The second annual MDM Distribution E-Commerce Survey conducted with Distribution Strategy Group revealed several key findings and trends:

- E-commerce revenue as a percent of overall revenue is rising relative to last year’s survey.

- The primary objectives among distributors for e-commerce are acquiring new customers, growing wallet share with existing customers and improving website usability.

- Respondents express mixed satisfaction with much of the functionality on their own e- commerce websites.

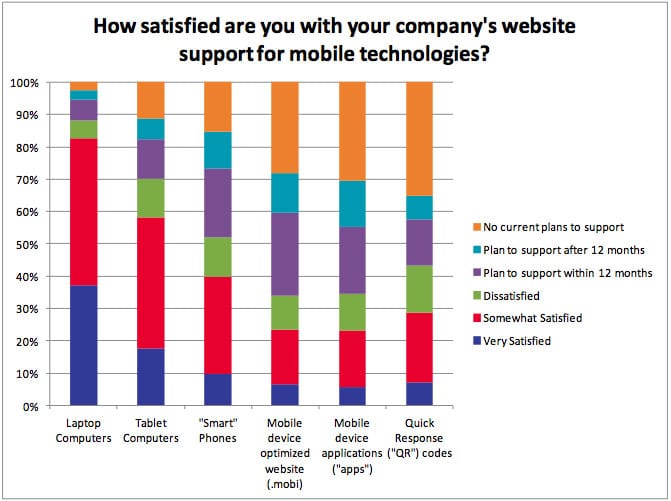

- Nearly 30 percent of companies that responded have a mobile device-optimized e-commerce solution. An additional 20 percent are implementing such a solution in the next 12 months.

- Grainger is still overwhelmingly considered to have the best website by its competitors.

E-commerce revenue as a portion of total revenue has grown significantly in the past year through the growth of existing e-commerce sites, as well as new implementations, according to a joint MDM online survey with Distribution Strategy Group conducted at the end of 2012.

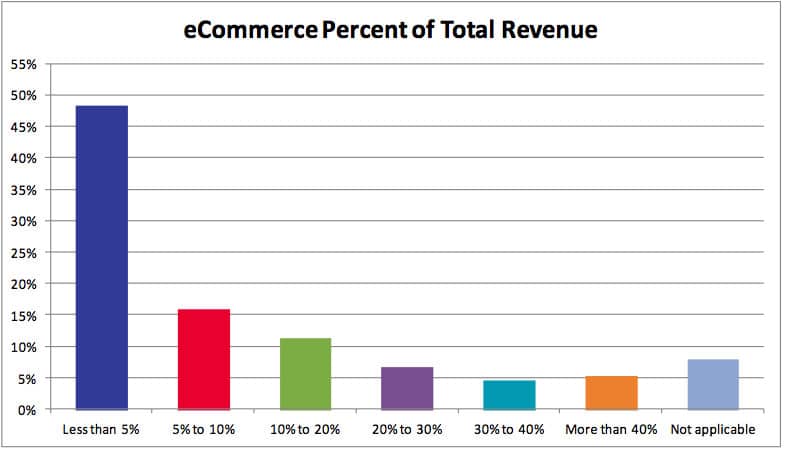

The number of distributors whose e-commerce revenue comprises 5 percent to 10 percent of total revenue has grown 50 percent from last year. The number of distributors with 10 percent to 20 percent of revenue or with 30 percent to 40 percent of revenue coming from e-commerce has doubled. (See Figure 1.)

This growth indicates that, in contrast to last year, e-commerce is really taking hold within distribution and has expanded far beyond the success of a few major distributors.

However, distributors still seem uncertain about the full potential of e-commerce for their businesses, as typified by the following comment: “Janitorial supply is the last industry to adopt technology. We’re old school. Our customer demographic is never on the cutting edge. No solution we come up with can match Amazon.”

On the other hand, one mid-market building materials distributor believes that e-commerce will be the largest portion of their business in a few years.

E-Commerce Priorities and Objectives

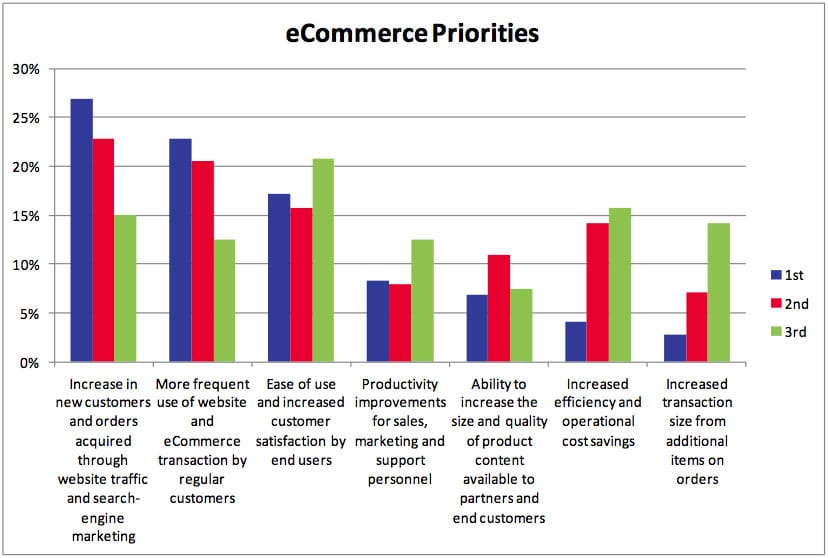

Not surprisingly, the top two priorities for distributor e-commerce initiatives are increasing new customers and increasing use of the website by existing customers. Respondents are expecting 5 percent to 20 percent improvement in each of these areas over the next 12 months.

Many distributors recognize that to increase customer satisfaction, their e-commerce website needs to be easier to use. Areas commonly cited include search and web site speed and performance.

Although only a small percentage of distributors consider increasing efficiency and operational cost savings the top priority for their e-commerce initiatives, a large percentage view it as a second or third highest priority. The efficiency is often gained by automating the processing of small orders that would be more costly if done by a person.

As e-commerce matures within the distribution industry, more distributors will focus on growing transaction size through cross-selling as seen on B-to-C sites such as Amazon. However, a gating factor on cross-selling is the quality of product data, something many distributors are still struggling to improve.

E-Commerce Capabilities

Respondents in this year’s survey take a critical view of their companies’ websites. They have mixed satisfaction about advanced search, product information, links to manufacturers’ websites and quote capability.

Respondents are primarily dissatisfied with their online help and purchase suggestion capabilities. This dissatisfaction is well expressed by a mid-market tools distributor who said: “Just providing customers with ease of use, fast connectivity, best search engine capabilities and the right product information so they want continue using the website and increase their ordering frequency is a challenge for us.”

In this year’s survey, distributors indicated a move toward a hybrid approach to website design, using a mix of internal and third-party resources. This is a good move for an industry where many websites lack aesthetic appeal and usability. A marketing executive at industrial product MRO distributor summed up its challenges with design and usability, saying: “The overall flow of the website, as well as the attractiveness/wow factor needs improvement. We are behind on taking advantage of the fresh, tech-savvy, programs available that would take our website and capabilities to the next level.”

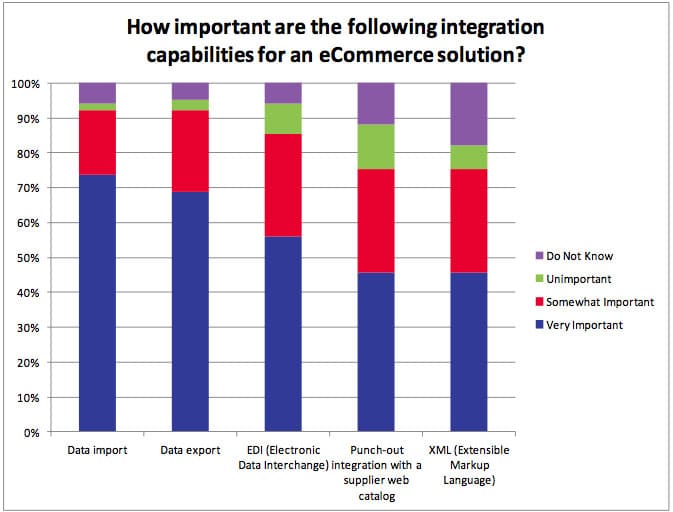

We also asked respondents about integration with internal and external systems (see Figure 3) As expected, data import and export are important for almost all distributors. However, we were surprised by the number of distributors who consider “punch-out” capabilities important because punch-out is typically used by larger distributors and many of the survey respondents are smaller distributors. Punch-out allows a customer to work within their own ERP system and purchase directly from the distributor without going to the distributor website.

The Mobile Trend

Deployment of mobile e-commerce is still in the early stages with only one-third of respondents indicating they have a solution. Yet, last year two-thirds of the respondents indicated that mobile e-commerce was either important or very important in the following three years. As shown in Figure 4, more than 20 percent of distributors have plans to support smartphones, mobile device- optimized websites and mobile device applications in the next year.

Product Data Quality

As noted last year, good data is the oxygen for a successful e-commerce site. The vast majority of data comes directly from the manufacturer. However, there is an increasing role of pure third- party solutions or blended third-party solutions relative to the last e-commerce survey.

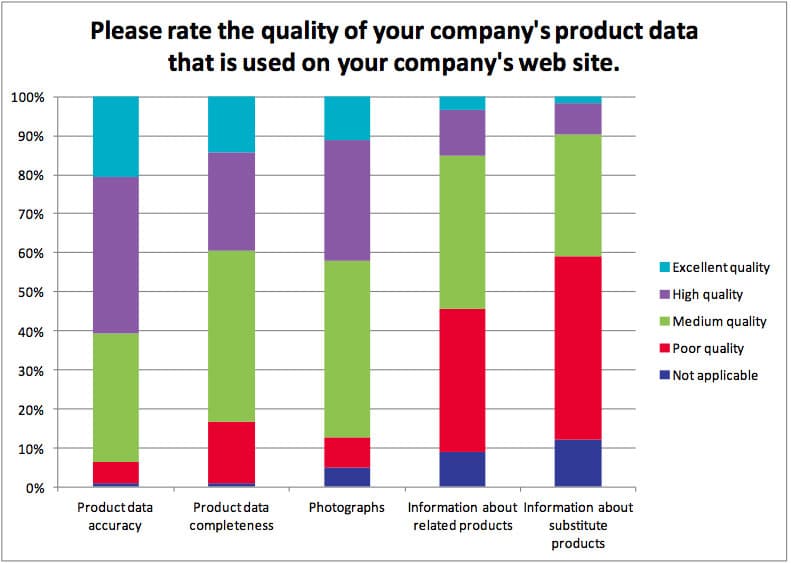

While product data accuracy and completeness are good for most distributors, photographs, substitutes and information about related products is weak as shown in Figure 5. There was almost no change in respondents’ perception of their own data quality this year versus last year.

Moving Forward

Distributor e-commerce is definitely on the move relative to last year. More companies are deploying e-commerce sites. In addition, many distributors are planning to enhance their e- commerce capabilities with mobile solutions. Still, there are many companies who have nascent e-commerce offerings that are beset by usability or data quality problems.

Despite progress, it is still early. Distributors who tackle these challenges quickly and move up the experience curve will be well-positioned to meet their objectives of growing revenue with new and existing customers.

Study Summary

This research was conducted by Distribution Strategy Group in conjunction with Modern Distribution Management. The research performed included an online survey taken by 170 participants across a variety of distribution sectors. There was heavier participation from industrial, safety, electrical/electronics, building materials, janitorial, HVACR/plumbing and hardware. Other participating sectors include oil and gas products, pulp and paper, chemicals and plastics, grocery/foodservice and pharmaceutical. Nearly half are small distributors with less than $50 million revenue, over 26 percent are mid-market with $50 million to $500 million revenue, and 11 percent large with more than $500 million revenue. Others did not disclose the revenue range. More than 40 percent are primarily focused on MRO, 16 percent are focused OEM customers, 26 percent are an even blend of MRO and OEM, and 17 percent are in other categories.

Jonathan Bein, Ph.D. is Managing Partner at Distribution Strategy Group. He’s

developed customer-facing analytics approaches for customer segmentation,

customer lifecycle management, positioning and messaging, pricing and channel strategy for distributors that want to align their sales and marketing resources with how their customers want to shop and buy. If you’re ready to drive real ROI, reach out to Jonathan today at

jbein@distributionstrategy.com.