There is a lot of sales advice floating around. This is especially true on LinkedIn, but advice abounds on other social platforms, too, as well as in websites, blog posts, articles, white papers, infographics, e-books, books, magazines, conferences, associations, mastermind groups and more. It’s dizzying.

In wholesale distribution today, you can’t turn around without hearing about sales transformation or digital transformation. To be clear, this is not a criticism of those spreading the word on these topics – many distributors need one or both. My point is that everyone has opinions, and they’re all sharing them. As you might imagine, the quality of advice is a bell curve or sliding scale.

In addition to a large variance in advice quality, there is also a wide spectrum of approaches. Somewhere on the far-left side, you’ll see the “if the only tool you have is a hammer, everything looks like a nail” phenomenon. Somewhere on the far right, you’ll hear the constant “it depends” retort.

Context Reigns Supreme

While I recognize that extremism and absolute thinking on either side can produce less-than-ideal results, I often find myself far closer to the right side of this scale in the “it depends” camp. Like a physician, we should diagnose first, then prescribe.

A few years ago, I started joking that business books were dangerous. The statement is hyperbole to make a point. It’s a caution to apply critical thinking since some authors who “had an experience” somewhere where something they did worked. Then they write about it as if it’s a silver bullet that will work anywhere, under any condition, in any company.

If the author prescribes a diagnostic method that helps people determine an appropriate solution in their specific situation, they may well be right. In other cases, with whitewash advice, not so much.

“In” Content May Be Out of Context

Popular content doesn’t mean it’s right for you. You may have noticed this relative to the ubiquitous sales force advice I mentioned earlier.

“Be this way, do this thing, use this technique, rework your sales force this way, and you’ll be better.” I’d respect it more when experts say, “In this situation, if you’re experiencing this issue, here are suggestions to consider that I’ve seen work.” But I don’t see that very often. I see a lot of absolute or whitewashed thinking, which treats all problems as technical problems (problems with known solutions) instead of recognizing that some problems are adaptive (require new learning). For more on technical vs. adaptive challenges, check out the work of Ron Heifetz.

There is a body of work around sales transformation, so it’s not completely an adaptive challenge. There are proven approaches to take. It becomes adaptive when you need to determine how you want to do it in your organization, starting with strategy first, then tactical go-to-market plans and then execution.

The real power comes not from having a prescribed answer, but by having a process or methodology to determine what you should do (perhaps even a hypothesis to test, to monitor, to shape), to get the result you want in your specific situation. Teaching people to fish is better than handing them fish. Teaching them to learn how to fish beats both.

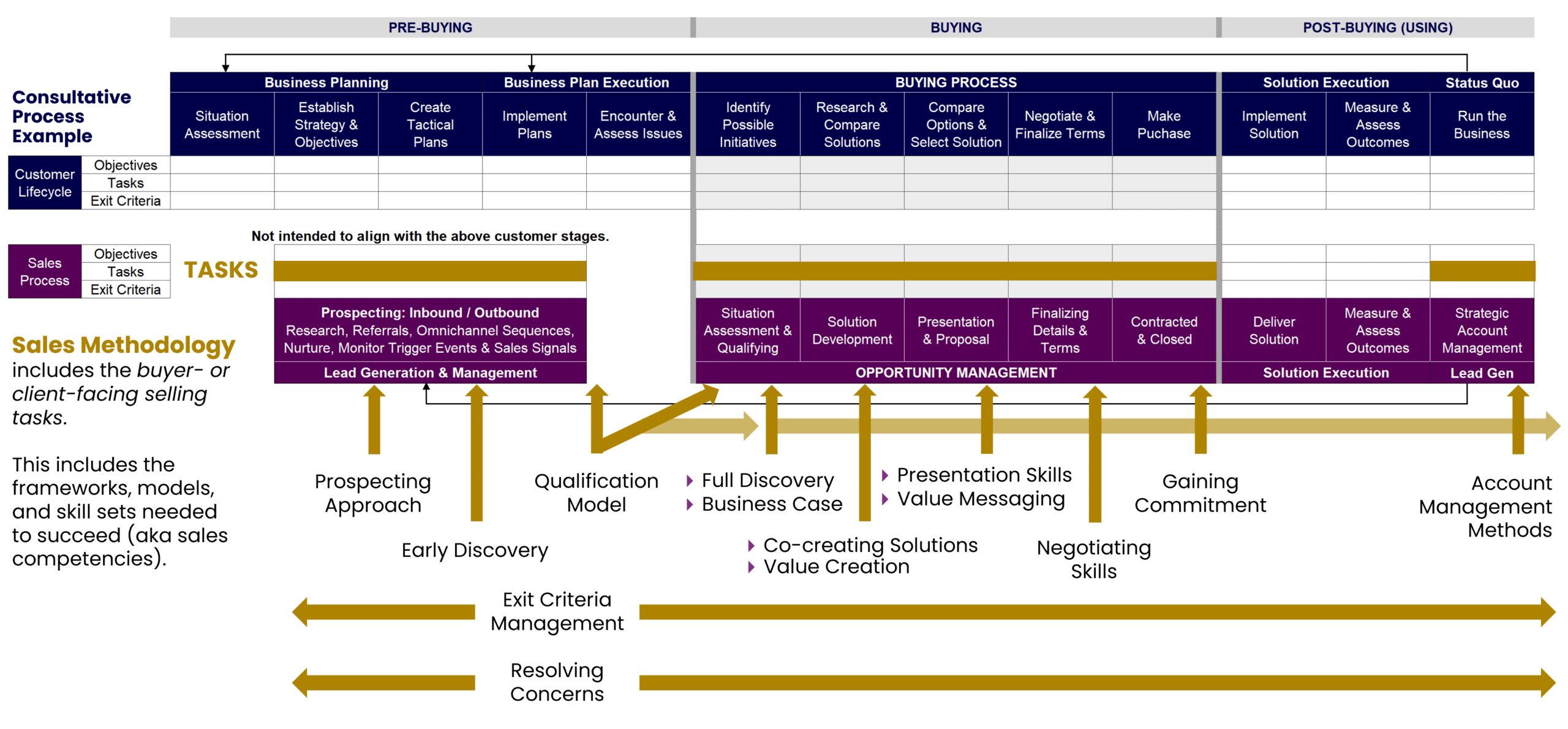

Perhaps some examples will help. In this post, I’ll talk about sales process, sales methodology and sales model nuances, but let’s start from a foundation of the customer lifecycle and corresponding sales processes.

Customer Lifecycle/Sales Process

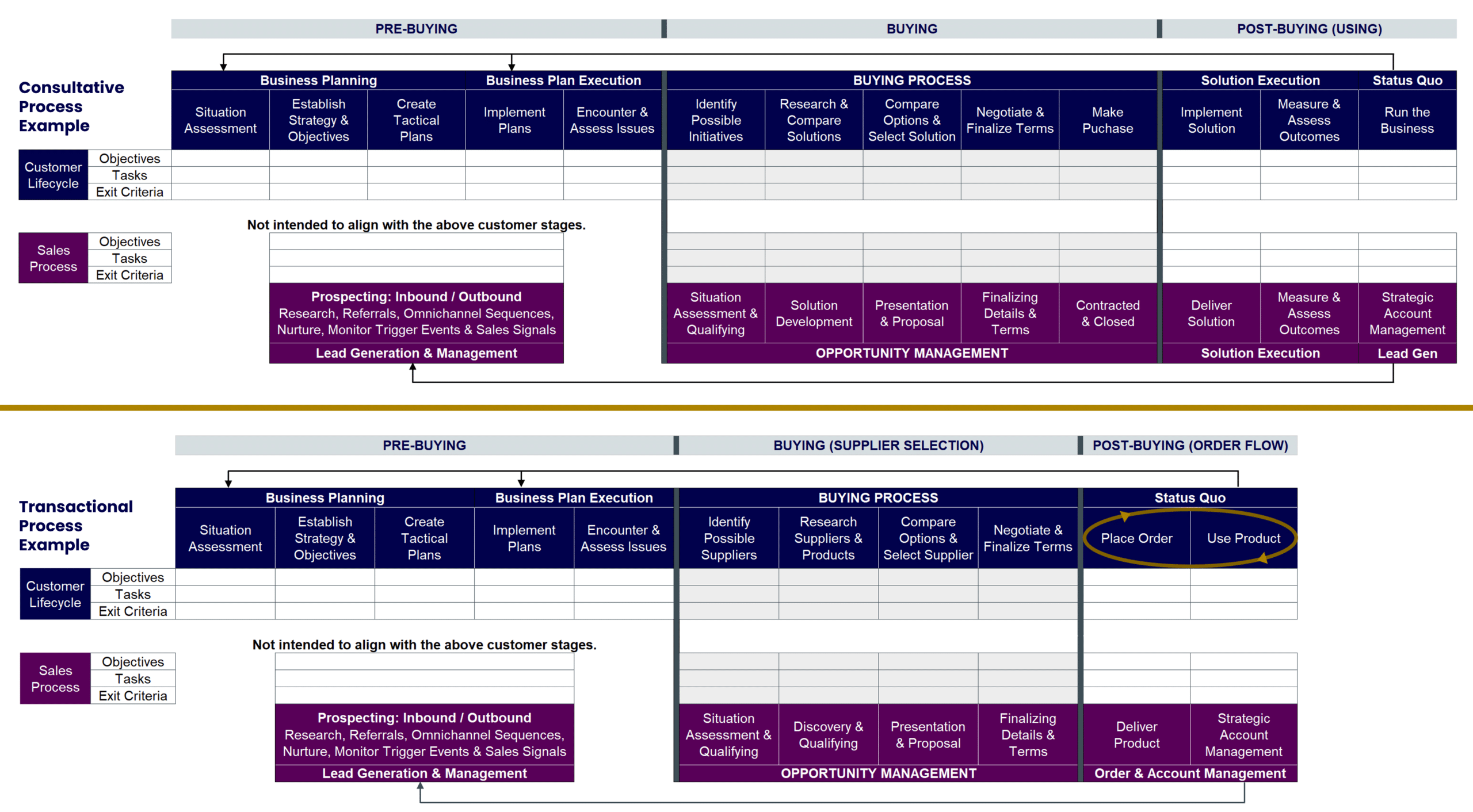

Take a moment and compare these consultative and transactional lifecycle examples.

- The consultative lifecycle and associated buying process is when customers buy and implement a solution. That solution may be off-the-shelf, modified (through the selection of options) or bespoke (fully engineered to specifications).

- The transactional lifecycle and associated buying process is when customers select a supplier to purchase and use products. Even in this case, a range of products, a specific manufacturer or part number may be incorporated in the agreement.

In these examples, which reflect only two of many possible iterations, you’ll note the Pre-Buying stages and corresponding sales process stages are the same. However, the Buying Process and Opportunity Management stages are slightly different, as are the Post-Buying stages and the sales response.

In the past four years at SPARXiQ, I have worked with distributor clients that fit one or both examples, and you may see yourself in one or both – either as-is or with slight modifications.

And this is my point about context and nuance.

Even more importantly, these lifecycles and processes should be built from the outside in, by researching your market, buyers, customers and others like them, not built from the inside out based solely on the opinions of your sellers, sales managers or others internally. (See this post and this post for more on developing buyer acumen.)

Everything feathers out from this foundation of buyer acumen and how your buyers and customers purchase from you (or how they want to – which evolves over time).

Clearly, one size does not fit all.

Sales Methodology

As you can imagine, the sales methodologies used across these lifecycles will also have some similarities and some differences. Here’s one example of how methodology maps to a customer lifecycle for a consultative sale.

And here is how that same methodology might need to be applied differently. In all instances, sellers should do some level of discovery. But there is a big difference between:

- An inside sales representative (ISR) who takes an inbound call from a buyer who wants a quote for Product X for a project.

- An account manager (AM) conducting discovery with a committee of buyers looking to solve a complex business problem with an engineered solution.

The first rep should ask additional questions to better understand the context of the purchase, the project it’s a part of and how the product will be used. This not only ensures the customer will be satisfied but could identify other cross-sell or upsell opportunities (which may also reduce additional sourcing effort for the buyer).

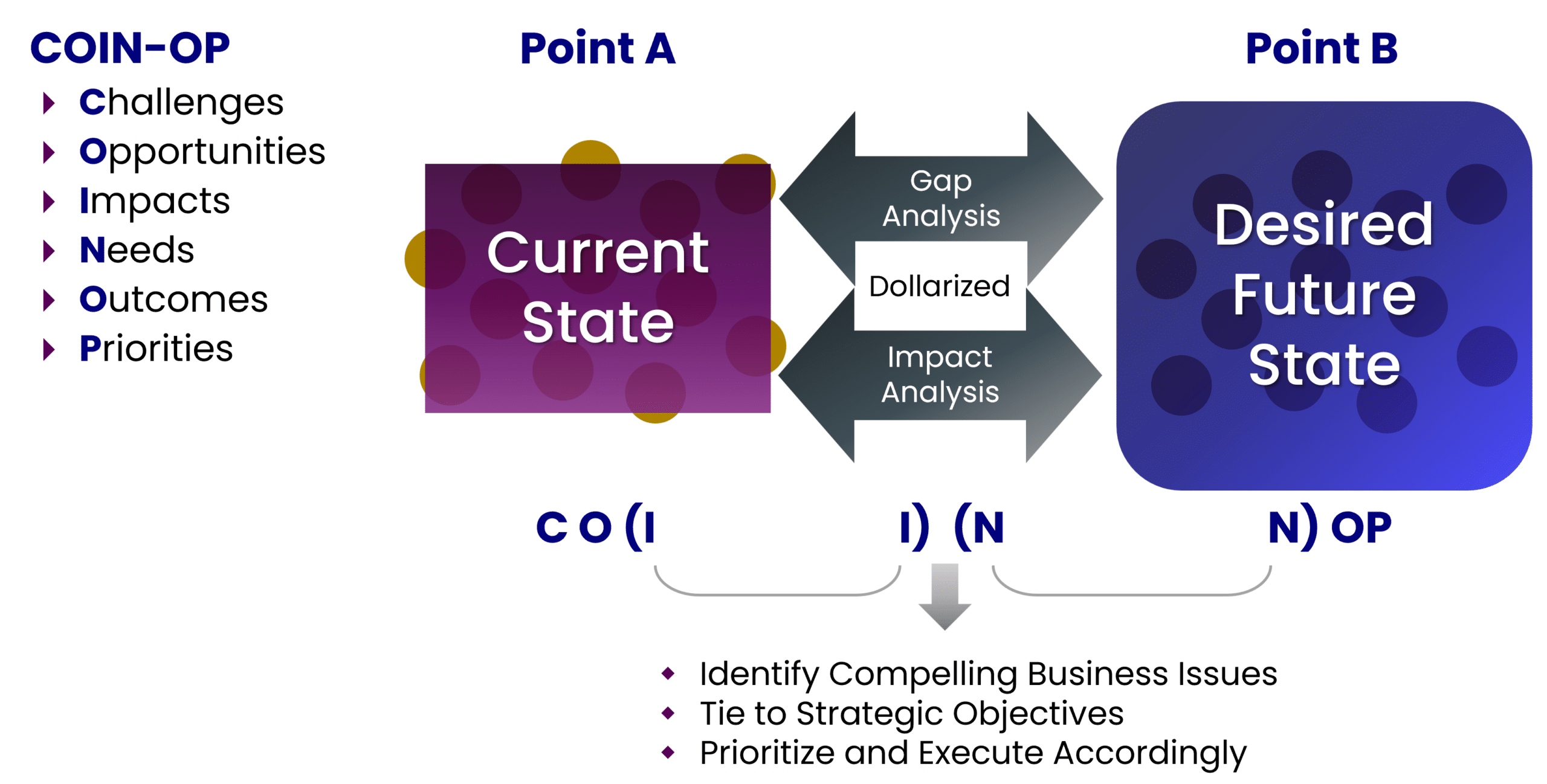

The second rep should do a far deeper discovery, which I call a Situation Assessment. In this example, the seller should identify the current state, COIN-OP (see diagram), the desired future state, determine or co-create the right solution, and develop a business case through dollarized Gap and Impact Analyses.

Situation Assessment Framework

This is just one example, with one piece of methodology (discovery), for two different roles (ISR and AM) and two different solutions. It’s a great example of how context and nuance matter. What selling situations do your sellers face? Whether it’s inbound, outbound, order-taking, gathering detailed requirement specifications and solution design, or other scenarios, the methodologies and how they are used may vary. Once the process is clearly identified, you can select or design the right methodology for each situation.

Again, clearly, one size does not fit all.

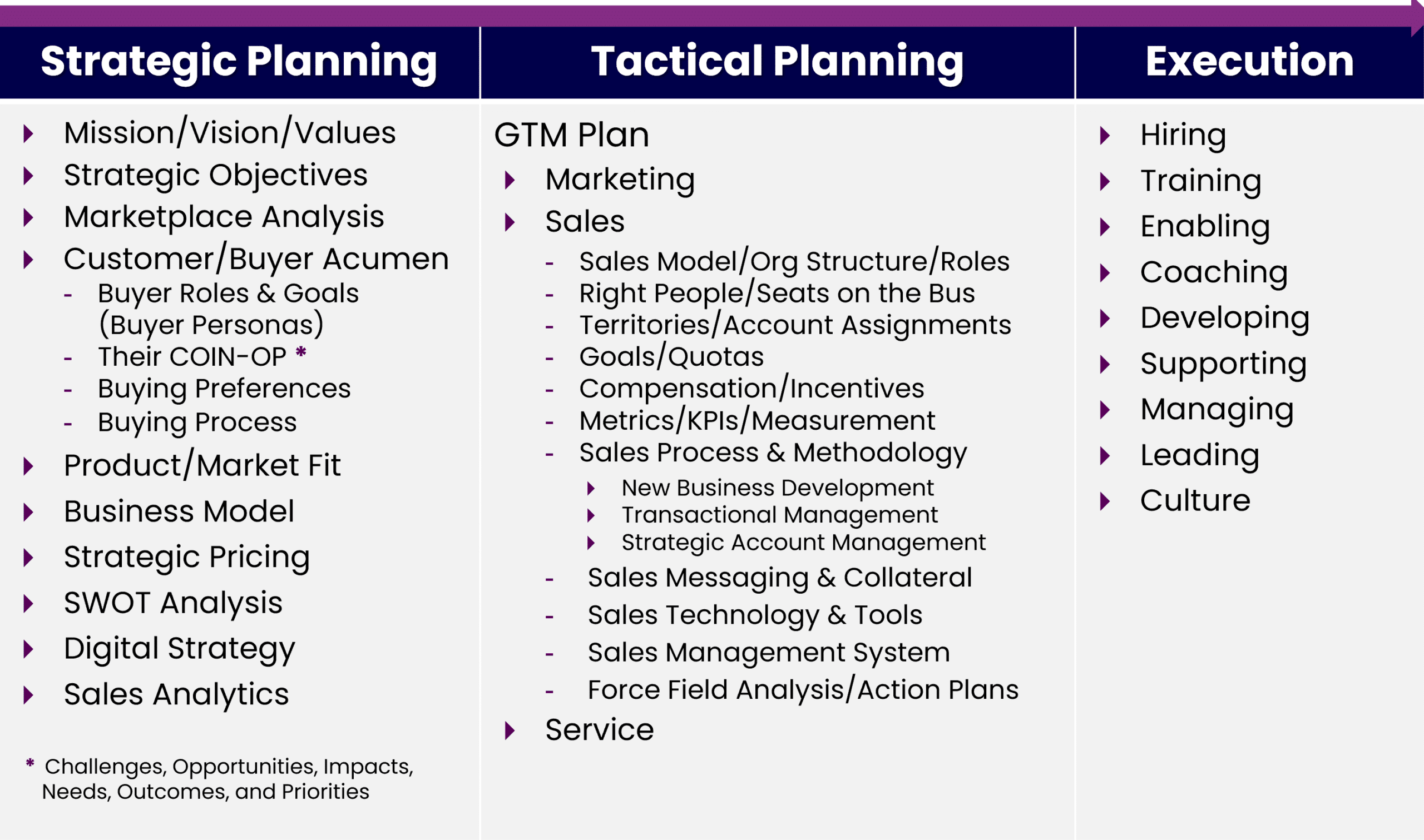

Sales Model

I debated whether to start or end here, but I chose to end with the sales model to explain. In a real-world application, however, I would do this work after the customer/buyer acumen research (and other things on the left side of the below chart) is complete when designing the sales process and aligning it to the customer lifecycle(s) and buying process(es).

Reengineering Sales

For mature companies who have been doing business for a long time and haven’t yet adapted to changes in buying behavior, it’s likely your sales model and go-to-market (GTM) approach (as well as your marketing and service models) will need to evolve.

What Exactly is a Sales Model?

Your sales model is a piece of your larger GTM plan. It’s your org structure, coverage model, processes you establish and the tools you use to support your buyers and customers through their buying journey.

This includes mapping the various ways that leads will enter the process, transactional orders will process, consultative sales will occur and accounts will be managed. The goal is to make it as easy as possible to buy from you (effortless buying experience/reduced buying friction), provide what they need to decide and support the ways that they want to buy.

Examples include:

- How you create interest or generate demand

- How you respond to that interest

- Your ecommerce strategy or self-service exploration and purchase options (especially for transactional flow business and current customers)

- The content you provide to

- Support demand generation

- Support self-service

- Satisfy decision criteria across their buying process and support their buying decision

- Whether you use sales development reps or business development reps to generate growth, and whether they do it through new account acquisition or current account growth

- How you establish inside sales and what they handle (for example, whether they handle inbound calls, work in a call center, mostly service clients, do outbound prospecting, work the front-end of the sales cycle or do full cycle sales and, if you differentiate this, for what size accounts)

- How you set up field sales (or sales specialists, account executives, account managers, sales consultants, or whatever you call them in these days of virtual and hybrid selling)

- If or how you incorporate sales overlays (specialists, SMEs, engineers)

- How you handle territorial account management and key or strategic account management

GTM plan

Just to show the difference, here are some elements of your larger go-to-market plan. It includes your sales model from above, plus:

- Your value proposition (or your separate value stories for your multiple solutions)

- Buyer personas

- ICP and segmentation

- Product/market fit and services/market fit

- Territory optimization

- Goals and quotas

- Account segmentation

- Account planning

- And more, from the chart above

As part of your buyer persona research and ongoing buyer acumen development, you should learn how your buyers want to buy. Research abounds about the changes in B2B buying behavior, and many buyers prefer a self-service or partially self-service experience when possible. Others involved in solving complex problems may prefer to engage with sellers and supporting experts earlier. I believe the research on B2B buying preferences, and I see evidence of the changes firsthand. I also recognize that research is like a photograph of a flowing river, and that picture of one river doesn’t look the same as every river in every location. The best advice? Talk to your buyers, customers and others like them.

Then, you can use, where it makes sense, lower-cost ecommerce models, Digital Solution Rooms, decision-supporting content, on-demand content, searchable FAQs and inside sales personnel. It can also guide you to know when and how to establish deeper sales and expert guidance, or even to use a sales role as an orchestrator to guide the buyer through their journey and pull in the right resources at the right times.

Next Steps

To the original point for this article, hopefully, it’s clear that one size does not fit all. My friend Mike Marks is fond of saying that if you’ve seen one sales transformation, you’ve seen one. That doesn’t mean there aren’t patterns and similarities, but to get the best results, you need to figure out what’s right for your company, with your buyers and customers, in your situation.

That’s it for this post. If this helps you in any way on your journey toward improved sales effectiveness, feel free to let me know. I’d enjoy hearing about your successes.

Mike Kunkle is an internationally recognized expert on sales enablement, sales effectiveness, sales training, sales coaching, sales management, and sales transformations.

He’s spent over 30 years helping companies drive dramatic revenue growth through best-in-class enablement strategies and proven effective sales systems.

Mike is the founder of Transforming Sales Results, LLC where he designs sales training, delivers workshops, and helps clients improve sales results through a variety of sales effectiveness practices and advisory services.

He collaborated to develop SPARXiQ’s Modern Sales Foundations™ curriculum and authored their Sales Coaching Excellence™ and Sales Management Foundations™ courses.

Mike's book, The Building Blocks of Sales Enablement, is available on Amazon, with others coming soon in 2026, starting with The CoNavigator Method for B2B Selling.

2 thoughts on “One Size Does Not Fit All: Stop Force-Fitting Sales Model, Process & Methodology”

As is often the case Mike, I find myself having to lie down when I read your posts to prevent myself from getting whiplash from violently shaking my head in agreement. I’d like to think that the oversimplification of various sales topics in popular business books is the result of the naivete or lack of experience of the authors, but too often I think it is the result of trying to rush from Point A (I see a sales “problem”) to Point B (I make bank by writing a flashy book, doing seminars, becoming a “thought leader”).

I LOVE the quote by Mike Marks!

Thanks, Kurt! Watch out for that whiplash!