This post previews some of the key findings in the fifth report based on our research for the National Association of Wholesaler-Distributors into how technology will transform the wholesale distribution industry. Download the report now.

Twenty years ago, B2B marketplaces, often called “exchanges” in those days, were cropping up everywhere. Ultimately, most of them collapsed spectacularly.

But despite the early failure rates, marketplaces eventually mounted a major comeback and are rapidly outgrowing company-specific websites in many industries.

As noted in the fourth report in our NAW Technology Research Report series, Distributor Suppliers Speak Out on Disruption, New Channels and Who Will Win, Forrester reported, “one-third of all US business now flows through ecommerce, and 63% of that is through marketplaces.” Clearly, something changed dramatically in the last 20 years.

B2B marketplace trends then and now

Applico Inc. is one of the world’s leading companies when it comes to understanding marketplaces and the trends and economics of the platform economy. They address what changed in 20 years in a column entitled, B2B Marketplaces: Their Failure in the Dotcom Era and Why This Time is Different by Kirk Enbysk. He identifies three reasons why early marketplaces were “destined to fall flat.” Here are some excerpts:

- Consumer behavior and prevalent trends. In the late 90s—early 00s, there simply weren’t enough people online, and buying products online was going to take some getting used to.

- Supply and demand issues. Many suppliers were reluctant to join online exchanges. Also, online payment infrastructure did not exist as it does now.

- Complexity of B2B fulfillment. B2B fulfillment often involves many more moving parts than in B2C. Distribution and logistics are more complex and involve multiple touch points spread out over time, and sales can be slowed down by regulations and legal hurdles.

While I agree with this, I would add a few other reasons why marketplaces are more viable today than 20 years ago:

Internet speed. Download rates in 2000 were about 69 kbits/s. “High speed” was about 200 kbp/s. In 2020, a reasonable average is 230,000 kbits/s. That is a 3,300X increase in average speed and 1,150X faster than the best service available in 2000. It was simply faster, easier and more productive to look up items in paper catalogs and call in your order than it was to buy online 20 years ago.

Change in delivery expectations. In 2000, distributors were obsessed with finding ways of combining shipments from multiple distribution centers or branches into a single delivery. Marketplaces made that problem much worse. Different distributors needed to coordinate with each other and sometimes set up special locations to consolidate multiple shipments for “last-mile delivery.” The world is different now. Buyers no longer expect consolidated deliveries.

The mobile revolution. The introduction of the first iPhone in 2007, coupled with the widespread rollout of 4G technology circa 2011, suddenly made it easy to access, browse and shop online from a mobile device. Significantly, this was also the first time that corporations began allowing large numbers of employees to access their networks with mobile devices. This combination of changes suddenly made it practical for business customers to shop online from almost anywhere.

Endless assortment and the death of the “hard-to-find” item. For decades, distributors thrived on sourcing items that customers couldn’t find. Today, almost no item is “hard to find.” Anyone can log on to Amazon, Walmart or Google and find plenty of suppliers for nearly anything. There is something highly satisfying about finding everything you’re looking for in one place. This is even more important than a low price to many buyers.

The dopamine rush of buying online. Numerous studies (see Shopping, Dopamine and Anticipation in Psychology Today) have demonstrated that the “rush” people get from shopping isn’t based on when they physically receive the products they order. It is the anticipation of receiving them. While it’s true that business buyers don’t shop recreationally, they can still be excited to get new items. Our brains are literally wired to prefer shopping online, because, all things being equal, we get a bigger rush waiting for the products to arrive.

With the COVID-19 crisis driving millions of people to work from home and buy online, the combined effects of these changes are likely to drive share toward marketplaces at an increasing rate. Distributors need to move rapidly up the ecommerce maturity curve to build the capabilities customers increasingly expect, even in B2B.

Essentials of mature B2B ecommerce for distributors

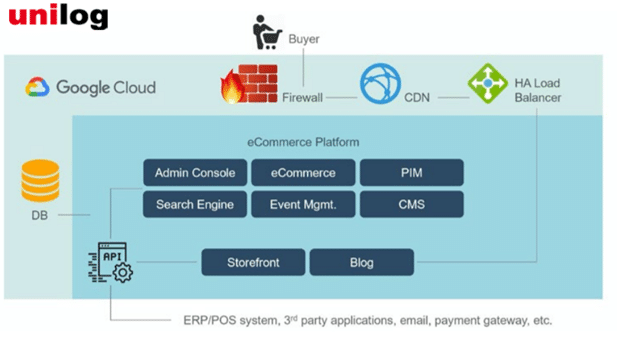

Unilog, which is one of the sponsors of the NAW series, as well as a leading technology supplier to distributors, offers a wealth of information on how to implement ecommerce solutions. As a baseline, they illustrate and describe the basic architecture required for ecommerce.

- PIM. This is the central hub for all the important product information and content for your selling channels. It is here that data is sourced, standardized and exported to different channels and partners.

- Site search. A sophisticated search tool uses algorithms that allow vendors to dictate the results users see while searching. Advanced search capabilities such as auto-complete suggestions, configurable search and a navigation bar with faceted attributes provide more targeted, relevant search results for buyers.

- Shopping cart. A comprehensive shopping cart gives buyers a flexible and secure way to shop and transact online. In addition to live product pricing and availability, shopping cart tools should meet the different needs of your buyers by offering shared carts, shipping options and multiple payment methods, including credit cards and purchase orders.

- Content management system. A robust CMS allows for easy updates to web pages and content and enables administrators to build SEO for better site visibility and create personalization options like product recommendations for customers. Your marketing team will leverage the CMS to build promotional pages and add content to supports campaigns.

- Mobile. An ecommerce site must be mobile-friendly. A responsive web design adapts a website’s layout to ensure the content and structure of the site remain consistent across all buyer devices, creating a seamless user experience.

- Taxonomy. This classification methodology categorizes products in a way that makes sense to buyers and leads them to products in as few clicks as possible. A proper taxonomy defines the hierarchy, attributes and categories within a product catalog to create a better framework and boost a site’s search and browsing capabilities.

- Event management. Many distributors offer training classes, new product demonstrations, customer appreciation days, and other events that help them connect with their customers and educate buyers on the products they carry. An Event Management module allows companies to manage an ongoing calendar of events and online registrations with ease.

- Punchout. Many B2B customers, especially those in government, higher education and larger buying groups, will require that you provide punchout capability. These online orders are sent directly from the customer’s procurement system (Ariba, SAP, Oracle, etc.) into your website. You will need a way to configure punchout for each customer’s system.

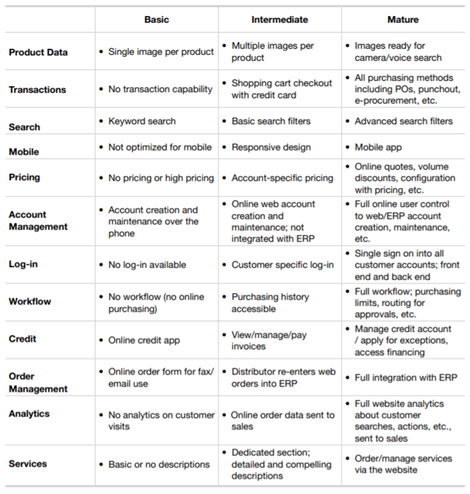

Distribution Strategy Group has developed a basic maturity table to help distributors understand how their e-commerce capabilities line up with competitors who are in the “mature state of digital capability.” Use this maturity table, or something similar, to guide your research and help you identify what actions are necessary for you to improve your competitiveness by moving continuously toward ecommerce maturity.

Learn more about the history of marketplaces and how you can achieve e-commerce maturity, and get perspectives from marketplace platform providers, in our whitepaper for the National Association of Wholesaler-Distributors, New Technology Frontiers for Distributors: Sizing Up Marketplaces and Becoming Digital Companies.

Ian Heller is the Founder and Chief Strategist for Distribution Strategy Group. He has more than 30 years of experience executing marketing and e-business strategy in the wholesale distribution industry, starting as a truck unloader at a Grainger branch while in college. He’s since held executive roles at GE Capital, Corporate Express, Newark Electronics and HD Supply. Ian has written and spoken extensively on the impact of digital disruption on distributors, and would love to start that conversation with you, your team or group. Reach out today at iheller@distributionstrategy.com.