E-commerce demand generation is in transition. According to results from the third annual MDM Distribution E-Commerce Survey, while most distributors are increasing e-commerce revenue from email marketing, catalog and organic search, they remain less effective with paid search and marketing automation. Furthermore, most of the demand generation approaches distributors are taking are not integrated.

Marketing Vehicle Effectiveness and Spend

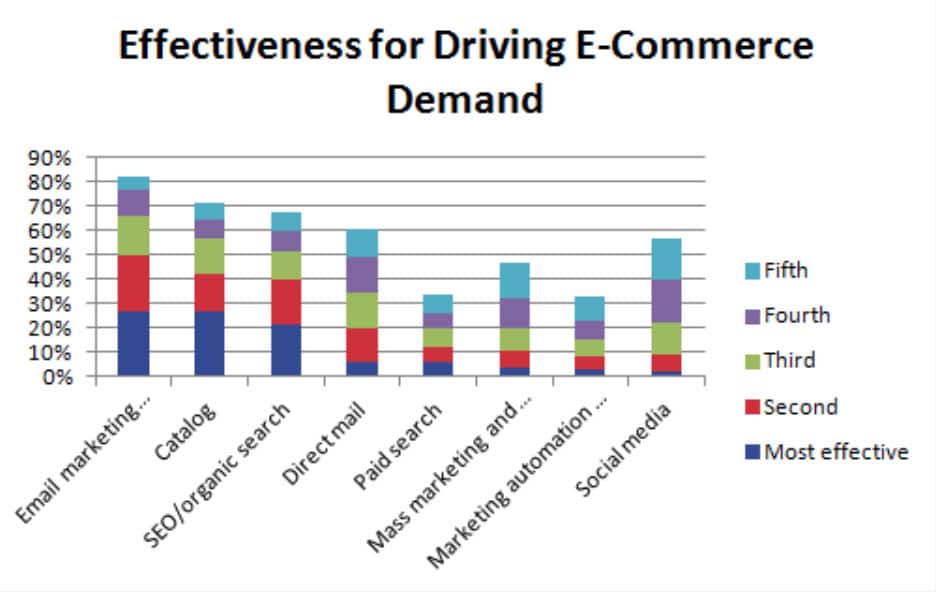

We asked survey respondents to rate the effectiveness of various marketing vehicles for driving e-commerce demand. As shown below in Figure 1, more respondents consider email marketing, catalog and organic search to be the most and second most effective vehicles to drive demand online.

While we expected that email marketing and organic search would be considered highly effective, three surprises arose from the results:

- Catalog is a significant driver of e-commerce revenue. However, the effectiveness of most distributor catalog programs is not measured well. Yet it is considered as effective as email marketing and organic search, which are both easy to measure.

- Companies that have core competency in paid search typically see high effectiveness. This supports the finding in the first article published March 25 that e-commerce capabilities in distribution have room to mature.

- Social media is not considered by most respondents to be very effective at driving e-commerce revenue. From a demand generation perspective, it is more of a complement to other primary and secondary approaches. Because of its complementary nature, distributors should continue efforts with social media.

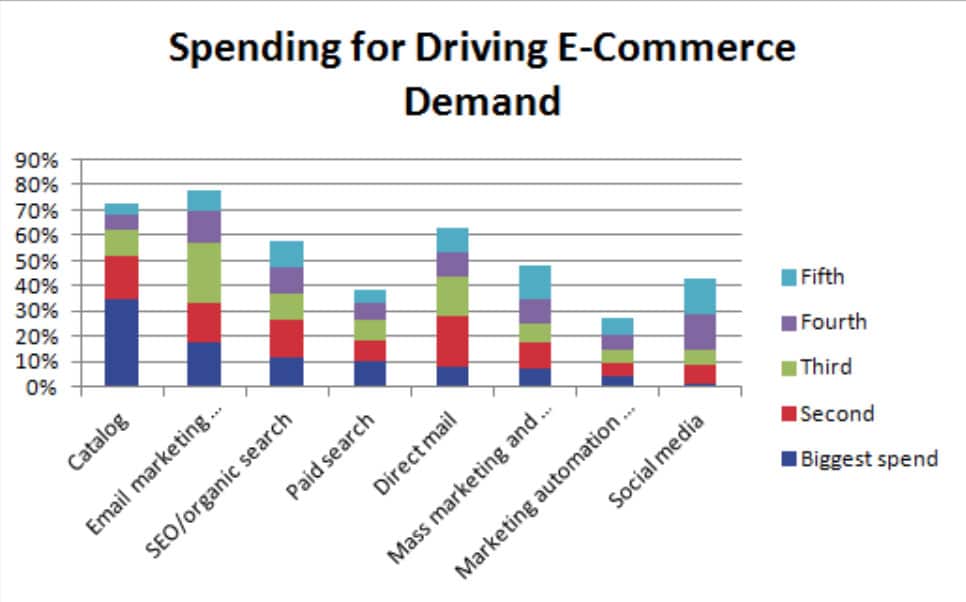

As shown in Figure 2, total spend on marketing vehicles for e-commerce corresponds well with effectiveness with a couple of exceptions:

- Catalog is considered the second most effective overall, yet it is the highest overall spend.

- Paid search has much lower effectiveness than direct mail, but is the biggest spend for a greater portion of the respondents than direct mail.

Search marketing, catalog marketing and marketing automation can each be effective for driving e-commerce demand if approached in the right way.

Here are some best practices in each.

Search Marketing

Search marketing includes organic search (also known as search engine optimization or SEO) and paid search. Search marketing can be a cost-effective way to grow revenue.

Distribution Strategy Group has seen this with several of our distributor customers for whom e-commerce is the primary, or sometimes the only, channel. For these companies, search marketing is a core competency that has been the basis for their success and has propelled significant growth.

However, just under half of the respondents believe that search marketing is effective or very effective for acquiring new customers, and paid search is not considered very effective by the respondents. But many distributors launch their e-commerce initiatives with search marketing as the primary or only means to drive traffic and generate demand.

Two recommendations to improve ROI on search marketing are:

- If it is not already a core competency, work with third-party experts in search marketing to get better results.

- Use search marketing to acquire new customers rather than to grow wallet share with existing customers. Direct response methods are a much more cost-effective means for reaching customers that you already have.

Catalog Marketing

The use of print catalogs can be a significant boon to your e-commerce initiatives. A prior MDM survey revealed these synergies between catalog and e-commerce:

- 85 percent of companies with successful catalogs believe that e-commerce and catalogs are synergistic or that their catalogs help drive e-commerce sales.

- 73 percent of companies who have a mature e-commerce channel – defined as having 10 percent or more of total revenue coming from e-commerce channels – believe that e-commerce and catalog are synergistic or that their catalog helps drive e-commerce sales.

- The three distributors who were considered by their peers in that survey to have the best websites (Grainger, MSC Industrial Supply and McMaster-Carr) were also considered by their peers to have the best catalogs.

Catalogs drive e-commerce revenue because when a computer is not available, catalogs are, and customers needing a product solution reach for the companies with whom they feel most confident. The net result is that many times customers will shop in the catalog and buy on the website.

Marketing Automation & Email Marketing

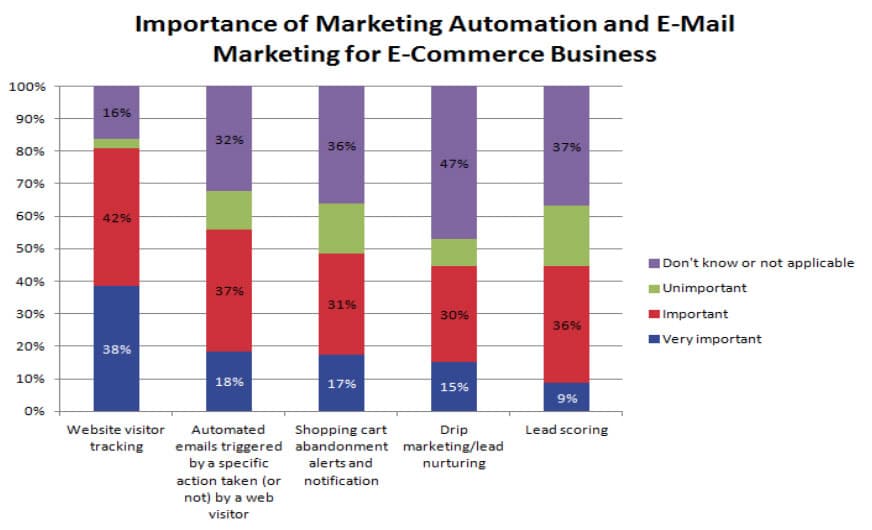

Survey respondents rated email marketing as the most effective means of generating e-commerce revenue, and they rated marketing automation as the second least effective means of generating revenue. Yet many other industries have seen tremendous benefits from using marketing automation.

Email marketing is powerful because of the ability to use this tool to track customer behavior. When an email blast is sent to a list of customers or prospects, the sender can tell if the email is opened.

Marketing automation goes a few steps beyond email marketing. In addition to knowing whether the email was opened, the sender can tell if someone clicked on a link that was in the email and which links were clicked on, for example a special offer that takes them to a dedicated landing page.

Based on the email recipient’s behavior with openings, clicks and pages visited, it is possible to orchestrate “drip marketing” campaigns in which offers and other content are staged to be sent at different times. The recipient’s behavior can be scored and when it reaches a threshold, the prospect can be handed off to sales.

There is limited awareness among distributors about marketing automation and how it differs from email marketing, as shown in Figure 3. Yet a 2012 study by Aberdeen Group shows that companies that deploy marketing automation see:

- 107 percent better lead conversion rates

- 40 percent greater average deal sizes

- 20 percent higher team attainment of quota

- 17 percent better forecast accuracy

Within distribution, the leading e-commerce programs all use marketing automation instead of email marketing. It is an area with significant opportunity for many nascent and maturing distributor e-commerce initiatives.

About This Research

This research was conducted by Distribution Strategy Group with Modern Distribution Management. The research included an online survey taken by 465 participants across a variety of distribution sectors. There was heavier participation from industrial, safety, electrical, electronics, building materials, janitorial, HVACR/plumbing and hardware. Other participating sectors include oil and gas products, pulp and paper, chemicals and plastics, grocery/foodservice and pharmaceutical.

Nearly 40 percent are small distributors with less than $50 million revenue, over 30 percent are mid-market with $50 million to $500 million revenue, and 19 percent are large with more than $500 million revenue. Others did not disclose the revenue range. About 40 percent are primarily focused on MRO, 19 percent are focused on OEM customers, 24 percent are an even blend of MRO and OEM, and 17 percent are in other categories.

This survey was conducted and produced by MDM and Distribution Strategy Group and sponsored by NetSuite.

Jonathan Bein, Ph.D. is Managing Partner at Distribution Strategy Group. He’s

developed customer-facing analytics approaches for customer segmentation,

customer lifecycle management, positioning and messaging, pricing and channel strategy for distributors that want to align their sales and marketing resources with how their customers want to shop and buy. If you’re ready to drive real ROI, reach out to Jonathan today at

jbein@distributionstrategy.com.