for being optimistic. Last year, 35 percent of respondents predicted they would reach maturity with their e-commerce offering, yet the numbers for 2014 show only 24 percent did so. In the 2015 survey, 31 percent of respondents predict that their offering will become mature this year.

E-Commerce Priorities

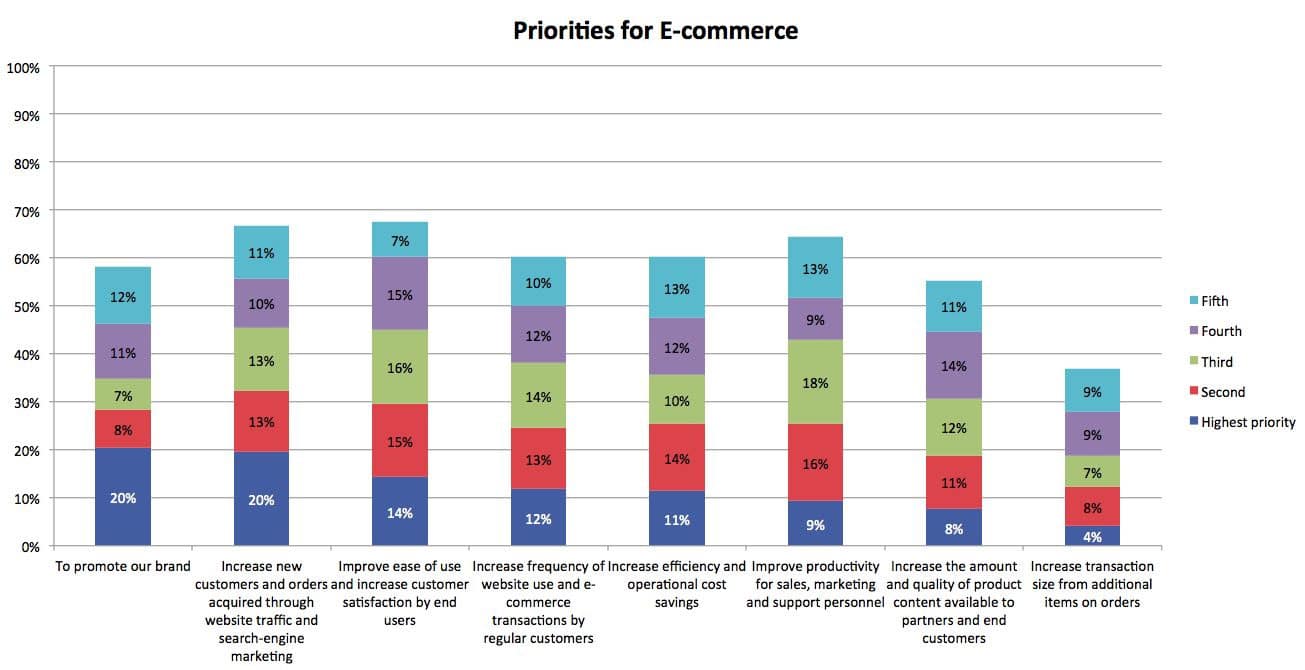

The top priorities for e-commerce, as shown in Figure 2, are:

- Increase new customers and orders from the website

- Promote the company brand

- Improve ease of use

While the highest priority in 2014 was to grow revenue from new customers, the next highest priority was to grow revenue with existing customers. Taken together, these three priorities reflect a partial shift from the nascent stage of maturity where the focus is more on existing customers. In the growth stage of e-commerce, the priority to get revenue from existing customers diminishes as the focus on new customers grows. Promoting the brand and the user experience both support reaching a new set of customers.

The percentage of respondents focused on increasing transaction size grew to 4 percent from 2 percent last year. This becomes a priority for distributors who have a mature e-commerce offering. As such, few mid-market and small distributors are focused on this.

E-Commerce Platform

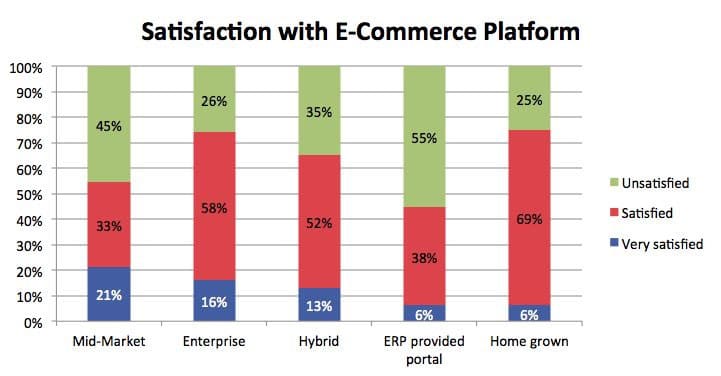

This year’s survey introduced a new topic to better understand trends in e-commerce platforms. It covers five categories of e-commerce platforms:

- Homegrown – These platforms are developed from scratch often with some third-party software components, e.g., a shopping cart.

- ERP-provided portal – The portal provides an e-commerce solution that is pre-integrated with the ERP system, typically with limited functionality and ability to customize.

- Hybrid – This approach could mix homegrown development with open source tools, e.g., Magento, and combine with one of the other platform types.

- Mid-market – These platforms have more functionality than the ERP-provided portal, but they are not bound to one ERP backend system. Generally, mid-market players appear in companies with revenues up to $750 million.

- Enterprise – The enterprise platforms are distinguished by their ease of content management, powerful search, support for multi-sites and support for complex, high-end integrations. The entry point of enterprise solutions is generally in organizations with a minimum of $500 million in revenue.

Large distributors can usually cost justify an enterprise platform even in the nascent stage of maturity. The incremental revenue derived from these platforms makes them worthwhile.

For mid-market distributors, it depends on the competition; if it is other mid-market distributors, then the mid-market platform or ERP provided portal can work.

Since the nascent stage often takes longer than expected, there is almost always a good rationale for small distributors to use a mid-market platform or ERP-provided portal to get going. Switching to a more sophisticated platform can occur in the transition to the development stage.

As shown in Figure 3, there is comparable overall satisfaction between enterprise and homegrown platforms. But there are almost three times as many respondents who are very satisfied with the enterprise platform than the homegrown approach. As expected, satisfaction correlates well with e-commerce maturity.

The Mobile Trend

Last year, respondents reported mixed satisfaction with their companies’ support for smartphones and very low satisfaction for .mobi implementations and mobile apps. One change from 2014 is that respondents expressed somewhat higher satisfaction with their mobile-enabled e-commerce sites. The biggest change from 2014 is 20 percent higher satisfaction with mobile apps that they offer.

While respondents were more satisfied with their company’s mobile-enabled sites and mobile apps, the satisfaction with website optimization for tablet and smartphones remained about the same as 2014. The Distribution Strategy Group Shopping and Buying Survey indicates that 35 percent of distributors’ customers consider optimization for tablet important within the next year. Forty-five percent consider optimization of the website for smartphones important within the next year. Some sectors of distribution are seeing 25 to 50 percent year-over-year increase in website visits and orders from a mobile platform.

Moving Forward

The increase in distributors that are approaching e-commerce maturity combined with the large number of small and mid-sized new entrants indicates that competition is heating up for distributor e-commerce. Many distributors are now in a second-generation e-commerce platform. There are two key implications for any distributor who has an e-commerce platform or is contemplating development:

The industry has moved past the point of it being sufficient merely to have an e-commerce offering. End users are expecting more and have more choice now.

It is important to really understand what end users expect. Qualitative and quantitative research should be employed to get a clear understanding.

While there is still plenty of opportunity for companies in the nascent stage, the approach to e-commerce should be strategic rather than tactical.

This survey was conducted and produced by MDM and Distribution Strategy Group and sponsored by hybris, an SAP Company.

About This Research

This research was conducted by Distribution Strategy Group with Modern Distribution Management. The research included an online survey taken by 415 participants across a variety of distribution sectors.

There was heavier participation from industrial, safety, electrical, electronics, building materials, janitorial, HVACR/plumbing and hardware. Other participating sectors include oil and gas products, pulp and paper, chemicals and plastics, grocery/foodservice and pharmaceutical.

Nearly 40 percent are small distributors with less than $50 million revenue, more than 30 percent are mid-market with $50 million to $500 million revenue, and 19 percent are large with more than $500 million revenue. Others did not disclose the revenue range.

About 30 percent are primarily focused on MRO, 12 percent are focused on OEM customers, 28 percent serve trades/contractors, 20 percent are an even blend of MRO and OEM, and 10 percent are in other categories.

Jonathan Bein, Ph.D. is Managing Partner at Distribution Strategy Group. He’s

developed customer-facing analytics approaches for customer segmentation,

customer lifecycle management, positioning and messaging, pricing and channel strategy for distributors that want to align their sales and marketing resources with how their customers want to shop and buy. If you’re ready to drive real ROI, reach out to Jonathan today at

jbein@distributionstrategy.com.