In Part 1 of this series, we presented the results of an MDM survey about distributor marketing, focusing on the level of success they are currently having in their marketing efforts and to what extent they are deploying the various kinds of marketing vehicle (SEO, social media, e-mail, print and telemarketing). The overall trend we identified is that while distributors are slowly getting better at marketing, only a small portion (6 percent) can be classified as high performers. In Part 2 of the series, we explore two areas that distributors must improve on if they are to join that 6 percent and reap first-mover benefits:

Adjusting their marketing strategy and tactics in response to a generational shift in which millennials are already the largest age segment in the workforce and the following generation, Gen Z, is growing rapidly.

Targeting their marketing content to specific roles/personas and market segments.

Marketing to Millennials and Gen Z

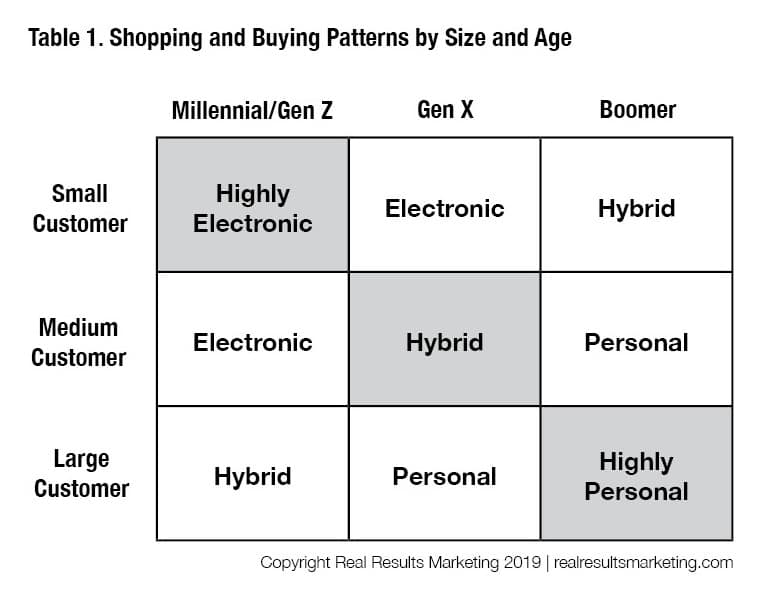

Our research with over 10,000 distributor customers reveals clear differences between age segments and customer sizes in how they shop and buy in a B2B setting. As shown in Table 1, for large customers shopping and buying tends to be more personal and involve more contact with field sales reps.

This is especially true for older customers. At the other end of the spectrum, small customers tend to be highly electronic in their shopping habits, and this is especially the case with younger generations. There are two main reasons for this:

Younger customers are more digitally oriented; and

Smaller customers may be classified as a house account and therefore receive little if any support from field sales.

In the middle of the spectrum are medium-sized customers. This demographic is a hybrid of more traditional personal interactions and digital purchasing.

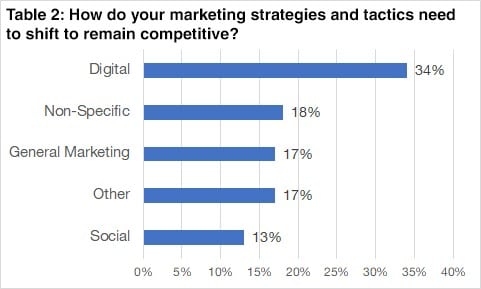

To better understand how distributors are thinking and responding as the demographics of their customer base change, we asked the following question: “As we approach the next decade, in which millennials and Generation Z become the dominant portion of the workforce, how do your marketing strategies and tactics need to shift to remain competitive?” The results are listed in Table 2.

Almost half (47 percent) stressed the importance of digital or social media; 17 percent cited their general approach to marketing; and 18 percent gave non-specific answers that indicated their company has given little thought to how to adjust their marketing efforts for millennials and Gen Z. These companies will be at a competitive disadvantage moving forward.

espondents were also able to provide verbal responses to the question. One emphasized the need for a hybrid approach: “Change the approach from 100% person-to-person selling to using more electronic media to contact and keep new customers.” Another said: “We have moved all of our marketing to digital tactics.”

Others cited a broader marketing approach that encompasses the nature of the content as well as the vehicle for it and stresses the need for brevity, as illustrated by various concise responses such as: “Relevant.” “Timed.” “Informative.” “Short.” “Targeted and relevant content.” “Personalization.” Overall, the variety of responses shows that the requirements for any particular distributor depend on the customer base. It is not one size fits all.

One respondent made what we believe is a crucial observation: “An obvious response centers on understanding and selecting the right touchpoints: Digital? Of course. Social media? Probably. A not-so-obvious response is to understand their definition of value. How is it evolving? What does a supplier need to do to fulfill it?”

This point is critical as companies begin to serve the younger generation. What millennials and Gen Z value may be very different from what their Boomer colleagues value. Innovative distributors are learning to listen more carefully to what is most important to younger generations. There is no substitute for getting the voice of those customers when formulating strategy.

Targeted Marketing: Roles and Personas

The objective in targeted marketing is to deliver content that is more relevant to the recipient rather than sending the same content to everyone. Distributors that want to do targeted marketing must start with a good customer database that is stored in a CRM system. An effective customer database also requires ongoing maintenance.

This includes gathering additional or updated information on existing contacts as well as cultivating and acquiring new ones. Ideally, a marketing automation system should be used to facilitate the creation of multiple groups or segments within the customer database. The goal is to be able to target customers by specific role or function in an organization, such as purchasing or operations, as well as to target customers by company segment, such as construction or manufacturing.

There are three key benefits of targeted marketing:

Those who receive effective marketing material are more likely to respond and make a purchase. Even a slight increase in the purchase rate usually creates a significant return on investment in customer segmentation.

The opt-out rate for e-mail or marketing automation goes down because the customer is getting fewer and better communications that are tailored to what they care about.

Targeting a smaller portion of the customer base reduces the variable cost of the campaign for print and e-mail because there is typically an incremental cost per recipient with these marketing vehicles.

We asked our survey respondents two questions related to roles:

Do you market specifically to roles or personas within a customer organization? These roles could include buyer, user, executive management, designer, etc.

Describe what you are doing that is specific to marketing to roles or personas.

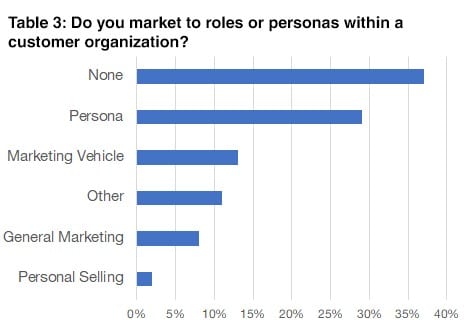

As shown in Table 3, well over a third (37 percent) of respondents are doing nothing specific regarding marketing to personas, though a few mentioned that they have done targeting by industry segment rather than by persona. At the other end of the spectrum, a small number (2 percent) described one-to-one personal selling as a way to tailor content for specific customers; however, that is not really a marketing approach and is not scalable to large customers.

About 13 percent referenced the marketing vehicles they use to deliver targeted content, including e-mail, web, marketing automation, print and display advertising, and 8 percent answered in general terms without mentioning anything specific about personas or targeted marketing. Less than a third (29 percent) said that they are doing something specific with targeting by persona or role.

Overall, there is a good correlation between companies that are high-performance marketers and those who are making the effort to do targeting. One respondent said: “We try to shape the email message to the role; e.g., [for] purchasing we’ll talk about the ease of the transaction; [for] operations we’ll talk about automation to ease labor shortages.” This company is doing a good job of emphasizing different aspects of their value proposition to the recipient. Another said: “At times, we layer in industry focus and role/function focus. This comes across as imagery, highlighting the targeted industry. Then the message is tailored to match what we believe [are] the trigger points for the audience.”

Distributors tend to know their customers better than any other channel and to offer a more personable alternative to huge corporations. Much of this reputation has been built over decades on the field-sales model. But if you’re not adapting your offering to the next generation or taking the time to get to know the people within your customers’ organizations by persona or role, your marketing efforts may fall flat in the long run.

Just as crucially, the buying and shopping habits of millennials – and Gen Z – must play a part in how you structure your go-to-market strategy. Based on the results of this latest survey, many distributors are not yet thinking in these terms, providing some first-mover advantages to those distributors that act now.

About This Survey

This research was conducted by MDM and Distribution Strategy Group through an online survey taken by 266 participants across a variety of distribution and manufacturing sectors. There was higher participation from industrial, safety, electrical, electronics, building materials, oil and gas, HVACR/plumbing and hardware. Other participating sectors included janitorial, pulp and paper, chemicals and plastics, grocery/foodservice and pharmaceutical. Nearly 50 percent of respondents were small companies with less than $50 million revenue, more than 40 percent of respondents have $50 million to $500 million in revenue and the remainder have more than $500 million revenue.

Originally published on MDM.com.

Jonathan Bein, Ph.D. is Managing Partner at Distribution Strategy Group. He’s

developed customer-facing analytics approaches for customer segmentation,

customer lifecycle management, positioning and messaging, pricing and channel strategy for distributors that want to align their sales and marketing resources with how their customers want to shop and buy. If you’re ready to drive real ROI, reach out to Jonathan today at

jbein@distributionstrategy.com.