Any distributor can take an order by phone, by person, by fax, or by email. That’s what distributors do; they roll out of bed knowing how to do these things and do them well.

And while many distributors are still struggling to get online ordering up and running, it’s the shopping part of the equation that is more difficult to do well and is usually not given the priority attention it deserves, despite its importance to driving demand across all channels.

Shopping happens before the transaction; it includes finding, researching and selecting a product, but not buying or purchasing the product. Make no mistake: It is important to be easy to order from. But a customer’s shopping experience is a distributor’s real opportunity to differentiate.

Based on our survey of more than 8,500 customers of distributors – the results of which were detailed in the second edition of our MDM-published report, “What Customers Want” – customers now prefer electronic shopping methods (manufacturer and distributor websites and search engine), marking a significant shift away from print.

Don’t be fooled into thinking that if you don’t offer a shopping cart on your website that a robust shopping experience isn’t as important. Just a small percentage of online shopping by distributors’ customers actually leads to placing an order on a distributor’s website, according to our survey. Instead, a customer does his research on a distributor’s or manufacturer’s website, and then picks up the phone, sends an email or even a fax, or submits an order via EDI.

Nearly half of those who very frequently shop by search engine end up sending an order by email. This may in part be due to existing inefficiencies on distributor websites (it’s easier for the customer to pick up the phone, for example, if they can’t find a product after searching not just your website but a couple of your competitors’, as well), but it does illustrate that online and offline methods of shopping and buying are not mutually exclusive and that a great shopping experience online can grow sales across all of your channels. After all, we know from our surveys of distributors that most don’t have even 10% of their revenue coming through an e-commerce-enabled website. So 90% of their orders are coming through other channels.

Add to this Forrester’s research outlined in “Death of a (B2B) Salesperson,” which found that 68% of buyers prefer to research (shop) online before even reaching out to a salesperson. And Millennials, who have already moved into decision-making positions or at least into positions in which they influence the sale, lean strongly digital in both their shopping and buying habits.

This is a pretty compelling case for prioritizing a better shopping experience on your website for prospects and customers.

Why Customers Leave Your Website

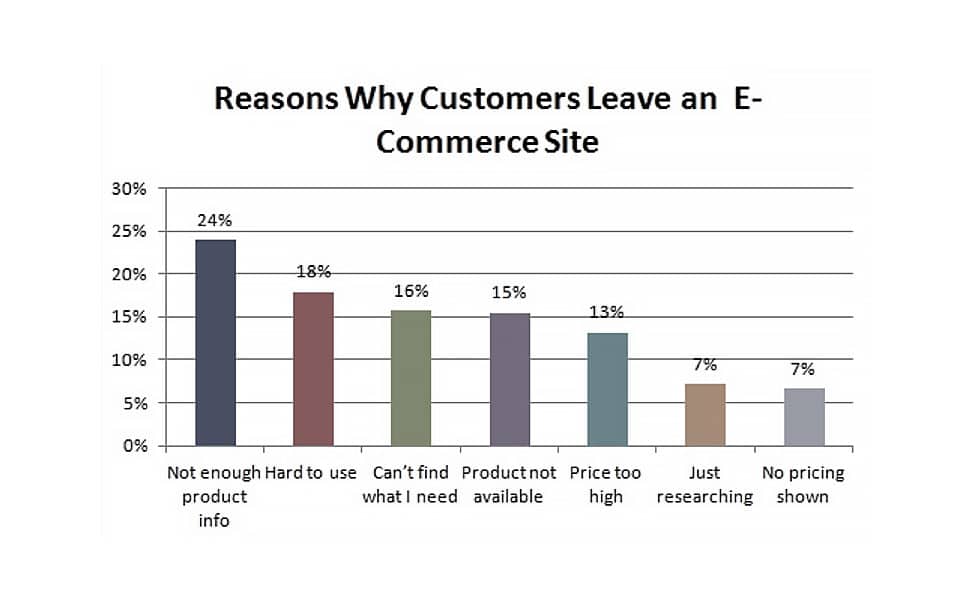

As part of our research, we asked end-users to tell us the most common reason they leave a distributor’s website without buying. Some of the most common reasons given have more to do with the shopping experience and less with the actual ordering functionality. They include:

- Not enough product information

- Hard to use

- Can’t find what I need

- Product not available

- Price too high or not shown

Think about this in the context of an offline experience. If your customer encountered the same obstacles in your showroom as he does on your website, would you be surprised that he left? If he doesn’t find information about your products, or available expertise to consult with to ensure he gets the right ones, he’d walk right out. This is especially important online. A customer will leave a website and go to a competitor’s if their experience is poor. It’s all about the customer’s efficiency.

Here are three places to start to improve the shopping experience for your customers:

Product Content

Product content – the attributes, imagery and availability/pricing data that appear on a product’s page in a distributor’s online store – is the tall pole in the tent. It is what fuels a distributor’s website and, as a result, will make or break a customer’s shopping experience. It’s historically been cost-prohibitive for small and mid-sized distributors to invest in good product data. But a lot of the growth we’re seeing in e-commerce is because the logjam of product data has finally been broken for smaller companies thanks to initiatives from organizations like the cross-segment buying group Affiliated Distributors, IMARK Group in the electrical channel, and the data initiative IDEA.

Distributors need good product data, and it has to be clean and relevant to the buyer’s needs. But beyond the basics (not to understate the challenge of getting that far), distributors must optimize and enhance that data for their core products to increase the chances that a prospect will land on their website after a search. About 10% of your products are considered core, and for most distributors make up 90% of their revenue. For these products, add video, an extended description, customer reviews and more – anything that will help move your buyers to the next stage of their journey with you. If you are part of a group product-data initiative, this is even more important to avoid having the same data or content as your fellow members; the search engine otherwise won’t know where to point first.

Chat

We’ve all experienced useless chat sessions in our attempt to learn more about a product we want to buy, or to get customer service. They frequently end in frustration and serve as a deterrent to returning to that website for future purchases. If you’re going to include a chat function on your website (and we recommend you do), take advantage of the latest chat technology and make sure the customer service rep behind the chat has the power and expertise to help your customers find and buy the right product. And if they don’t, that they have immediate access to someone who does. This is all about integrating the online with the offline to create a seamless shopping experience for your customers.

Nearly 45 percent of distributor customers we surveyed want the ability to request a chat with a CSR online when needed. With Millennials gaining increased purchase responsibility, expect that number to grow due to the high acceptance and usage of online capabilities within that group.

Manufacturer Resources

Many customers prefer to shop on a manufacturer’s website over a distributor’s, according to our research. That’s in large part due to the resources manufacturers tend to offer, which make it easier to compare products or build the right solutions. For example, some manufacturers have developed online configurators that allow the customers to basically build their own kits for their application. Configurators are usually rule-based, so they don’t allow the customer to add a part that won’t work for the job. Some have even partnered with third-party software companies that offer the ability to integrate a 3-D configurator into their website, so that the customer can see what they are building.

This represents a deeper level of content that helps customers go beyond scanning product pages and pricing. Partner with your suppliers to integrate resources like these into your own website, or develop tools that are unique to your customer base. In other words, combine the tools and technical content that a manufacturer typically hosts on its own website with an Amazon-like buying experience, and that will contribute to making your website a destination.

Make Your Website a Destination

When more than 90% of your revenue is not going through e-commerce, you’re not going to differentiate on a shopping cart alone. It really is all about the shopping experience. That’s why people love destination sites, even if they don’t buy there. A destination website is one that a customer will visit before they use a search engine. Examples of destination websites include Grainger, Ferguson, MSC Industrial Supply, Digi-Key and Amazon. Every sector probably has a destination website that fulfills that function, and the gap between these companies and those without a functional e-commerce platform is widening.

But there aren’t enough distributors serving this role. In our research, customers prefer to shop first on a manufacturer’s website; many don’t see a distributor’s website as a place where they can find what they need to make a purchase decision. In other words, the manufacturer has the customer’s mindshare. Even more importantly, there’s no guarantee a potential customer will come to you for the purchase after visiting a manufacturer’s website or using a search engine.

If yours is not a destination website, then you are missing out on that traffic, and as a result, sales.

It’s time to prioritize the shopping experience for your customers. As the generations shift, meeting Millennials and, soon, Gen Z, where they are (online) is key to getting their business. Many customers, regardless of age, don’t even want regular visits from a field sales rep, whose role is becoming more consultative and less of an order-taker.

Getting the online shopping experience right now is key to competitive advantage in the long run.

Jonathan Bein, Ph.D. is Managing Partner at Distribution Strategy Group. He’s

developed customer-facing analytics approaches for customer segmentation,

customer lifecycle management, positioning and messaging, pricing and channel strategy for distributors that want to align their sales and marketing resources with how their customers want to shop and buy. If you’re ready to drive real ROI, reach out to Jonathan today at

jbein@distributionstrategy.com.