Amazon continues to build share into traditional distribution channels. Their obsession for the customer experience raises the bar high for suppliers – distributors and manufacturers – whether you sell through them or not.

According to a Distribution Strategy Group survey of distributors, the percentage of distributors deriving more than a tenth of total revenues from e-commerce grew from 34 to 41 percent in 2017. In this article, we explore survey findings on how distributors are using Amazon as a sales channel, types of products sold and ways in which Amazon may be a threat.

Key takeaways include:

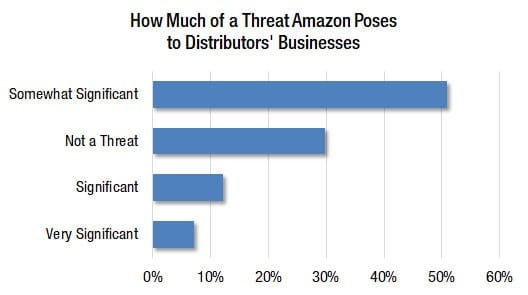

- More than two-thirds of distributors surveyed view Amazon as a threat.

- More than a quarter of distributors polled said they sell, or are willing to sell, all the products they carry on Amazon.

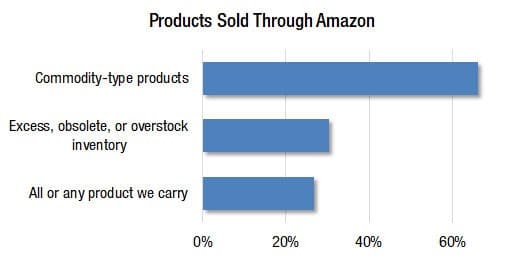

- Two-thirds of distributors in the survey selling on Amazon sell commodity-type products and 30 percent use the platform to sell excess and obsolete inventory.

- You must understand customer expectations regarding how they want to shop and buy; then align your capabilities with those expectations.

Key Activities with Amazon

Amazon continues to build share into traditional distribution channels, according to our 2018 survey data. This is the first time we’ve included specific questions on usage of Amazon Business in our annual distribution e-commerce benchmarking series that we’ve conducted in partnership with Modern Distribution Management for the past seven years.

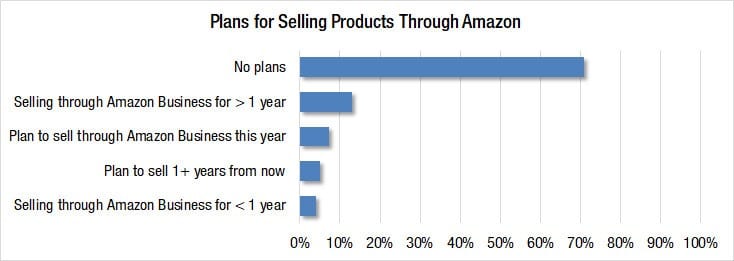

Respondents were asked to identify their involvement with Amazon Business. More than 70 percent indicated they had no plans to sell through Amazon Business, while more than a quarter of distributors in the survey said they sell, or are willing to sell, all the products they carry through Amazon. A larger percentage of distributors are willing to use Amazon Business selectively as an inventory management strategy.

Among distributors selling or planning to sell on Amazon, 45 percent of respondents have been selling there for more than a year; 14 percent began selling through this channel less than a year ago; 25 percent indicated they are planning to sell through Amazon this year and another 17 percent said they are planning to sell through Amazon more than a year from now.

Distributors were asked to identify the types of products sold on Amazon (Figure 2). Two-thirds said they were selling commodity-type products that require little explanation or configuration. An example would be basic personal protection equipment such as safety googles. These product types are ideally suited for an e-commerce site and do not require complex explanation or configuration.

There has been significant discussion on how to manage the impact that Amazon has on distribution channels. This report examines the survey responses of nearly 300 distributors and manufacturers to gain a baseline understanding of how suppliers are using and thinking about Amazon (see end of article for survey details). Based on these data points, we identify recommendations on how to move forward.

Just under a third of distributors using Amazon said they sold their excess, obsolete, or overstock (E&O) items on the market place. Obsolete items often have the advantage of no longer having a minimum advertised price (MAP) requirement, allowing the distributor to price these items lower than list price for a quick sell.

The other advantage with using Amazon to sell E&O products is that the potential market is much larger than a distributor’s traditional channels. One distributor commented, “It’s a great way to get rid of dead inventory for a much higher price and with less effort than selling to contractors.”

Slightly fewer distributors (27 percent) said they sell, or are willing to sell, all the products they carry on Amazon. Distributors in this category have told us they want to jump start their e-commerce initiative; placing products on the Amazon platform reaches eyeballs they simply couldn’t get through other methods.

One thing to note is that companies do not always list products to sell on Amazon under their company brand. In some cases, a separate entity is created to minimize potential customer/channel conflict. In other situations, a third-party company either buys E&O product, or the products are sold in a consignment-type arrangement. Some distributors find they do not have the time or personnel to address or adhere to Amazon’s fairly stringent guidelines. A third-party organization that specializes in these transactions could be a good choice in those situations.

(In 2018, there are an increasing number of consulting firms – often ex-Amazon employees – providing strategic advice, guidance and resale services for optimizing sales results through Amazon Business.)

Pros & Cons of an Amazon Relationship

As with any channel and market opportunity, there are pros and cons. While some distributors see Amazon as a threat, others see it as a way to increase sales by expanding into markets and customers they would normally not have access to. Distributors in our survey pointed out challenges of working with Amazon as a channel partner. One distributor summarized a common theme with this comment: “Expensive fees and a heavy-handed returns policy deter us from putting much volume through this channel.” There were also many comments around the process of getting products listed and following through with Amazon being time-consuming and rigid. The flip side is that the rigid process results in a more consistent customer experience.

Some distributors noted that selling through Amazon opens up a huge market and exposes them to customers they wouldn’t normally reach. One distributor commented: “Amazon Business increased our overall sales significantly.” As identified above, using this channel to move E&O products can be effective.

About twice as many distributors (70 percent) surveyed felt that Amazon posed some level of threat versus those not seeing a threat (30 percent). Figure 3 breaks out how distributors characterized the threat levels.

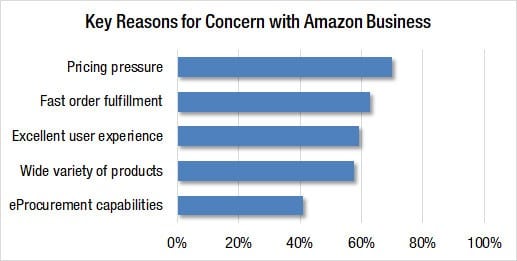

Beyond that basic positioning, we also wanted to find out more specifically the areas where distributors felt concern about Amazon’s industry presence. Pricing was the top pick (70 percent), with “fast order fulfillment” coming in second at 63 percent. Close behind were “excellent user experience” (59 percent) and “wide variety of products” (58 percent). (Figure 4)

This data highlights the importance of understanding your customer base. As our research has shown in our updated report, What Customers Want – 2nd Edition: A Distributor’s Guide to Customer Buying & Shopping Preferences, there can be significant differences in how customers shop, or research/find products versus how they buy.

The key reasons for concern distributors express here are actually good reasons to take a cue from Amazon. Our individual online expectations regarding overall customer experience have evolved over the years in large part due to Amazon’s zeal to continually raise the bar. While the variables above are identified as threats to distributors, they should be viewed as opportunities. Customers expect fast order fulfillment, an excellent user experience, etc. Knowing what your customers expect provides a guide for how to invest in your e-commerce experience.

Moving Forward

In MDM’s ongoing analysis of Amazon Business, Ian Heller has advocated for distributors to “be like Amazon – not so much in terms of matching their capabilities, which no company can do – but in terms of matching their obsession with meeting customer needs.”

There are other ways that a pure online seller such as Amazon can’t match the capabilities of most distributors. Those distributors with branches, for example, provide a valuable way for customers to pick up product immediately. Distributors have other ways to differentiate, such as vending machines, emergency delivery, providing superb technical support and other value-added services. Our advice is to build a successful distributor multichannel strategy by first understanding customer expectations, then crafting a value proposition and your organization’s capabilities to meet those needs.

Understanding your customer’s experience is a critical foundation for improvement. Do you clearly understand what the shopping and buying process is like from a customer’s perspective? Shop from your own company’s branches and website; do mystery shopping if needed. Document the experience, including confirmation emails you receive. How does that process compare to your key competitors’? How can you improve and evolve if you really don’t know what customers experience from their perspective?

E-procurement capability is increasingly critical for larger companies and digitally sophisticated mid-sized organizations. While the number of customers using e-procurement may not be high today, it will grow. If you do not have that capability, you miss out on revenue from that growing segment. Amazon promotes e-procurement with more than 70 different purchasing systems (Ariba, Coupa, etc.). Amazon is developing a strong e-procurement platform for large companies to provide a very user-friendly experience that, once implemented, is difficult to displace.

Amazon has a history of transforming entire industries – the book selling industry today is radically different than just a decade ago. Those transformations are made by understanding customers deeply and the gaps in the industry dynamics they can fill. The company’s history is to invest to gain share by continuing to deepen its understanding of customer needs. They then make changes – sometimes radical – to keep making it incredibly easy to do business with Amazon.

What our research validates is that it’s not the case on the other side of the table. Amazon’s obsession for the customer experience raises the bar high for suppliers – distributors and manufacturers – whether you sell through them or not. The same strict policy for sellers that the suppliers in our survey complained about are a function of Amazon’s deep commitment for an unprecedented level of customer responsiveness in the areas they can engineer.

But that doesn’t mean distributors can’t win – we believe they can. In fact, as you craft a strategy to develop e-commerce capabilities, we believe Amazon’s service levels are a critical benchmark not for replicating their value proposition, but rather identifying where you can clearly differentiate and orient your own unique successful strategy.

About this research

This research was conducted by Distribution Strategy Group, Boulder, CO, in partnership with MDM. The research included an online survey taken by 298 participants across a variety of sectors. Of those who provided identifying information, 67 percent are distributors and 33 percent are manufacturers. There was heavier participation from industrial, safety, electrical, building materials, janitorial, oil and gas products, HVACR/plumbing and hardware, power transmission/ bearings sectors. Other participating sectors included chemical and plastics, pulp and paper, chemicals and plastics, grocery/foodservice and pharmaceutical. About 44 percent of respondents are small distributors with less than $50 million in revenue. About 31 percent are mid-market with $50 million to $500 million, and 15 percent are large with more than $500 million revenue. The remaining 10 percent did not disclose their revenues. About 22 percent are primarily focused on MRO, 12 percent are focused on OEM customers, 28 percent serve trades/contractors, 23 percent are an even blend of MRO and OEM, and 15 percent are in other categories.

Want to share? Download the PDF of this article.

Dean Mueller is Independent Consultant at Distribution Strategy Group. He has more than 30 years of experience in sales and marketing and helps distributors build holistic digital strategies that drive a significant shift to online sales, improve profitability and grow customer satisfaction. Take your digital strategy to the next level. Contact Dean at dmueller@distributionstrategy.com.