One of the biggest challenges for any sales and marketing organization is when to reach out to a customer with an offer or promotion. The objective is to reach out according to a natural buying cycle. If it is done too frequently, it loses its impact or even turns the customer off. By contrast, if it is too infrequent, sales opportunities may be missed altogether.

A simple behavioral segmentation technique called recency-frequency monetary (RFM) value is key to optimizing the timing of offers and promotions without requiring “Big Data” to be effective. The main idea of RFM analysis is to classify customers by how recently they have purchased and by how many times they have purchased in a given time period, typically months or years. Here are the key principles of RFM:

- “When you’re hot, you’re hot.” – Customers who buy a lot and have bought recently will continue to do so, probably without special offers or promotions.

- “When you’re not, you’re not.” – Customers who have not bought a lot OR have not bought recently need offers or promotions to get back into a good purchasing pattern.

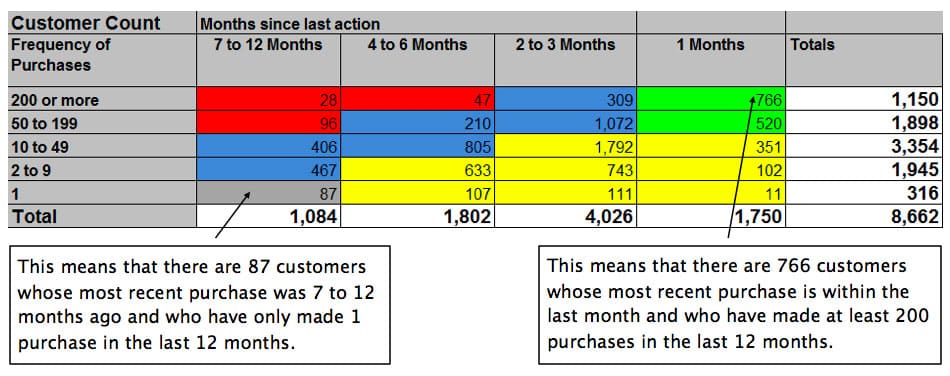

When used skillfully, RFM analysis can drive retention, re-acquisition, and wallet-share programs as well as optimize promotional spend. Let’s look at how it works. Figure 1 contains a point-in-time RFM summary analysis of 8,662 customers from a distributor over a 12 month period. Cells in the upper right portion of the summary represent higher volume customers who have purchased recently. Cells in the lower left of the summary represent low volume customers who have not purchased recently. In between, are various mixtures of sales volume and recency of purchase.

Companies who used RFM will run the analysis weekly or monthly and often compare against the previous month to see how things are trending. If the customer base is increasing in recency and frequency, that is strong evidence that marketing and sales is going well. By contrast, if overall customers are decreasing in recency, it is a sure sign of problems to be addressed.

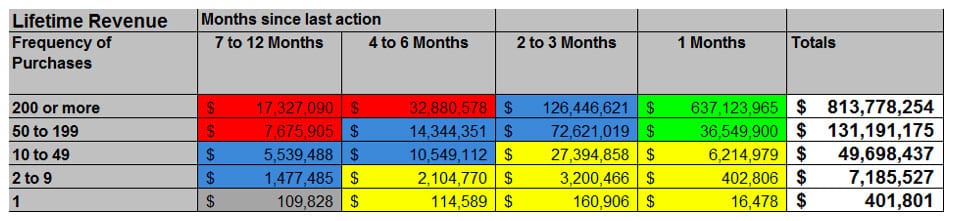

For each cell in the grid in Figure 1, the corresponding cell in Figure 2 contains the value of the customers in the time period of the analysis. For example, the 7 66 customers in the upper right cell in Figure 1 have made nearly $640 million of orders during the time period of the analysis. In fact, the customers who have made 200 or more orders total $855 million of revenue. For this distributor and many others, most revenue comes from high volume customers. The “one-and-done” customers in the first row only total $400,000 revenue.

Dean Mueller, VP Marketing at Kele, has been using RFM for the last 2 years. According to Dean, “It is at the heart and center of our marketing operations. Customers who have not purchased recently are identified and alerts are generated to the sales team and appropriate automated marketing campaigns initiated. When we run a campaign we choose which customers to target based on RFM cells.” Since using RFM, Kele customer has seen significant improvement in implementing the right initiatives that drive customer retention and wallet share.

Lifecycle Management with RFM

RFM provides a straightforward approach for customer lifecycle management. As shown in Figure 3, each cell has a lifecycle objective. For the most current, high volume customers, the objective is to serve and maintain the account.

The RFM analysis helps detect when a customer is at risk of defection. For example, a high volume customer who has not purchased in one month or more it is at risk of defecting because it normally orders several times per month. Then, the lifecycle objective is to actively retain the customer through a variety of methods including offers, additional service, etc. For lower volume customers, it may be several months before retention becomes relevant. At a certain point, the customer, the customer has defected and traditional retention methods are no longer applicable. The customer needs to be re-acquired or re-activated.

For some distributors, retention is the main issue. For others, their challenge is to grow small customers into mature customers. We have seen a number of distributors who have 30 to 40 percent of their customers who buy only once or a few times. To be sure, there are small volume customers who have little potential to become mature customers. However, we usually find that within the low volume customers, there are many who fall into the distributor’s sweet-spots. Those customers have good potential to grow.

While one time buyers are technically customers, until they have established a multiple repeat purchase pattern, they are really a combination of customer and prospect. At this stage of the lifecycle, the customer needs to brought fully on-board. Converting these customers requires a coordinated campaign between sales and marketing to move the customer into the growth stage of the lifecycle. Once customers are in the growth stage, the objective is to increase orders and order size steadily until the customer is mature and can be handled by field sales or more senior inside sales reps.

Multi-channel, Multi-Vehicle RFM

RFM has been used as a direct marketing technique for nearly 50 years. At its inception when postage was 4 cents, it was used to determine which customers will receive an offer. The determination is made by testing the marketing response rate of the various cells. For example, if we know that the grow cells have a 3 to 4 percent response rate, we will include them in marketing campaigns where the breakeven is at 3 percent or lower. If a campaign has a 5 percent breakeven, those cells will not be included. RFM is used to predict by cell in the grid which customers are most likely to respond to an offer.

Today, RFM is applied not only to print marketing vehicles, but also for outbound telemarketing, email marketing, web marketing, and even field sales. The break even calculation for a campaign now includes the cost for each marketing vehicle in the campaign. In contrast to many years ago when print was the only vehicle, the economics of email marketing significantly expands the set of customers who can be touched. Once the contact has been acquired, transmission at less than 1 penny per contact is extremely affordable.

Conclusion

RFM has been used as an effective direct marketing technique for nearly 50 years. The analysis it provides can help predict which customers are most likely to respond to specific offers. And while marketing has grown to include new techniques, such as telemarketing, email, web and even field sales, RFM can still be used to determine which approaches may be most effective, depending on the lifecycle objective, and to calculate the best use of your resources. In addition, the economics of email marketing – which can cost less than one cent per point of contact – significantly expands the set of customers who can be touched.

Even with all of the analytic models available today, RFM remains one of the most powerful methods for predicting campaign response. In contrast to many analytics tools, it does not require significant hardware to run. Furthermore, RFM is easily understood by marketing and sales organizations. Once people get used to the method, they become hooked on it. Lifecycle objectives derived from the RFM analysis can be easily integrated into a CRM system so that sales reps can take the appropriate actions.

Jonathan Bein, Ph.D. is Managing Partner at Distribution Strategy Group. He’s

developed customer-facing analytics approaches for customer segmentation,

customer lifecycle management, positioning and messaging, pricing and channel strategy for distributors that want to align their sales and marketing resources with how their customers want to shop and buy. If you’re ready to drive real ROI, reach out to Jonathan today at

jbein@distributionstrategy.com.