The third annual MDM distribution e-commerce survey conducted with Distribution Strategy Group revealed several key trends:

- E-commerce revenue as a percent of overall revenue is rising relative to last year’s survey.

- The primary objectives among distributors for e-commerce remain acquiring new customers, growing wallet share with existing customers and improving website usability.

- Mobile deployments are growing rapidly with a 25% increase over last year, and many more are still in progress for the next 12 to 24 months.

This article examines the results of the 2014 State of E-Commerce in Distribution Survey and how the industry’s e-commerce offerings are maturing. Part 2 will look at best practices for distributor e-commerce marketing, data management and operations.

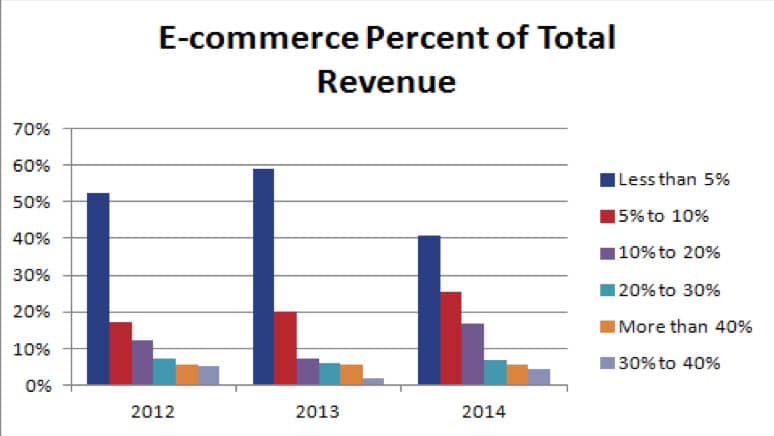

Companies are generally considered to have a mature e-commerce channel when 10% or more of their total revenue comes from e-commerce. From this perspective, e-commerce within distribution is still young with just above 20% of the companies in 2013 at the point of maturity, according to a joint MDM online survey with Distribution Strategy Group conducted in the first quarter of 2014. Still, survey results indicate that distributors are beginning to reach maturity in their e-commerce programs.

The percentage of distributors with e-commerce initiatives contributing less than 10% of total revenue grew about 15% from 2012 to 2013 (see Figure 1). That growth is expected to continue this year. From 2013 to 2014, the percentage of emerging e-commerce programs with less than 5% total revenue is expected to shrink by one-third, while the portion of companies with 5% to 10% revenue from e-commerce is expected to grow by 25%.

The percentage of companies with e-commerce reaching 10% to 20% of their revenues is expected to more than double in 2014.

The portion of companies with more than 20% e-commerce revenue is projected to be fairly stable in 2014.

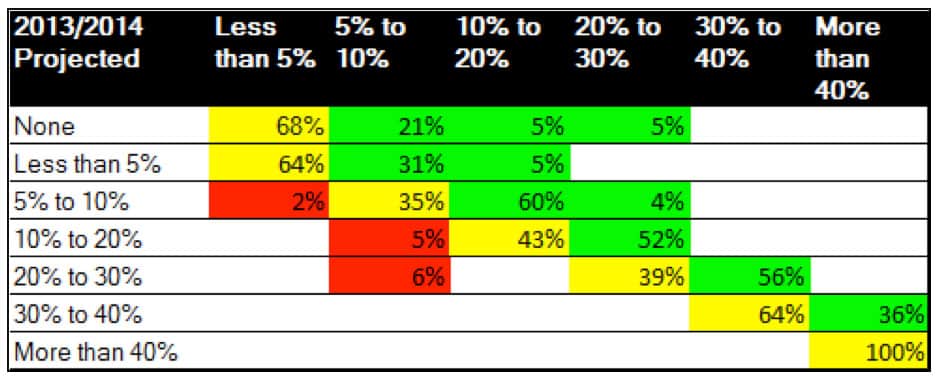

While nearly 70% of the respondents who have new e-commerce initiatives in 2014 expect e-commerce to represent less than 5% of their revenues, the rest expect to have 5% to as much as 30% of their revenues generated from e-commerce. In general, it is difficult to achieve such rapid growth in the first year unless there has been exceptional planning, and they hit the ground running at the beginning of the year, or if the company is very small. The table below shows fairly substantial movement from one level of maturity to the next.

E-Commerce Priorities & Objectives

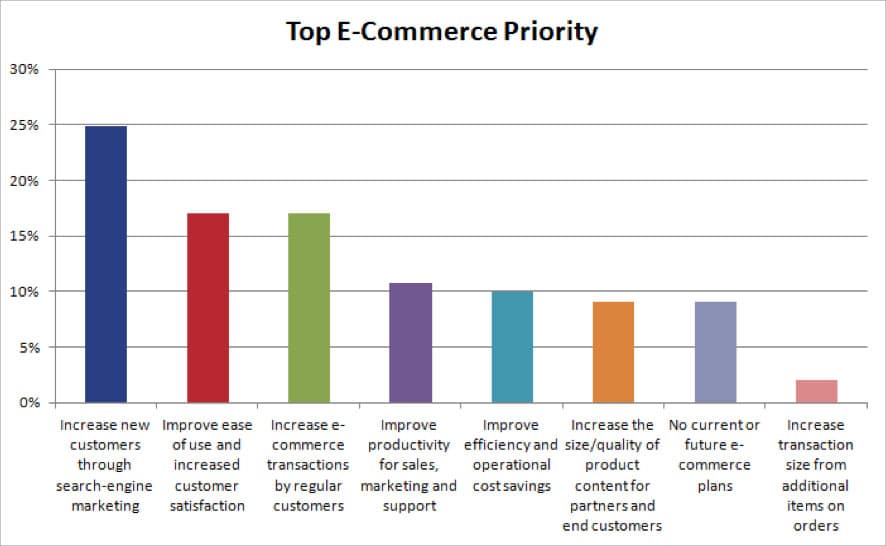

The e-commerce priorities for the distributors in this survey reflect a natural evolution toward maturity. The initial focus for most companies’ e-commerce initiatives is growing revenue from existing and new customers while making the e-commerce site friendly and easy to use. Those goals are the top priorities for survey respondents (see Figure 2).

However, half of the respondents are finding that growing e-commerce revenue from new customers with search marketing – a key element of many e-commerce programs – is somewhat or very ineffective. It is well known in marketing that growing revenue from existing customers is easier than acquiring new customers. As such, we believe that there is too great an emphasis on new customer acquisition through e-commerce for most of the respondents in this survey given the maturity of their programs. Once they have been successful at selling to existing customers, the focus can shift to new customers.

The next priorities identified by distributors in the survey are primarily internal benefits including productivity and operational cost savings. Many of the respondents who selected either of these internal benefits as the top priority have more mature e-commerce programs.

The small percentage of respondents who are focused on increasing transaction size have very mature e-commerce programs where ROI metrics are well-defined.

E-Commerce Capabilities

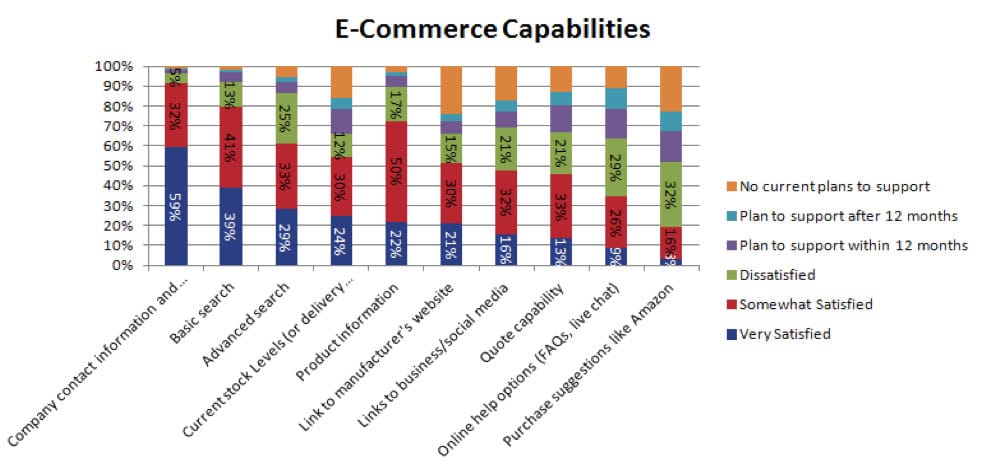

The survey asked distributors to rate their satisfaction with different capabilities on their companies’ e-commerce site. Respondents are most satisfied with table-stakes capabilities such as contact information and basic search (see Figure 4.) With slightly more complex capabilities, such as stock levels, technical information and social media, satisfaction is mixed. For more advanced capabilities, including quote, live chat and purchase suggestions, satisfaction is low.

We expect that as the programs mature, the more advanced capabilities will improve along with respondent satisfaction.

The Mobile Trend

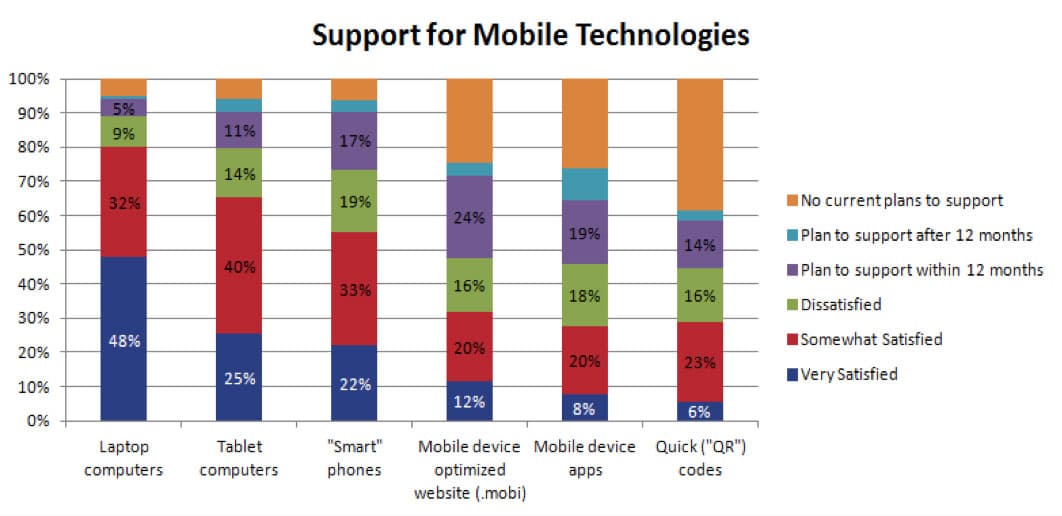

Support for mobile technology has grown nearly 25% from last year including smartphones, mobile device-optimized website (.mobi) implementations and mobile applications. In addition, more than 30% of respondents intend to implement new support for mobile technologies in the next year and beyond.

However, as Figure 5 shows, most respondents have mixed satisfaction with their companies’ support for smartphones and very low satisfaction for .mobi implementations and mobile apps so far. Respondents are generally satisfied with their companies’ support for tablet computing.

Moving Forward

Relative to last year, there has been a tremendous amount of energy put into e-commerce. The year-over-year growth in each of the areas addressed in this article, including revenue, priorities, capabilities and mobile technologies, shows that e-commerce as a sales and marketing channel in distribution is certainly maturing even though it currently remains relatively immature.

Many companies recognize that e-commerce is now a must-have rather than nice-to-have channel. Without it, they will lose market share and customers. As a result, many are planning to continue to invest in building the channel over the next two years.

This survey was conducted and produced by MDM and Distribution Strategy Group and sponsored by NetSuite.

About this Research

This research was conducted by Distribution Strategy Group in conjunction with Modern Distribution Management. The research included an online survey taken by 465 participants across a variety of distribution sectors. There was heavier participation from industrial, safety, electrical, electronics, building materials, janitorial, HVACR/plumbing and hardware. Other participating sectors include oil and gas products, pulp and paper, chemicals and plastics, grocery/foodservice and pharmaceutical. Nearly 40% are small distributors with less than $50 million revenue, over 30% are mid-market with $50 million to $500 million revenue, and 19% large with more than $500 million revenue. Others did not disclose the revenue range. About 40% are primarily focused on MRO, 19% are focused on OEM customers, 24% are an even blend of MRO and OEM, and 17% are in other categories.

Jonathan Bein, Ph.D. is Managing Partner at Distribution Strategy Group. He’s

developed customer-facing analytics approaches for customer segmentation,

customer lifecycle management, positioning and messaging, pricing and channel strategy for distributors that want to align their sales and marketing resources with how their customers want to shop and buy. If you’re ready to drive real ROI, reach out to Jonathan today at

jbein@distributionstrategy.com.