Your top 10% of customers are covered by field sales. How are you reaching the other 90%?

The very largest of a distributor’s accounts (on average the top 5%) tend to make up 55% to 70% of a distributor’s revenue. They have massive buying power, and distributors typically offer them value-added services pro bono.

The next 5% – the “large accounts” – make up about 10% to 15% of revenue. These customers are valuable, as they tend to have several points higher gross margin than even the “very large accounts.”

This seems to hold true across distributors, no matter the sector. And these important customers rightfully tend to get the most attention from a distributor’s field sales team. In fact, most of a sales rep’s time is typically spent among the top 10% of accounts, with very little to no time spent with other accounts, even if they have more potential for growth.

But just as large accounts tend to have a higher gross margin than “very large” customers, small and medium-sized accounts have the potential to be more profitable than either of these groups. Medium-sized accounts typically make up about 10% to 12% of revenue, with 8% to 15% higher gross margin than “very large accounts.” And small accounts – about 75% of the total number – make up about 3% to 7% of revenue. (The size of an account refers to the customer’s spend with a distributor, not total revenue size.)

Sell More to Existing Customers

It’s no surprise that field sales reps tend to focus on the “large” and “very large” accounts, given their impact on a distributor’s top line. Assuming a distributor has done its due diligence and is serving those accounts profitably, it is the best place to apply a distributor’s most-expensive resource. But a lot of untapped value still lives within the remaining 90% of most distributors’ accounts. Most distributors would be reluctant to send a field sales rep after those, and for good reason. But there are ways to get at that value with an effective omnichannel approach, which is an integrated version of multichannel. Everything is linked from the pre-sale to post-sale and beyond.

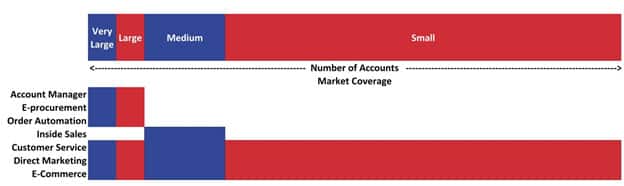

The benefit for a distributor is that a small or medium-sized account can be served far more cost-effectively. But for this to work, channel alignment is key. Field sales may serve large and very large accounts, which would also be supported by e-procurement and order automation. But for the remaining 90% or so of accounts, a lower-cost, lower-touch model is important. Medium-sized accounts with potential can be nurtured by a proactive inside sales force. And all accounts, including the small, can be served by ecommerce, customer service and direct marketing.

Strategically applying resources to the remaining 90% of a distributor’s accounts can create real value.

The Value Creation Opportunity: Medium Accounts

For example, if an outside salesperson has an account base of 50-75 accounts, chances are they are not paying attention to the accounts on the bottom of their list, spending close to three-quarters of their time on their 20 biggest accounts.

Those unattended accounts may be ripe for attention by a proactive inside sales team. Proactive inside sales refers to a team that is focused on outbound calls that generate more business, or employing active selling techniques with customers. They aren’t customer service reps. When targeting accounts with a proactive inside sales team, consider both current spend, as well as potential for growth. For example, if they are large in revenue size, but only purchase one category with a distributor, they may be a target for a proactive inside sales program.

One of the highest-return activities an inside sales team can do is to grow medium-sized accounts with potential. In additional to the growth opportunity, the cost to serve is significantly lower. A proactive inside sales team can complete more sales calls and extend sales coverage to accounts that don’t make financial sense for a field sales rep. Inside sales, for example, can reach 20 to 25 customers per day at $10-$12 per contact. That’s a tenth of the average cost of a field sales contact. Without those touches, these customers will either continue ordering what they always have from the distributor, or they will be picked off by the competition. A proactive inside sales force can focus on retaining and growing these accounts, connecting with customers to better understand their needs so they can cross-sell or upsell other products and services that could benefit them. These acorns could either grow into large field sales accounts, or solid and profitable inside sales accounts that still benefit the organization.

Applied to the right accounts, and for a relatively low cost, a proactive inside sales team can uncover a tremendous amount of value sitting dormant in medium-sized accounts.

The Value Creation Opportunity: The Bottom 75%

Smaller accounts are not going to get attention from field sales, and unless they have great potential, they should not be focus of a proactive inside sales team. In general, smaller accounts prefer to shop and buy through electronic channels. But without this knowledge, distributors tend to pass up these high-margin opportunities because they’re being missed by their traditional go-to-market approach.

But thanks to lower platform costs, better product data, and more know-how around e-business technologies, distributors can serve these customers more consistently, efficiently and cost-effectively than they ever have. For example, the cost per order with website ordering is significantly lower than with a field or inside sales rep, often $20 to $30 per order.

Beyond website ordering, distributors can gain great efficiencies through other e-business channels with their smaller accounts, including digital marketing such as marketing automation, Search Engine Marketing, local SEO, mobile apps and email order automation. Going digital makes any transaction more efficient and a distributor’s team more productive when they don’t have to re-key orders, both of which result in more gross-margin dollars.

It can also grow the top line. Even if a smaller account does not have an assigned distributor rep, with the right cross-sell and upsell functionality built into the website, for example, existing customers may grow their average order size. And marketing automation can deliver relevant offers to smaller accounts through email based on that customer’s online behavior, growing wallet share with that customer with very little touch from an actual person.

Make a Plan

Of course, growing higher-margin business with small and medium accounts is not as simple as just adding other channels to your mix. To determine what you need to meet your customers’ needs, start with customer research to learn how they prefer to interact with you throughout the shopping and buying journey.

Align channels with account size and potential. Reconsider your sales structure, shifting transactional activities in house with your Customer Service Reps, and reposition inside sales to play a more proactive role. Invest in digital methods in line with your customers’ needs (not everyone has to look like Amazon).

The field sales-driven model is quickly becoming outdated. Distributors that cling to that approach could limit their ability to sustain growth in the long-term and will miss out on high-margin opportunities across their customer base.

Jonathan Bein, Ph.D. is Managing Partner at Distribution Strategy Group. He’s

developed customer-facing analytics approaches for customer segmentation,

customer lifecycle management, positioning and messaging, pricing and channel strategy for distributors that want to align their sales and marketing resources with how their customers want to shop and buy. If you’re ready to drive real ROI, reach out to Jonathan today at

jbein@distributionstrategy.com.