There are an outrageous number of buyers in an “average” opportunity these days. (I’ve seen stats stating it ranges from nine to more than 20 in recent years.) Here’s one from Gartner:

Keep in mind that Gartner reports on the technology sector. The size of buying committees still varies greatly by vertical market and the problem/solution being explored. I hear from some distributor clients that there are only three or four stakeholders in their buying committees, and in some cases, even fewer. In others, I hear mention of larger numbers.

So, what is a “complex sale?” For years the term was used to designate just what we’re discussing – an opportunity with multiple decision-makers (hence, making it more “complex”).

More recently, that definition has been expanded by some. My friend George Brontén, founder and CEO of Membrain, defines “complex sale” based on three key factors:

- The number of decision-makers

- The length of the sales cycle

- The buyers’ perceived risk

I often also include the price point and complexity of the problem or solution, but both of those play into the perceived risk factor. However you define it, having multiple decision-makers and influencers (stakeholders) on the buying committee is the key, which makes it more difficult to navigate an opportunity successfully.

Think: emotions, pressures, opinions, varying interests, differing desired outcomes and a plethora of other personal needs and perspectives.

So, what is a seller to do? How do you improve your chances of winning these complex deals?

I’m glad you asked.

Factors in the Buyer Landscape

While it’s almost impossible to cover everything in a single blog post (entire books have been written on this topic), let’s explore some key factors in the buyer landscape that are worth your attention.

We’ll start with Buyer Types. This doesn’t mean personas or roles/positions, but a particular focus for each buyer. The three types are Financial, Feasibility and Functional.

- Financial: These buyers are focused on financial and operational metrics or outcomes. They are often C-suite or other executives with interest in the business case and ROI. Complex opportunities without an actively involved Financial Buyer generally prove difficult to win, or at least to accurately forecast.

- Feasibility: These buyers care about whether something can work in their company, how the change might impact other operations and the likelihood of success.

- Functional: These buyers are personally interested in and affected by the decision and its resulting outcomes. They are often directly involved in the use of your solution and seek to understand the use case and impact on their day-to-day tasks.

The amount of influence a stakeholder holds can be mapped on a sliding scale.

- Influence: These buyers can sway a decision with their input but cannot make a purchase decision. Not all influencers are equal. Depending on their level of influence and political capital (such as having the ear of a decision-maker, particularly a Financial Buyer or potential Champion), they can propel a deal or stall it.

- Decision Authority: These buyers can make a purchase decision or veto it. In larger groups, with multiple leaders who can make a purchase decision, the level of influence often depends on who controls the budget or funding for the project. If a Financial Buyer is involved, they may have the ultimate decision authority. In the most complex opportunities, consensus may be required.

- Approver: An Approver often lurks behind the scenes and receives a final recommendation from the committee with a request to ratify it. They often do approve the committee’s recommendation but may veto based on a broader awareness of business issues, some of which may not yet be socialized. They are generally not involved in the purchase pursuit enough to be considered Champions, Coaches or Detractors. To avoid surprises, sellers should try to learn from a Coach or Champion whether there is an Approver.

Attitude is important to identify, but by itself isn’t as actionable. In context of the other factors, however, it can become critical quickly.

For example, if a Financial Buyer with decision authority views you negatively, winning the business will be next to impossible. If a Functional Buyer with low influence views you negatively, and you have a Champion and Financial Buyer in your corner, it may be less of a concern. (This doesn’t mean you shouldn’t try to build a relationship, but if it proves difficult, there are likely better ways to spend your time.)

- Positive: These buyers perceive you, your company and your solution favorably and may openly advocate for you.

- Neutral: These buyers are neutral toward you, your company and your solution. They won’t advocate for or against you.

- Negative: These buyers perceive you, your company and your solution negatively and may openly advocate against you.

Next is Buyer Role. Again, this does not refer to their position title, persona or role in their organization. Rather, it’s how the various buyers interact with you and the role that they play in the purchase decision.

- Champion: Champions have high influence with a positive attitude toward you and your solution. They will actively and openly advocate for you and sell internally on your behalf, in your absence. Champions are, or have access to, the Financial Buyer and have a vested interest in the success of your solution and any related initiatives. Deals with Champions close at a far higher rate than those without. Identifying potential Champions and cultivating them should be a key part of your strategy.

- Coach: Coaches are lower-level advocates without the decision authority or political capital of a Champion. Coaches have medium-to-low levels of influence with a positive attitude. They serve a different supporting role than the Champion. While the Coach is not a key decision-maker, they can be a great source of insider information for you.

- Neutral Party: As the name suggests, this buyer will not actively advocate for or against you, unless they learn something that shifts them from their neutral position. Depending on their level of influence, you might want to work to ensure they don’t become a detractor or influence them toward being an advocate.

- Detractor: Detractors will advocate against you or for another solution, either openly or covertly. They have varied degrees of influence and a negative attitude toward you. Detractors with high levels of influence significantly reduce your chance of success. Identifying detractors early allows you to engage with them to address their concerns and build relationships, instead of reacting too late in the process.

Buyer Landscape Mapping

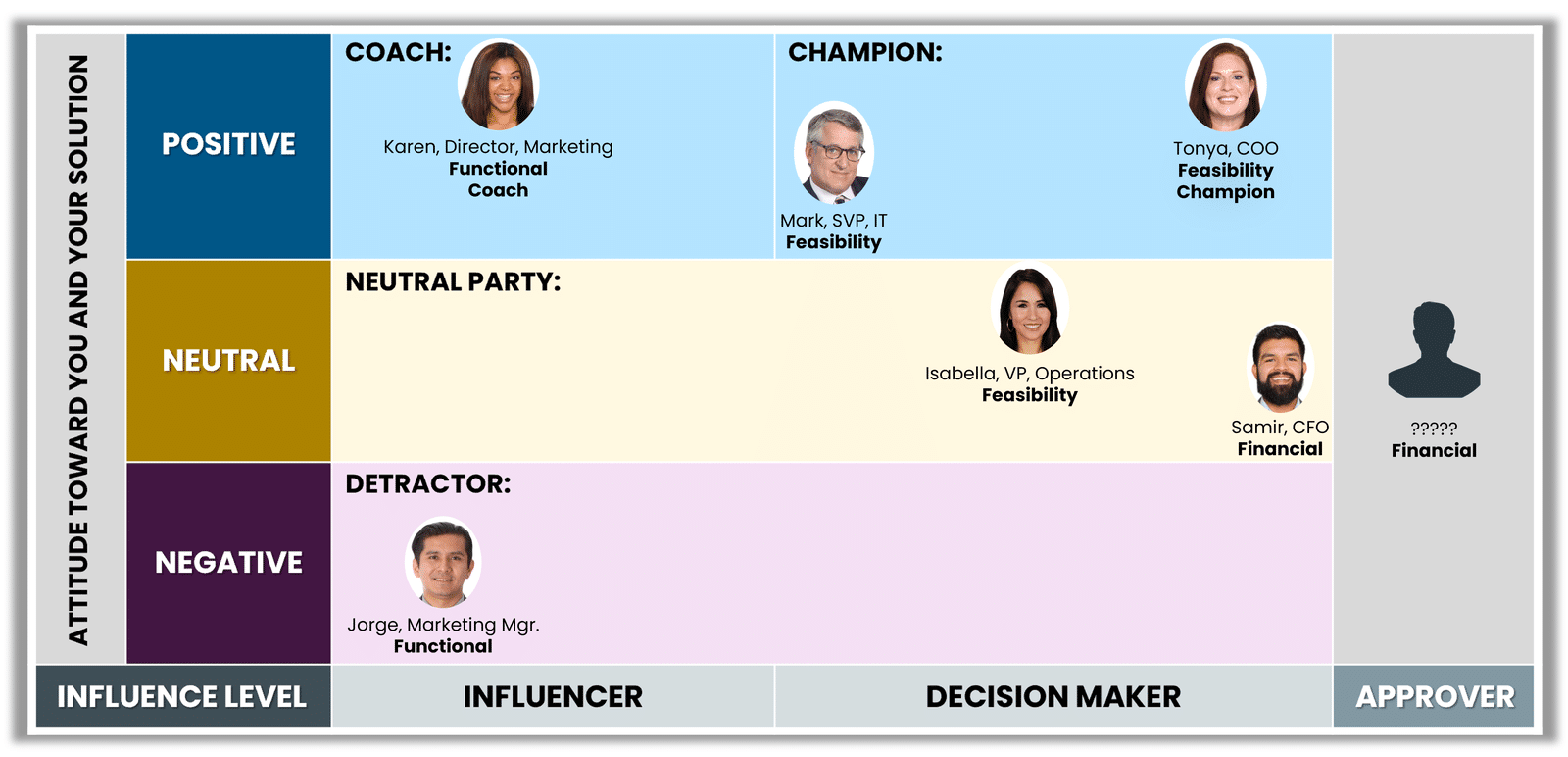

With those factors identified, it’s time for the sales version of the old game, “Pin the tail on the donkey.” For any given opportunity, you can graph where your stakeholders should be “pinned” on the landscape. See the image below for the buyer landscape that I manufactured as an example.

For the Positive row, rather than create a separate row for those who are positive but not a Coach or Champion, I simply list them on the positivity scale without a Coach/Champion label. That would apply to Mark, who is a decision-maker who views you favorably, but is not coaching you, nor as influential as Tonya, who is your validated Champion.

From this mapping exercise, you can expose several key things.

- Information Gaps: What don’t you know or don’t you know well enough? The fact that you’re not sure if there is an Approver is an information gap.

- Risk Factors: What in your map indicates that your account plans or current opportunity may be at risk? If Samir the CFO, with his high level of influence, were down in the Negative row as a Detractor, your deal would be at high risk. Even in the current map, the information gap about the Approver (possibly the CEO or CMO?) could be a risk.

- Leverage Points: What or whom you might leverage to add momentum to your plans or improve the likelihood of achieving your desired results? Discussions with your knowledgeable Coach or Champion might unearth the Approver. Or, you might invest in your relationship with Champion Tonya, to ensure she has the resources, data and business case to position your solution internally, as effectively as possible.

Ultimately, this information can feed into your account management plan, which I wrote about in detail in this previous post. (Check out the Force Field Analysis.)

Whether you need to maintain, reinvigorate/recover, or expand and grow an account, you can apply this thinking to better navigate the buyer landscape for your customer, as well as any pipeline opportunities you generate from your efforts.

While your account managers need to master other sales skills to maximize their efforts, these methods will serve your team well.

Well, that’s it for this post. If it helps you in any way on your journey toward improved sales effectiveness, please feel free to let me know. I’d enjoy hearing about your successes.

Mike Kunkle is an internationally recognized expert on sales enablement, sales effectiveness, sales training, sales coaching, sales management, and sales transformations.

He’s spent over 30 years helping companies drive dramatic revenue growth through best-in-class enablement strategies and proven effective sales systems.

Mike is the founder of Transforming Sales Results, LLC where he designs sales training, delivers workshops, and helps clients improve sales results through a variety of sales effectiveness practices and advisory services.

He collaborated to develop SPARXiQ’s Modern Sales Foundations™ curriculum and authored their Sales Coaching Excellence™ and Sales Management Foundations™ courses.

Mike's book, The Building Blocks of Sales Enablement, is available on Amazon, with others coming soon in 2026, starting with The CoNavigator Method for B2B Selling.