The application of cross selling rules can provide up to 5% sales lift.

Given all of your products, how can you determine where to cross sell effectively?

Wallet Share vs. Market Share

Increasing market share is good. However, increasing wallet share is even better because it is usually far easier to sell additional products to existing customers than it is to acquire new customers. Also, increasing wallet share is more profitable than acquiring new customers. So, before you begin a program to increase wallet share, you should know how much wallet share you have by each customer segment? Is the wallet share growing or shrinking over time? How much wallet share can you reasonably expect to capture? There are several ways to increase wallet share:

- Upselling: selling more of the same product. This will increase revenue short term, but usually has little long term effect.

- Substitute products: selling a different product that performs the same function. This is powerful when a customer is unable to find the exact product they want and you can provide a substitute that solves the problem.

- Cross-selling: selling related products to one that has already been selected. For example, if a customer is purchasing a flashlight, then try to sell them batteries.

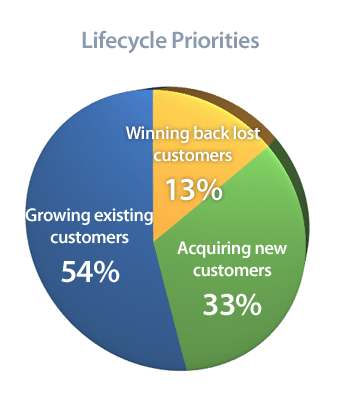

Among these three techniques, cross-selling is paramount. Here’s why: many distributors have regular customers who buy the same set of 10 to 20 SKUs over and over, yet, they have thousands of other products that could be sold to those same customers. As shown in the chart below, more than half of distributors believe that existing customer growth is the highest priority. By expanding the set of product categories for these customers, wallet share can grow dramatically.

Identifying Good Cross Selling Rules

Figure 1 — Lifecycle Priorities

Since most distributors have many thousands of SKU’s, it can be difficult to identify cross-selling rules like the flashlight and battery example from above. While manufacturers will tell you which of their products go together, they won’t tell how to cross sell products from other manufacturers. There are two ways to identify these rules:

- Sales and product management experts: In this approach, product managers and veteran salespeople determine good cross-sell rules based on their expertise and experience.

- Analytic techniques: Data mining can be applied to look at line item data to analyze the market basket of real customers.

In fact, we find the approaches complementary. The human approach can identify where cross selling SHOULD be happening. The analytic approach can identify where cross selling IS happening. Whichever approach is used, the cross sell rules should involve items that are often sold together. In the flashlight and battery example, the flashlight is the primary item and the batteries are cross sold. We want there to be a high confidence that when the primary item is being sold, then the other item can be cross sold. Otherwise, customers will be turned off by irrelevant attempts to cross sell.

Applying Cross Selling Rules

There are numerous applications of cross selling within your sales and marketing channels.

- Field sales: This typically involves a small set of rules that could fit on a laminated sheet of paper in a sales manual. This is by far the easiest to implement.

- Inside sales: To set up inside sales for cross selling usually requires integration with a CRM system and may involve changes to product data to reflect cross selling relationships. Once it is implemented, your inside sales people will be more informed and they will add more value than ever to the client. As a result, the sale becomes consultative.

- Web: Everybody has experience being the target of cross selling on websites whether is Amazon or Netflix. Automation on the web allows for the application of a much larger set of cross selling rules than can fit on a sheet of paper. However, it also the most difficult because it requires changes to product data and integration with the e-commerce system.

As you create a cross selling program, be sure to test it in a couple of sales territories before rolling it out across your entire organization. It is also important to measure wallet share in each account on a monthly basis. To do this effectively you should determine for each market how much a typical customer in that market will purchase of your product categories. Be sure to distinguish between different size customers in the same segment.

Jonathan Bein, Ph.D. is Managing Partner at Distribution Strategy Group. He’s

developed customer-facing analytics approaches for customer segmentation,

customer lifecycle management, positioning and messaging, pricing and channel strategy for distributors that want to align their sales and marketing resources with how their customers want to shop and buy. If you’re ready to drive real ROI, reach out to Jonathan today at

jbein@distributionstrategy.com.