With its recently announced deal to acquire SRS Distribution, Home Depot is now more of a distributor than a retailer. And it’s not the only major retailer that sees potential for growth in the $8 trillion U.S. distribution market where sales are divided among nearly 700,000 wholesale companies.

Such other deep-pocketed and technologically advanced retailers as Amazon, Walmart and Lowe’s are also moving aggressively into distribution. Amazon’s B2B play, Amazon Business, in particular has grown rapidly, with more than a third of B2B buyers surveyed in 2023 saying they make more than 25% of their purchases there.

Contrary to most analysts’ assumptions, these retail companies can earn higher margins in certain sectors of distribution than they can get in the highly consolidated retail market, says Ian Heller, co-founder and Chief Strategy Officer of Distribution Strategy Group. And they’re largely blocked from growing by acquisition within retail by an aggressive Federal Trade Commission, led by chairperson Lina Khan, that has challenged several proposed mergers, notably the Albertsons-Kroger deal.

“Home Depot can’t buy anybody in the home center industry because the FTC isn’t going to let it go through,” Heller says. “If Home Depot or Lowe’s want to grow, it will be by going into the highly fragmented distribution industry.”

In this article, we’ll look at how the SRS deal fits into Home Depot’s growth strategy, the inroads other big retailers have made in distribution, what’s likely to come next and what it all means for distributors.

Home Depot’s B2B Strategy and the SRS Acquisition

Home Depot has always served contractors and other business buyers from its stores, which now number 2,000 in the U.S. and another 300 in Canada and Mexico. The SRS acquisition is a big step toward serving larger customers that want bulk orders delivered to their job sites, a very different customer from the contractor who comes to a Home Depot store to pick up tools or materials.

The business buyer is already a majority of the retailer’s business. As of mid-2023, 50% of Home Depot’s sales were to business buyers. Add in about $10 billion in SRS annual sales and Home Depot is 53% B2B.

But Home Depot executives concede that big construction companies and other businesses that buy in bulk are mostly “convenience” customers. They come into Home Depot stores when they need products quickly, but not to fill major orders.

Home Depot took a step towards serving these larger customers, what its executives call the “complex pro,” in 2020 when it reacquired HD Supply, an MRO (maintenance, repair and operations) distributor it had previously spun off.

“HD Supply is delivery-based, operating out of big distribution centers, rather than the customer coming into a store,” Heller says.

Also in 2020, Home Depot made another investment aimed at big customers by opening its first flatbed distribution center in Dallas, an 800,000-square-foot warehouse designed to fulfill bulk orders to large customers. By the end of 2024, the company expects to have such bulk DCs in 17 major markets in North America.

In recent years, the retailer also has invested in improved order management technology and trade credit for big customers, although it concedes its credit program is still limited. It also enhanced its Pro Xtra loyalty program in 2023 to give additional perks to bigger customers.

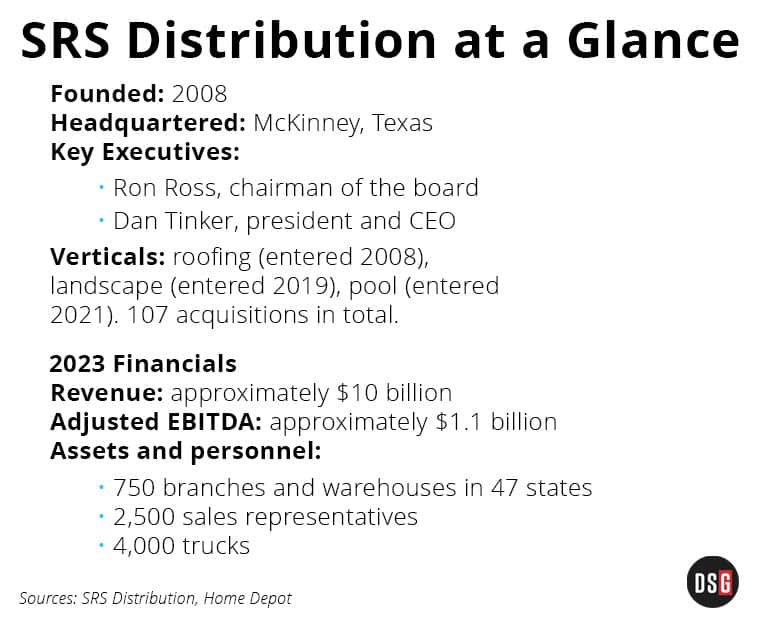

What SRS brings Home Depot is a nationwide distribution company geared to serving big buyers. Founded in 2008 and backed by private equity, SRS has acquired 107 distribution companies, initially in roofing and more recently in landscaping and pool supply.

SRS provides Home Depot with a nationwide footprint in these three verticals, with 750 branches and warehouses in 47 states. It also has 2,500 sales representatives, giving Home Depot direct connections to many thousands of additional contractors and construction companies.

What’s more, with 4,000 trucks, SRS is experienced in delivering bulk orders to job sites, a capability Home Depot is still developing. And unlike Home Depot, SRS has long experience in extending credit to bulk buyers.

“We’re going to learn a lot and they’re going to teach us,” Home Depot executive vice president Richard McPhail said in discussing the SRS acquisition with J.P. Morgan analysts in April.

There’s every reason to think Home Depot will put that learning to use over time to move into more distribution verticals.

Distribution Strategies of Other Big Retailers

Amazon Business

Of the other retail giants muscling into distribution, Amazon.com Inc. is widely considered the biggest threat. The leading U.S. online retailer by far, Amazon has used its vast experience in serving consumers online plus its deep cash reserves to quickly become a big player in B2B ecommerce through its online marketplace Amazon Business.

Only launched in 2015, Amazon Business by early 2023 had 6 million customers and was operating at an annual run rate of $35 billion in sales — more than double the $16.5 billion in 2023 sales for W.W. Grainger, one of the biggest U.S. distributors. Those Amazon Business sales will hit $83.1 billion by 2025, according to Bank of America.

Drawing on its parent’s retail experience, Amazon Business has made free and fast shipping a big differentiator, Heller notes. It’s done that with a B2B version of its wildly successful Amazon Prime loyalty program called Business Prime.

Customers who sign up can get free same-day shipping on some items, one-day shipping on millions of items and two-day shipping on more than 100 million products, Amazon says. The annual fee starts at $179 for up to three users and goes to $10,000 for 100 users.

Plus, Amazon Business keeps adding sophisticated B2B features to its ecommerce website. They include approval workflows, trade credit and invoicing for approved customers, customer-set procurement rules, and negotiated and tiered pricing.

Its credit offerings are noteworthy because that’s an area where Home Depot has lagged. Some Amazon Business customers, presumably larger ones with well-established credit, can pay by invoice in up to 60 days. Other customers, presumably smaller businesses, can pay with an Amazon corporate credit card, deferring payment for 90 days with no interest.

Amazon already is a formidable competitor and it’s gaining ground in B2B sales every year. Originally an online-only retailer it moved into brick-and-mortar sales in a big way in 2017 when it acquired high-end supermarket chain Whole Foods. It has the cash to move into physical distribution via acquisition and would face less antitrust scrutiny in B2B than it would if it tried to acquire a retailer.

Walmart Business

Walmart Inc. is the world’s largest retailer by sales and views Amazon as its biggest rival. No surprise then that Walmart has taken note of the success of Amazon Business and, belatedly, is trying to match it.

Walmart Business was only unveiled in late 2022 with the launch of Business.Walmart.com. Targeting small and midsized businesses, the big retailer counters Amazon’s Business Prime with Walmart Business+, which offers free shipping for a $98 annual fee, as well as 2% in rewards on orders of $250 and 5% on certain items in subscription orders.

Walmart Business is still far behind Amazon Business. But Walmart has more than 5,200 stores in the U.S. and had nearly $10 billion in cash on hand as of early 2024. It has the resources to make up ground quickly.

Lowe’s

Lowe’s is Home Depot’s biggest competitor in the home center business, and, like Home Depot, said in 2023 that B2B customers accounted for 50% of its sales.

The company’s ecommerce site, LowesForPros.com, shows price quotes for bulk orders and lets customers place big orders and specify delivery locations, such as to job sites. The company introduced in 2022 its MVP Rewards and Partnership Program, which includes financing for B2B buyers, the kind of credit terms many businesses expect.

Lowe’s is prioritizing B2B: CEO Marvin Ellison says his goal is to grow B2B sales at 2X the market rate.

However, unlike Home Depot, which is moving up to serve bigger B2B companies, for Lowe’s the focus remains on smaller contractors, Ellison said in September 2023. “We’re not chasing the larger, more industrial Pro. That’s not in our strategic viewpoint as of yet.”

However, Heller says, Home Depot’s move upmarket with the SRS deal may force Lowe’s executives to rethink that strategy.

What Comes Next and What It Means for Distributors

What does this all mean? “In a word, disruption,” Heller says. “Other industries have been disrupted. Why not distribution?”

These major retailers are likely disruptors because, like sharks, big public companies can’t stand still: They need to grow to satisfy Wall Street. With acquisitions largely blocked in retail by a trust-busting FTC chair, the fragmented distribution market is an inviting opportunity.

And these four retailers are the deadliest kinds of business sharks: profitable companies with deep pockets and growth-minded executives. If these retailers are looking to grow in distribution, as Heller believes, they have access to plenty of cash to make that happen.

That’s clear from a comparison of the stock market value of these four retailers versus that of four of the largest pubilicly traded distributors. Even ignoring the astronomical $1.861 trillion market cap of Amazon, which partly reflects the huge profits of its Amazon Web Services cloud computing unit, these retailers dwarf distributors in stock market value. Home Depot’s market cap, for instance, is roughly three times that of the four big distributors put together.

That means these retailers can raise funds in large amounts by selling stock, giving them ready access to cash for acquisitions.

They are also very profitable, with strong free cash flow. That enabled Home Depot to pay a hefty multiple of 16 times earnings for SRS, a price few, if any, distribution companies could afford, Heller says.

It’s more than chump change for Home Depot, to be sure, but manageable, company executives say. Home Depot expects to borrow most of the $5.5 billion it needs to finance the SRS deal with short-term debt that it will pay off in just two years. At that point, if not before, Home Depot could be ready to scoop up more distributors.

Which companies will most likely feel the disruption that’s coming?

Lowe’s is surely on that list, Heller says. Home Depot made clear it aims to draw SRS customers and other B2B buyers it can attract into its Pro Xtra program, making them more likely to turn to Home Depot when they need a few extra items or at night or on weekends. That stands to undercut the appeal of Lowe’s to some B2B customers.

The deal also has implications for bigger wholesalers that are adjacent to home centers’ core customers, Heller says. He cites as two examples White Cap1, the distributor of concrete construction products, and SiteOne Landscape Supply. Through the SRS acquisition, Home Depot also owns Heritage Landscape Group, so SiteOne is a natural fit. Home Depot used to own White Cap and knows the company well. Of course, either distributor could be a potential acquisition for Lowe’s to counteract Home Depot’s moves.

“Customers of these distributors almost certainly buy from Home Depot and Lowe’s on a regular basis. But they’re convenience customers just like those of SRS. Both companies are extremely well-run with highly capable CEOs and have grown sales and margins at remarkable rates for many years. I’d be very surprised if major retail players evaluating wholesale distribution weren’t looking at distributors like these.”

Such expansion is clearly on the minds of Home Depot leaders, as executive vice president Richard McPhail made clear in speaking about future acquisitions by SRS: “There’s not a necessity to take on every single trade vertical. But where we can generate acceleration to sales and earnings per share growth, and generate exceptional return on investment, that’s always going to be an opportunity that we look at.”

But, Heller says, for the big majority of distributors the big takeaway is that they can expect to face stronger competition from powerful new rivals in the years ahead as these retailers move into additional verticals within the wholesale industry.

Those retailers have plenty of cash, can offer convenient fulfillment through their many stores and distribution centers, and are leaders in ecommerce and mobile technology. Distributors in a variety of verticals will have to up their game to meet these new competitors.

1 Heller worked at White Cap from 2010-2017 but currently has no financial stake in the firm.

Don Davis, former editor-in-chief of Internet Retailer magazine and Vertical Web Media, is a freelance writer based in Chicago. His experience in retail and distribution goes back to his childhood when he worked in the toy wholesale business founded by his father and two uncles and in their discount department stores located throughout the New York metropolitan area.