In our previous installment, we covered the subjects of The Service Lifecycle and The Value Map. These concepts are, too often, glossed over in the pursuit of value but they are essential in putting definition and profit-making potential to the subject.

Our central premise is that independent distributors are, primarily, purveyors of commodity products. And, as products have matured, the opportunity to differentiate by application performance is small or non-existent. Ecommerce only models, launched in the last decade, have taken market-share in the low commodity/low service quadrant of the at large marketplace as their transaction costs are less than full-service/high-touch competitors. Hence, distributors have moved or are moving into the area(s) of added value in services or entirely new capabilities to differentiate themselves from commodity product status and low operating cost competitors.

The need for a more targeted, tangible, and manageable aspect of value add is prescient. However, most distributors create differentiated services and lump them into the commodity product price thereby creating a Commodity Trap. They negate or diminish the value of the service with the commodity product and, in an environment where there are lower cost platforms, they all but guarantee a low earnings spiral with each passing year.

The Value Manager: Role, Duties and Capability

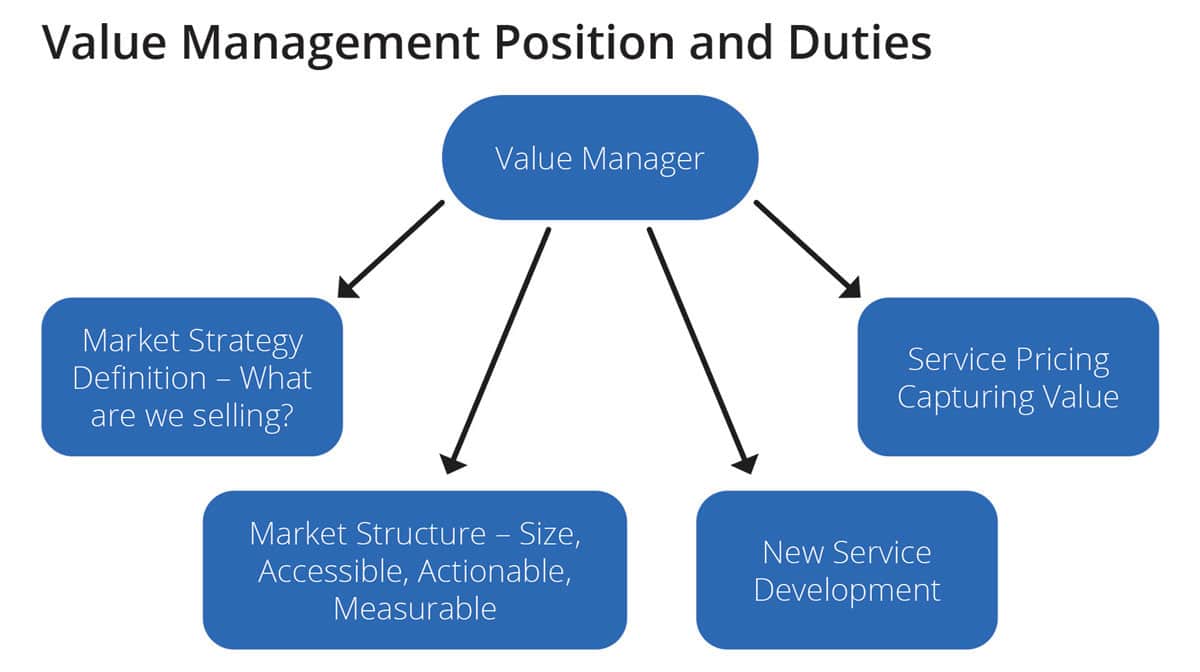

In the pursuit of greater value and avoiding the commodity trap, we advocate the position of a Value Manager. The Value Manager is a position that is, today, seldom found in distribution. The functions are scattered across sales, marketing and general management positions. We advocate strongly for the position as it imparts focus and development of corporate expertise in critical areas for market growth.

A value manager’s primary areas of effort include:

- Market Strategy: Identification and redefinition of the core value added efforts of the firm inclusive of mapping value, expansion of the market definition, and investing in areas of value generation.

- Market Structure: Developing a viable segment logic for the organization, planning value efforts around unique segments, and using segment logic to improve profitability from new services, service pricing, and reduced investment for limited-growth activities.

- New Service Development: Developing a new service launch process, using research and ideation for new service candidates, developing new service products, launching new service products, and developing post-launch review and improvement efforts.

- Service Pricing: Establishing service pricing including pricing strategy, segment- based pricing, and development of pricing systems including control and reporting.

Basic services should be left out of the value management function. Our experience is that these services, while the bedrock of the distributor’s value-added efforts, are best left to operations. Ongoing application of technology, reduction of error, process mapping and improvement are essential to the service value of the distribution firm. However, this work is best left to the warehouse, inside sales, and managers of day-to-day activities who have the knowledge and interest to ensure these services run error-free and efficiently.

The Value Manager position can be assigned at the manager or executive level. Attributes for a good candidate include experience in distribution at a manager or above level, knowledge of marketing and operations, experience in pricing and service development, and some sales work. Ideally, the position should be visible, with reasonable influence, hence a director or VP level designation is recommended.

Market Strategy Definition: What are we selling?

Duties of the Value Manager are too lengthy to be covered in detail but we encourage readers to seek out literature and coursework on the subjects presented. We devote the remainder of this article to a concise review of the subject of Market Strategy Definition.

Durable goods distribution is an uber-mature industry starting, for most product verticals, between the 1860s to 1950s. These industries are well-defined within their product markets. For example, HVAC distributors, almost universally, sell compressors, refrigerants, condensing units, a-coils, line-sets, etc. The distributors identify closely with their vendors and customers. However, over time, these product definitions can become limiting, even debilitating, as technology changes and the industry moves from core technologies to new ways of doing things. The risk of an old, worn-out marketing definition is called Marketing Myopia. And it can be devastating if not addressed.

An example of myopic marketing is the Pullman Car company, a maker of passenger cars for consumer rail travel. The company was started in 1862 and supplied passenger cars to the rail lines. It grew as rail travel grew and as new rail lines crisscrossed the North American continent. By 1925, the company had 28,000 Conductors and 12,000 Porters to support their rail car service. The company was started on 4000 acres 14 mi. south of Chicago and included living quarters for employees among other amenities. 1 The company, however, began a visible decline in the late 1940s and early 1950s as passenger rail miles gave way to the automobile and interstate highway system. The problem, as argued by Ted Leavitt, Harvard Professor of Marketing, was that the railroads identified themselves as being in the railroad business as opposed to the transportation business. They were blindsided by the growth of the automobile for passenger transport.

Today, we argue that wholesale distribution is, in many instances, myopic in that they seek identity with original technologies and how these technologies work instead of taking a broader view of the at-large market, new technologies and expanded definitions to allow for better customer engagement and more revenues.

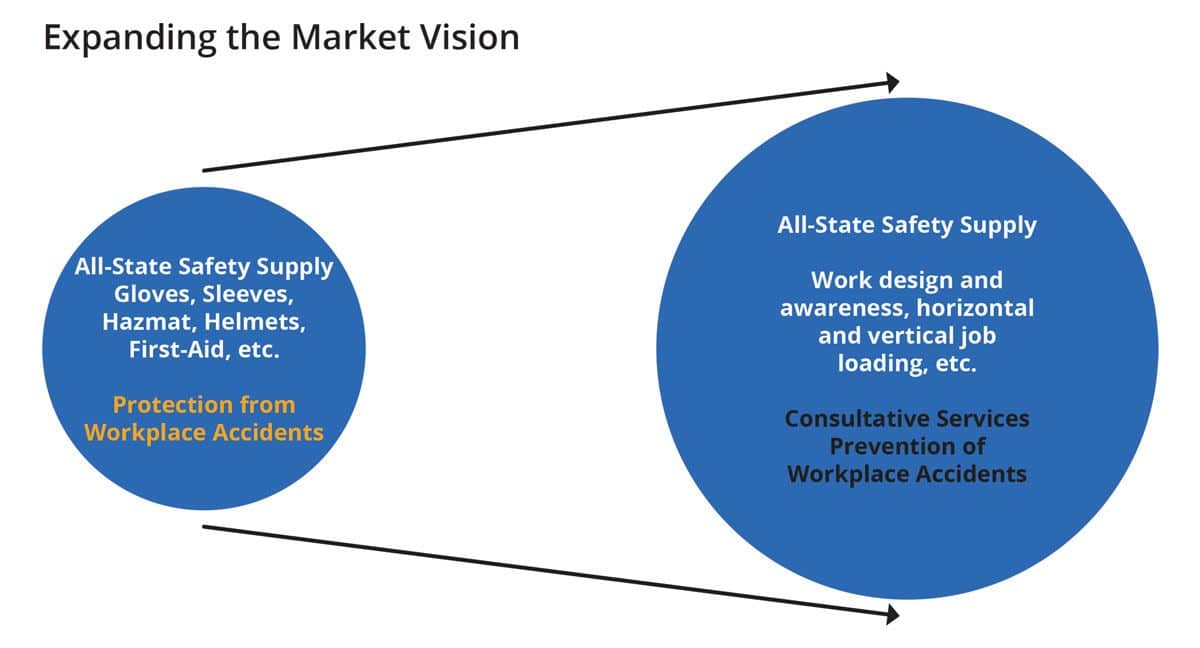

To illustrate the problem and opportunity, we refer to fictional wholesaler All-State Safety Supply. Today, the company carries a standard complement of products inclusive of gloves, sleeves, hazmat suits, hard-hats, first aid items and other products common to the safety supply industry. The operative headset in the industry is protection as seen in the left side of the exhibit below where the firm sells a standard complement of products to protect from workplace accidents.

However, on the right side of the exhibit, the firm has expanded the served-market view to include prevention of workplace accidents. This includes consultative services for workplace and job design, situational awareness, and job enrichment versus job loading.

The broadened definition of the served market for All-State Safety does not exclude the original value-added focus but it enhances the definition to provide more value to the customer. An important aspect of the expanded view is that All-State already has customer relationships so the expense of getting net new customers with a new offering is greatly reduced.

An expanded market view takes a significant amount of iteration and ideation of new products and services. Information can be gathered internally, from customers, vendors and those familiar with the industry. The exercise looks at where the firm adds value, today, and where it can be successful in the future. Better and more effective use of the marketing mix often follows the exercise.

The more the distribution firm identifies with existing and uber-mature products, services and industry definition, the more it will struggle with organic growth and profitability. Often, we can gauge how close a company is to marketing myopia by asking the question: What are you selling? If the answers come back reflective of mature products and ages-old industry definitions, there is a good chance the company is struggling with top-line and bottom-line measures.

Value Management

This series has covered the subject area of value management inclusive of strategic need, mapping value, lifecycle characteristics of value and role of a value manager for the wholesale distributor.

The better a firm can identify its value, map it, make it segment-specific, and enlarge the value definition to better serve the customer, the better revenue streams and profitability becomes.

Value, hopefully, will reflect services and capabilities outside the current product/market definition common in wholesale circles. Commodity products and basic services are being taken over by ecommerce-only firms with reduced cost structures. The traditional full-service/high-touch distributor is encouraged not to rest on value definitions of yesteryear but, instead, fund and develop their value through a dedicated, in-house, professional.

1 See article on distributor marketing myopia at: https://www.linkedin.com/pulse/distributor-myopia-x-factor-scott-benfield/

Scott Benfield is a consultant for B2B Manufacturers and Distributors. He is the author of six books and numerous research projects on B2B channels. He can be reached at benfield.scott@aol.com or (630) 640-5605.