In a series of moves, including bringing on the executive who launched Amazon Business, ODP is joining the marketplace war.

With a flurry of aggressive, recent actions, ODP (the newly named parent company of Office Depot) seems intent on building a rival marketplace to Amazon Business.

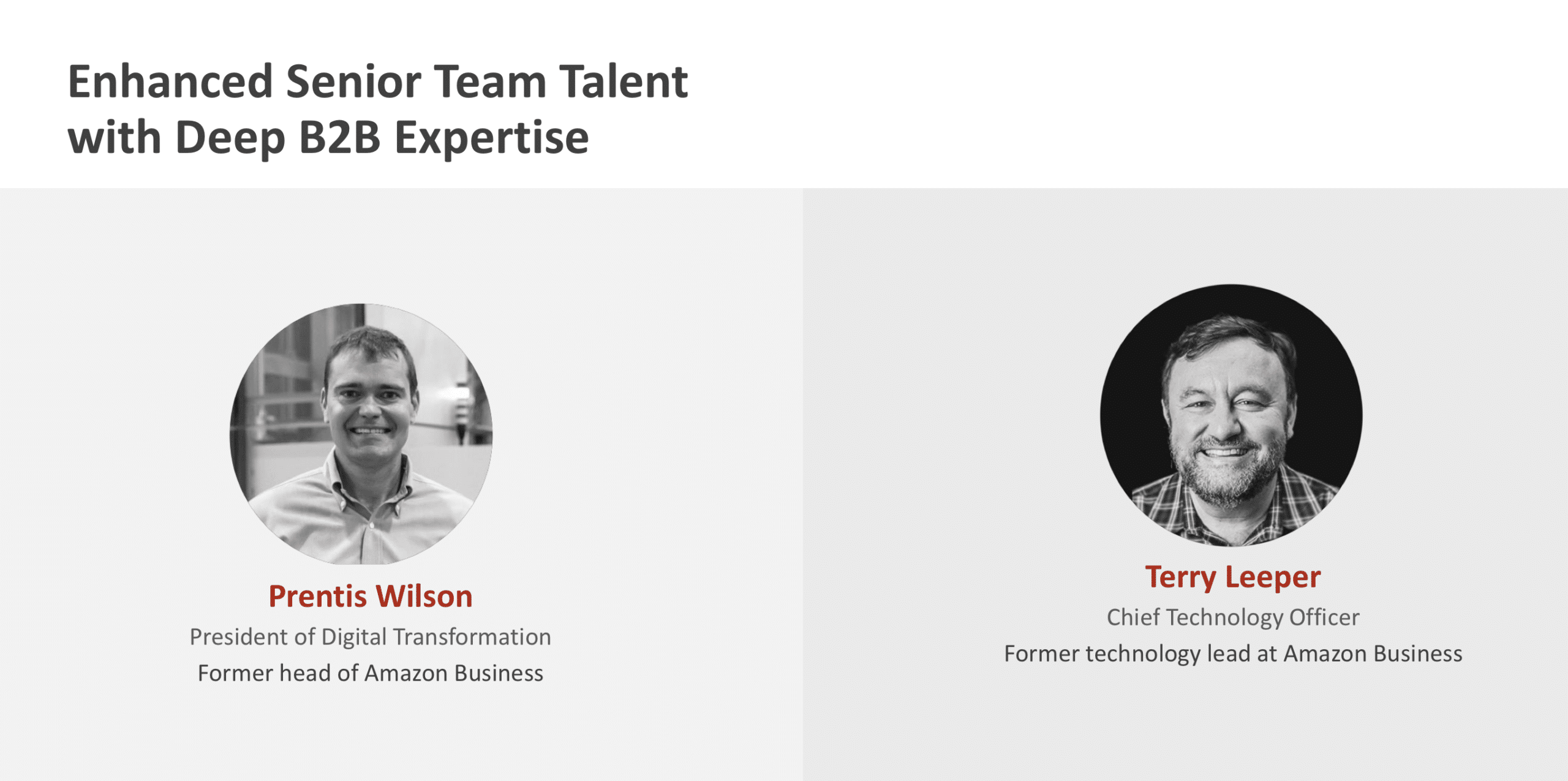

On Feb. 16, the company announced it had hired Prentis Wilson, the former Vice President and General Manager of Amazon Business. His title is President of Digital Transformation and the subhead of the press release says:

Wilson to Lead Digital Transformation and Scale New Technology Business That Combines Cloud Innovation and eCommerce Technology with ODP’s Physical Assets to Transform How Businesses Buy and Sell.”

The Takeaway: ODP has landed the most-qualified candidate to build a marketplace competitive with Amazon Business: The executive who built Amazon Business.

Here are some of ODP’s other significant moves.

Acquires eProcurement software provider BuyerQuest

On Feb. 18, 2021, ODP announced it had acquired leading eProcurement software provider BuyerQuest. “’We are committed to delivering on our vision to be a leading B2B company. With the addition of BuyerQuest’s market-leading capabilities, and our recent announcement that Prentis Wilson has joined ODP, we are well on our way to fulfilling that vision,’” said Gerry Smith, CEO of The ODP Corporation. The company expanded on this explanation in the slide deck accompanying its recent earnings call:

- (BuyerQuest is) an “advanced software platform with a ‘blue-chip’ customer base handling $ billions of transactions.”

- “Acquisition accelerates ODP’s technology development and launch plan.”

- “Positions ODP to participate immediately in the $50+ Billion P2P marketplace while we add to our capabilities.”

- “Key asset in our digital transformation journey to pursue growth in the $8 trillion business transaction market.”

The Takeaway: Integrating BuyerQuest into its third-party marketplace gives ODP eProcurement functionality that is competitive with that of Amazon Business.

Hires former Amazon Business CTO

On July 20, 2020, ODP announced it had hired Terry Leeper as its new CTO. His previous job: CTO for Amazon Business. An EVP and member of the executive team, Leeper reports to Smith, and “will play a key role in accelerating our pivot toward a broader business and technology platform.”

The Takeaway: The company now has the tech leader who apparently built Amazon Business’s architecture and just handed him an integrated eProcurement platform in BuyerQuest to help him match those capabilities at ODP quickly.

Turns down buyout offer from Staples owner

On Jan. 19, 2021, ODP announced that it was turning down a buyout offer from Staples’ owner Sycamore Partners. Sycamore had proposed acquiring ODP and then spinning off its B2B business to reduce regulatory risk. The remaining retail part of ODP would be combined with Staples’s consumer business. ODP countered by suggesting that its consumer business be combined with Staples – or that Staples could buy it outright.

The Takeaway: ODP is eager to double down on B2B and is more than happy to sell its retail business at the right price.

Announces strategic partnership with Microsoft

On Feb. 22, 2021, ODP announced a strategic partnership with Microsoft Dynamics 365. Wilson said: “B2B purchasing is rapidly moving online, and procurement organizations of all sizes are embracing digital sourcing and purchasing. Suppliers need B2B-grade ecommerce technology and nimble supply chains to remain competitive. Partnering with Microsoft Azure and Microsoft Dynamics 365 Business Central, ODP and its customers – buyers and suppliers alike – can quickly grow and scale efficiently.”

The Takeaway: Microsoft is just the sort of software giant you’d want to join forces with to take on Amazon. Getting ODP’s eProcurement platform and third-party marketplace plugged into Microsoft’s solutions is huge – but there could be other, major synergies ahead. For example, Microsoft is a leader in artificial intelligence, but its Cortana voice assistant has never been competitive with Amazon’s Alexa. One reason is that voice shopping is a “killer app” for a smart speaker and Microsoft needs access to a B2B marketplace. This is just one potential AI opportunity for the two companies.

Changes holding-company name to ODP

Let’s not overlook the name change. Last year, Office Depot completed a holding company reorganization in which the parent company is now “ODP.” Office Depot is a subsidiary.

The Takeaway: If you want to operate a large-scale B2B marketplace with many different categories, getting the word “office” out of your name is a good idea.

Have laid out a clear strategy for the B2B market

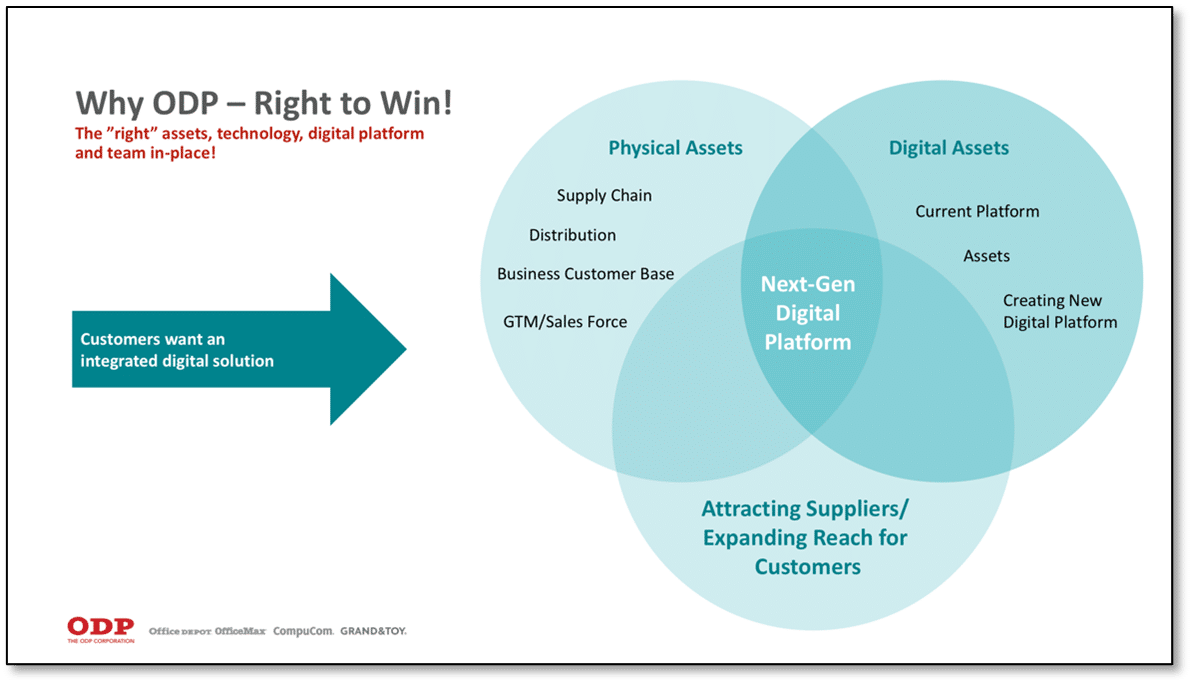

In this must-read earnings transcript, Gerry Smith brought it all together in a compelling narrative that made the company’s strategy clear. In addition to a slide dedicated only to Prentis Wilson and Terry Leeper, the company shared this graphic summing up its B2B strategy:

Selected quotes from CEO Smith on this call:

- “More and more business customers are demanding end-to-end integrated digital-platform solutions in order to more effectively manage their businesses. We are evolving our platform, combining our physical assets with a new and modern digital experience in order to position ODP to meet these needs and capture growth in the B2B commerce market.”

- “B2B revenue is now approximately 60% of our total revenue, up from about 49% three years ago. Our efforts to diversify our product portfolio outside of our traditional categories have resulted in growth in our adjacency product categories.”

- “Our supply chain represents one of our key B2B assets and creates a significant competitive advantage on how we reach and serve our customers today and tomorrow. It consists of a large private fleet of 1,000 vehicles over 9 million square feet of space and distribution centers in cross-docks and numerous third-party relationships to enable us to deliver reliably to our customer base.”

- “We are excited about how these initiatives position us to positively disrupt the over $8 trillion B2B commerce market in the U.S., of which today less than 20% is digitally enabled.”

- In response to an analyst’s question: “I think it’s actually really different than Amazon, Alibaba. Think of a curated platform, defined by contractual agreement, source-to-settle from a B2B perspective where you’re not looking at loose spend or some of that tail spend. But it’s really contractual relationships, connecting buyers, B2B buyers and sellers. And we’re trying to give a simpler – and as far BuyerQuest comes into this – very effective world-class, ecommerce procurement platform.”

Our Take

Despite CEO Smith’s statement that what ODP is building is “actually really different than Amazon,” we see many similarities. But that’s a good thing for ODP – there’s room for another endless-assortment marketplace aimed at commercial MRO buyers and Amazon Business, while familiar to customers, doesn’t have a well-organized (e.g., “curated,” in ODP’s language) assortment. However, there’s probably not room for more than two or three of these players and ODP has made some of the earliest – and clearly the most aggressive – moves.

It’s a daring strategy but Smith and his team are acting smartly to reduce risk and increase the odds of early success. When Prentis Wilson left his job as GM of Amazon Business in July 2019 and went to a start-up, arguably the most-qualified executive to build a rival marketplace was off the market. Now he’s back in the game. Whether ODP initiated the move or Wilson was waiting for the right opportunity (perhaps after a brief non-compete expired?), it’s a great match between an obviously-aggressive and forward-thinking corporation and the top talent in the space.

Office Depot’s earlier hiring of Terry Leeper (direct from Amazon Business; they apparently need better non-competes at Amazon), is just as big. ODP is no doubt hoping these two can recreate their old magic and build a flourishing B2B marketplace, supported by BuyerQuest’s software, the strategic partnership with Microsoft and Office Depot’s robust logistics network.

At Distribution Strategy Group, we believe that the vast majority of “tail-spend” purchases are going to be transacted on marketplaces soon. We also believe that Amazon Business and other marketplaces can manage the marketing and the transactions and have manufacturers – not distributors – do the fulfillment – including picking, packing and shipping. Marketplaces could remove distributors entirely, with the platform and the manufacturer splitting the work and the profits that used to go to an additional intermediary.

That means distributors not only need a marketplace strategy, they need be part of a marketplace – not just a third-party seller on someone else’s platform. Some distributors like ODP (which is clearly less a retailer than a B2B seller now) are large enough to build their own marketplaces. But the vast majority of distributors will need to rally around a cooperative effort to build or join a trusted marketplace partner that:

- Competes effectively with Amazon Business and ODP

- Does not intend to eliminate distributors from the channel and rely on manufacturers to fulfill orders

Perhaps ODP will establish itself as such a partner. As far as we know, Amazon Business hasn’t offered any assurances that it won’t displace distributors and rely on manufacturers for fulfillment. Regardless, the B2B marketplace war is heating up and it’s time to build alliances, choose partners and implement your strategy for tail-spend business or a few years from now, you won’t have any left.

Be sure to join us on Wednesday, March 3, on The Wholesale Change Show. DSG Principals Ian Heller and Jonathan Bein, Ph.D., will discuss the ODP news in detail and review the earnings of Home Depot, Henry Schein, Watsco and Motion Industries (Genuine Parts). As always, we’ll take listener questions. Don’t miss it!

Ian Heller is the Founder and Chief Strategist for Distribution Strategy Group. He has more than 30 years of experience executing marketing and e-business strategy in the wholesale distribution industry, starting as a truck unloader at a Grainger branch while in college. He’s since held executive roles at GE Capital, Corporate Express, Newark Electronics and HD Supply. Ian has written and spoken extensively on the impact of digital disruption on distributors, and would love to start that conversation with you, your team or group. Reach out today at iheller@distributionstrategy.com.