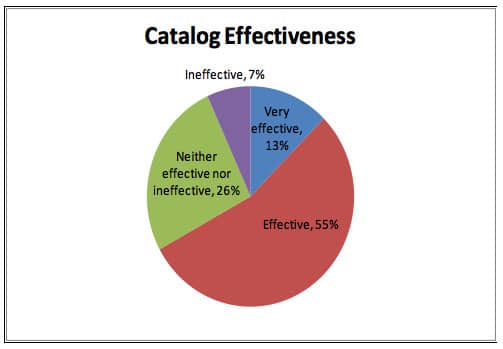

Distributor measurements of effectiveness primarily include return on marketing investment, customer retention and lifetime value, and secondarily include share of wallet and internal rate of return. Furthermore, nearly 80 percent of distributors have gather customer feedback on catalog effectiveness.

While e-commerce is rapidly expanding reach and gaining widespread usage among industrial buyers, it is not completely replacing print catalogs. As noted by one mid-market distributor: “Print will be dead when people stop reading. Not everything works well on a desktop, laptop, tablet or phone!” There appears to be a need for both channels and the challenge for distributors is to ensure that there is a synergistic effect generated with these marketing vehicles.

This research was conducted by Distribution Strategy Group in conjunction with Modern Distribution Management. The research performed included an online survey taken by 170 participants across a variety of distribution sectors. There was heavier participation from industrial, electrical/electronics, building, safety, hardware, and HVACR. Over half are small distributors with less than $50M revenue, over 30 percent are mid-market with $50 million to $500 million revenue, and 15 percent large with more than $500 million revenue.

Catalog Use and Purpose

Catalogs provide a different value for customers than e-commerce and although there is overlap with e-commerce websites, there remains enough differentiation between these two channels that one cannot replace the other. Buyers use catalogs in a number of situations:

- When no computer is available: Product specifiers or users are not always in a position to jump on a computer to research potential suppliers.

- When comparing multiple distributors: It is easier to flip through relevant pages of two or more catalogs to make quick product comparisons.

- In conjunction with the Web: Users when on a supplier website often like to page thru a supplier catalog to help them better navigate and research alternatives.

Catalogs are a branding tool, serving as a constant reminder of where buyers can source products. Catalogs sit on the shelf in a customer’s office or on a desk somewhere in the facility and when a product need arises, that supplier’s name is top of mind. This is especially true for low usage products.

Distributors who produce catalogs on a regular basis mostly target current customers rather than utilizing them as prospecting tools. A greater percentage of small distributors use catalogs for prospecting than do larger distributors. Smaller distributors are also likely to be more of a product specialist and thus have fewer offerings and smaller catalogs which provide better prospecting opportunities. Building materials and construction, hardware, pulp and paper, industrial, and safety are the most focused on current customers, not prospects.

Catalog Circulation and Publishing Frequency

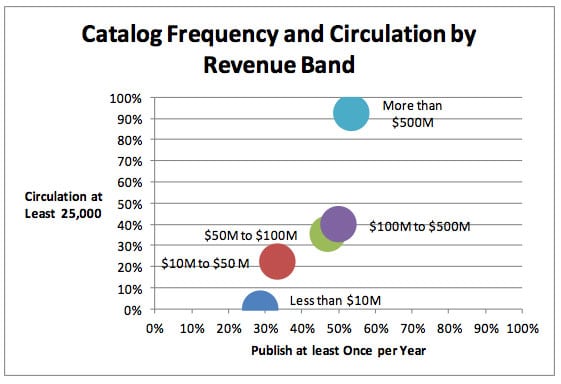

Surprisingly, our research also reveals that nearly 30 percent of distributors are not using catalogs as a revenue generator leaving room for competitors to win away their customers. As shown in Figure 2, only 60 percent of distributors publish a catalog at least once per year with a minimum circulation of 25,000. Among large distributors with $500 million or more in revenue, 20 percent do not publish any catalog. Fifty percent of mid-market and just over 30 percent of small distributors publish at least once per year. Naturally, catalog circulation is correlated with the size of the distributor. Small distributor catalog circulation is usually less than 25,000 except for companies that are focused exclusively on catalog marketing.

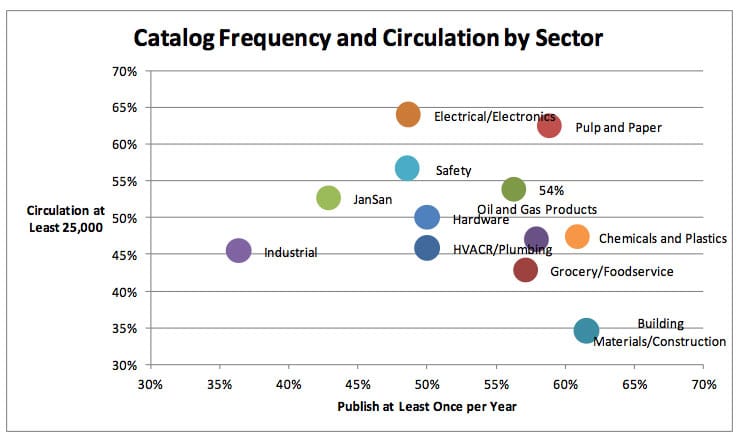

Within distribution sectors, electronics and janitorial were least likely to publish a print catalog, focusing instead on in-store and e-commerce, according to Figure 3. Distributors who compete in sectors where overall demand has been waning have the highest rates of catalog production frequency. These markets have been depressed, and distributors want to do all they can to gain market share. Additionally there is a correlation with the degree of competitor fragmentation and the frequency of catalog publication.

Those who abandoned catalog efforts said they did so for two primary reasons:

- Belief that e-commerce would make catalogs entirely obsolete. The “print-is-dead” mantra began with the advent of e-commerce in the late 1990s. A number of companies who abandoned catalog marketing did so in the early part of the new millennium.

- Inability to measure catalog ROI to justify continued efforts internally and to suppliers. Companies who use imprecise metrics for marketing effectiveness are often hard-pressed to make a compelling case to suppliers for marketing development funds. Such companies view the catalog as a cost, not a profit center. When budgets get tight, they discontinue publication.

Attitudes about Print Marketing Vehicles

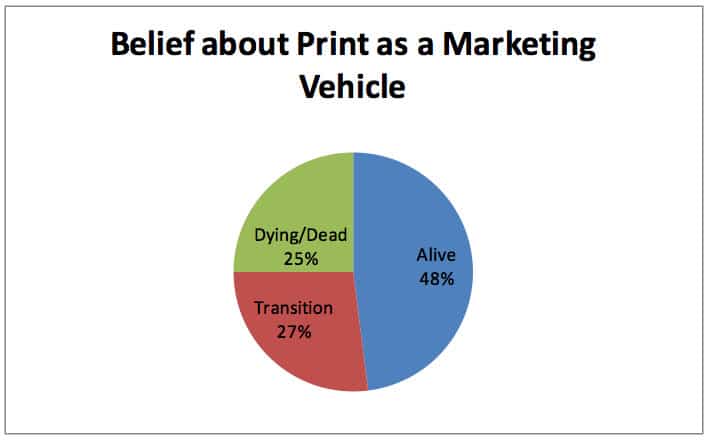

The survey showed that overall (see Figure 4) there is still confidence in print as a marketing vehicle with nearly half saying that it is still alive, and more than quarter saying print is in transition in a significant way.

There are several segments of those who believe that print is alive and well. Some believe it is a channel best-suited for MRO segments as an effective and useful purchasing tool. Others note the importance of print in a relationship-oriented sale where people use the catalog as a talking point or leave-behind collateral. Several of the large distributors commented on the synergy between print and digital. An executive from a large electrical distributor, wrote: “Print is NOT dead for our customer base. Demographics of our customers will keep print catalogs relevant for years to come. We need both print and online catalogs.”

The respondents who felt that print is in transition recognize it is declining overall due to e-commerce, but it is nevertheless here to stay. The transition may be as short as five years and as long as 20 years. For some, the transition is from full-line catalogs to mini-catalogs and specialty publications. One respondent wrote: “It is still necessary. However we are trying to train our customers to access online PDF versions of our catalog for more current information. This training will be ongoing until our customer base catches up with technology.”

Sentiments about the death of print as a marketing vehicle are typified in this comment from a very large distributor who said: “Print is dying, pieces are outdated as soon as printed, whereas anything and everything on the Web can be updated immediately.” Interestingly, the belief that print is dying or dead was correlated with neither the company size nor the sector.

Conclusion

While the frequency of and size of catalog publications is evolving, research for this article and our current experiences in distributor marketing make it clear to us that print catalogs for many parts of distribution are here to stay. We believe that for many companies, print catalogs are in fact underutilized. They can provide competitive advantage in many sectors if properly utilized. Coordination with e-commerce programs can provide even greater return on catalog efforts.

Jonathan Bein, Ph.D. is Managing Partner at Distribution Strategy Group. He’s

developed customer-facing analytics approaches for customer segmentation,

customer lifecycle management, positioning and messaging, pricing and channel strategy for distributors that want to align their sales and marketing resources with how their customers want to shop and buy. If you’re ready to drive real ROI, reach out to Jonathan today at

jbein@distributionstrategy.com.