Mike DeCata, CEO and president of Lawson Products, loves the way distribution touches all of our lives, and it shows. His impressive career spans from leadership at Grainger, United Rentals, and Chef’s Warehouse to growing the share price of MRO distributor Lawson Products by 1,000% since taking his position there in 2012.

In 2020, Lawson hit a 20-year high. That makes Lawson one of the few distributors to see enterprise value growth comparable to Amazon’s, which grew 12 times vs. Lawson’s 10. It’s one of the best stories in distribution right now.

How was he able to achieve this astounding nine-year upward trajectory? We talked with him about differentiation, processes, culture and marketing on a recent episode of Wholesale Change.

Distribution Strategy Group: How did you do it? We want to talk about your leadership principles, your values and differentiation. Talk about the strategy that you inherited when you got to Lawson and what you have done instead.

Mike DeCata: Despite the initial numbers, underneath, the value proposition was sound. The company had embarked on making significant changes all at the same time. My first week on the job, investors asked me if we really needed to eat the elephant in one large bite.

We were opening our largest distribution center ever at the same time we were installing SAP and re-engineering the company. Our salesforce was made up of independent agents and my predecessor had made the decision to convert them to employees. Every one of those changes was an enterprise-level risk and had any one of those gone wrong, we might not have a company today.

But underneath all of that, I knew that there was a differentiated value proposition that customers would pay for and would continue to value increasingly. And it was differentiated from everybody else in the space. That’s the reason I was excited to join the company.

There are three phases to the strategy we put in place:

1. Infrastructure

First, we built, rebuilt and optimized infrastructure, completed the distribution centers, sold off inefficient buildings, sold off non-core business, finished the technology infrastructure and made sure SAP was up and running and successful.

2. Processes

Next, we focused on process. Many company executives fall into a trap of “flavor of the month.” We are the opposite of that. If you listen to any of our earnings calls, what we say is just an update from the previous nine years’ worth of calls that are always consistent. That’s true internally, as well.

I am a passionate follower of George Eckes, who has written a great many books on Lean Six Sigma and quality, and we brought that ideology in as an active part of re-engineering processes. It has helped us analyze our data in a pragmatic down-to-earth way, making it available to different people and levels within the company, mapping and optimizing 37 primary processes that operate the company.

For the last nine years, the leadership team gets together three days a week to review about 141 variables–everything from sales, operations, margins, sales rep count, backorders, inventory, hours picked, and hours worked. That data is updated every single day so we have a comprehensive P&L statement in the company.

It’s not a heavy lift now to look at data; we’re trained to look at key variables.

3. Growth

The third phase has been about growth. We’ve gone from 757 sales reps when we converted them from contract workers to about 1,100 sales reps today. We’ve made seven acquisitions: five small ones, and two large ones. We focus every day on enabling our sales reps to be more productive and more effective with their customers.

At our core, our value proposition is differentiated with unique value drivers that enhance our future, making it even brighter than our past.

DSG: Can you talk about your hybrid sales service model? It seems like it’s an important part of your value proposition, and it’s not where the company was going when you took over.

DeCata: We are really pragmatic in providing what works for the customer to keep them up and running.

Service-Intensive Vendor Managed Inventory

We try and create the optimum blend of what we call service-intensive vendor managed inventory(VMI). VMI is a broadly used term, and it can mean many things to many different companies.

I use the term service-intensive VMI because we visit our 85,000 active customers on average every 10 days. When our sales rep goes in, we’ve already shipped boxes from our six distribution centers to the customer. Generally, the customer waits for the rep to come open the box, put it away, and count everything that was consumed since the rep was there last.

Our rep often places the order with hardly any customer involvement at all. Because we’re there every week or every other week, and the executives all make sales calls with our reps, we see that customers will wait for us knowing that we’re going to be there at the same time every week and save up a bunch of problems that came up and ask how to solve it.

Reps use high-tech and low-tech communication – they’re there to solve problems that came up since they were there last. They will often replenish our vending machines at the same time they’re replenishing static bins and cabinets. They sit next to each other and both have a role.

There’s an expression in quality: “If all you have is a hammer, everything looks like a nail.” So a vending machine dispensing quarter-cent flat washers is probably not the best use for a piece of capital equipment. By contrast, a vending machine that tracks usage of safety products for someone who is injured or high-theft items like batteries or expensive cobalt drill bits can be valuable. There is a proper application for vending machines, and we embrace that. It’s rarely the only solution to the customer’s inventory challenges.

Knowledge Sharing

The most amorphous thing we do is to share application best practices across industries when a customer may not know a problem can be solved because they don’t have an experience with a technology or a process. Our sales rep will help them solve problems that they don’t know can be solved. And there are real-world examples for this happening every single day.

Private Label

The other thing that differentiates us is that 60% of our product is private label. When people think about private label, they see it as the “good” of the “good, better, best” – the economy choice. For Lawson, it tends to be just the opposite of that. Many of our private label products are what we call “maintenance engineered.”

These products have been optimized for the unique needs of the maintenance mechanic. Mechanical engineers in design class may be designing a John Deere backhoe, assuming it’s being built on a pristine assembly line and an optimum use case. However, when our customer gets involved, the backhoe may be covered in grime and rust or broken, deep in mud in 20-degree below-zero weather. The mechanic is trying to fix it in the field in the frozen mud. The needs of the maintenance mechanic are very different than the needs of the production line engineer or the production or assembly person. Our private label products have been engineered for the needs of the maintenance mechanic.

There are other products that we’ll package it and sell to customers in very tiny quantities–one drill bit at a time, or a bag of 50 flat washers rather than 50,000. We provide the minimum number of pieces that the customer needs not to run out with an intent to never overstock or sell more or put more in the bins than is actually being used on a weekly or biweekly basis.

DSG: I remember Michael Dell saying once that if his customers wanted to order with smoke signals, he would learn how to read them. If it generates profits – who cares? It’s about meeting the needs of the customer where they’re at instead of trying to lead them to a place they don’t want to go.

DeCata: What we do in distribution is often not that sexy or exciting. Ninety-four-cent parts aren’t exciting, but if that 94-cent part keeps your machine up and running, it matters. We talk a lot about our employees and our culture, but I always remind people they’re enabling 85,000 of our customers’ kids to go to college and being able to pay their mortgages. It’s not just us, we’re enabling 85,000 customers and tens and tens of billions of dollars of their enterprise value to be enhanced by keeping them up and running in doing what we do and keeping them productive.

It’s important for company culture to know we’re adding value to society and doing something that matters. Sometimes in distribution, we’re a couple of steps removed from the effect. But what all of us do in distribution has a huge overall effect on greater society.

DSG: You mentioned George Eckes earlier. Did you hire him?

DeCata: We hired him as a consultant for four years to teach his unique approach to Lean Six Sigma. The first step was re-engineering our process – mapping the entire company and looking at opportunities for removing non-value-added work and activities. People from the top to bottom of the company really embraced this approach to systematically understanding and dissecting the processes of the company.

My primary desire for bringing Lean Six Sigma in was around quality of work life, not primarily around improving customer service, though that was a component. It was not around cost-cutting, though that was an effect, as well. No one feels good spending half of a day reworking something that got to their desk incorrectly – redoing work before they could actually do their jobs. By stripping away all that non-value-added activity, everybody was able to focus on their actual job and add value in their job rather than repeating or reworking something that didn’t get to them correctly in the first place.

And as a result, our G&A head count has been falling every year since 2012. Stripping non-value-added work gives people a more fulfilling workday and more capacity as the company has grown tremendously. We didn’t have to add a whole bunch of human infrastructure to service our needs. For every dollar to the top line, 25 to 30 cents flows to the bottom line of our company. That is in large part because of process re-engineering and certainly because of an incredibly gifted team of people that are committed to what we’re trying to do.

DSG: What are the values that you operate with at Lawson?

DeCata: It’s more about how we put the values in practice. Integrity, teamwork, commitment to customer service, and being a customer’s first choice are major. Many companies have value statements, but values get tested in the reverse. Integrity is an easy value when it’s easy to do the right thing, but integrity is tested when there’s a price to pay for doing the right thing. Our company is a collection of information and people. That’s all we are. We’re not providing basic patents or doing basic science. We are people and information. So we must be analytical in our orientation, but also based in culture and values and people with a deep commitment to what they’re doing. The umbrella over all of it has been our culture and recognizing the institutional knowledge in our 69-year-old company.

DSG: Do you have a program for harvesting the knowledge and expertise of senior employees for the training of the new workforce?

DeCata: Years before COVID, we set up knowledge-sharing communities. Sales reps can ask a highly technical sales language into the community and one of their thousand teammates is going to answer that question within minutes.

I call it just-in-time knowledge. With sales reps that range from weeks on the job to 40 years on the job, there’s an incredible knowledge base available. If you have all 1,000 people proactively involved in Q&A, the cycle time gets really compressed.

Our distance-learning programs from live and recorded presentations, podcasts, and videocasts have also taken off during COVID. We’ve built an incredibly robust library that we add to every week.

DSG: Do you use dashboards with your sales reps? What do you measure and how often?

DeCata: We regularly give reps pragmatic data. Our heat maps help them identify which customer they should visit based on how they’re using product categories compared to their industry peers.

The dashboard is a combination of increasing wallet share, opening new accounts, and retaining accounts. It also reminds reps to call on any forgotten customers. We focus on using robust data sales that reps want to see and can readily understand.

It’s evolved from sending lots of data that wasn’t very useful, and we’ve continued to refine the non-value-added information and add more information sales reps and district sales managers actually value.

DSG: Clearly your salesforce is crucial to growing your sales. What role does your marketing function play in growing sales and margin?

DeCata: Marketing used to be predominantly focused on product marketing. Now we’re evolving to include to market segmentation, data analytics, and understanding unique markets where we can add tremendous value.

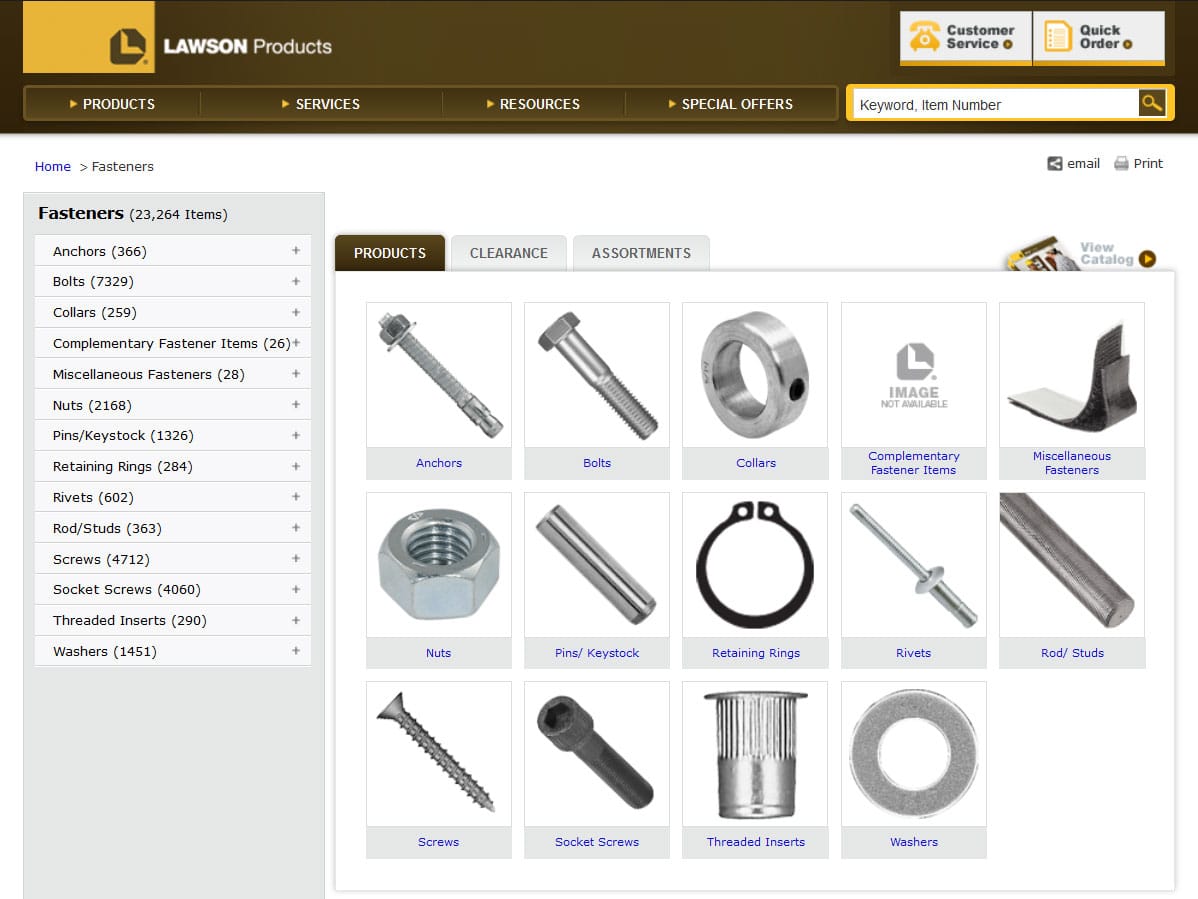

With 12 product categories, 60,000 items in inventory, and over 250,000 items available to the customer within a calling cycle, we came to understand that some products are more differentiated and far stickier than other products. Training our sales reps to focus on the most differentiated, stickiest products first has been a result of product marketing. An analytical approach to product marketing translates to real-world applications for sales reps along with market segmentation.

DSG: How did your reps stay in touch with their customers during the pandemic?

DeCata: At end of March and April last year when everyone had some degree of fear for our personal safety, companies were closing doors and yet they needed our products to maintain their machines. Our sales reps, who are usually in person putting away product, started working on the phone with their customers up to four times a week during the days. There were ongoing telephone or email communication with customers. Some even met customers in parking lots.

I’m proud of how our sales reps innovated across the spectrum and believe our response to COVID has further differentiated us in the eyes of our customers because our reps knew how much our customers depended on us and found whatever way necessary to continue our service to our customers–even unloading stuff out of the back of the car so customers could keep their machines operating.

We built tremendous customer loyalty, and over the years, we have moved from about 88% revenue retention up to a high of about 92% revenue retention. And even in COVID, our retention was extraordinarily high. And I believe coming out of this challenge, our role in the eyes of the customer will be further enhanced from where it was before.

DSG: Back in 2012, a lot of broadline MRO distributors were closing branches, firing sales reps, and trying to become more digital. In the process, they were just becoming more Amazon-like, which really put the min the bullseye for that company. Meanwhile, you were adding to your sales force, training them, increasing the ways they can add value while at the same time building a great digital platform. You’ve really accomplished something unusual in that you’re a great operator, but you also have built a great strategy. I find that most distribution CEOs tend to be better operators than they are strategists. You’ve done a remarkable job.

DeCata: Huge credit goes to an incredibly strong team. We trust each other. We’re open and value candor. We each bring something unique. We’re all pragmatists. The most important skill of a CEO above being an operator or a strategist is being able to rally a strong team and enable people to perform better than they were before. If I do just that and nothing else, I will have accomplished what I set out to do.

Ian Heller is the Founder and Chief Strategist for Distribution Strategy Group. He has more than 30 years of experience executing marketing and e-business strategy in the wholesale distribution industry, starting as a truck unloader at a Grainger branch while in college. He’s since held executive roles at GE Capital, Corporate Express, Newark Electronics and HD Supply. Ian has written and spoken extensively on the impact of digital disruption on distributors, and would love to start that conversation with you, your team or group. Reach out today at iheller@distributionstrategy.com.

1 thought on “How Lawson Products Grew Its Enterprise Value by 10x: A Differentiation Case Study for Distributors”

Outstanding article about the great direction of Lawson.