Logistics companies and European economies cannot catch a break. Just when it seemed like supply chains were starting to stabilize, and schedule reliability was improving, the latest attacks by Houthi on merchant shipping in the Red Sea have created another round of instability.

The Red Sea along with the Suez Canal is like a high-speed super-highway for shipping between Asia and Europe. Shipping through the Suez Canal accounts for roughly 15% of world trade and nearly 30% of all container movement.

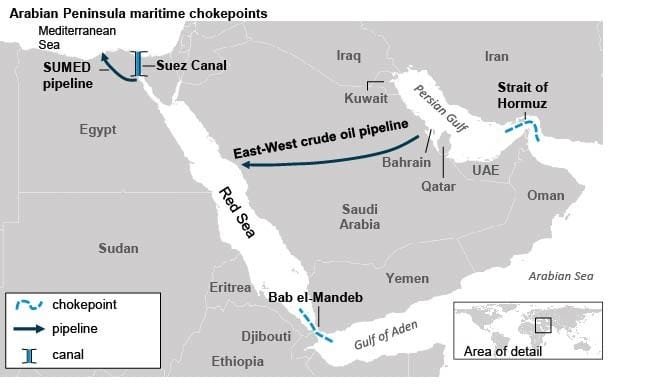

The Red Sea is a natural chokepoint for crude and natural gas movement. The East-West crude pipeline and the SUMED pipeline terminate in the Red Sea. The Bab el-Mandeb Strait is another chokepoint between the Red Sea and Gulf of Aden.

The passage through the Suez is vital to European economies because everything from palm oil, grain and jet fuel, among other things, passes through. In 2022, roughly 4.5bn cubic feet per day of LNG passed through the Bab el-Mandeb Strait.

The evolving crisis has had an immediate impact on trade and shipping. Some of the biggest carriers like Maersk, Hapag-Lloyd and MSC are all reacting to the unfolding crisis by diverting traffic around Cape of Good Hope. This is a non-trivial matter, since the route is at least 10 days longer and will cost between $1 million to $2 million more in fuel for routes originating in the far East and headed to Europe.

In addition to the longer shipping distance, the lack of crude refining infrastructure in the African region drives up the cost of fuel oil in the region. Furthermore, the maritime insurance risk premium has climbed from 0.03% before the onset of the war to over 0.3%, and expected to continue to rise if violence in the Red Sea escalates. To put in perspective, it can add over $1 million to the cost of container ship.

This has had a ripple effect through the entire supply chain including the availability and pricing of moving containers, since the re-routing of ships could decrease the availability of containers by 10%-15%. Drewry’s World Container Index spiked 61%. The cost of shipping a 40-foot container jumped from $1,661 on Dec 21, 2023, to $2,670 on Jan 4, 2024. To offset these rising costs, carriers have introduced surcharges on shipments in the region.

While the U.S. and other European nations have reacted to the crisis by initiating Operation Prosperity Guardian to protect commercial shipping in the Red Sea, there are some notable absentees from the coalition like Egypt and Saudi Arabia, which has cast some doubt on its likely effectiveness. CMA CGM Group has issued a notice of Force Majeure, suggesting they do not believe this is likely to be resolved very quickly.

Ultimately, consumers and merchants around the world are going to pay the price for this unfolding crisis as the inflationary implications of rising costs will be passed along to consumers. The risk of disrupting industrial production in Europe could have an effect beyond the shores of Europe.

G. 'Ravi’ Ravishankar is a faculty member at the Strategy, Entrepreneurship and Operations Division at the Leeds School of Business. He is a veteran of supply chain, lean transformation, implementing product innovation strategies and technology transfer from national laboratories.

His career has spanned a wide range of operating roles from president, CFO to engineering manager and director of innovation. He has worked in four continents on lean manufacturing, supply chain, logistics, product development, factory start-up, and business strategy. His industry experience includes, semiconductors, machinery, medical devices, food and beverage, chemicals, consulting and not-for-profit organizations.