Based on our experience and on results from a recently conducted survey, we believe that distributors need to address three key issues to increase e-commerce revenue:

- Product data: Distributors’ websites need much better data about products so that customers can find, compare, and purchase effectively.

- Web design and implementation: Web design for many distributor websites needs to be more aesthetically appealing to attract customers and more user-friendly to drive conversion.

- Marketing: Distributors need to be more pro-active in generating web traffic through search engine marketing and email marketing.

The remainder of this article explores the findings from the survey in product data, web design, and marketing.

Study Summary

This research was conducted by Distribution Strategy Group in conjunction with Modern Distribution Management. The research performed included an online survey taken by 170 participants across a variety of distribution sectors. There was heavier participation from industrial, electrical/electronics, building, safety, hardware, and HVACR. Other participating sectors include chemicals and plastics, building materials, pulp and paper, janitorial, hardware, oil and gas, grocery, and pharmaceutical. Over half are small distributors with less than $50M revenue, over 30 percent are mid-market with $50 million to $500 million revenue, and 15 percent large with more than $500 million revenue. Almost half are primarily focused on MRO, nearly a quarter are focused OEM customers, thirteen percent are an even blend of MRO and OEM, and fourteen percent are in other categories.

Data

Good data is the oxygen for a successful e-commerce site. Without it, customers are unable to find products, get correct pricing, see product detail, consider alternatives or select compatible accessories. This creates a frustrating experience with low conversion rates and limited, if any, repeat business.

Minimally, product data needs to be accurate and complete. However, as shown in Figure 2, nearly one third of respondents believe their data is inaccurate and half believe that it is incomplete. Furthermore, just over 40 percent think that their photographs are high quality. On these e-commerce sites, customers will either not find the product they want or worse, find the wrong product. Such sites have little chance of gaining traction in the market.

In the early days of e-commerce, websites relied on part numbers and text searches to help customers find the right products. As the numbers of SKUs on websites went from hundreds to tens of thousands, distributors found that product browse by category or parametric search gave their customers the best chance of finding the right product. This raised the bar on product data — requiring the parametric data to be uniform (so similar products could be compared), complete (so that you could search all available product) and relevant (customer could search on attributes important to him). Large electronics distributors such as Digi-Key with the best product data thus best product parametric search saw their online and in turn total sales significantly outpace the industry.

The most successful e-commerce sites gather and maintain data on related products and alternative products. Anyone who has shopped at Amazon knows that their recommendation engine works “overtime” to suggest other products for you to purchase related to the one you are considering or have previously purchased. Offering substitutes, alternatives and complementary products (such as batteries for flashlights) is the next level of e-commerce excellence. While most large distributors have placeholders in their website for this data, only a few industry leaders like Grainger have invested the product management resources to populate these fields. However, among the survey respondents, only a quarter are well positioned to show related products and less than 20 percent can offer meaningful substitute products.

Clearly, the process of getting and maintaining data is a challenge for any distributor. Nearly 80 percent of the distributors in this survey get data directly primarily or entirely from manufacturers. Only 10 percent rely significantly on third-party sources that aggregate data such as IDEA’s Industrial Data Warehouse or on companies that clean data such as ByteManagers or Unilog for product data.

Design and Implementation

Clearly, an attractive design with the right functionality is essential for growing e-commerce revenue, otherwise customers will bounce from the site before even doing a search. It is also important to have the right ways to find data. For highly technical industries such as electronics or pharmaceuticals, search by product parameters is required. In other cases, it is necessary for customers to search by the manufacturer part or a custom part number.

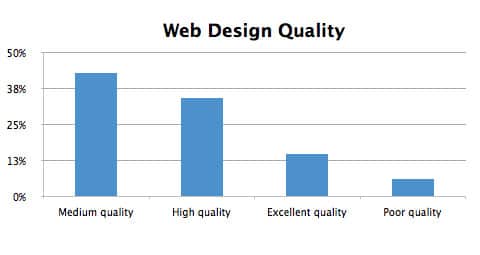

As shown in Figure 3 below, just under half of the respondents thought that their own web designs were of medium or poor quality. Based on our experience and on a review of the respondents’ websites, we believe that percentage is understated. Most small distributors have websites that need a facelift. However, the dynamic is not unique to smaller distributors. Mid-size distributors without dedicated creative marketing experts who have relevant web design experience will be unlikely to create an attractive and usable e-commerce site.

The respondents from the survey who have the most confidence in their web design include building materials, electrical and electronic, hardware, and safety. Grocery, pharmaceutical and energy respondents had the least confidence in their web designs.

Marketing

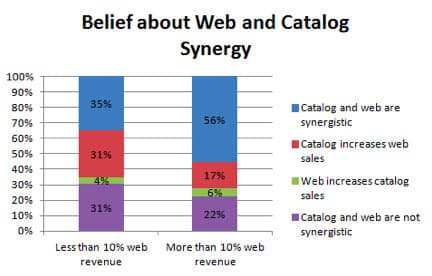

It is often said that company roots have a big impact on e-commerce success. In general, companies that were direct marketing/catalog-focused without significant branch networks were able to move resources to the new e-commerce channel without channel conflicts. In addition, the skills for targeting with print translated well to targeting with email. For example, Digi-Key was able to leverage its non-branch low-cost business model into lower everyday web prices for small customers. By contrast, Compaq Computers’ extensive dealer network went from being a competitive advantage to a cost disadvantage during a period when we saw the huge growth of online players like CDW. The exception was the MRO market where Grainger and its competitors invested heavily in world-class websites, product data, and online promotion despite having to support huge branch networks and were able to prevent the growth of Internet-centric MRO distributors.

Distributors that had strong direct marketing and annual catalogs were more Internet-ready. The direct marketers viewed the Internet favorably as a new low-cost channel for servicing the customer. In many cases the product data necessary for a good website already was required for the print catalog and transparent columnar pricing structures were easily implemented online.

On the other hand, among mid-market and small distributors, our research revealed that even though 70 percent are using search marketing and half are using email marketing, only about 20 percent believe it is important.

New Trend

Sixty-seven percent of distributors in the survey felt mobile e-commerce would be either important or very important in the next one to three years. New data shows nearly 1 in 3 adult cell phone owners in the U.S. owns a smart phone. Industry e-commerce leaders are already rolling out applications that allow customers to check inventory, order and get product datasheets via their smart phones. One has to believe in less than three years we will take this capability for granted on all major websites.

Other developments we have observed is manufacturers using social media like Twitter to announce new products and datasheets. Social media is being used to push new products out to design engineers in their new communication channels.

Conclusion

With a few notable exceptions, to date, the impact of e-commerce for distributors has been limited. To increase e-commerce revenue, distributors need to significantly enrich product data, make their websites more appealing and usable, and apply proactive marketing to drive traffic and conversions. Given the relative immaturity of distributor e-commerce, the companies who move with agility to improve e-commerce can be expected to reap significant reward.

Jonathan Bein, Ph.D. is Managing Partner at Distribution Strategy Group. He’s

developed customer-facing analytics approaches for customer segmentation,

customer lifecycle management, positioning and messaging, pricing and channel strategy for distributors that want to align their sales and marketing resources with how their customers want to shop and buy. If you’re ready to drive real ROI, reach out to Jonathan today at

jbein@distributionstrategy.com.