In our first installment, we reviewed the need for full-service independent distributors to concentrate on managing value. The ability of the independent privately held firm to compete for the commodity sale is an uphill battle vs. large, well-funded ecommerce-leading companies.

Selling commodity products with basic services can be done much more efficiently online, and firms that offer basic services while transacting commodity products online are low-cost producers. They will succeed at the expense of firms who offer a full-service high-touch platform with limited value differentiation.

Added value, in the past, has been confined to services inclusive of inventory management, kitting, packaging, specialized delivery, etc. and are well-covered in prior literature.1 These services inclusive of integrated supply, VMI, vending machines, kitting, assembly, etc. are mature and, hence, marginal for differentiating the firm.

While the customer may want these services, they are ubiquitous and fail to differentiate value to any great degree. We advise distributors to drive unique value inclusive of consulting services that are fee-based product augmentation where the distributor controls the manufacturing/assembly process, and audit and process-based services that use advanced knowledge and experience.

These services often decouple value from the product whereas prior service value efforts have been connected to the products used by the customer. In addition, their financial return is measured apart from product sales that may or may not accompany their usage. They are dependent on advanced knowledge from experienced and highly educated managers; their provision is an investment and is not inexpensive. Done well, unique services benefit from concepts of the Service Life Cycle and Value Mapping. We cover these in the remainder of this installment.

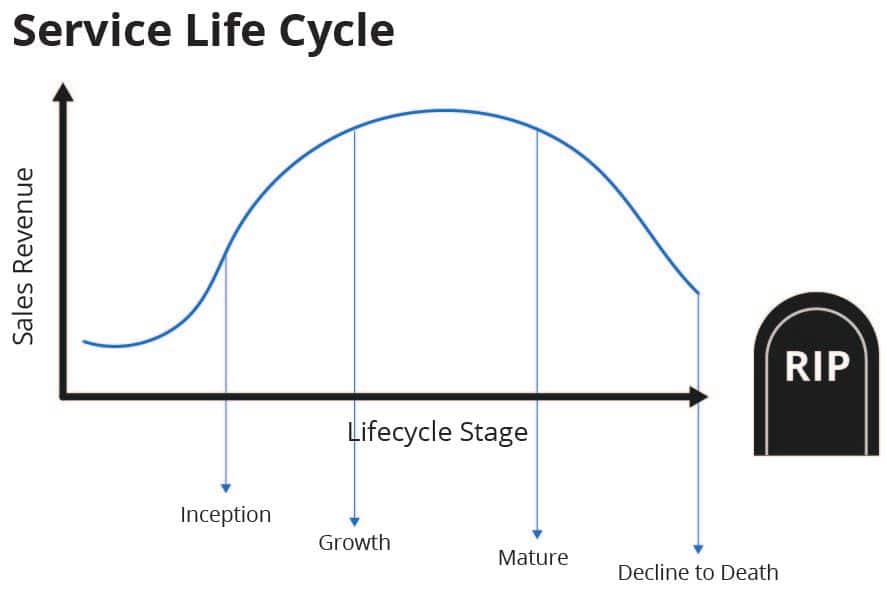

Service Life Cycle

Services, like products, have lifecycles. The lifecycle tends not to move as clearly or as fast as their product equivalent, however, services go through predictable stages and become mature, price-sensitive and commoditized. In the below graphic, Service Life Cycle is illustrated with the Y Axis of Sales Revenue and X Axis of Lifecycle Stage.

There are four common lifecycle stages (to the left of each descending arrow) including:

Inception: Beginning of lifecycle and where unique services are found. The investment for unique services is high and, typically, one in eight make it to commercial success.

Growth: Composed of unique and augmented services where there is noticeable growth and customer want of the service. An augmented service is a basic service that has special features. An example is kitting combined with vending machines.

Mature: The mature stage of the lifecycle is most often composed of basic services including extending credit, breaking bulk, warehousing, shipping, etc.

Decline: Finally, the decline stage of the lifecycle includes services are those that are increasingly less valued by customers including ordering of a commodity by phone where the customer would rather place the order online, EDI or with order recognition software.

The service lifecycle is often a glossed-over concept, considered too simple or too esoteric to be of use. For Value Management, however, the concept has significant use. We often find distributors mis-classify services and confuse their value to the customer. Examples include vending machines as unique services or CSR support as an augmented service. There are instances where vending machines can be growth services or CSR support augmented (consider product recommendation, etc.) but, for the most part, these services are mature or in decline. Hence, they have limited value differentiation.

Placing the service in the wrong part of the lifecycle gives a distorted view of the firm’s value. We often find where distributors overestimate their service value to the customer believing their services to be unique or augmented and less basic or in decline. The tell-tale signs of this include falling sales, falling margins, defecting customers and customers who demand price concessions. Properly defined, positioned and marketed services are financially profitable and customers realize their value. Done correctly, services support better financial performance and customer value realization leads to less price shopping and less unfunded demands.

Mapping Value

Creating a Value Map is important to get a 3D view of the value offerings of the firm. Without an understanding of the entirety of the value offering, it is easy to waste resources in the profitable improvement of value.

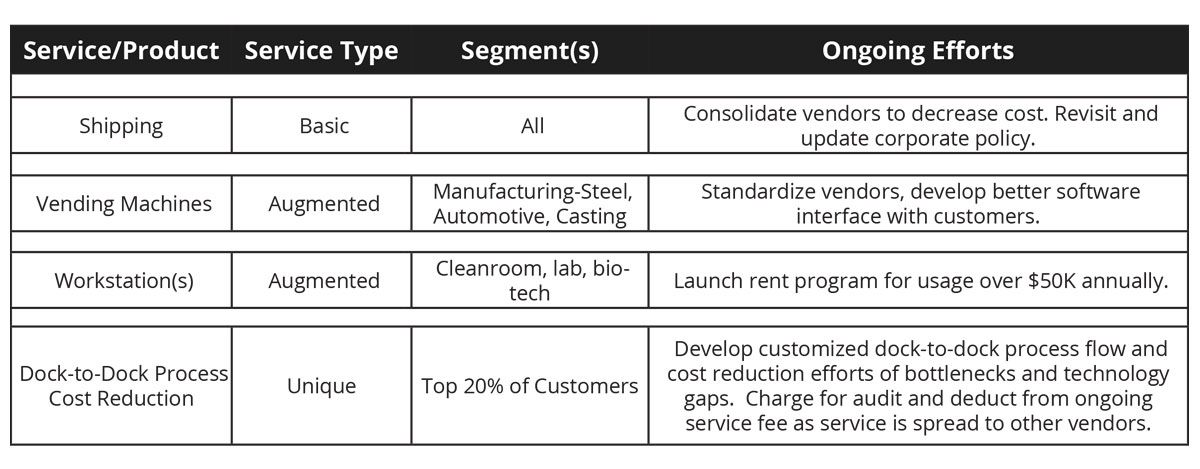

A simple, but often overlooked, tool for mapping value is a simple spreadsheet that lists the value offering, its place in the lifecycle, segment served and plans for the offering.

This table shows a truncated view of several services and products in a value mapping exercise for mock distributor A&M Supply. In the exhibit, we’ve listed four services, the service type, segments served and ongoing plans.

For instance, workstations are listed as an augmented service targeting the life sciences and cleanroom segments. The ongoing work for the service is to develop a rental agreement for accounts using over $50,000 of the product in a given year. The map also lists a unique service that is a dock-to-dock process review of materials and information flows with the goal of reducing bottlenecks, improving information and reducing costs.

The service will take a significant amount of time for an audit and solution proposal; it can be implemented across the entirety of the customer’s vendor base hence it will be fee-based and ongoing as different customers are added. It is important to note that the dock-to-dock process improvement is outside of products the distributor sells and can be used to manage other, unrelated vendors that the customer has relationships with.

The value map is truncated for purposes of publication; value maps should be an annual exercise and are extensive. The following considerations for creating a proprietary value map are taken from our service consulting over the years and include:

Map all services by type including a full list of basic services. Review technology, information and process changes for basic services. Don’t work on process changes for all basic services; pick those that are most needed for the coming year.

Assign segments to augmented and unique services. If you do not have segments and customers who can use the services, the prospect for the service to create or enhance existing value is limited.

Use a valid stage-gate or agile development process for unique services. New Service Development (NSD) is not covered in this series, however, services launched with a well-designed NSD process have a much better chance of financial success.

Be judicious about assigning services to the correct lifecycle stage. We often find where distributors are reticent to assign aging unique services to augmented or basic definitions. Errant lifecycle assignments create customer tension, especially is the service is over-valued by the distributor.

A Clear Advantage

The Service Life Cycle and Value Maps are simple yet powerful concepts for value management. They are often poorly done or not done at all in many distribution firms; they are the domain of marketing.

As full-service, family-owned distribution firms are pushed to provide a clear value advantage over ecommerce firms, they can help tremendously in value differentiation and future growth of revenue streams.

1 There are many industry consultants and authors who have covered the subject of value-added services. We suggest the literature or work of: Tim Underhill, Bruce Merrifield and Frank Hurtte for a start.

Scott Benfield is a consultant for B2B Manufacturers and Distributors. He is the author of six books and numerous research projects on B2B channels. He can be reached at benfield.scott@aol.com or (630) 640-5605.