In wholesale distribution, the buying process isn’t always as clear-cut as we think it is. And it’s not just one process. There are two distinct buyer’s journeys that every sales leader needs to understand and operate when they apply to their company:

- The Supplier Selection Journey: This is the more transactional path. A customer who needs supplies to use or resell evaluates suppliers, selects one (or several), places an order, uses the products, and eventually reorders. It’s a repeatable process loop, and today it is sometimes self-service and increasingly digital.

- The Consultative Solution Journey: This is the more complex path. A customer is facing a challenge or hoping to capitalize on an opportunity. They need more than a product – they need a solution. It needs to be the exact right solution and may be a bespoke one. This journey involves deeper discovery, solution design (co-creation with the customer), a pilot, eventual implementation, and post-sale support.

Both journeys are valid. Some distributors only have one, but both may be happening in your business right now. And both require different sales models, motions, support levels, and enablement strategies.

Both journeys also follow simple Pre-Buying, Buying, and Post-Buying phases.

Here’s the key: they often start the same way. Whether it’s a simple quote request, reorder, or a strategic initiative, the initial stages of Awareness, Interest, and Consideration look remarkably similar. That’s why I’ve started to recommend a blended, high-level buyer’s journey to guide early engagement – and then branch into the appropriate path or deepen the process specifics, as the opportunity unfolds.

Let’s unpack how this works in practice.

How Opportunities Enter the Pipeline in Distribution

In distribution, opportunities don’t follow a single path into your pipeline, do they? They emerge from a variety of sources, each with their own dynamics, expectations, and sales motions. You have segmented your buyers (buyer personas and archetypes) and established sales models or channels already. If not, that is the best place to start. Understanding your buyers and these various entry points is critical for aligning your sales process and resources effectively.

Inbound Orders via Inside Sales or Customer Service

Many opportunities begin with a phone call or email to your inside sales team. There is a wide variance among companies, but in distribution, this function often looks more like customer service than traditional sales. These reps are reactive – responding to requests, checking inventory, quoting prices, and processing orders. But don’t underestimate the strategic potential here. These interactions are often the first signal of a need, and they can be the gateway to deeper engagement if handled well. Well-trained and coached inside sales teams can upsell, cross-sell, and deliver significant value to their customers, as well as your bottom line.

Ecommerce and Self-Service Channels

Some customers, especially younger generations, prefer to bypass human interaction entirely or as much as possible. They tend to be price buyers (an archetype) who know what they need. They log into your portal, and they place an order. This is the purest form of the supplier selection journey. It’s fast, efficient, and increasingly preferred by buyers who value convenience without a value-added service model (and the increase in price that accompanies it). But it also means your digital experience must be seamless, and your product data must be accurate and compelling. For your company’s benefit, you should also analyze the buying habits and patterns of these accounts to seek opportunities that may benefit both you and your customer.

Outbound Prospecting by Account Executives

In more competitive or growth-focused scenarios, opportunities are created through outbound efforts. Account Executives (AEs) reach out to prospects with the goal of taking market share from competitors (new business development). These are often consultative sales, where the AE identifies a problem that the prospect may not even be fully aware of, and positions a solution that delivers measurable value. But if the volume is large enough, it can apply to supplier selection and transactional flow business, as well.

Referrals and Word of Mouth

Referrals are still one of the most powerful – and often underleveraged – sources of new business. According to a 2023 study by The Brevet Group, 91% of customers say they’d give a referral. In stark contrast, only 11% of salespeople ask for referrals. Whether it’s a satisfied customer, a supplier partner, or a channel ally, a warm introduction can accelerate trust and shorten the sales cycle. These opportunities can fall into either journey, depending on the nature of the need.

Account Growth by Account Managers

Your existing customers often represent your biggest growth opportunity at the lowest cost. New business development certainly can be lucrative (and it’s always fun to steal market share from competitors), but it takes more effort and time to establish a new relationship, as well as to pursue and win the opportunity. As a friend of mine says, “Don’t hear what I’m not saying.” You absolutely should do new business development (most distributors don’t do it enough), but your account base is a goldmine.

Account Managers (AMs), who know their customers well can identify gaps between what the customer is buying from you and what they’re buying overall. Since they’re buying these other products somewhere, this is another way to increase market share at your competitors’ expense. Through upselling and cross-selling, AMs can expand wallet share and deepen relationships. These efforts may start as transactional but can evolve into consultative engagements as new needs emerge. Combined with outbound prospecting for new business, both represent a wonderful opportunity to take market share from competitors.

Each of these entry points requires a different level of support, from light-touch digital interactions to full-on strategic account management. That’s why a one-size-fits-all sales process doesn’t work in distribution (or anywhere else). You need a flexible framework that adapts to the customer’s journey – not the other way around.

The Full Lifecycle: From Status Quo to Strategic Partnership

Once an opportunity enters the pipeline, the path it follows depends on the type of need. Let’s look at how the two journeys unfold.

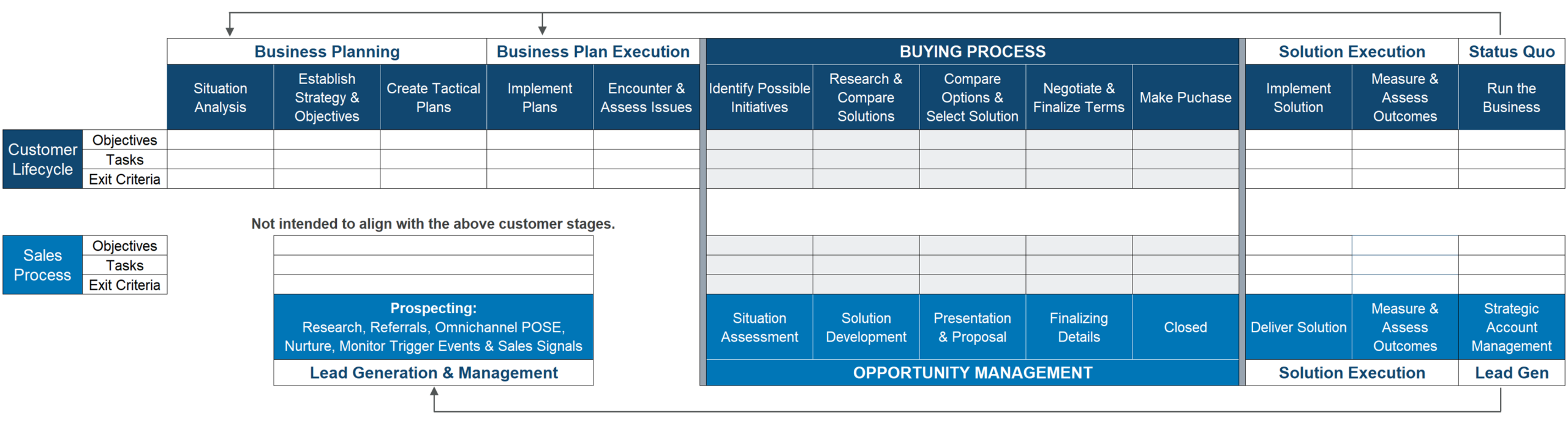

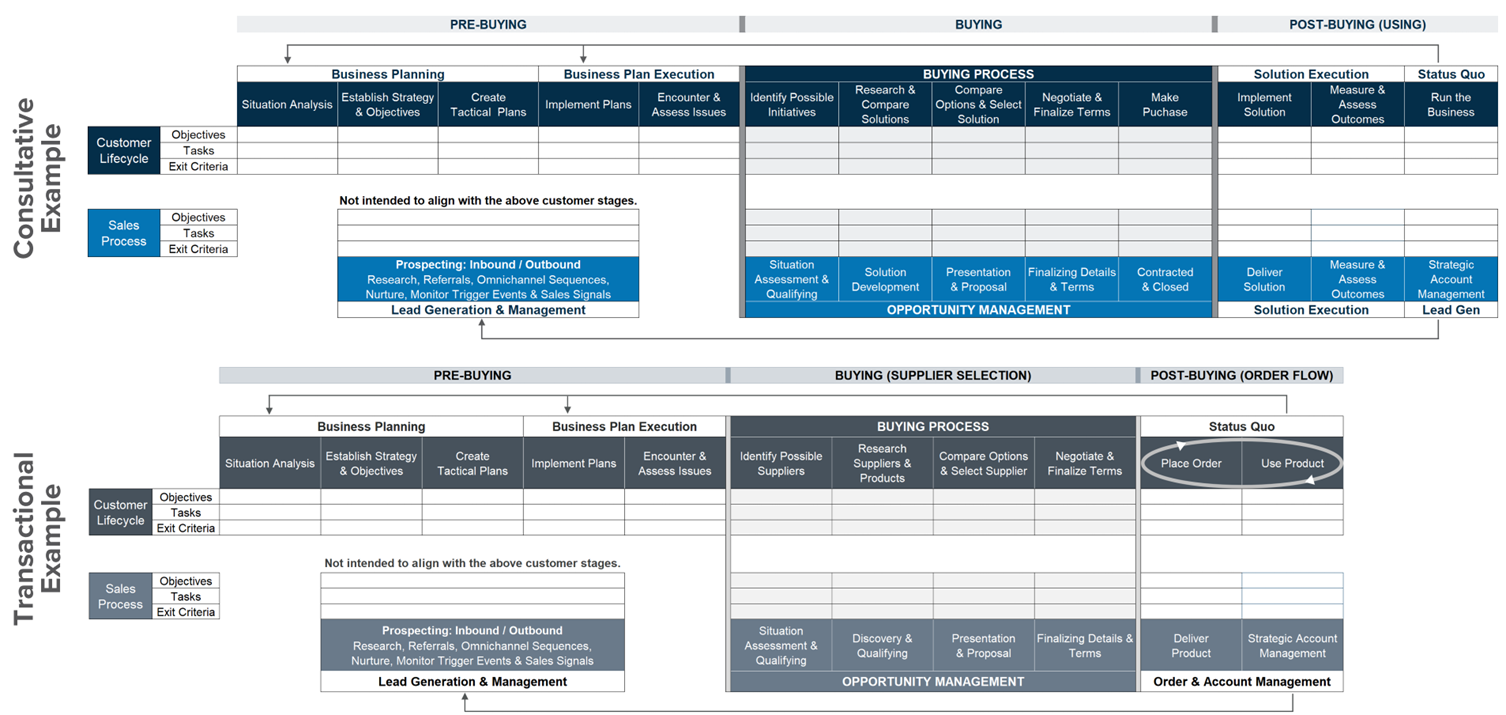

The Consultative Buyer’s Journey (Solution Selection)

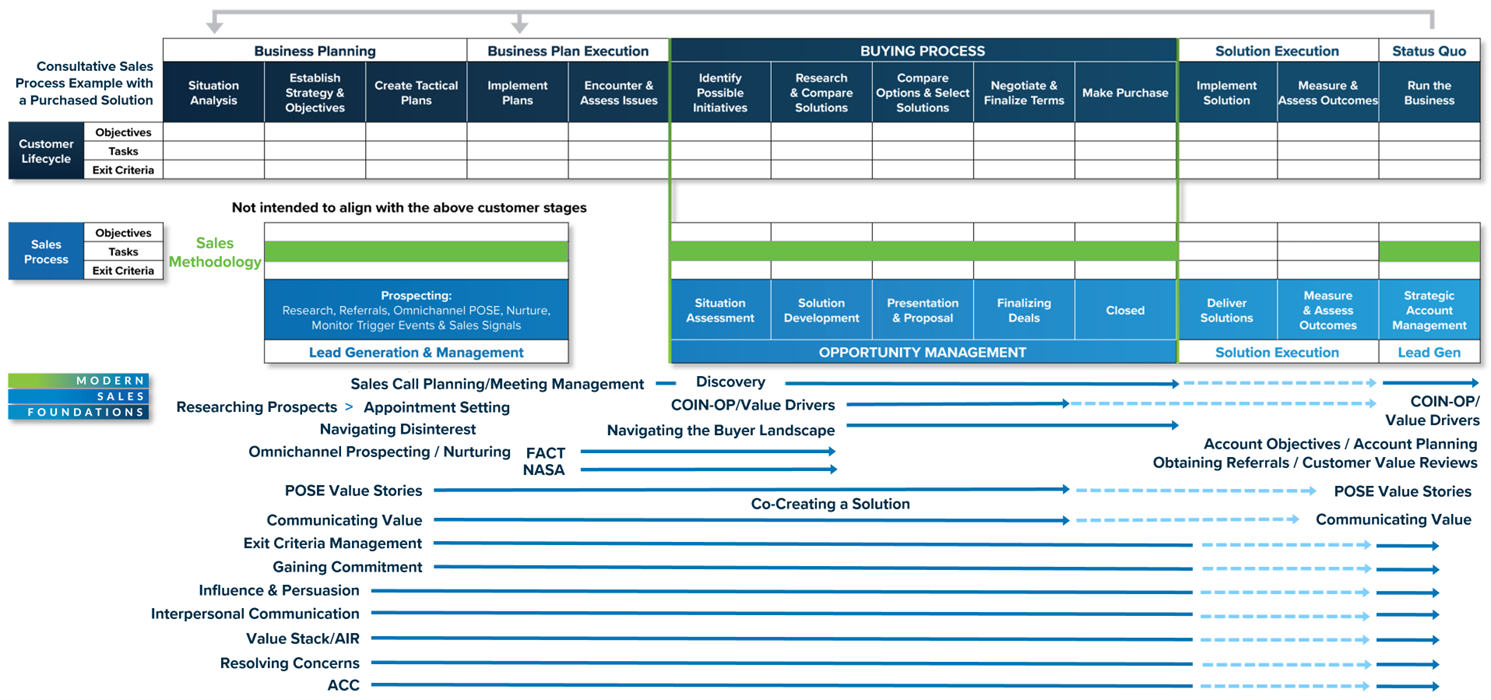

This journey begins when a customer recognizes a challenge or opportunity and wants to solve it (challenge) or capitalize on it (opportunity). It’s not about buying a product – it’s about achieving an outcome. The above image is just one example. Click the image to view a larger version. Here’s how it typically unfolds:

- Status Quo: The customer did their strategic planning and is executing their tactical plans, aka running their business. This is “business as usual.”

- Encounter & Assess Issues: They begin to encounter issues with their plan progress and start to assess what’s happening and why.

- Research & Compare Solutions: When the issues are considered serious enough, they define objectives and start exploring solutions. This could include you, your competitors, and/or an internal DIY project.

- Compare Options & Select Solution: They compare options and evaluate providers to find the best solution (although based on what they learn, DIY or status quo are often still on the table as options).

- Decision and Purchase: They select a solution and finalize terms.

- Implementation: The solution is deployed and integrated.

- Measurement: Outcomes are tracked and assessed.

This journey requires a consultative sales process that includes discovery, solution development, proposals, and post-sale support. It’s not just about closing the deal – it’s about delivering results.

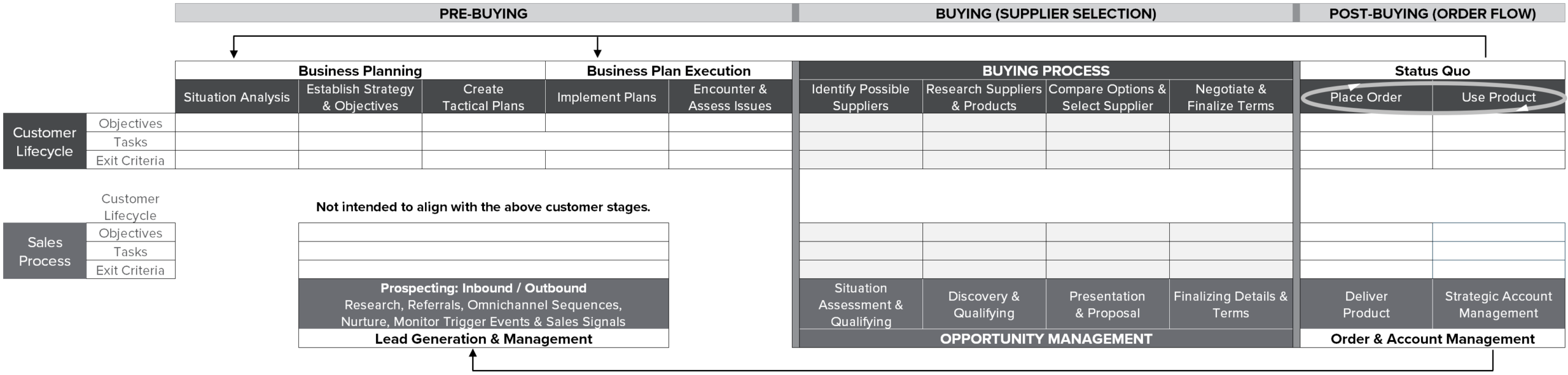

The Transactional Buyer’s Journey (Supplier Selection)

This is the more traditional path for many distributors. The customer knows what they need and is looking for the best supplier with the right price and the right level of service and support. The steps are similar in structure but different in intent. This is also just one example, and you can click on the image again to see a larger version.

- Status Quo: The customer is using a product or supplier.

- Encounter Issues: Something goes wrong. It could be a supply chain issue, a price increase, a bad service experience. (Or a salesperson helps them see a better possibility.)

- Supplier Research: They compare other vendors and products.

- Decision and Order: They negotiate terms and select the supplier.

- Usage and Reorder: They order, stock, use or resell, and reorder the product, as needed.

This journey is often supported by inside sales, ecommerce, or light-touch account management. The focus is on availability, pricing, terms, service, and ease of doing business.

Aligning the Sales Process to the Customer Lifecycle

To support both journeys, your sales process must align with the customer lifecycle. That means mapping your internal stages to the customer’s external experience.

These mappings help ensure that your team is doing the right things at the right time – and that your CRM, training, and enablement programs are aligned with how customers buy.

I’ll start with a simplified view and move to a mode detailed version, so you get the full picture.

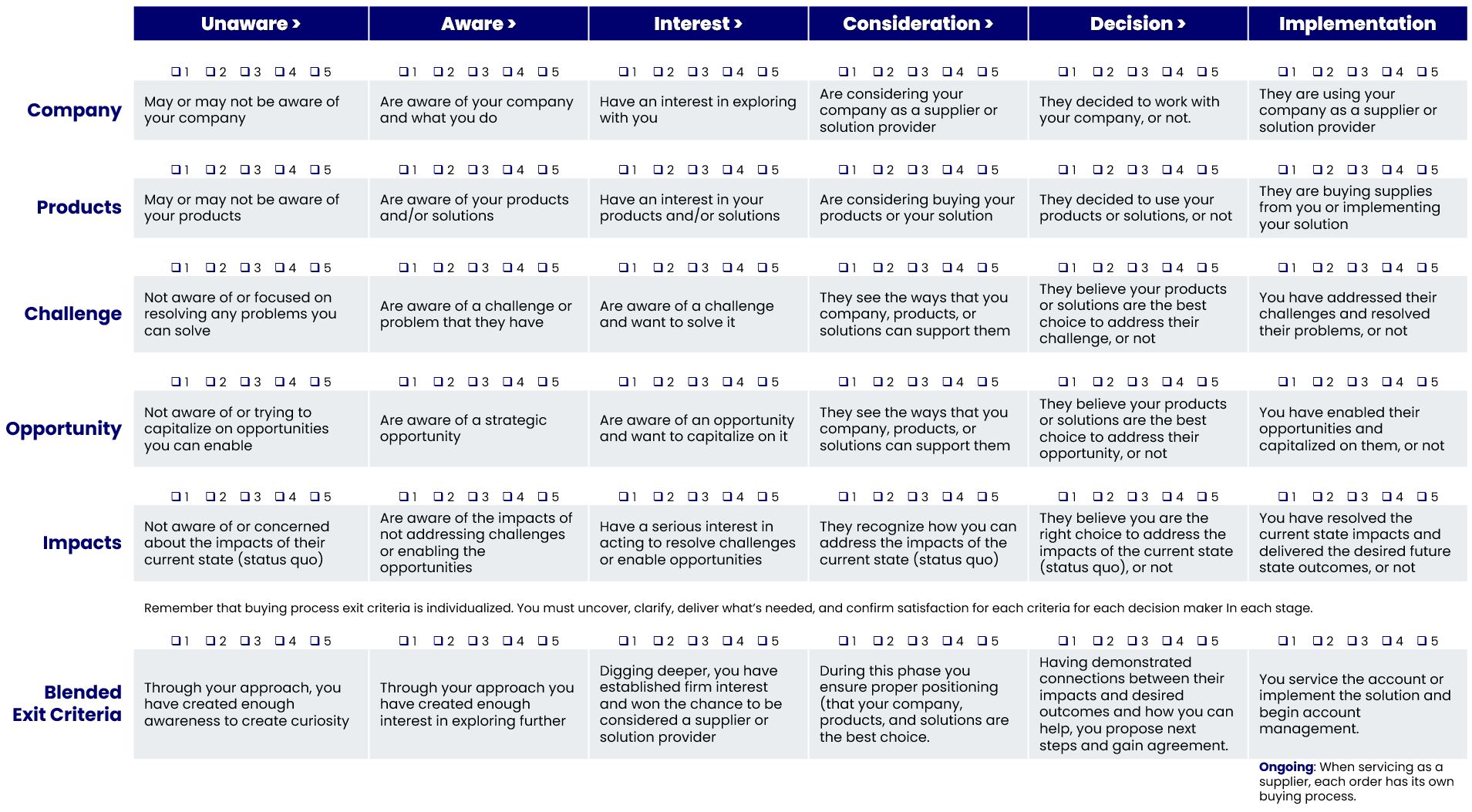

A Closer Look at the Simplified Buyer’s Journey

Because both journeys often begin the same way, I’ve started to recommend a simplified, blended buyer’s journey to guide early engagement. For those who haven’t done this work before, it’s less overwhelming and easier to get started. This model works across all customer types and entry points – from ecommerce to strategic accounts. It’s not where you want to be long-term, but it is a great starting point.

Let’s walk through each stage:

- Unaware: The customer may or may not know your company or doesn’t recognize a need. Your job is to create awareness through marketing, content, outreach, and education.

- Aware: They become aware of your company, your products, and especially the challenge they’re facing. This is where curiosity begins.

- Interest: Here, they show interest in learning more. This is your opportunity to engage, ask questions (conduct discovery), and begin qualifying.

- Consideration: Now, they evaluate you as a potential supplier or solution provider. Positioning and differentiation matter here.

- Decision: They choose to collaborate with you – or not. This is where your solution design/proposal, pricing, and trust-building efforts pay off.

- Implementation: They begin using your products or implementing your solution. This is where delivery, onboarding, and support take center stage.

Each stage has its own exit criteria. And each decision-maker may have unique needs. Your job is to uncover, clarify, and deliver what’s needed to move forward (with confirmation that the exit criteria was satisfied).

Here’s a more detailed version with a scale to allow you to rate how you’re doing at each stage. Click the image to view a larger version.

The above process framework doesn’t account for the fact that every process has stages, stages names, objectives per stage, tasks per stage, and exit criteria per stage for each decision maker. (Buying Process Exit Criteria is whatever each decision maker needs to see, hear, feel, understand, and believe in each stage of their buying journey, to feel comfortable moving ahead to the next stage with the salesperson). If you understand this and factor it in, you can make this simplified framework work for a while. But you will eventually want to expand to the full customer lifecycle (with the buying process in the middle) with your sales process aligned to it.

Please also remember that these images are examples and may or may not be relevant and accurate for your business.

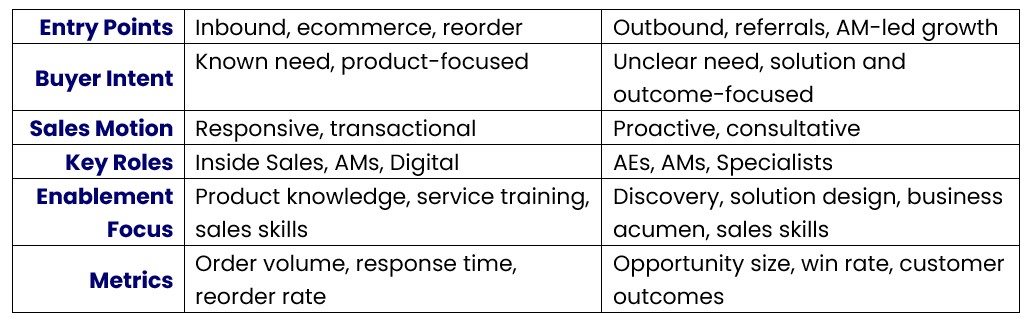

Role Clarity Across the Journeys

To execute these journeys effectively, each role in your commercial organization must understand where they fit and how they contribute.

- Inside Sales / Counter Sales / Customer Service: These sellers manage transactional orders, respond to inbound inquiries, collaborate with walk-in customers, and identify signals for potential upselling or consultative engagement. They are often the first human touchpoint and can play a pivotal role in identifying when a transactional interaction might evolve into a more strategic conversation.

- Account Executives (AEs): These sellers focus on outbound prospecting, competitive displacement, and consultative selling. They are responsible for identifying and developing new businesses, especially where a solution sale is required but displacing a competitor as a supplier. Their ability to uncover latent needs and position differentiated value is critical in the consultative journey.

- Account Managers (AMs): These sellers own the relationship for accounts. They may manage strategic accounts, key accounts, territory accounts, or house accounts. They manage reorders, identify growth opportunities, and work to evolve transactional accounts into strategic ones, where possible. AMs are often the bridge between the supplier selection and consultative journeys, especially when they recognize that a customer’s recurring purchases could be part of a broader solution. Strategies vary widely based on the account objective (grow, maintain, recover).

- Sales Engineers / Specialists: These subject matter experts support complex solution development and implementation, especially in the consultative journey, but in the initial product selection phase during a suppler selection journey. They bring technical depth and credibility to the sales process, helping to design and deliver solutions that meet specific customer requirements.

- Digital Channels: These channels serve self-service buyers and support the supplier selection and ongoing ordering journey with seamless ecommerce experience. They also play a role in lead generation, nurturing, and re-engagement through marketing automation, retargeting, and content delivery.

Sales Enablement for Dual-Path Journeys

Supporting two distinct buyers’ journeys requires more than a flexible sales process. It demands a thoughtful enablement strategy that equips your team with the right tools, training, and content for each path.

Here’s what that looks like in practice:

Process Clarity

Your team needs to know which journey they’re in – and how to navigate it. That means clearly defined stages, exit criteria, and handoffs. Use visual maps, playbooks, and CRM workflows to reinforce the process.

Messaging and Content

Equip your team with messaging frameworks that align with each journey. For supplier selection, focus on product specs, pricing, availability, and service. For consultative sales, provide insight-driven content that helps customers understand their challenges and envision a better future state.

Skills Development

Transactional selling requires discovery, speed, accuracy, and service orientation. Consultative selling demands deeper discovery, qualification, business acumen, and solution design. Train your team accordingly – and don’t assume one set of skills covers both. Some methodologies, like Modern Sales Foundations, can flex to manage multiple situations. Others cannot.

Tools and Technology

Your tech stack should support both journeys. That means ecommerce platforms, CPQ tools, CRM systems, and enablement platforms that can flex to different sales motions. Make sure your tools are integrated and easy to use.

Coaching and Reinforcement

Sales managers play a critical role in reinforcing the right behaviors. Use pipeline reviews, deal or account coaching, overall skills coaching, and win-loss analysis to help reps stay aligned with the journey they’re supporting.

A Practical Framework for Sales Leaders

To bring this all together, here’s a practical framework you can use to align your organization around the dual-path model:

Use this table as a diagnostic tool. Where are you strong? Where are the gaps? What needs to change in your process, training, or tools to better support both journeys?

Closing Thoughts

In distribution, there’s no single buyer’s journey – and no single sales process that fits all situations. You need to recognize the two distinct paths your customers take, segment your buyers (using personas and archetypes), understand how opportunities enter your pipeline, and align your sales model, process, and methodology to your customer lifecycle.

Start with the blended journey to guide early engagements. Take one step at a time.

Then, as you progress, shift into the deeper approach for the supplier selection or solution selection processes, and support them with the right sales model, motions, sales methodology, content, tools, and resources.

This is how you build a sales organization that meets customers where they are, adapts to how they buy, and delivers value at every stage.

Have you taken this journey already? Are you taking this journey now? Or are you considering it based on what I shared here? In either case, I’d enjoy hearing from you and learning about both your successes and challenges.

Mike Kunkle is an internationally recognized expert on sales enablement, sales effectiveness, sales training, sales coaching, sales management, and sales transformations.

He’s spent over 30 years helping companies drive dramatic revenue growth through best-in-class enablement strategies and proven effective sales systems.

Mike is the founder of Transforming Sales Results, LLC where he designs sales training, delivers workshops, and helps clients improve sales results through a variety of sales effectiveness practices and advisory services.

He collaborated to develop SPARXiQ’s Modern Sales Foundations™ curriculum and authored their Sales Coaching Excellence™ and Sales Management Foundations™ courses.

Mike's book, The Building Blocks of Sales Enablement, is available on Amazon, with others coming soon in 2026, starting with The CoNavigator Method for B2B Selling.